One advocate called the CFPB's new rule "a major milestone in its effort to level the playing field between regular people and big banks."

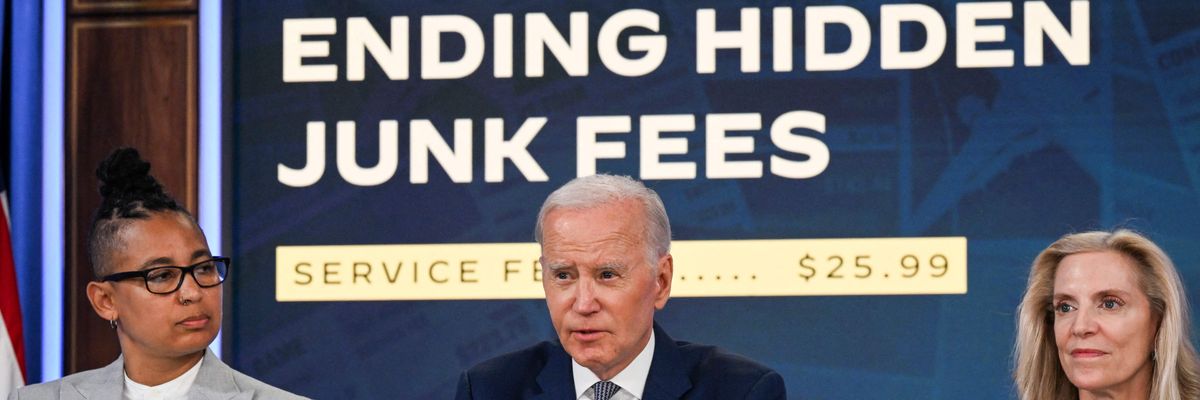

U.S. President Joe Biden speaks about protecting consumers from junk fees in Washington, D.C. on June 15, 2023.

(Photo: Andrew Caballero-Reynolds/AFP via Getty Images)

Julia Conley

Dec 12, 2024

COMMON DREAMS

The Consumer Financial Protection Bureau, one of President-elect Donald Trump's top expected targets as he plans to dismantle parts of the federal government after taking office in January, announced on Thursday its latest action aimed at saving households across the U.S. hundreds of dollars in fees each year.

The agency issued a final rule to close a 55-year-old loophole that has allowed big banks to collect billions of dollars in overdraft fees from consumers each year,

The rule makes significant updates to federal regulations for financial institutions' overdraft fees, ordering banks with more than $10 billion in assets to choose between several options:Capping their overdraft fees at $5;

Capping fees at an amount that covers costs and losses; or

Disclosing the terms of overdraft loans as they do with other loans, giving consumers a choice regarding whether they open a line of overdraft credit and allowing them to comparison-shop.

The final rule is expected to save Americans $5 billion annually in overdraft fees, or about $225 per household that pays overdraft fees.

Adam Rust, director of financial services at the Consumer Federation of America, called the rule "a major milestone" in the CFPB's efforts "to level the playing field between regular people and big banks."

"No one should have to pick between paying a junk overdraft fee or buying groceries," said Rust. "This rule gives banks a choice: they can charge a reasonable fee that does not exploit their customers, or they can treat these loan products as an extension of credit and comply with existing lending laws."

The rule is set to go into effect next October, but the incoming Trump administration could put its implementation in jeopardy. Trump has named billionaire Tesla CEO Elon Musk to co-lead the Department of Government Efficiency, an advisory body he hopes to create. Musk has signaled that he wants to "delete" the CFPB, echoing a proposal within the right-wing policy agenda Project 2025, which was co-authored by many officials from the first Trump term.

"The CFPB is cracking down on these excessive junk fees and requiring big banks to come clean about the interest rate they're charging on overdraft loans."

"It is critical that incoming and returning members of Congress and President-elect Trump side with voters struggling in this economy and support the CFPB's overdraft rule," said Lauren Saunders, associate director at the National Consumer Law Center (NCLC). "This rule is an example of the CFPB's hard work for everyday Americans."

In recent decades, banks have used overdraft fees as profit drivers which increase consumer costs by billions of dollars every year while causing tens of millions to lose access to banking services and face negative credit reports that can harm their financial futures.

The Federal Reserve Board exempted banks from Truth in Lending Act protections in 1969, allowing them to charge overdraft fees without disclosing their terms to consumers.

"For far too long, the largest banks have exploited a legal loophole that has drained billions of dollars from Americans' deposit accounts," said CFPB Director Rohit Chopra. "The CFPB is cracking down on these excessive junk fees and requiring big banks to come clean about the interest rate they're charging on overdraft loans."

Government watchdog Accountable.US credited the CFPB with cracking down on overdraft fees despite aggressive campaigning against the action by Wall Street, which has claimed the fees have benefits for American families.

Accountable.US noted that Republican Reps. Patrick McHenry of North Carolina and Andy Barr of Kentucky have appeared to lift their criticisms of the rule straight from industry talking points, claiming that reforming overdraft fee rules would "limit consumer choice, stifle innovation, and ultimately raise the cost of banking for all consumers."

Similarly, in April Barr claimed at a hearing that "the vast majority of Americans" believe credit card late fees are legitimate after the Biden administration unveiled a rule capping the fees at $8.

"Americans pay billions in overdraft fees every year, but the CFPB's final rule is putting an end to the $35 surprise fee," said Liz Zelnick, director of the Economic Security and Corporate Power Program at Accountable.US. "Despite efforts to block the rule and protect petty profits by big bank CEOs and lobbyists, the Biden administration's initiative will protect our wallets from an exploitative profit-maximizing tactic."

The new overdraft fee rule follows a $95 million enforcement action against Navy Federal Credit Union for illegal surprise overdraft fees and similar actions against Wells Fargo, Regions Bank, and Atlantic Union.

Consumers have saved $6 billion annually through the CFPB's initiative to curb junk fees, which has led multiple banks to reduce or eliminate their fees.

"Big banks that charge high fees for overdrafts are not providing a courtesy to consumers—it's a form of predatory lending that exacerbates wealth disparities and racial inequalities," said Carla Sanchez-Adams, senior attorney at NCLC. "The CFPB's overdraft rule ensures that the most vulnerable consumers are protected from big banks trying to pad their profits with junk fees."

No comments:

Post a Comment