Joseph Wilkins

Fri, September 1, 2023

UBS is based in Zurich, Switzerland.Fabrice Coffrini/AFP/Getty Images

UBS completed one of the largest bank mergers in March when it rescued failed rival Credit Suisse.

The bank posted a record $29 billion second quarter profit due to an accounting gain from the deal.

UBS plans to cut 3,000 jobs and save $10 billion as part of its integration strategy.

UBS posted the biggest quarterly profit for a bank on record following its rescue of Credit Suisse earlier this year.

The $29 billion profit for the second quarter announced Thursday was mostly due to an accounting gain known as negative goodwill following the takeover of its Swiss rival in March.

The assets of Credit Suisse were worth far more than the $3.25 billion that UBS paid in the government-brokered rescue deal, which meant it could book the difference.

The biggest quarterly profit posted by a bank had been $14.3 billion from JPMorgan at the beginning of 2021.

Excluding the post-merger gains, UBS reported a far more modest $1.1 billion pre-tax profit.

The bank is cutting 3,000 jobs in Switzerland by the end of next year and reducing costs by $10 billion as part of its restructuring plans, CEO Sergio Ermotti said.

"There is no room for nostalgic considerations," he told Bloomberg TV. "We are executing on the strategy, we are making very good progress."

UBS plans to eliminate any overlap between the two organizations and eventually stop using the Credit Suisse brand.

Two-thirds of Credit Suisse's investment bank, including almost all of its trading division, is set to be wound down, Bloomberg reported.

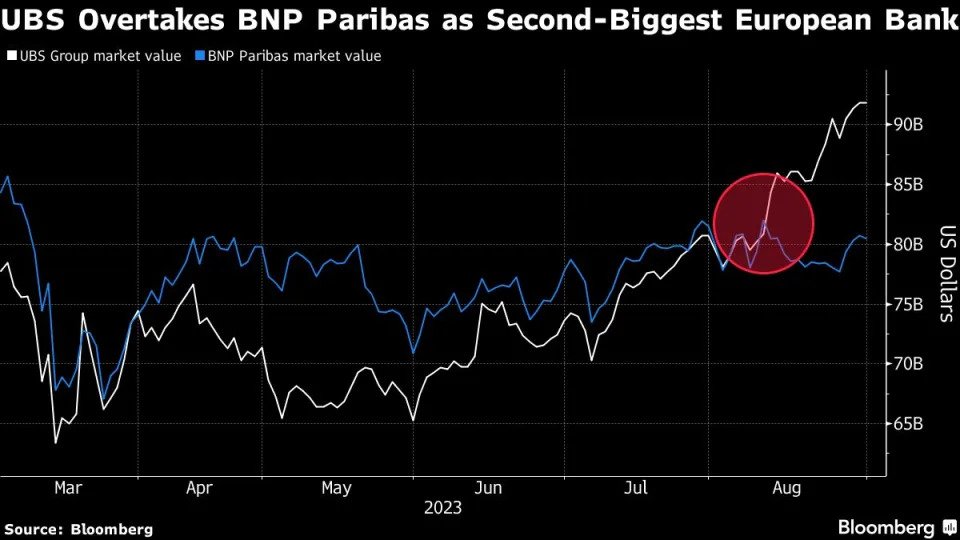

UBS is up almost 30% this year and Deutsche Bank analysts Benjamin Goy and Sharath Kumar rate the shares as a "buy."

"The underlying UBS business is seemingly not impacted by the deal," they wrote in a note reported by The AP. "Clearly, the group remains a construction site in the near term, however we believe this set of results and announcements should give confidence in the mid-term bull case."

UBS stock soars to 15-year high after blockbuster profit from Credit Suisse deal

David Hollerith

·Senior Reporter

Thu, August 31, 2023

In March Swiss regulators pushed for UBS to take over smaller rival Credit Suisse as a way of tamping down unfolding chaos in the global banking system. Five months later, the stock of UBS is at a 15-year high.

The latest catalyst came Thursday as UBS reported a record $29 billion quarterly profit due to an accounting gain from the Credit Suisse purchase. It is the biggest quarterly profit for any bank ever, exceeding the $14.5 billion earned by JPMorgan Chase (JPM) last quarter.

UBS (UBS, UBSG.SW) stock surged 7% at the open of Thursday's trading in the US. Year to date it has climbed more than 43%, reaching its highest price since 2008.

UBS Group AG (UBS)

View quote details

The blockbuster gain recorded by UBS is the latest example of how some banks were able to benefit from the turmoil of the spring by absorbing troubled rivals with help from their governments.

JPMorgan's second quarter profit, which ballooned by 67%, got a major boost from a $2.6 billion gain tied to its rescue of First Republic in May after regulators seized the San Francisco lender and sold the bulk of its operations to the largest bank in the US.

JPMorgan, which purchased the bulk of First Republic's operations, was among the other giants that booked a huge gain from the rescue of a smaller rival this year. (Jeff Chiu/AP Photo, File)

First Citizens (FCNCA), a sizable regional bank, also benefitted after it purchased assets from the failed Silicon Valley Bank, which was seized by regulators on March 10 during the initial wave of panic that roiled the industry.

The deal helped make the Raleigh, N.C.-based institution the second-most profitable US bank for the first three months of the year.

The union of UBS and Credit Suisse created a mega institution with $5.5 trillion in assets. After some deliberation, UBS said it will fully integrate Credit Suisse’s large Swiss bank into its operations as opposed to spinning it off.

That integration will bring $10 billion in cost reductions including layoffs of approximately 3,000 employees expected to begin in late 2024 and spread out over several years. The integration of the two Swiss banks is expected to finish by the end of 2026.

"Given the events leading up to the acquisition, stabilizing the Credit Suisse client franchises globally has been our most immediate priority," Sergio P. Ermotti, UBS Group chairman and CEO, told analysts Thursday.

UBS chief executive Sergio Ermotti at a press conference on Thursday in Zurich. (Fabrice Coffrini/AFP via Getty Images)

The Credit Suisse franchise brought in $18 billion in net deposits over the quarter. UBS also attracted more money from wealthy clients. It said it attracted $16 billion in net new assets for its enormous wealth management business, the operation's highest second quarter inflows in over a decade.

Excluding acquisition-related costs, Credit Suisse AG reported a pretax net profit loss of $10.1 billion.

Ermotti, who stepped down from the role in 2020, was asked to return to the bank’s top seat in April to lead it through the enormous transaction.

"Since closing in June, we have won back clients' confidence, as evidenced by the positive asset flows and strong engagement across wealth management, and the Swiss business," he added.

UBS reaps windfall gain from Credit Suisse deal after Swiss bank nabs rival at bargain $29 billion discount

Christiaan Hetzner

Thu, August 31, 2023

UBS CEO, Sergio Ermotti

In a move that could be considered the deal of the decade, UBS, having rescued rival Credit Suisse from a liquidity crisis prompted by the collapse of Silicon Valley Bank, has announced extraordinary gains for the second quarter.

UBS CEO, Sergio Ermotti, revealed that the bank raked in a staggering $29 billion in net profit, a remarkable 14-fold increase solely attributable to this emergency acquisition.

“We are very proud to see that clients are entrusting us and really believing in the story,” he said, citing wealth management customers placing more of their money with the bank despite the turmoil surrounding the deal.

This substantial Q2 gain, however, is a paper gain resulting from “negative goodwill” arising from the transaction—a term that sounds bad but is in fact a sign of sharp negotiating skills.

Normally when a company acquires another, it pays a premium over the market price, creating an intangible asset called goodwill, representing the difference between the target company‘s perceived worth and the acquisition price.

In most cases, less goodwill is seen as favorable for investors since excessive goodwill can lead to substantial impairment charges if assumptions behind the transaction fail.

Probably the most famous example is AOL Time Warner. After merging at the height of the dotcom bubble, the new group in 2002 wrote down close to $100 billion of the deal’s goodwill, leading to the largest loss in corporate history.

By comparison, UBS created negative goodwill by underpaying for Credit Suisse. At the time of the shotgun wedding, Credit Suisse was already trading at a substantial discount to its book value when UBS insisted to the federal government that they would only countenance a purchase if a deal was priced even lower.

In the end, they agreed to end 166 years of Credit Suisse history for just 3 billion Swiss francs ($3.4 billion).

Distraction is now the number one integration risk

Today’s quarterly results revealed the sheer scale of the discount it got for the franchise.

Thanks to the negotiation of chair Colm Kelleher, UBS managed to generate nearly $30 billion in value for its own shareholders in one fell swoop.

Had it not been for this windfall profit, the lender would have seen its $2.1 billion net income from the previous year swing to a small loss for the period.

There is a downside, however. As much as $28 billion in added costs, including $4 billion in litigation risks, could result from the deal. But this estimate from the company is likely a worst-case scenario.

The merger of Switzerland’s two biggest names in banking has however created an entirely different problem.

The combined $1.7 trillion balance sheet of the new behemoth is roughly twice the size of the Swiss economy.

This has sparked concerns UBS bankers may be tempted to take oversized risks just like their colleagues at Credit Suisse, knowing the institution is now definitively too big to fail.

To soothe fears in the country, Kelleher has said his management team will screen Credit Suisse’s notoriously free-wheeling investment bankers to ensure no bad apples make it through the ongoing integration process.

Earlier this month UBS assured Swiss citizens the bank had no need of 9 billion francs in taxpayer money to backstop losses arising from Credit Suisse’s derivatives exposure and already returned all support to the country’s central bank.

The Swiss native, brought in for political reasons in conjunction with the deal, said he wanted the process of consolidating Credit Suisse and restructuring the merged entity to take a back seat in the minds of his employees to prevent any distractions from their day-to-day tasks.

“Everybody wants to talk about it, but the reality is that what we need to do is to continue to stay close to clients and manage our current business, both at UBS and Credit Suisse,” he said, before going on to call the integration “a second priority.”

This story was originally featured on Fortune.com

Christiaan Hetzner

Thu, August 31, 2023

UBS CEO, Sergio Ermotti

In a move that could be considered the deal of the decade, UBS, having rescued rival Credit Suisse from a liquidity crisis prompted by the collapse of Silicon Valley Bank, has announced extraordinary gains for the second quarter.

UBS CEO, Sergio Ermotti, revealed that the bank raked in a staggering $29 billion in net profit, a remarkable 14-fold increase solely attributable to this emergency acquisition.

“We are very proud to see that clients are entrusting us and really believing in the story,” he said, citing wealth management customers placing more of their money with the bank despite the turmoil surrounding the deal.

This substantial Q2 gain, however, is a paper gain resulting from “negative goodwill” arising from the transaction—a term that sounds bad but is in fact a sign of sharp negotiating skills.

Normally when a company acquires another, it pays a premium over the market price, creating an intangible asset called goodwill, representing the difference between the target company‘s perceived worth and the acquisition price.

In most cases, less goodwill is seen as favorable for investors since excessive goodwill can lead to substantial impairment charges if assumptions behind the transaction fail.

Probably the most famous example is AOL Time Warner. After merging at the height of the dotcom bubble, the new group in 2002 wrote down close to $100 billion of the deal’s goodwill, leading to the largest loss in corporate history.

By comparison, UBS created negative goodwill by underpaying for Credit Suisse. At the time of the shotgun wedding, Credit Suisse was already trading at a substantial discount to its book value when UBS insisted to the federal government that they would only countenance a purchase if a deal was priced even lower.

In the end, they agreed to end 166 years of Credit Suisse history for just 3 billion Swiss francs ($3.4 billion).

Distraction is now the number one integration risk

Today’s quarterly results revealed the sheer scale of the discount it got for the franchise.

Thanks to the negotiation of chair Colm Kelleher, UBS managed to generate nearly $30 billion in value for its own shareholders in one fell swoop.

Had it not been for this windfall profit, the lender would have seen its $2.1 billion net income from the previous year swing to a small loss for the period.

There is a downside, however. As much as $28 billion in added costs, including $4 billion in litigation risks, could result from the deal. But this estimate from the company is likely a worst-case scenario.

The merger of Switzerland’s two biggest names in banking has however created an entirely different problem.

The combined $1.7 trillion balance sheet of the new behemoth is roughly twice the size of the Swiss economy.

This has sparked concerns UBS bankers may be tempted to take oversized risks just like their colleagues at Credit Suisse, knowing the institution is now definitively too big to fail.

To soothe fears in the country, Kelleher has said his management team will screen Credit Suisse’s notoriously free-wheeling investment bankers to ensure no bad apples make it through the ongoing integration process.

Earlier this month UBS assured Swiss citizens the bank had no need of 9 billion francs in taxpayer money to backstop losses arising from Credit Suisse’s derivatives exposure and already returned all support to the country’s central bank.

The Swiss native, brought in for political reasons in conjunction with the deal, said he wanted the process of consolidating Credit Suisse and restructuring the merged entity to take a back seat in the minds of his employees to prevent any distractions from their day-to-day tasks.

“Everybody wants to talk about it, but the reality is that what we need to do is to continue to stay close to clients and manage our current business, both at UBS and Credit Suisse,” he said, before going on to call the integration “a second priority.”

This story was originally featured on Fortune.com

In wake of Credit Suisse, Switzerland told to better prepare for bank failure

The logos of Swiss bank Credit Suisse and UBS are seen in Geneva, Switzerland

Fri, September 1, 2023

By Noele Illien, Elisa Martinuzzi and John O'Donnell

BERN (Reuters) -Switzerland was urged to prepare properly for the failure of a big bank on Friday by a group of experts in the wake of the collapse of Credit Suisse, but their report to government skirted radical reform some say is needed.

UBS Group emerged as Switzerland’s single largest bank earlier this year after the government hastily arranged and partly bankrolled its takeover of stricken Credit Suisse to prevent that bank's collapse.

The failure of one of the world's biggest banks and a one-time symbol of Swiss financial strength blindsided the country's officials and regulators, who had long grappled with the lender as it lurched from one scandal to the next.

On Friday, a group of Swiss experts, including bankers and academics, urged the government to improve its readiness should UBS, which is now far larger, run into trouble.

They called for the country's regulator FINMA to be given more clout with the power to impose fines. They said FINMA should be given more authority to intervene and that there should be improved coordination amongst Swiss authorities.

The experts also recommended that FINMA get closer to banks' executives before there is a crisis.

The experts also suggested that it should be made easier for banks to tap central bank funding, by loosening the rules on what security can be offered in return.

The recommendations are not binding and may not make it further than their report. The powerful central bank, Swiss National Bank (SNB), said it disagreed with some of the suggestions, including on liquidity and on how the authorities work.

The Credit Suisse takeover – the first rescue of a global bank since the financial crisis of 2008 – grants enormous clout to UBS, ridding it of its main rival.

It will change the landscape of banking in Switzerland, where branches of Credit Suisse and UBS are dotted everywhere, sometimes just metres apart.

The banks, two of the most systemically relevant in global finance, hold combined assets of up to 140% of Swiss gross domestic product in a country heavily dependent on finance for its economy.

The collapse of Credit Suisse has prompted an international debate about reforms introduced after the last financial crash to prevent banks becoming too outsized to wind down - a drive that has since faltered.

Although Switzerland imposed losses on shareholders and some bond investors - one pillar of those crisis reforms - they balked at the prospect of winding up Credit Suisse, opting to sell to UBS instead.

The deal was criticised by some in Switzerland. "UBS got the deal of the century," said a spokesperson for the Social Democrat party, which is a member of the ruling coalition. "At the same time, the costs of massive job cuts are foisted on the public. We need bank rules with teeth."

Others also see grave failings.

"Swiss policymakers failed to adequately supervise Credit Suisse throughout the past decade leading to its demise," said Beat Wittmann, chairman of Porta Advisors, a Swiss boutique advisory firm.

"Unfortunately there is so far no political willingness to learn any lessons," he said.

Nicolas Veron of the Peterson Institute for International Economics in Washington, cautioned that Switzerland could be stumped if UBS were to run into trouble.

"(The) rescue of Credit Suisse isn't a perfect success but it's not a story of policy failure either.

"The Swiss had two options - the merger, plan A, or resolution, plan B, and the judgement call was that a deal was better," he said, adding that there is no such fallback if UBS runs into trouble.

During the global financial crash of 2008, it was UBS, not Credit Suisse, that needed a state rescue.

At that time, the Swiss central bank lent more than $54 billion to a vehicle that UBS used to offload problem debt, including subprime loans.

(Additional reporting by Oliver Hirt in Zurich; Writing By John O'Donnell; Editing by Susan Fenton)

The logos of Swiss bank Credit Suisse and UBS are seen in Geneva, Switzerland

Fri, September 1, 2023

By Noele Illien, Elisa Martinuzzi and John O'Donnell

BERN (Reuters) -Switzerland was urged to prepare properly for the failure of a big bank on Friday by a group of experts in the wake of the collapse of Credit Suisse, but their report to government skirted radical reform some say is needed.

UBS Group emerged as Switzerland’s single largest bank earlier this year after the government hastily arranged and partly bankrolled its takeover of stricken Credit Suisse to prevent that bank's collapse.

The failure of one of the world's biggest banks and a one-time symbol of Swiss financial strength blindsided the country's officials and regulators, who had long grappled with the lender as it lurched from one scandal to the next.

On Friday, a group of Swiss experts, including bankers and academics, urged the government to improve its readiness should UBS, which is now far larger, run into trouble.

They called for the country's regulator FINMA to be given more clout with the power to impose fines. They said FINMA should be given more authority to intervene and that there should be improved coordination amongst Swiss authorities.

The experts also recommended that FINMA get closer to banks' executives before there is a crisis.

The experts also suggested that it should be made easier for banks to tap central bank funding, by loosening the rules on what security can be offered in return.

The recommendations are not binding and may not make it further than their report. The powerful central bank, Swiss National Bank (SNB), said it disagreed with some of the suggestions, including on liquidity and on how the authorities work.

The Credit Suisse takeover – the first rescue of a global bank since the financial crisis of 2008 – grants enormous clout to UBS, ridding it of its main rival.

It will change the landscape of banking in Switzerland, where branches of Credit Suisse and UBS are dotted everywhere, sometimes just metres apart.

The banks, two of the most systemically relevant in global finance, hold combined assets of up to 140% of Swiss gross domestic product in a country heavily dependent on finance for its economy.

The collapse of Credit Suisse has prompted an international debate about reforms introduced after the last financial crash to prevent banks becoming too outsized to wind down - a drive that has since faltered.

Although Switzerland imposed losses on shareholders and some bond investors - one pillar of those crisis reforms - they balked at the prospect of winding up Credit Suisse, opting to sell to UBS instead.

The deal was criticised by some in Switzerland. "UBS got the deal of the century," said a spokesperson for the Social Democrat party, which is a member of the ruling coalition. "At the same time, the costs of massive job cuts are foisted on the public. We need bank rules with teeth."

Others also see grave failings.

"Swiss policymakers failed to adequately supervise Credit Suisse throughout the past decade leading to its demise," said Beat Wittmann, chairman of Porta Advisors, a Swiss boutique advisory firm.

"Unfortunately there is so far no political willingness to learn any lessons," he said.

Nicolas Veron of the Peterson Institute for International Economics in Washington, cautioned that Switzerland could be stumped if UBS were to run into trouble.

"(The) rescue of Credit Suisse isn't a perfect success but it's not a story of policy failure either.

"The Swiss had two options - the merger, plan A, or resolution, plan B, and the judgement call was that a deal was better," he said, adding that there is no such fallback if UBS runs into trouble.

During the global financial crash of 2008, it was UBS, not Credit Suisse, that needed a state rescue.

At that time, the Swiss central bank lent more than $54 billion to a vehicle that UBS used to offload problem debt, including subprime loans.

(Additional reporting by Oliver Hirt in Zurich; Writing By John O'Donnell; Editing by Susan Fenton)

No comments:

Post a Comment