LNG

Ruth Liao and David Pan

Fri, September 1, 2023

(Bloomberg) -- Jose De Hoyos is recruiting in the oil patch. He got his start meeting workers in Pennsylvania’s Marcellus shale basin. This month, you’ll find him glad-handing in Odessa, Texas.

But De Hoyos isn’t in the Permian to hire engineers for gas rigs or roughnecks to join drilling crews. Instead, the founder of the cryptocurrency consulting firm LFG Mining is pitching a career pivot to data centers, the unsexy backbone of all things tech. He touts better pay and working conditions and a career with big growth potential.

“We are going to cross train them and make them proficient in the Bitcoin mining and traditional data center setup,” said De Hoyos, who is seeking to hire as many as 12 people for operations in Pecos and Odessa.

While it’s hardly new for energy workers to migrate toward tech — President Joe Biden infamously encouraged coal miners to “learn to code” — the current push from De Hoyos and other recruiters to poach them comes at a precarious moment for the gas industry.

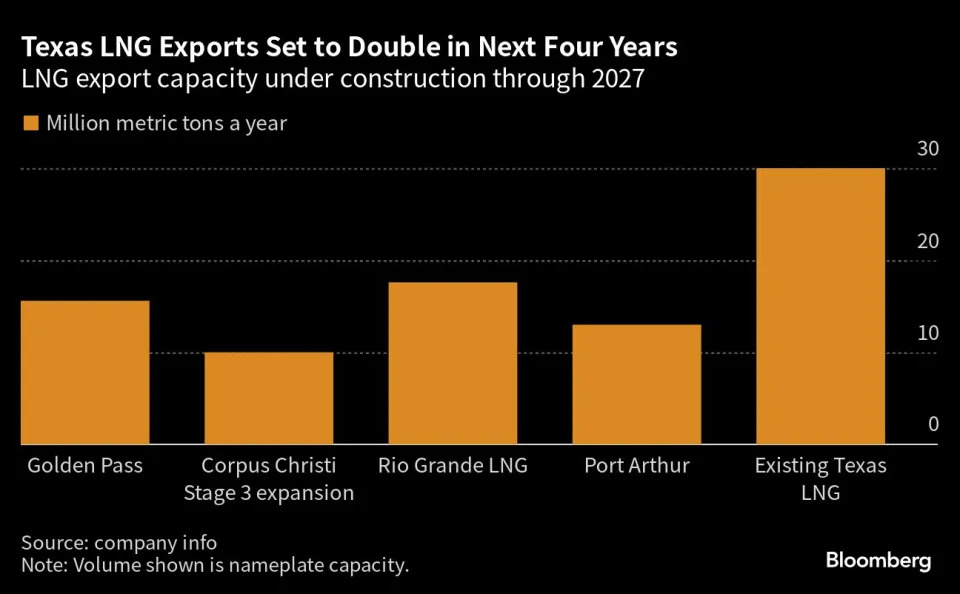

Developers are racing to build a series of massive projects in Texas to liquefy and export US gas to make up for reduced Russian pipeline flows to Europe in the wake of the Ukraine invasion. These companies need every skilled worker they can get. Executives and analysts warn the increasing competition from tech threatens to drive up project costs and slow construction as the clock is ticking to bring the fuel to the global market.

The recruiters targeting the Texas energy industry have been a nightmare for Paul Marsden, president of the energy division at the engineering and construction company Bechtel. He’s losing workers to Elon Musk’s SpaceX and the technology titans that moved to the Lone Star State amid the pandemic migration.

“Big Tech has a lot of buying power,” he said in an interview. “The mission is to go hard, go fast, and that’s been a disruptor for the labor market. That’s not something we’ve had to compete with in the past.”

The US is set to become the world’s largest LNG exporter this year, but to keep up with demand, it’ll need to get new export terminals online quickly.

NextDecade Corp. will need as many as 5,000 workers on site as it starts construction of an $18.4 billion LNG export plant in Brownsville, dubbed Rio Grande LNG. Golden Pass, a joint venture between QatarEnergy and Exxon Mobil Corp., needs as many as 7,700 workers near the Louisiana border before it opens next year. In nearby Port Arthur, Sempra’s project needs as many as 1,500 workers a month over the 4 1/2 years it will take to construct.

The cost and availability of workers is a huge issue for companies as they embark on these massive LNG projects, according to Mike Webber, managing partner at the firm Webber Research and Advisory, an energy industry consultant.

“Not only will the existing labor pool get stretched, that pool is getting more expensive” along the US Gulf of Mexico coast, Webber said in an email. “There’s a hidden cost of training so many new people and ramping their skill level to the point it can hit the quality standards.”

Golden Pass declined to comment on the risk of delays or cost overruns at its project, while NextDecade didn’t directly address the question. Sempra said it was seeing a tighter labor market and cost increases, but that it seeks to keep those to a minimum by locking in prices in advance.

The biggest US LNG producer, Cheniere Energy Inc., is expanding one of its export terminals in Corpus Christi. The company says costs on that project might be about 10% higher because of the “inflationary environment.” Executives have also said that industrywide, project costs are up as much as 40% at some sites because of rising labor and construction expenses and higher interest rates.

Read more: Oil Workers Expect More Pay Raises Amid Competing Job Offers

Sarah Oliveira, who works as a recruiter for the firm Airswift Global, says competition from tech companies has made it increasingly difficult to fill LNG roles in Texas. For every five potential engineering candidates that she’s vetting for LNG-specific roles, she says at least one or two of them are also interviewing with Tesla. And Tesla often offers higher pay.

“Money can be the dealbreaker,” she said.

Of course the labor shortage in Texas isn’t wholly unique. Across the US, companies in industries from semiconductors to meatpackers are struggling to find workers amid historically low unemployment. Trade workers are particularly hard to find, with the US short some 200,000 electricians, according to industry estimates.

“The trades are in a desperate need,” said Helene Webster, executive director of the Independent Electrical Contractor, Texas Gulf Coast.

Specialized roles for major infrastructure projects, like project managers who make sure everything is running smoothly and on time, can be particularly difficult to fill.

“We say it’s like finding hens’ teeth,” Damon Hill, president of growth and development for projects at Wood Group, a consultant on major infrastructure works.

The increased competition for Texas workers also reflects how the economy transformed over recent decades. While the state remains the US energy hub, the industry is a smaller part of the overall Texas economy than it was in years past. The number of oil and gas workers in Texas has fallen 20% since 2018, according to data from the Texas Workforce Commission, while jobs tied to computing infrastructure, data processing and other related work grew by almost 40% over the same period.

Jeff Reid, 34, left a job doing business development for Mesa Natural Gas Solutions, a company supplying natural gas generators to shale operations, in February to join Sunbelt Solomon. His new employer provides electrical equipment such as transformers to data centers and other businesses.

“A lot of my friends in the oil and gas industry either make the moves themselves or ask me how to get away,” Reid said. “They have seen the energy cycles and the volatility of the oil and gas industry. It gets a little scary when things slow down.”

Reid said there’s a surprising amount of overlap in skills needed for either field. “There are a lot of parallels,” Reid said. “Plugging in computers and trouble-shooting, hooking up electrical components, tightening pipes, set the equipment on site.”

De Hoyos, whose company does repairs, training and operations for cryptomining facilities, said one of his favorite hunting grounds for recruits is gas stations.

He stalks out the parking lot looking for tell-tale signs of energy workers, specifically the large ice chests in the back of their vehicles that provide cool drinks in the sweltering West Texas oil patch. He always makes sure to mention that data centers are air conditioned.

--With assistance from Catarina Saraiva.

Bloomberg Businessweek

No comments:

Post a Comment