Celtic Sea Demonstration Floating Wind Project Gets Welsh Approval

Plans for the first floating wind farm in the Celtic Sea cleared key hurdles with permissions from the Welsh government. The project is viewed as a demonstration that would help to unlock the potential for offshore wind power generation in the region and play a critical step in the UK’s target of over 100 GW of power from offshore resources.

The Erebus project is being jointly developed by TotalEnergies and the Simply Blue Group. Planning began in 2019 when they first identified the location. They point to the potential for wind power generation in the Celtic Sea citing independent studies that report there are 150 to 250 GW of wind resources in the region. They believe that 50 GW is an attainable target for the Celtic Sea.

“The Erebus project has the potential to show the world that Wales and the Celtic Sea can deliver renewable energy alongside the sustainable management of our marine resources,” said First Minister of Wales, Rt Hon Mark Drakeford. “In determining the marine license and the planning consents, the Welsh Government and our partners in Natural Resources Wales have enabled this project to move forward to apply for subsidy support from the UK Government.”

Welsh Ministers have granted consent with planning permission for the Erebus project to proceed. This comes weeks after the project secured its marine license from Wales. The license was granted after a comprehensive environmental impact assessment process was completed and the planning permission marked a key step forward for the project. The project still needs to complete contracts with the UK government.

“We welcome the decision from Welsh Ministers to grant the necessary planning consents for project Erebus and have been working with Planning and Environment Decisions Wales and other key stakeholders since 2019 to develop a project that is sympathetic to the natural environment and minimizes impacts to local communities and stakeholders,” said Mike Scott, Project Managing Director at Blue Gem Wind.

Erebus would be located nearly 25 miles off the Southwest coast of Pembrokeshire between the Bristol and St. George’s channels. The challenge for the area is that it will encounter depths of up to approximately 250 feet.

They expect when completed it will be among the largest floating offshore wind projects in the world. The group is working with Principle Power on the development of the floating platforms. They anticipate that the demonstration project would have between seven and ten platforms each with a 14 MW turbine.

The plan calls for starting construction in January 2025 and having the project operational by December 2026. In the first phase, they would have a capacity of 100 MW and they look at this as a steppingstone toward the goal of 4 GW of offshore wind power from the Celtic Sea.

Shell Funds Offshore Wind Research at Former Avondale Shipyard Site

Louisiana-based company Gulf Wind Technology has secured funding from Shell to set up a wind power research and training facility at the former Avondale Shipyard site, a storied location which is ready for redevelopment.

With $10 million in backing from Shell, Gulf Wind plans to hire 30 people and found a new hub for offshore wind R&D in the region.

Gulf Wind has experience in improving the economic performance of operational wind farms and conducting research on rotor technology, primarily for onshore applications. It is headquartered at Avondale, with 30,000 square feet of workspace and access to 1.5 million additional square feet for fabrication. The new R&D program will be an expansion of its activities.

The company says that an investment in R&D for designing custom rotors - its primary area off experience - will be useful when it comes to adapting offshore turbines to the unique conditions in the Gulf.

“Wind resources in the Gulf region are more variable than what you find on the east coast where most of U.S. offshore wind development activity is currently happening,” said James Martin, GWT's CEO. “Seasonal hurricane conditions and moderate average wind speeds create a situation that requires a novel approach to the application of technology and the framework in which it is both developed and demonstrated. The Shell Gulf Wind Technology Accelerator program has been specifically created to address and fulfill this need."

The first demonstrator turbine at the site is expected to be ready as early as next year. In addition to its R&D work, the program weill also house an offshore wind workforce education and training initiative.

To get the project built in Avondale, the state of Louisiana offered Gulf Wind Technology a workforce development incentive package, including a $375,000 award to support site infrastructure improvements. The company is also expected to participate in two state tax exemption programs.

The news is a big boost for the former Avondale Shipyard, renamed Avondale Global Gateway under the ownership of terminal operator and stevedoring company T. Parker Host.

"When we took the risk of transforming Avondale shipyards, this is exactly the type of progress and partnership we envisioned. With hundreds of acres of laydown space for equipment like offshore wind blades, our site is the ideal location for this type of groundbreaking investment," said T. Parker Host CEO and President Adam Anderson. "We had a vision of Avondale Global Gateway becoming the first offshore wind hub on the Gulf Coast and with the launch of this partnership, we are quickly making this a reality."

Last month, the Port of South Louisiana agreed to buy and further redevelop the Avondale site, and the port's management welcomed the news that Gulf Wind will be expanding.

"Today’s announcement from Gulf Wind Technology and Shell is confirmation that Avondale is open for business and attracting commerce and investment from the world’s most recognizable organizations," said Port of South Louisiana CEO Paul Matthews. "This is just the beginning. We look forward to fostering more development and job creation as Avondale Global Gateway’s new owner."

T. Parker Host purchased Avondale from Huntington Ingalls in 2018 for $60 million and invested over $100 million more in its redevelopment. It has agreed to sell the site to the Port of South Louisiana for $445 million, reflecting upgraded expectations of the complex's future business opportunities.

Marshall Unveils Robotic Drone System for Offshore Wind Inspections

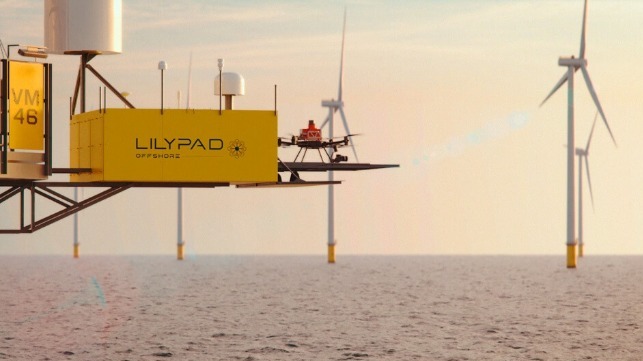

As more countries increasingly exploit offshore wind energy, the demand for new technologies to inspect and maintain wind turbines is going to skyrocket. To solve this challenge, Marshall Futureworx, the venture building and advanced technologies arm of Cambridge-based Marshall Group, has unveiled a “resident robotic ecosystem” to provide offshore wind farm inspection services.

The ground-breaking new system, dubbed Lilypad, is an ecosystem of multiple autonomous over-the-horizon UAVs (Unmanned Aerial Vehicles), which utilize artificial intelligence and navigational sensors. This revolutionizes the way operators are able to monitor real-time performance of their wind farms.

The UAVs are deployed from dedicated offshore charging stations and monitored by a single remote pilot stationed in an onshore command and control center. Vital inspection data and reports are then transmitted back to the wind operators, enabling faster and predictive maintenance scheduling.

According to Marshall Futureworx, Lilypad reduces the requirement for offshore personnel undertaking inspections, minimizing both cost and impact to the environment. At the same time, the higher frequency of revisits and the improved intelligence operators gain through Lilypad’s remote inspections will enable an offshore wind farm operator to increase wind turbine uptime.

As a UK based company, Marshall Futureworx hopes Lilypad will gain traction from the country’s booming offshore wind market. The UK has the world’s second largest installed offshore wind capacity at around 12 GW. It forms a key component of the UK government’s net zero strategy, including its ambitious target to achieve 50GW offshore wind installed capacity by 2030 and potentially more than 100 GW by 2050.

“The ever increasing demand for secure and renewable energy to power our communities has resulted in the surging need for innovative solutions to enable the installation and support of offshore wind infrastructure, right from initial construction and through the life of projects,” said Kieren Paterson, the Managing Director of Marshall Futureworx.

The Lilypad’s announcement follows the signing of a memorandum of understanding in 2022 between Futureworx and ISS Aerospace, who offer industrial UAVs and leading AI drone guidance and control software.

NASSCO, Navantia Partner Up for West Coast Offshore Wind Projects

General Dynamics NASSCO is joining forces with Spanish shipbuilder Navantia to compete for future offshore wind contracts on the U.S. West Coast.

Last year the Biden administration has auctioned five offshore wind lease areas off the coast of California, securing bids from five different experienced developers. The sites are all in deep water, and will require floating platform technology to develop. This is a costlier and more infrastructure-intensive method of construction, and has never been done before in the 800-1000 meter water depths of the California shelf. It will require building floating steel structures on a scale ordinarily found in the oil and gas industry, and that means new opportunities for shipbuilders.

Developers will also need to charter some quantity of Jones Act-qualified tonnage to install and service the towers, and these specialized ships will have to be built in America. As the West Coast's sole deep-sea shipbuilder, General Dynamics NASSCO is well positioned to compete for those contracts. As an additional financial incentive, local supply chain partners like the San Diego-based yard could potentially benefit from a pool of $117 million in U.S.-content investment commitments, which the leaseholders offered during the federal bidding round.

General Dynamics NASSCO's agreement with Navantia centers on the prospect of building components and assembling floating foundations. It leverages Navantia's years of experience in the European offshore wind sector, including localization projects deploying Navantia technology, alongside NASSCO's local infrastructure and capabilities in the United States. If successful, the business opportunity is larger than just the first five lease auctions. California wants to install at least 25 gigawatts worth of capacity by 2045, and the U.S. East Coast market holds potential opportunities too. This could help keep NASSCO's drydocks busy in between contracts for support ships for the U.S. Navy, its primary business line.

"We’re always looking for commercial work to complement our government work because it keeps labor level in the yard,” explained Brett Hershman, director of government relations and business development at NASSCO, speaking to the Union-Tribune.

Gulf of Maine Offshore Wind Potential Highlighted in DNV Study

DNV recently completed a series of studies designed to help the state of Maine develop the critical pathways for its offshore wind industry. The initiative was launched in June 2019 to outline a clear roadmap to develop floating offshore wind in the Gulf of Maine, while ensuring balance with Maine’s maritime industries and environment.

The U.S. Department of the Interior through the Bureau of Ocean Energy Management has been actively targeting the Gulf of Maine as one of the future areas for the development of the offshore wind industry. According to BOEM’s leasing strategy announced in 2021, they are targeting the first lease auctions for the Gulf of Maine in 2024.

Maine has an abundant coastline and some of the highest average wind speeds in the United States, which makes it a strong candidate for offshore wind development. However, according to DNV, project development is more complex than other areas already underway on the East Coast, because of the Gulf of Maine’s water depths and its status as a primary economic driver for the state. State officials, including the governor, have expressed concern over the potential impact on the fishing industry and tourism, which are two of the state’s largest industries.

The U.S. Economic Development Administration (EDA) awarded a $2.166 million grant in 2020 to the State of Maine’s Governor’s Energy Office to advance the offshore wind industry through the development of a comprehensive industry roadmap. DNV was selected through a competitive bidding process to develop a series of technical, socio-economic, and strategy advisory studies to inform the state’s roadmap.

Broadly, DNV projects that offshore wind will rise from eight percent of total wind production in 2020 to 34 percent in 2050, totaling almost 2000 GW. Floating wind, which is expected to be the primary resource for the Gulf of Maine, is expected to represent about six percent of the power generated globally from the offshore wind industry with a total installed capacity potential for 300 GW.

“Offshore wind is an important component to transition to a decarbonized energy industry, and the roadmap prepared by DNV and others will help the State of Maine to build a dynamic and equitable offshore wind industry,” said Richard S. Barnes, region president, Energy Systems North America for DNV. “Floating wind is in its earliest stages and has not yet reached commercialization. This initiative provides the State of Maine, as well as other areas where fixed-bottom wind turbines are not feasible, an opportunity to be a global leader in the development of the market and the technology.”

DNV’s analysis of the industry’s potential in Maine revealed that the benefits of the offshore wind industry to the state are substantial. However, they anticipate that no large-scale wind farms will be operational in the near term. In the majority of DNV’s scenarios, offshore wind capacity in the Gulf of Maine will accelerate only after 2040.

In addition to the potential to generate significant amounts of electric power from offshore wind, DNV identifies the potential for a strong economic benefit to the state. They project the potential to create up to 33,000 jobs during the construction phase and up to 13,000 long-term jobs from the ongoing operation of the wind farms. They estimate the potential for $2 billion in wages to be generated from the offshore wind industry.

“While the development of offshore wind in the State of Maine demonstrates a potential for clear benefits such as job development and health, stakeholders are concerned about negative consequences to the industries and communities that rely on the ocean,” DNV writes. “There is a risk of displacement from harvest areas for fishermen and lobstermen, which can be problematic due to the strong social convention of harvesting only in specific areas that have often been negotiated over generations. The tourism industry could be affected by the perception that visible wind turbines would mar the scenery and ‘untouched’ feel of the coast.”

The roadmap set forth by DNV and other organizations identifies some solutions, including continued proactive communication with affected communities, and also recommends further research as lease areas and project development is more certain.

BOEM has been moving forward with the early stages of its planning efforts for the Gulf of Maine. In the spring of 2022, they released an initial report broadly defining a planning area consisting of 13.7 million acres in the Gulf of Maine and released an initial request for interest that ran to October 2022. Through consultations and a review of comments it is anticipated that the areas will be significantly reduced as the process moves forward.

A university-led project is already studying the Gulf of Maine’s offshore wind potential and developed a design for floating wind turbines. After testing near shore, the project filed for a research permit. BOEM in January reported that it has determined that there was no competitive interest for the research lease and as a next step toward awarding the license would be initiating an environmental review of potential impacts from offshore wind leasing activities associated with the research lease.

No comments:

Post a Comment