Pamela Heaven

Tue, March 14, 2023

Good Morning,

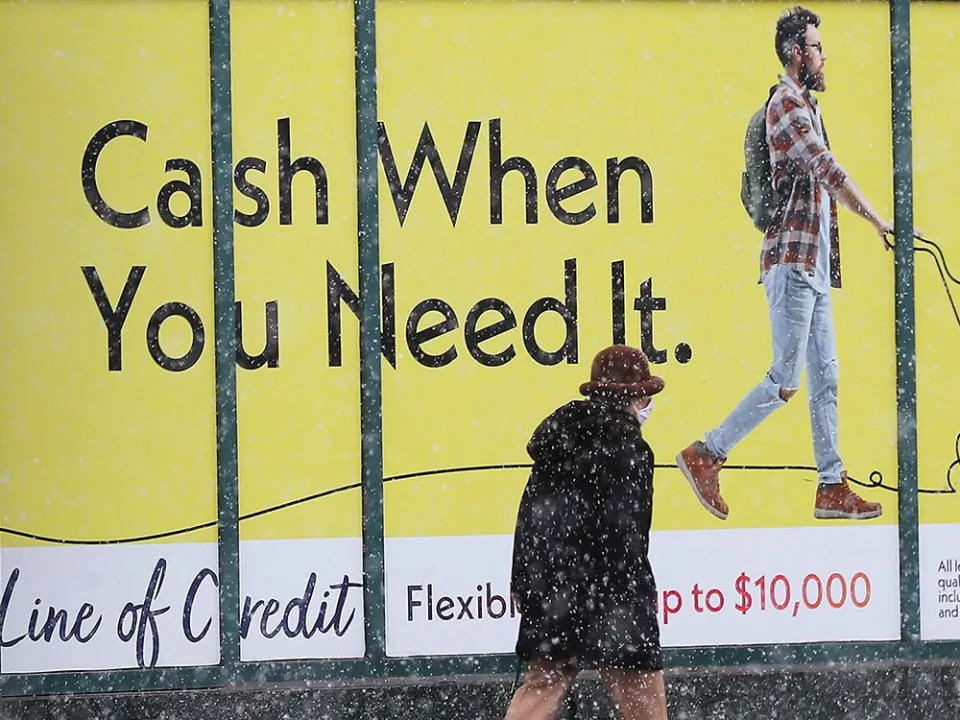

These are historic times for Canadian debt.

Canadians are now paying 45 per cent more interest than they were a year ago, the fastest increase in records going back to 1990, Statistics Canada said on March 13.

Interest payments totalling $33.2 billion rose 14.1 per cent from the quarter before, surpassing the record increase set in the third quarter.

Nor is there any relief on the horizon. With interest rates likely to remain higher for longer, debt servicing costs are expect to continue rising and not peak until the second half of 2024, said TD economist Ksenia Bushmeneva.

All this raises concern about the increasing burden on Canada’s heavily indebted households amid the most rapid run-up in interest rates in the Bank of Canada‘s history.

The central bank’s own indicators of financial vulnerabilities released last week showed the share of households falling behind on their debt payments is on the rise — but still below pre-pandemic levels, said Bushmeneva. But with some consumer loans households are not doing so well. The share of loans in arrears on credit cards has returned to pre-pandemic levels and on auto and instalment loans they are now above.

“The Bank of Canada will need to maintain a close watch on household credit performance as headwinds from higher interest rates continue to hit Canadian households this year,” wrote Bushmeneva in a note on the data.

Another concern is growth in alternative loans. According to the Canada Mortgage and Housing Corporation, mortgage investment entities, which includes mortgage investment corporations and private, non-bank lenders, accounted for 10.2 per cent of residential mortgages in the third quarter of 2022, up from 8.43 per cent the year before.

“Canadians are taking out more alternative loans, and according to FSRA, they are holding them for longer periods of time,” said RATESDOTCA.

Private lenders do not have to follow the same rules as government-regulated banks, making it easier for customers to take out a mortgage. But those loans offer carry higher rates and fees.

“For homeowners squeezed by rising rates and tougher lending guidelines, private lenders can appear to be a saving grace,” said Victor Tran, RATESDOTCA mortgage expert. “However, there are risks that homeowners need to be aware of when taking out a mortgage with alternative lenders. There are significant differences between taking a mortgage from a traditional lender and taking one from an alternative lender, and these differences can cost consumers more than they might think.”

There was good news in Statistics Canada’s household balance sheet. After two straight quarterly declines, household wealth rose 1.2 per cent in the fourth quarter.

The gain was mainly down to a better performance by the stock market, which lifted the value of financial assets by 3.4 per cent. This offset the drop in home prices.

That said, household net worth was down 4.7 per cent from the same quarter in 2021, points out Randall Bartlett, senior director of Canadian Economics for Desjardins.

Disposable income, thanks to income growth in the fourth quarter, rose by 3 per cent, beating the 1.6 per cent rise in household consumption. And the pace of household borrowing slowed.

This pushed the debt-to-income ratio down to 180.5 per cent in the fourth quarter from 184.3 per cent in the quarter before.

However it didn’t stop the debt service ratio from ticking up to 14.3 per cent.

“Today’s release speaks to an economy that is defying the gravity of rate hikes to some extent,” wrote Desjardins’ Bartlett in a note. “The question is not so much if rate hikes will be felt in full but when.”

No comments:

Post a Comment