Andrew Rosati

Fri, September 1, 2023

(Bloomberg) -- Just six months ago, grim warnings about Brazil’s economy were looming over Luiz Inacio Lula da Silva’s pledge to restore the prosperity he oversaw during his previous presidency.

But now with the first half of the year under his belt, the economy that soared on his watch two decades ago is once again defying the odds.

Official data released Friday showed gross domestic product expanded 0.9% in the April-June period from the previous quarter, three times more than expected by economists surveyed by Bloomberg. That’s the second straight period of solid growth, and many analysts see the economy outperforming at least through December despite headwinds.

Lula is “stronger today than when he assumed office” on Jan. 1, said Christopher Garman, managing director at political risk consultancy Eurasia Group. “We’ve had positive shock which means Lula is going to be much stronger for much longer than we were handicapping for.”

At the start of 2023, economists braced for sluggish growth as steep borrowing costs and above-target inflation chipped away at consumers’ spending power. Investors fretted that ambitious plans to fight poverty would overburden Brazil with debt. And the leftist leader was staring down a divided congress and an emboldened opposition whose most radical supporters stormed congress mere days after his inauguration.

Fast forward to September: Lula’s approval rating is touching 60%, major banks have raised their 2023 GDP forecasts, with Bank of America Corp betting on an expansion of 3% — over three times the rate most analysts were calling for in January — and Fitch Ratings has upgraded Brazil on the government’s spending reform progress.

To be fair, not all sectors are benefiting equally. Key industries like manufacturing have wobbled from tight financial conditions and lack of investment even as overall growth powered forward. Much of the bump wasn’t of Lula’s making either, Brazil’s massive agriculture sector saw strong harvests in the first quarter, inflation cooled on tight central bank policy while the labor market stayed surprisingly strong.

In the second quarter, industry gained 0.9% on a strong performance in extractive sectors like mining while services grew 0.6%, representing the top drivers of the period. Meanwhile agriculture contracted 0.9% after seeing a major jump in the previous three months, the statistics agency said.

What Bloomberg Economics Says

“The outsize print adds a strong upside bias to the analyst consensus estimate for 2023 growth. However, it may reinforce the central bank’s concern on the level of economic slack. We think the central bank will still proceed with rate cuts, but it’s less likely to accelerate the pace.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for the full report.

Brazil’s benchmark stock exchange, the Ibovespa, opened on the green on Friday after stronger than expected GDP data, rising 1.6% in Sao Paulo in morning trading. The index was boosted by materials and consumer discretionary stocks, while the real gained 0.4% against the dollar.

Brazil is not alone in enjoying better-than expected growth. This week, in Latin America’s second largest economy, Mexico, the central bank of lifted its GDP forecasts for this year and 2024 on strong trade and private consumption. Chile also saw a surprising rise in economic activity in July.

The Brazilian president welcomed Friday’s economic data, but said the gains “needed to be distributed” among the population.

Lula has so far managed to defy naysayers and please supporters who voted him back into office on hopes he’d resurrect the glory days. On the campaign trail last year, fans donned red caps with white stitched letters that read: “Make Brazil 2002 Again.” It was a throwback to when he was first elected president.

During his 2003-2010 administration, the now 77-year-old head of state oversaw a commodities-fueled economic renaissance that pulled millions of people into the ranks of the middle class. When he left office, he was by far Brazil’s most popular leader since the end of military dictatorship.

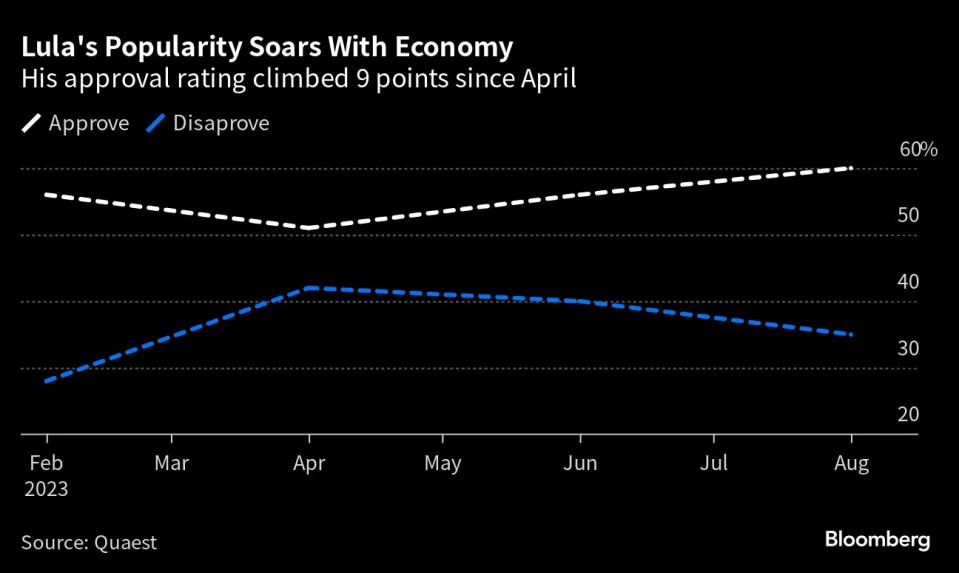

Popularity Soars

The economy’s current performance is still short of that boom. Even so, Lula is reaping the benefits with supporters and detractors alike.

Between April and August, Lula’s approval rating rose 9 percentage points to 60%, according to the pollster Quaest. It also jumped to 50% or above among conservative demographics that largely opposed him during last year’s election, including evangelicals and residents of the wealthy south of Brazil.

That’s almost double the ratings Lula’s ideological allies are getting elsewhere in South America. After winning elections on mandates for change, Chile’s Gabriel Boric and Colombia’s Gustavo Petro are both mired in economic slumps, struggling to advance their agenda and polling in the low 30s.

“Lula has chosen to debate the economy and its effects,” said Felipe Nunes, the director of Quaest. He “is neutralizing the divisive aftermath of the election and opening space to conquer part of the opposition.”

A bitterly fought race against former President Jair Bolsonaro culminated in Lula’s victory with the slimmest margin in Brazil’s modern history. The right-wing leader’s refusal to explicitly recognize his loss, combined with false claims he spread about voter fraud, fanned the rage of Bolsonaro backers who rioted in Brasilia on Jan. 8.

In his third term, Lula has concerned himself more with budgetary matters and rewriting Brazil’s byzantine tax code than with his predecessor’s legacy. Most of Lula’s public bouts of anger have been directed not at Bolsonaro, but rather his central bank chief for resisting calls for looser monetary policy.

The fracas shook financial markets, but the central bank since began easing its key rate in August, which should boost growth further on and may also serve to soothe Lula.

Investors have also found an unlikely ally in Lula’s Finance Minister Fernando Haddad. The longtime confidant of the president is credited with striking a balance between the market’s concerns and demands of the ruling Workers’ Party. Lula signed a major fiscal reform into law on Thursday.

Garman, the political risk analyst, says Lula’s popularity is strengthening his hand in congress, and the passage of key parts of his economic agenda could help growth in the mid-term.

“It creates a positive feedback loop that generates the conditions for an economic rebound in the second half of next year,” he said.

Brazil is still facing plenty of challenges. Its dominant trade partner, China, is in an economic slowdown. Interest rates in the US are expected to stay higher for longer, which could weigh on monetary policy locally. The long process of turning Lula’s reforms into laws is also likely to take toll on his popularity.

For now at least, Lula seems vindicated when he declared “Brazil is back” after getting elected last year. Looking at the economic data, it’s hard to prove him wrong.

--With assistance from Robert Jameson and Leda Alvim.

Bloomberg Businessweek

No comments:

Post a Comment