Alicia Hiyate | March 10, 2023 |

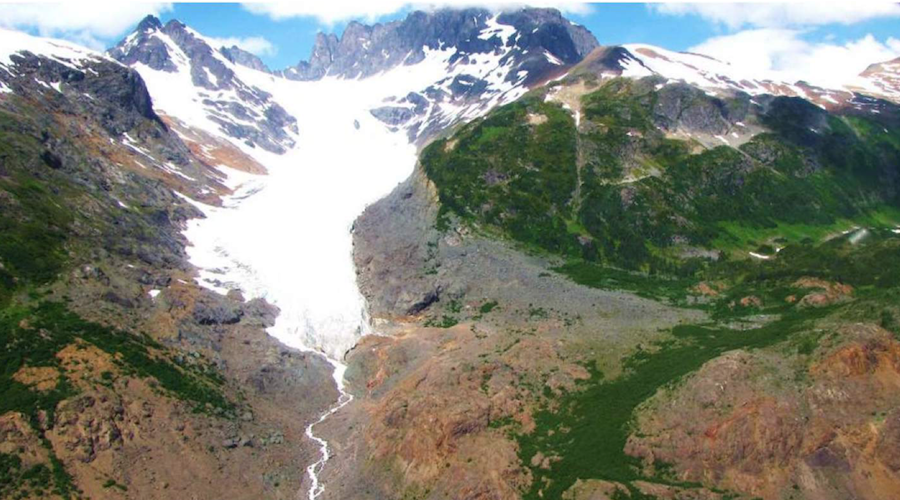

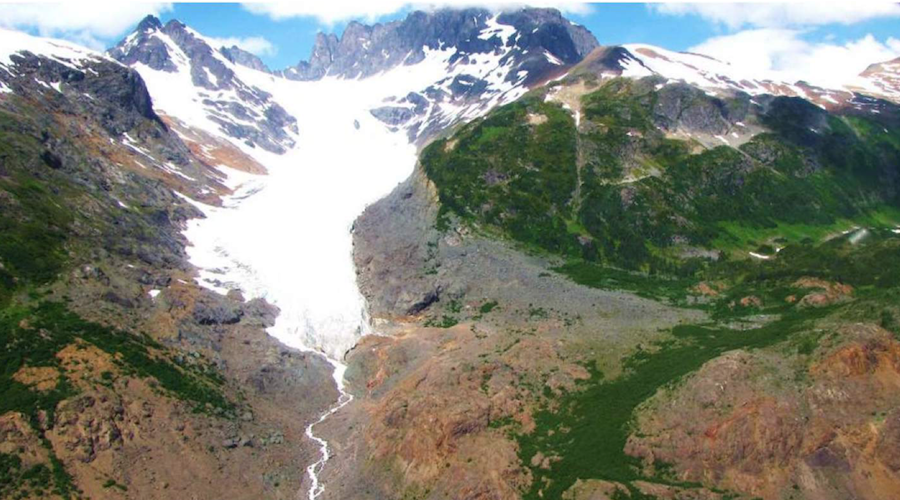

Todd Creek project in British Columbia. (Reference image by ArcWest Exploration).

Shares in junior explorer ArcWest Exploration (TSXV: AWX) jumped more than 80% in morning trading in Toronto after it announced an earn-in deal with Freeport-McMoRan (NYSE: FCX) on one of its copper-gold properties in BC’s Golden Triangle.

Under the agreement, Freeport will be able to earn up to 80% of ArcWest’s Todd Creek project which is next to Newcrest Mining’s (TSX: NCM; ASX: NCM) Brucejack mine. To earn an initial 51% interest, Freeport needs to fund C$20 million of work at ArcWest over five years, and make staged payments to the company totalling C$900,000. ArcWest will remain operator during this stage.

Once it earns its initial stake, Freeport can up its interest to 80% by funding C$30 million in work at Todd Creek over five years and making staged payments totalling C$750,000.

After Freeport has finalized its ownership level (whether at 51% or 80%), each party will be responsible for funding its proportionate share of work at Todd Creek.

ArcWest believes the project, which it says covers one of the fundamental north-south structural corridors in the Stikine terrane and is near multiple major projects and mines, could be an analogue to the Hod Maden gold-copper project in Turkey.

“ArcWest looks forward to advancing our Todd Creek project in partnership with Freeport, one of the world’s largest copper miners and a team with a track record of global copper-gold discoveries that have proceeded to mine development,” said Tyler Ruks, president and CEO of ArcWest, in a release.

“ArcWest’s Todd Creek project is host to one of the largest underexplored copper-gold systems in BC’s Golden Triangle, and Freeport’s endorsement of the project is a testament to its potential for hosting a world class copper-gold deposit.”

Ruks added that ArcWest is in discussions with other mining companies on potential earn-in agreements for its other copper-gold porphyry projects. The company has seven in BC.

ArcWest isn’t the only BC junior to attract the attention of copper majors recently.

Amarc Resources (TSXV: AHR), which already had a strategic exploration partnership with Freeport at its JOY project, also signed a deal with Sweden’s Boliden in November for its DUKE copper-gold district in the Babine region of BC.

ArcWest shares reached a new 52-week high of C$0.10, up 82% or C$0.045, at noon ET. The stock has traded between C$0.05 and C$0.10 over the last year and has a market cap of C$7.6 million.

Todd Creek project in British Columbia. (Reference image by ArcWest Exploration).

Shares in junior explorer ArcWest Exploration (TSXV: AWX) jumped more than 80% in morning trading in Toronto after it announced an earn-in deal with Freeport-McMoRan (NYSE: FCX) on one of its copper-gold properties in BC’s Golden Triangle.

Under the agreement, Freeport will be able to earn up to 80% of ArcWest’s Todd Creek project which is next to Newcrest Mining’s (TSX: NCM; ASX: NCM) Brucejack mine. To earn an initial 51% interest, Freeport needs to fund C$20 million of work at ArcWest over five years, and make staged payments to the company totalling C$900,000. ArcWest will remain operator during this stage.

Once it earns its initial stake, Freeport can up its interest to 80% by funding C$30 million in work at Todd Creek over five years and making staged payments totalling C$750,000.

After Freeport has finalized its ownership level (whether at 51% or 80%), each party will be responsible for funding its proportionate share of work at Todd Creek.

ArcWest believes the project, which it says covers one of the fundamental north-south structural corridors in the Stikine terrane and is near multiple major projects and mines, could be an analogue to the Hod Maden gold-copper project in Turkey.

“ArcWest looks forward to advancing our Todd Creek project in partnership with Freeport, one of the world’s largest copper miners and a team with a track record of global copper-gold discoveries that have proceeded to mine development,” said Tyler Ruks, president and CEO of ArcWest, in a release.

“ArcWest’s Todd Creek project is host to one of the largest underexplored copper-gold systems in BC’s Golden Triangle, and Freeport’s endorsement of the project is a testament to its potential for hosting a world class copper-gold deposit.”

Ruks added that ArcWest is in discussions with other mining companies on potential earn-in agreements for its other copper-gold porphyry projects. The company has seven in BC.

ArcWest isn’t the only BC junior to attract the attention of copper majors recently.

Amarc Resources (TSXV: AHR), which already had a strategic exploration partnership with Freeport at its JOY project, also signed a deal with Sweden’s Boliden in November for its DUKE copper-gold district in the Babine region of BC.

ArcWest shares reached a new 52-week high of C$0.10, up 82% or C$0.045, at noon ET. The stock has traded between C$0.05 and C$0.10 over the last year and has a market cap of C$7.6 million.

Artemis Gold passes final regulatory hurdle to begin works at Blackwater mine

Staff Writer | March 9, 2023

Site of the Blackwater gold project in central B.C. (Image courtesy of Artemis Gold.)

Artemis Gold (TSXV: ARTG) has announced the approval of its BC Mines Act Permit for the Blackwater project in central British Columbia, which is the final step required to allow the company to begin major construction activities at the mine site with the expectation of an initial gold pour in the second half of 2024.

Located about 446 km northeast of Vancouver, the Blackwater project comprises the construction, operation and closure of an open-pit gold mine and ore processing facilities that will be developed in multiple stages.

“The approval of the BC Mines Act Permit is the culmination of a substantial amount of work completed by our team in collaboration with our First Nation partners and the provincial government,” Steven Dean, Artemis Gold CEO, said in a news release.

The Blackwater mine is estimated to be the largest gold mine development project in the Cariboo region of BC in more than a decade, supporting regional employment over multiple decades with the potential to be extended through further exploration.

In addition, the Blackwater mine “has been designed to have one of the smallest carbon footprints for an open pit gold project in the world, with a defined path forward to substantially reduce that footprint further and potentially achieve net zero carbon emissions through the integration of a zero-exhaust-emission haul fleet by 2029,” Dean said.

The mine will be connected to the BC Hydro grid, which is powered by hydroelectricity. This provides the foundation for Blackwater to be developed into one of the lowest greenhouse gas (GHG) emitting open pit mining operations in the world, according to Artemis. The company also invested in a fully electrified process plant with all diesel and propane components replaced with electric equipment.

Artemis is planning a 22-year mine life with open pit methods and using gravity and conventional cyanidation methods for gold recovery. Over that period, it is expected to produce an average of 339,000 oz. of gold per year. Life-of-mine capital costs are estimated at C$2.25 billion, beginning with C$645.2 million to be spent before production begins next year.

As part of the permitting process, Artemis said it also collaborated with the federal and provincial governments as well as First Nations communities on the development of environmental management plans related to caribou habitat offsetting, fish habitat offsetting, wetlands offsetting, and conservation and enhancement activities.

David Eby, Premier of British Columbia, also put out a statement on Thursday: “The Blackwater gold project will put lots of people to work and create a wide range of opportunities and benefits for local businesses, communities and First Nations while ensuring the highest standards of environmental protection, mitigation and sustainability.”

Josie Osborne, British Columbia’s Minister of Energy, Mines and Low Carbon Innovation, added: “British Columbians will benefit from hundreds of new jobs from this new mine, with both its construction and multiple decades of operation.”

An economic impact study completed by KPMG on the Blackwater project in November 2020 anticipates that it will create 457 direct full-time jobs per year over the operating life of the mine and with 825 direct full-time jobs per year created during the construction/expansion phases of mine development.

Additionally, the mine is expected to contribute C$13.2 billion ($9.5bn) to the provincial economy, over the life of the mine, including C$2.3 billion ($1.6bn) to provincial revenues, the report said.

Staff Writer | March 9, 2023

Site of the Blackwater gold project in central B.C. (Image courtesy of Artemis Gold.)

Artemis Gold (TSXV: ARTG) has announced the approval of its BC Mines Act Permit for the Blackwater project in central British Columbia, which is the final step required to allow the company to begin major construction activities at the mine site with the expectation of an initial gold pour in the second half of 2024.

Located about 446 km northeast of Vancouver, the Blackwater project comprises the construction, operation and closure of an open-pit gold mine and ore processing facilities that will be developed in multiple stages.

“The approval of the BC Mines Act Permit is the culmination of a substantial amount of work completed by our team in collaboration with our First Nation partners and the provincial government,” Steven Dean, Artemis Gold CEO, said in a news release.

The Blackwater mine is estimated to be the largest gold mine development project in the Cariboo region of BC in more than a decade, supporting regional employment over multiple decades with the potential to be extended through further exploration.

In addition, the Blackwater mine “has been designed to have one of the smallest carbon footprints for an open pit gold project in the world, with a defined path forward to substantially reduce that footprint further and potentially achieve net zero carbon emissions through the integration of a zero-exhaust-emission haul fleet by 2029,” Dean said.

The mine will be connected to the BC Hydro grid, which is powered by hydroelectricity. This provides the foundation for Blackwater to be developed into one of the lowest greenhouse gas (GHG) emitting open pit mining operations in the world, according to Artemis. The company also invested in a fully electrified process plant with all diesel and propane components replaced with electric equipment.

Artemis is planning a 22-year mine life with open pit methods and using gravity and conventional cyanidation methods for gold recovery. Over that period, it is expected to produce an average of 339,000 oz. of gold per year. Life-of-mine capital costs are estimated at C$2.25 billion, beginning with C$645.2 million to be spent before production begins next year.

As part of the permitting process, Artemis said it also collaborated with the federal and provincial governments as well as First Nations communities on the development of environmental management plans related to caribou habitat offsetting, fish habitat offsetting, wetlands offsetting, and conservation and enhancement activities.

David Eby, Premier of British Columbia, also put out a statement on Thursday: “The Blackwater gold project will put lots of people to work and create a wide range of opportunities and benefits for local businesses, communities and First Nations while ensuring the highest standards of environmental protection, mitigation and sustainability.”

Josie Osborne, British Columbia’s Minister of Energy, Mines and Low Carbon Innovation, added: “British Columbians will benefit from hundreds of new jobs from this new mine, with both its construction and multiple decades of operation.”

An economic impact study completed by KPMG on the Blackwater project in November 2020 anticipates that it will create 457 direct full-time jobs per year over the operating life of the mine and with 825 direct full-time jobs per year created during the construction/expansion phases of mine development.

Additionally, the mine is expected to contribute C$13.2 billion ($9.5bn) to the provincial economy, over the life of the mine, including C$2.3 billion ($1.6bn) to provincial revenues, the report said.

No comments:

Post a Comment