Azmi Haroun,Dave Levinthal

Fri, January 21, 2022

Rep. Marjorie Taylor Greene (R-GA).Kevin Dietsch/Getty Images

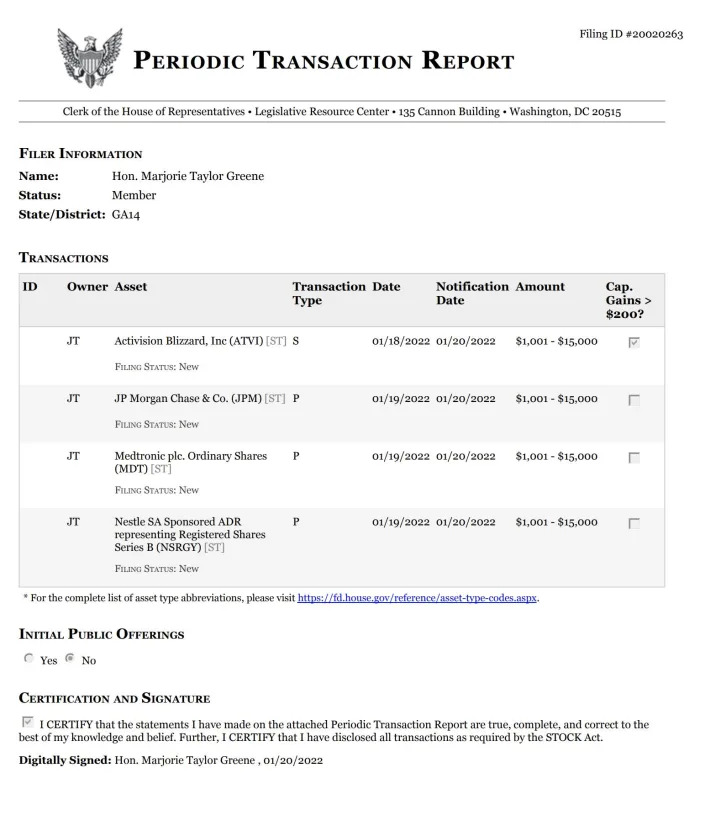

Rep. Marjorie Taylor Greene filed a stock disclosure that she sold up to $15,000 worth of Activision stock on January 18.

Microsoft's announced plans to acquire video-game giant Activision Blizzard for $68.7 billion on the same day.

Activision's stock soared that day, and Greene reported more than $200 in capital gains from the sale.

Rep. Marjorie Taylor Greene filed a stock disclosure indicating she sold up to $15,000 worth of Activision Blizzard stock on January 18 — the day news broke of plans for the video game company to be purchased by Microsoft.

Greene reported more than $200 in capital gains on the sale on the disclosure form, which she filed with Thursday with the Clerk of the House of Representatives. It was not immediately clear how much Greene — a freshman Republican from Georgia and one of Congress' most polarizing members — pocketed from the sale.

A stock trade disclosure from Rep. Marjorie Taylor Greene, a Republican of GeorgiaUS House of Representatives

On Tuesday, Microsoft announced plans to acquire video-game giant Activision Blizzard for $68.7 billion. If the deal is greenlit, it will be the largest-ever deal in the tech industry. On the same day, Activision's price soared.

There is no indication that Greene violated the STOCK Act by making this trade.

Greene ranks among Congress' most active stock traders. She was the first member of Congress to invest in Donald Trump's social media company, TRUTH social, and has had no problem investing in companies that espouse social views that clash with her own, such as those on Black Lives Matter.

Greene's office could not be reached for immediate comment on the recent sale of Activision Blizzard stock. In September, Greene told Insider, "I have an independent investment advisor that has full discretionary authority on my accounts. I do not direct any trades."

Greene's stock sale comes in the background of Insider's new investigative reporting project, "Conflicted Congress," which chronicled the myriad ways members of the US House and Senate have eviscerated their own ethical standards, avoided consequences, and blinded Americans to the many moments when lawmakers' personal finances clash with their public duties.

The project identified 54 members of Congress who've failed to properly report their financial trades as mandated by the Stop Trading on Congressional Knowledge Act of 2012, also known as the STOCK Act.

Speaker of the House Nancy Pelosi, a Democrat who in December said lawmakers should be allowed to trade individual stocks, reversed course this month, saying she was now open to a stock trading ban for lawmakers.

"If members want to do that, I'm okay with that," Pelosi told reporters on Thursday.

Microsoft was the No. 2 most popular stock among members of Congress, according to an Insider analysis of congressional financial records. As part of Insider's "Conflicted Congress" project, Greene received a "solid" rating on the strength of her disclosing her various stock trades on time.

Only 10 members of Congress have placed their assets in a "qualified blind trust" — a formal, congressionally approved financial vehicle independently managed by a trustee and designed to prevent conflicts of interest. Greene is not among them.

Read the original article on Business Insider

No comments:

Post a Comment