Reuters | March 12, 2025 |

Donald Trump (Photo by Michael Vadon, Wikimedia Commons)

Donald Trump threatened on Wednesday to escalate a global trade war with further tariffs on European Union goods, as major US trading partners said they would retaliate for trade barriers already erected by the US president.

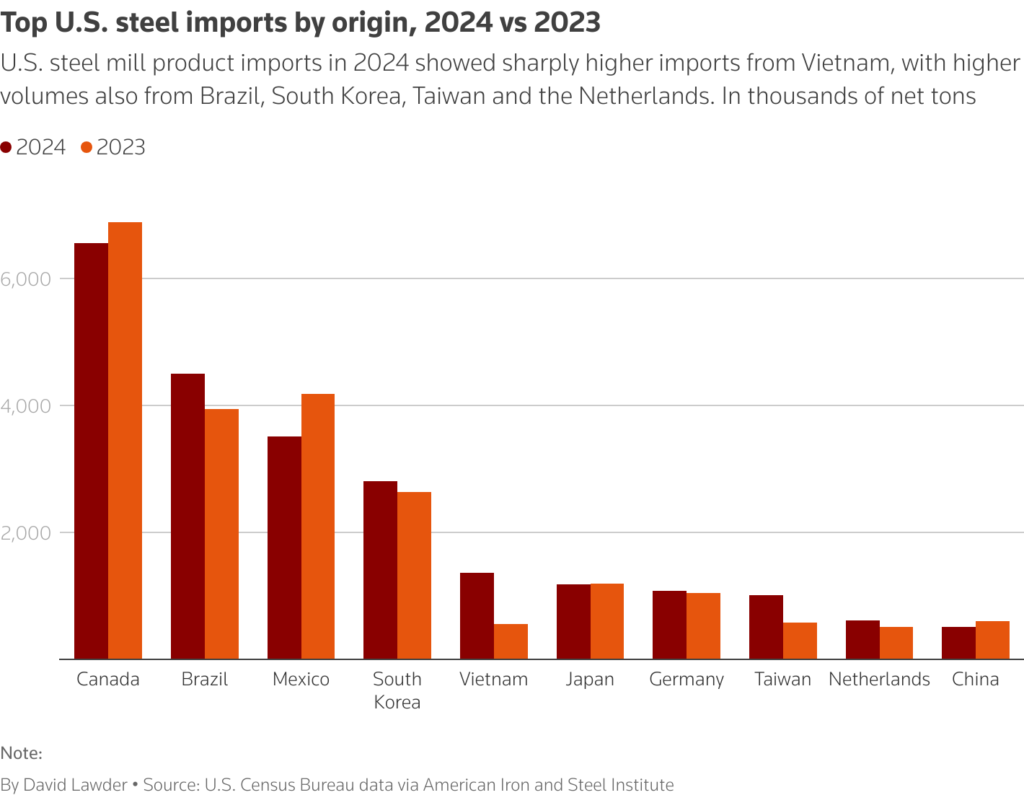

Just hours after Trump’s 25% duties on all US steel and aluminum imports took effect, Trump said he would impose additional penalties if the EU follows through with its plan to enact counter tariffs on some US goods next month. “Whatever they charge us, we’re charging them,” Trump told reporters at the White House.

Trump’s hyper-focus on tariffs has rattled investor, consumer and business confidence and raised recession fears. He has also frayed relations with Canada, a close ally and major trading partner, by repeatedly threatening to annex the neighboring country.

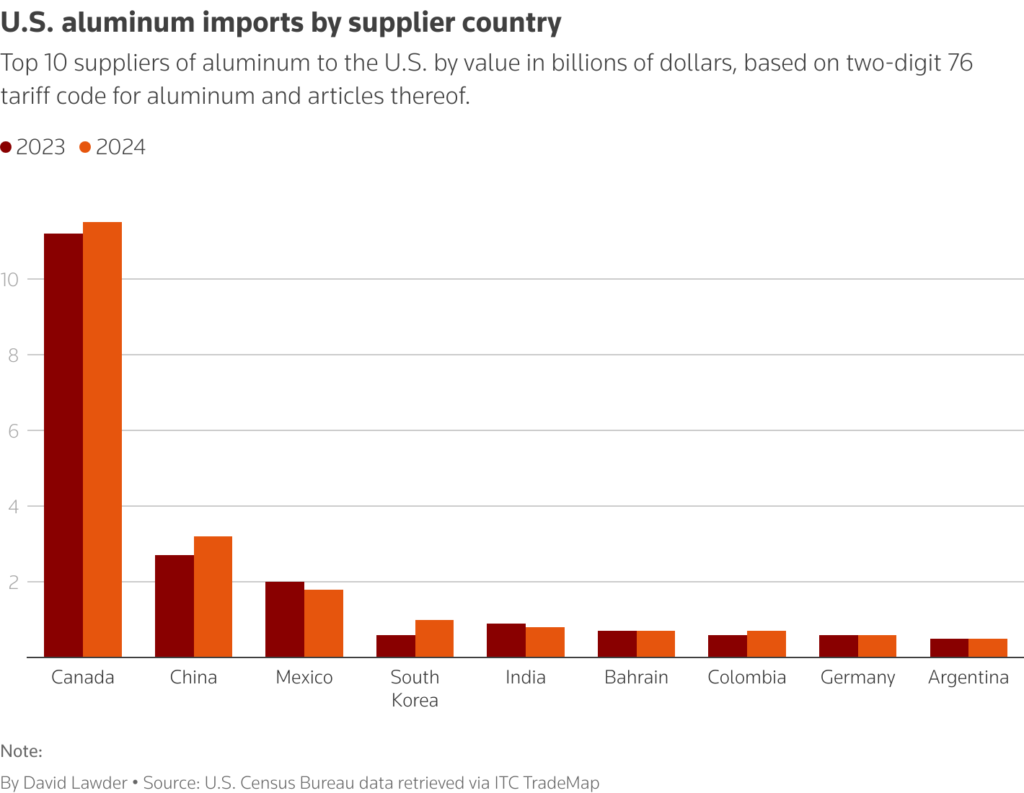

Canada, the biggest foreign supplier of steel and aluminum to the United States, announced 25% retaliatory tariffs on those metals along with computers, sports equipment and other products worth $20 billion in total. Canada has already imposed tariffs worth a similar amount on US goods in response to broader tariffs by Trump.

“We will not stand idly by while our iconic steel and aluminum industries are being unfairly targeted,” Canada’s Finance Minister Dominic LeBlanc said.

Canada’s central bank also cut interest rates to prepare the country’s economy for disruption.

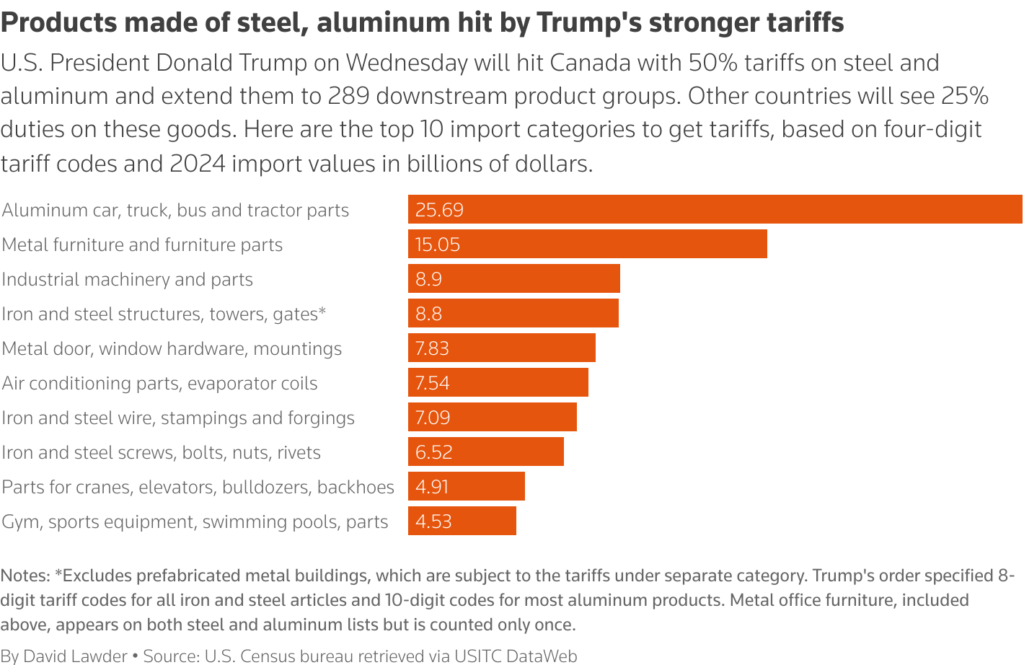

Trump’s action to bulk up protections for American steel and aluminum producers restores effective tariffs of 25% on all imports of the metals and extends the duties to hundreds of downstream products, from nuts and bolts to bulldozer blades and soda cans.

US Commerce Secretary Howard Lutnick said Trump would impose trade protections on copper as well.

A Reuters/Ipsos poll found 57% of Americans think Trump is being too erratic in his effort to shake up the US economy, and 70% expect that the tariffs will make regular purchases more expensive.

EU less exposed

The 27 countries of the European Union are less exposed, as only a “small fraction” of targeted products are exported to the United States, according to Germany’s Kiel Institute.

The EU’s counter-measures, due to take effect next month, would target up to $28 billion worth of US goods like dental floss, diamonds, bathrobes and bourbon – which likewise account for a small portion of the giant EU-US commercial relationship. Still, the liquor industry warned they would be “devastating” on its sector.

Nevertheless, Commission President Ursula von der Leyen said the bloc will resume talks with US officials.

“It is not in our common interest to burden our economies with such tariffs,” she said.

At the White House, Trump said he would “of course” respond with further tariffs if the EU followed through on its plan. With Irish Prime Minister Micheal Martin at his side, Trump criticized the EU member country for luring away US pharmaceutical companies.

China’s foreign ministry said Beijing would safeguard its interests, while Japan’s Chief Cabinet Secretary Yoshimasa Hayashi said the move could have a major impact on US-Japan economic ties.

Close US allies Britain and Australia criticized the blanket tariffs, but ruled out immediate tit-for-tat duties.

Brazil, the No. 2 provider of steel to the United States, said it would not immediately retaliate.

Stocks steady, companies spooked

With Wednesday’s tariff increase well flagged in advance, global stocks were barely changed on Wednesday.

But the back and forth on tariffs has left companies unnerved, and producers of luxury cars and chemicals painted a gloomy picture of consumer and industrial health. More than 900 of the 1,500 largest US companies have mentioned tariffs on earnings calls or at investor events this year, according to LSEG data.

“We are in a trade war and when a trade war begins, it tends to sustain itself and feed itself,” Airbus CEO Guillaume Faury said on French television.

Shares in German sportswear maker Puma lost almost a quarter of their value after earnings underscored concerns that trade concerns are curbing American spending.

US steel producers welcomed Wednesday’s move, noting Trump’s 2018 tariffs had been weakened by numerous exemptions. The cost of aluminum and steel in the United States hovered near recent peaks.

JP Morgan’s chief economist forecast a 40% chance of a US recession this year and lasting damage to the country’s standing as a reliable investment destination if Trump undermines trust in US governance.

A steep US stocks selloff in March has wiped out all of the gains notched by Wall Street following Trump’s election.

Frayed relations with Canada

The escalation of the US-Canada trade war occurred as Prime Minister Justin Trudeau prepares to hand over power to his successor Mark Carney, who won the leadership race of the ruling Liberals last weekend.

“I’m ready to sit down with President Trump at the appropriate time, under a position where there’s respect for Canadian sovereignty and we’re working for a common approach,” Carney said while touring a steel plant in Ontario.

Other Canadian officials are due to meet with US officials in Washington on Thursday.

The US national anthem has been booed at hockey games and some stores removed US products from their shelves, even before the duties took effect. Travelers are steering clear of the United States, with bookings down 20% from a year ago.

Canadian Energy Minister Jonathan Wilkinson told Reuters that Canada could impose non-tariff measures such as restricting oil exports to the US or levying export duties on minerals if US tariffs persist.

(Reporting by David Lawder, Philip Blenkinsop, Andrea Shalal, Mark John, David Ljunggren, Jarrett Renshaw, Arathy Somasekhar, Shubham Kalia, Gnaneshwar Rajan and Renju Jose; Writing by Andy Sullivan; Editing by Lincoln Feast, Christina Fincher and Toby Chopra)

Column: Bad news for American beer drinkers as aluminum tariffs kick in

Reuters | March 12, 2025 |

Image source: Rusty Clark via Flickr, under Creative Commons license CC2.0.

First some good news for US aluminum buyers. President Donald Trump has backed off from his threat to hit imports of Canadian metal with a huge 50% tariff.

Now for the bad news. As of today they will be paying a 25% import tariff, not just for Canadian metal but for all aluminum products from all countries.

Market pricing has already shifted to reflect the Trump administration’s doubling-down on tariffs as a way of reviving domestic smelting capacity.

The CME Midwest premium , reflecting the cost of unwrought aluminum delivered to a US fabricator over and above the international London Metal Exchange basis price, is trading at record highs.

The high premium will flow down the aluminum product chain until it hits the last-stage user, whether it be Ford Motor, Lockheed Martin or one of the country’s many independent brewers.

That’s how tariffs have worked to date and things won’t change while the United States remains so dependent on imports.

Import dependency

Harbor Aluminum’s finding that the main beneficiaries of tariffs to date have been first-stage processors reflects the imbalanced nature of the domestic US supply chain.

The country has a large base of semi-manufactured product makers but only four operating primary metal smelters to supply them.

The aluminum sector directly employs more than 164,000 workers but only 4,000 are engaged in upstream metal production, according to the US Aluminum Association.

Those four smelters produced 670,000 metric tons of metal in 2024, compared with US consumption of around 4.9 million tons.

Imports of primary metal totaled almost 4.0 million tons, of which 70% came from Canadian smelters.

It’s hard to see how that dynamic is going to change any time soon. Even if all the currently idled smelting capacity of around one million tons per year returned to production – a big “if” given the age and cost structure of the four mothballed plants – it would still leave a big import dependency gap.

Century Aluminum’s proposed new smelter is years away and the company hasn’t yet found a source of competitively priced power to feed the plant’s electrolysis process.

There is much more potential to lift domestic production from domestic scrap but as long as even one ton of extra imported metal is needed to meet domestic consumption, you can be sure that the tariffs will continue to determine the end price for American buyers.

Trading uncertainty

Moreover, as the markets learned on Tuesday, Trump is quite capable of raising tariffs on a presidential whim.

The changeable tariff rhetoric is causing volatility in the CME US premium, which briefly jumped to almost $1,000 per ton over the LME price on the threat of 50% tariffs on Canadian metal before retreating on news of the truce with Ontario Premier Doug Ford.

But it may also be about to generate a major realignment of global trading patterns.

Previous spikes in the US aluminum premium have pulled European premiums higher. This is logical given that Europe, which is also dependent on primary metal imports, must compete for spare units in the global market-place.

Not this time, though. Even as the US premium has surged to all-time highs, European premiums have been falling.

This is counter-intuitive, particularly since European consumers are set to lose Russian supply over the next year as part of the bloc’s latest sanctions package. If anything, the European premium should be even more sensitive to what is happening in the North American market.

The divergence suggests that some suppliers to the United States are already looking to avoid Trump’s tariff tantrums by re-directing sales to Europe.

If so, it will be good news for European beer drinkers, who may raise an aluminum can to their less fortunate American counterparts.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Jason Neely)

Reuters | March 12, 2025 |

Image source: Rusty Clark via Flickr, under Creative Commons license CC2.0.

First some good news for US aluminum buyers. President Donald Trump has backed off from his threat to hit imports of Canadian metal with a huge 50% tariff.

Now for the bad news. As of today they will be paying a 25% import tariff, not just for Canadian metal but for all aluminum products from all countries.

Market pricing has already shifted to reflect the Trump administration’s doubling-down on tariffs as a way of reviving domestic smelting capacity.

The CME Midwest premium , reflecting the cost of unwrought aluminum delivered to a US fabricator over and above the international London Metal Exchange basis price, is trading at record highs.

The high premium will flow down the aluminum product chain until it hits the last-stage user, whether it be Ford Motor, Lockheed Martin or one of the country’s many independent brewers.

That’s how tariffs have worked to date and things won’t change while the United States remains so dependent on imports.

CME Premium Contracts for US, Europe and Japan

Tariff hangover

Trump’s original 2018 tariffs on aluminum were set at 10% and within a year the Beer Institute, which represents the nearly 8,000 brewers in the United States, estimated they had already cost the industry an extra $250 million.

A report by consultancy Harbor Aluminum found that $50 million had gone to the US Treasury, $27 million to domestic smelters and $173 million to the fabricators who convert metal to aluminum sheet for beer cans.

What really irked the Beer Institute was that the import tariff was being passed through even though US cansheet typically contains around 70% recycled metal sourced domestically.

But that’s how tariffs tend to work.

Just ask European aluminum buyers. The European Union also imposes import tariffs ranging from 3% on primary aluminum to 6% on some alloys.

Researchers from the LUISS University of Rome studied the impact on consumers and in a 2019 paper found that even though duty-exempt metal accounted for around half of all European Union imports, everyone ended up paying 6% anyway.

Producers are incentivized to “align their prices to the highest possible level – that is, the duty-paid price,” the researchers wrote.

The Beer Institute’s follow-on research in 2022, confirmed this harsh economic reality, finding that even with exemptions for key suppliers such as Canada, beer makers were still paying the full import tariff for their can metal. The cost at that stage had risen to $1.4 billion.

Tariff hangover

Trump’s original 2018 tariffs on aluminum were set at 10% and within a year the Beer Institute, which represents the nearly 8,000 brewers in the United States, estimated they had already cost the industry an extra $250 million.

A report by consultancy Harbor Aluminum found that $50 million had gone to the US Treasury, $27 million to domestic smelters and $173 million to the fabricators who convert metal to aluminum sheet for beer cans.

What really irked the Beer Institute was that the import tariff was being passed through even though US cansheet typically contains around 70% recycled metal sourced domestically.

But that’s how tariffs tend to work.

Just ask European aluminum buyers. The European Union also imposes import tariffs ranging from 3% on primary aluminum to 6% on some alloys.

Researchers from the LUISS University of Rome studied the impact on consumers and in a 2019 paper found that even though duty-exempt metal accounted for around half of all European Union imports, everyone ended up paying 6% anyway.

Producers are incentivized to “align their prices to the highest possible level – that is, the duty-paid price,” the researchers wrote.

The Beer Institute’s follow-on research in 2022, confirmed this harsh economic reality, finding that even with exemptions for key suppliers such as Canada, beer makers were still paying the full import tariff for their can metal. The cost at that stage had risen to $1.4 billion.

Import dependency

Harbor Aluminum’s finding that the main beneficiaries of tariffs to date have been first-stage processors reflects the imbalanced nature of the domestic US supply chain.

The country has a large base of semi-manufactured product makers but only four operating primary metal smelters to supply them.

The aluminum sector directly employs more than 164,000 workers but only 4,000 are engaged in upstream metal production, according to the US Aluminum Association.

Those four smelters produced 670,000 metric tons of metal in 2024, compared with US consumption of around 4.9 million tons.

Imports of primary metal totaled almost 4.0 million tons, of which 70% came from Canadian smelters.

It’s hard to see how that dynamic is going to change any time soon. Even if all the currently idled smelting capacity of around one million tons per year returned to production – a big “if” given the age and cost structure of the four mothballed plants – it would still leave a big import dependency gap.

Century Aluminum’s proposed new smelter is years away and the company hasn’t yet found a source of competitively priced power to feed the plant’s electrolysis process.

There is much more potential to lift domestic production from domestic scrap but as long as even one ton of extra imported metal is needed to meet domestic consumption, you can be sure that the tariffs will continue to determine the end price for American buyers.

Trading uncertainty

Moreover, as the markets learned on Tuesday, Trump is quite capable of raising tariffs on a presidential whim.

The changeable tariff rhetoric is causing volatility in the CME US premium, which briefly jumped to almost $1,000 per ton over the LME price on the threat of 50% tariffs on Canadian metal before retreating on news of the truce with Ontario Premier Doug Ford.

But it may also be about to generate a major realignment of global trading patterns.

Previous spikes in the US aluminum premium have pulled European premiums higher. This is logical given that Europe, which is also dependent on primary metal imports, must compete for spare units in the global market-place.

Not this time, though. Even as the US premium has surged to all-time highs, European premiums have been falling.

This is counter-intuitive, particularly since European consumers are set to lose Russian supply over the next year as part of the bloc’s latest sanctions package. If anything, the European premium should be even more sensitive to what is happening in the North American market.

The divergence suggests that some suppliers to the United States are already looking to avoid Trump’s tariff tantrums by re-directing sales to Europe.

If so, it will be good news for European beer drinkers, who may raise an aluminum can to their less fortunate American counterparts.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Jason Neely)

Aluminum premiums for US buyers hit record after Trump doubles tariffs

Reuters | March 11, 2025 |

Aluminum ingots. Stock image.

Premiums for consumers buying aluminum on the physical market in the United States soared to record highs on Tuesday after President Donald Trump said he would double tariffs on Canadian metal to 50%.

The doubling of levies, in response to the Canadian province of Ontario placing a 25% tariff on electricity coming into the US, take effect from Wednesday.

Consumers buying aluminum on the physical market typically pay the London Metal Exchange (LME) benchmark aluminum price plus a premium that covers taxes, transport and handling costs.

Traders predict premiums will continue to rise as producers pass on as much of the extra costs of tariffs as they can.

Canadian smelters account for most primary and alloyed aluminum shipped to the United States. Aluminum is vital for the transport, packaging and construction industries.

About 70%, or 3.92 million metric tons of the primary and alloyed aluminum exported to the United States last year, came from Canada, according to information provider Trade Data Monitor (TDM).

The 25% tariff originally planned would have meant the premium would have had to rise to 47 cents a lb or more than $1,000 a ton to cover the extra costs for sellers, analysts have calculated.

The US Midwest duty-paid aluminum premium jumped to 45 US cents per lb, or more than $990 a metric ton, on Tuesday, a jump of nearly 20% from Monday. It has climbed more than 70% since the start of 2025.

During his previous presidency, Trump in 2018 sought to use tariffs on aluminum to encourage investment in capacity.

Given that aluminum smelters take longer to build than political election cycles, analysts were sceptical investors would be confident to spend the large capital sums needed.

“US primary aluminum production has experienced a sequential decline over the past two decades due to often thin or negative margins, and the implementation of tariffs in 2018 has not sustainably helped local supply to recover,” Macquarie analysts said in a note last month.

While premiums for US buyers have risen, industry sources have said they are likely to continue falling elsewhere as aluminum produced in countries where import levies apply are diverted.

In Europe, the duty-paid physical market premium has dropped to $240 a metric ton, the lowest since January last year. It has fallen more than 35% since the start of 2025.

(By Pratima Desai; Editing by Eric Onstad, David Goodman and Barbara Lewis)

Reuters | March 11, 2025 |

Aluminum ingots. Stock image.

Premiums for consumers buying aluminum on the physical market in the United States soared to record highs on Tuesday after President Donald Trump said he would double tariffs on Canadian metal to 50%.

The doubling of levies, in response to the Canadian province of Ontario placing a 25% tariff on electricity coming into the US, take effect from Wednesday.

Consumers buying aluminum on the physical market typically pay the London Metal Exchange (LME) benchmark aluminum price plus a premium that covers taxes, transport and handling costs.

Traders predict premiums will continue to rise as producers pass on as much of the extra costs of tariffs as they can.

Canadian smelters account for most primary and alloyed aluminum shipped to the United States. Aluminum is vital for the transport, packaging and construction industries.

About 70%, or 3.92 million metric tons of the primary and alloyed aluminum exported to the United States last year, came from Canada, according to information provider Trade Data Monitor (TDM).

The 25% tariff originally planned would have meant the premium would have had to rise to 47 cents a lb or more than $1,000 a ton to cover the extra costs for sellers, analysts have calculated.

The US Midwest duty-paid aluminum premium jumped to 45 US cents per lb, or more than $990 a metric ton, on Tuesday, a jump of nearly 20% from Monday. It has climbed more than 70% since the start of 2025.

During his previous presidency, Trump in 2018 sought to use tariffs on aluminum to encourage investment in capacity.

Given that aluminum smelters take longer to build than political election cycles, analysts were sceptical investors would be confident to spend the large capital sums needed.

“US primary aluminum production has experienced a sequential decline over the past two decades due to often thin or negative margins, and the implementation of tariffs in 2018 has not sustainably helped local supply to recover,” Macquarie analysts said in a note last month.

While premiums for US buyers have risen, industry sources have said they are likely to continue falling elsewhere as aluminum produced in countries where import levies apply are diverted.

In Europe, the duty-paid physical market premium has dropped to $240 a metric ton, the lowest since January last year. It has fallen more than 35% since the start of 2025.

(By Pratima Desai; Editing by Eric Onstad, David Goodman and Barbara Lewis)

Gold price rises as traders digest US inflation, Trump’s metal tariff

Bloomberg News | March 12, 2025 |

Stock image.

Gold climbed as investors assessed the outlook for the US economy and the Federal Reserve interest-rate path following the latest inflation print and the start of President Donald Trump’s metal tariffs.

US consumer prices rose at the slowest pace in four months in February, welcome news for American households who remain apprehensive about the potential for tariffs to drive costs higher.

Trump’s 25% tariffs on steel and aluminum imports came into force Wednesday, triggering concern across export-reliant Asia and immediate reprisals from the European Union and Canada.

“I read the lower-than-expected CPI data as being favorable for commodities, and the precious sector in particular. The market will interpret this as allowing the Fed to ease sooner rather than later,” said Bart Melek, global head of commodities strategy at TD Securities.

“As tariffs hit, however, price pressures may well reemerge.” he added. Lower rates typically benefit bullion as it pays no interest.

Bullion has risen 11% this year, helped in part by haven demand emanating from uncertainty surrounding Trump’s tariff measures.

Spot gold was up 0.4% at $2,927.27 an ounce at 11:43 a.m. in New York. The Bloomberg Dollar Spot Index was up 0.1%. Silver, platinum and palladium rose.

(By Yvonne Yue Li)

Bloomberg News | March 12, 2025 |

Stock image.

Gold climbed as investors assessed the outlook for the US economy and the Federal Reserve interest-rate path following the latest inflation print and the start of President Donald Trump’s metal tariffs.

US consumer prices rose at the slowest pace in four months in February, welcome news for American households who remain apprehensive about the potential for tariffs to drive costs higher.

Trump’s 25% tariffs on steel and aluminum imports came into force Wednesday, triggering concern across export-reliant Asia and immediate reprisals from the European Union and Canada.

“I read the lower-than-expected CPI data as being favorable for commodities, and the precious sector in particular. The market will interpret this as allowing the Fed to ease sooner rather than later,” said Bart Melek, global head of commodities strategy at TD Securities.

“As tariffs hit, however, price pressures may well reemerge.” he added. Lower rates typically benefit bullion as it pays no interest.

Bullion has risen 11% this year, helped in part by haven demand emanating from uncertainty surrounding Trump’s tariff measures.

Spot gold was up 0.4% at $2,927.27 an ounce at 11:43 a.m. in New York. The Bloomberg Dollar Spot Index was up 0.1%. Silver, platinum and palladium rose.

(By Yvonne Yue Li)

Trump rules out Australian steel, aluminum tariff exemptions

Bloomberg News | March 11, 2025 |

(Stock image)

Australia has failed to secure an exemption from US steel and aluminum tariffs despite an extensive lobbying campaign by Prime Minister Anthony Albanese’s government, in a blow to ties between the longtime allies.

White House spokesman Kush Desai confirmed in a statement that the planned levies would come into effect from midnight on Wednesday, with no exemptions for any US trading partners.

Albanese told reporters after the announcement that the Trump administration’s actions were “entirely unjustified” and an act of “economic self-harm” on the part of the US. But, he added, Australia would not take any reciprocal measures.

“This is against the spirit of our two nations’ enduring friendship and fundamentally at odds with the benefits that our economic partnership has delivered over more than 70 years,” Albanese said Wednesday in Sydney. Australia will continue to advocate for an exemption, he added.

President Donald Trump had told the Australian prime minister during talks by telephone last month that he would consider an exemption. Albanese, who must hold an election by May 17, had been under intense pressure from local lawmakers and executives to secure a carve out for Australia’s exports.

Albanese said after the announcement that he would be working with the steel and aluminum industries to diversify their exports, encouraging citizens to buy domestically produced products.

“Friends need to act in a way that reinforces to our respective populations the fact that we are friends. This is not a friendly act,” Albanese said Wednesday.

During Trump’s first term, Canberra undertook months of painstaking negotiations with Washington to secure an exemption. However, then-Prime Minister Malcolm Turnbull told Bloomberg this week that he believed it would be “a lot harder” for Australia to get a similar deal this time.

White House spokeswoman Karoline Leavitt had told reporters earlier that Trump had decided against giving an exemption, according to Australian media reports.

“He considered it, and considered against it,” she told the Australian Broadcasting Corp., referring to Trump.

(By Ben Westcott)

Bloomberg News | March 11, 2025 |

(Stock image)

Australia has failed to secure an exemption from US steel and aluminum tariffs despite an extensive lobbying campaign by Prime Minister Anthony Albanese’s government, in a blow to ties between the longtime allies.

White House spokesman Kush Desai confirmed in a statement that the planned levies would come into effect from midnight on Wednesday, with no exemptions for any US trading partners.

Albanese told reporters after the announcement that the Trump administration’s actions were “entirely unjustified” and an act of “economic self-harm” on the part of the US. But, he added, Australia would not take any reciprocal measures.

“This is against the spirit of our two nations’ enduring friendship and fundamentally at odds with the benefits that our economic partnership has delivered over more than 70 years,” Albanese said Wednesday in Sydney. Australia will continue to advocate for an exemption, he added.

President Donald Trump had told the Australian prime minister during talks by telephone last month that he would consider an exemption. Albanese, who must hold an election by May 17, had been under intense pressure from local lawmakers and executives to secure a carve out for Australia’s exports.

Albanese said after the announcement that he would be working with the steel and aluminum industries to diversify their exports, encouraging citizens to buy domestically produced products.

“Friends need to act in a way that reinforces to our respective populations the fact that we are friends. This is not a friendly act,” Albanese said Wednesday.

During Trump’s first term, Canberra undertook months of painstaking negotiations with Washington to secure an exemption. However, then-Prime Minister Malcolm Turnbull told Bloomberg this week that he believed it would be “a lot harder” for Australia to get a similar deal this time.

White House spokeswoman Karoline Leavitt had told reporters earlier that Trump had decided against giving an exemption, according to Australian media reports.

“He considered it, and considered against it,” she told the Australian Broadcasting Corp., referring to Trump.

(By Ben Westcott)

No comments:

Post a Comment