Bloomberg News | March 10, 2023 |

Credit: CATL

China’s Contemporary Amperex Technology Co. Ltd. reported annual earnings that beat estimates on stronger demand for cleaner cars, underscoring its dominance as the world’s biggest maker of batteries for electric vehicles.

The Tesla Inc. supplier on Thursday reported net income for the 12 months ended Dec. 31 of 30.72 billion yuan ($4.4 billion), an increase of 92.9% from the previous year. That beat the median analyst estimate of 28.8 billion yuan, according to data compiled by Bloomberg, and was in line with CATL’s preliminary guidance in January for profit between 29.1 billion yuan to 31.5 billion yuan.

Revenue came in at 328.6 billion yuan, up 152% and in line with analysts’ forecasts. CATL’s core power battery business, which in 2021 accounted for the majority of the company’s sales, generated margins of 17.2%, matching market estimates. Shares in CATL surged as much as 3.3% Friday despite a broader EV rout sparked by a round of steep price cuts that have stirred worries about overcapacity.

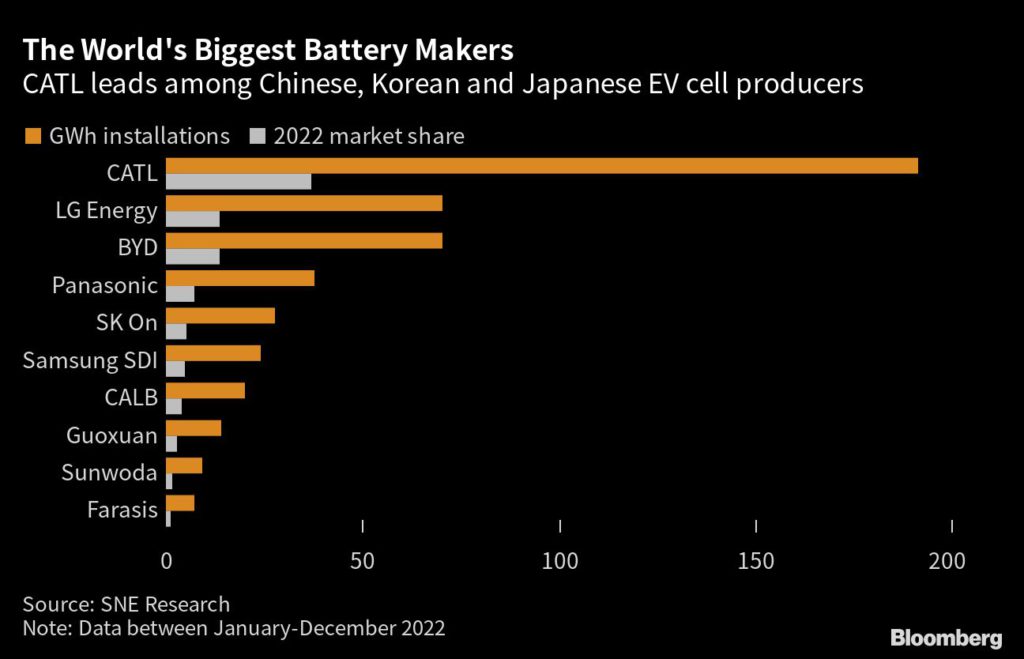

CATL commanded a 37% share of the global market for EV batteries in 2022, testimony to the popularity of its cheaper-to-produce lithium-iron-phosphate (LFP) batteries. In joint second place, with 13.6% each, are South Korea’s LG Energy Solution Ltd. and China’s BYD Co., the Warren Buffett-backed company that also makes cars, according to SNE Research data.

The size and dominance of CATL — which recently sealed a deal to build a plant with Ford Motor Co. in the US — has caught the attention of Chinese President Xi Jinping, who in rare remarks offered at annual parliamentary meetings in Beijing earlier this week said he viewed its leading position with “joy and worry.”

China’s Contemporary Amperex Technology Co. Ltd. reported annual earnings that beat estimates on stronger demand for cleaner cars, underscoring its dominance as the world’s biggest maker of batteries for electric vehicles.

The Tesla Inc. supplier on Thursday reported net income for the 12 months ended Dec. 31 of 30.72 billion yuan ($4.4 billion), an increase of 92.9% from the previous year. That beat the median analyst estimate of 28.8 billion yuan, according to data compiled by Bloomberg, and was in line with CATL’s preliminary guidance in January for profit between 29.1 billion yuan to 31.5 billion yuan.

Revenue came in at 328.6 billion yuan, up 152% and in line with analysts’ forecasts. CATL’s core power battery business, which in 2021 accounted for the majority of the company’s sales, generated margins of 17.2%, matching market estimates. Shares in CATL surged as much as 3.3% Friday despite a broader EV rout sparked by a round of steep price cuts that have stirred worries about overcapacity.

CATL commanded a 37% share of the global market for EV batteries in 2022, testimony to the popularity of its cheaper-to-produce lithium-iron-phosphate (LFP) batteries. In joint second place, with 13.6% each, are South Korea’s LG Energy Solution Ltd. and China’s BYD Co., the Warren Buffett-backed company that also makes cars, according to SNE Research data.

The size and dominance of CATL — which recently sealed a deal to build a plant with Ford Motor Co. in the US — has caught the attention of Chinese President Xi Jinping, who in rare remarks offered at annual parliamentary meetings in Beijing earlier this week said he viewed its leading position with “joy and worry.”

CATL also reported a strong performance in its fast-growing energy storage segment, which generated revenue of 45 billion yuan, ahead of expectations. That’s an area of the business that billionaire Chairman Zeng Yuqun is taking a keener interest in, recently calling for stricter standards — a move that could benefit his firm at the expense of smaller rivals.

Based in Ningde, Fujian province, CATL is facing intensifying competition in the battery space. Those dynamics are in part being spurred by CATL itself, which reportedly has been offering discounts to some Chinese carmakers against the backdrop of tumbling prices for raw materials like lithium, where it has direct investments.

In comments to investors Friday, the battery maker clarified that recent rebates to some carmakers were aimed at sharing lithium mineral resources with long-term strategic clients.

What Bloomberg intelligence says:

CATL’s battery profitability can recover further in 2023 on falling materials costs and greater economies of scale. We expect CATL’s battery sales volume to surge another 40-50% after more than doubling last year, fueled by robust demand from EVs as China extends a zero-purchase tax after ending Covid-Zero.

– Steve Man and Joanna Chen, BI auto analysts

Citibank analysts led by Jack Shang, which maintains a buy rating on the stock, said CATL believed its competitive advantage versus peers were widening in comments during a post-earnings investor call. “We prefer battery leader CATL with strong pricing power and access to overseas customers,” said Shang in a note Friday.

Jefferies Financial Group Inc.’s Johnson Wan, which downgraded CATL, remained unimpressed with its battery business margins, and foresaw pressure ahead, he said in a note Friday.

Being the industry behemoth means CATL is particularly exposed to geopolitical risk, especially with the US seeking to limit reliance on Chinese companies in the EV supply chain and encouraging automakers to manufacture in North America.

CATL’s recent agreement with Ford to license its LFP battery technology for use in a new $3.5 billion EV battery plant that Ford will run and control in southwest Michigan has drawn scrutiny from Beijing, people familiar with the matter have told Bloomberg News, with officials concerned that competitive aspects of CATL’s technology could be given to or accessed by the American automaker.

Meanwhile, CATL is on a global expansion push, with 13 production bases around the world including in Germany and Hungary, according to its website, and five R&D centers. It’s mulling a Swiss GDR fundraise of up to $6 billion to fuel its many capital investments.

(By Danny Lee)

US Senator blasts Ford’s battery deal with China’s CATL

Reuters | March 10, 2023 |

West Virginia Senator Joe Manchin. Credit: Third Way Think Tank

US Senator Joe Manchin said on Friday he is “totally opposed” to allowing Chinese battery maker CATL to access US tax dollars that finance electric vehicle purchases as part of its partnership with Ford Motor Co.

The blunt statements from Manchin, who wrote the Inflation Reduction Act (IRA) in a bid to develop a domestic EV battery industry, come amid rising tension over how the landmark legislation is implemented and who can benefit.

Under the IRA, consumers can receive $7,500 in tax credits for purchasing an EV, although the new law also allows the rebate to be kept by the company involved if the vehicle is leased. A 12% royalty that is included in the Ford-CATL partnership would send $900 of the $7,500 tax credit to CATL, Manchin told the CERAWeek energy conference in Houston.

“I’ll be damned if I’m going to give them $900 out of $7,500, to let it go to China for basically a product we started,” said Manchin, a West Virginia Democrat who chairs the Senate Energy and Natural Resources Committee.

In response to Manchin’s comments, Ford defended the CATL deal and said it will own the US facility making the battery and no one else will get US tax dollars. “Making these batteries here at home is much better than continuing to rely exclusively on foreign imports, like other auto companies do,” said a company spokesperson.

CATL’s advanced and low-cost batteries could be reverse-engineered, Manchin said, arguing the technology may have originated in the United States. Manchin added he has talked extensively with Ford executives as well as Jon Huntsman, a member of Ford’s board of directors and former US ambassador to China, about the CATL deal.

“You’re telling me we don’t have the smart people and the technology, and we can’t get up to speed quick enough? That doesn’t make sense,” said Manchin, who did not specify what steps he might take to block CATL from accessing funds.

It was the first time that Manchin raised an objection to the Ford-CATL licensing agreement.

Ford’s agreement with CATL is part of the US automaker’s stated intent to boost annual EV production to 600,000 vehicles by late 2023 and more than 2 million by the end of 2026.

US Senator Marco Rubio, a Florida Republican, introduced legislation on Thursday that would block tax credits for EV batteries produced using Chinese technology. Rubio has also called for the Biden administration to review the Ford-CATL agreement.

Oil and minerals

Manchin and Senator Lisa Murkowski, Republican of Alaska, told the CERAWeek conference that US permitting reform is needed to achieve the goals of the IRA and other recent legislation.

The Biden administration should greenlight a ConocoPhillips oil project in northern Alaska, Murkowski said, adding the project was needed for US energy security.

A decision is “imminent,” and could come at any hour, she said at the conference.

If the administration rejects the development or does not make it economically viable for ConocoPhillips to go through with the project, “legislation is always something we have to reckon with,” Murkowski told reporters.

Both senators said that while Africa and other parts of the globe may want to deepen trade ties with the United States to take advantage of the IRA, the legislation’s true aim is boosting American mining and EV supply chains.

“There are extraordinary mineral opportunities in many places around the globe,” said Murkowski. “But we are not focusing what we have here at home and what we’re doing to help facilitate that first. That’s part of my beef.”

Murkowski derided the US Department of Energy’s decision last summer to lend $102.1 million to Syrah Resources Ltd for a graphite processing plant in Louisiana that will source the metal from Mozambique.

“Tell me why we’re so eager to help facilitate that and why we’re not willing to kind of step it up and say, ‘Well, what do we have here at home?'”

Energy security

After Iran and Saudi Arabia agreed on Friday to re-establish relations after seven years of hostility, Murkowski warned about a realignment of global energy alliances following Russia’s invasion of Ukraine last year. The invasion prompted US and other governments to impose sanctions on Russian oil.

“When you see alliances come together over energy that cause us concern, we need to wake up here in this country,” Murkowski said.

Manchin addressed President Joe Biden’s budget proposal this week that would scrap billions of dollars in oil and gas industry subsidies, saying a conversation is needed around what happens if the price of oil and gas falls and makes it uneconomical for companies to produce energy.

Manchin earlier on Friday said he would not support the nomination of Laura Daniel-Davis as assistant secretary of the Department of Interior, saying she supported higher royalty rates for Alaskan oil production.

(By Ernest Scheyder, Stephanie Kelly, Ben Klayman and Gary McWilliams; Editing by David Gregorio and Matthew Lewis)

No comments:

Post a Comment