"As CMS negotiates the prices Medicare will pay for top-selling drugs, it should take into account the billions we've already lost due to these patenting tactics," said one researcher.

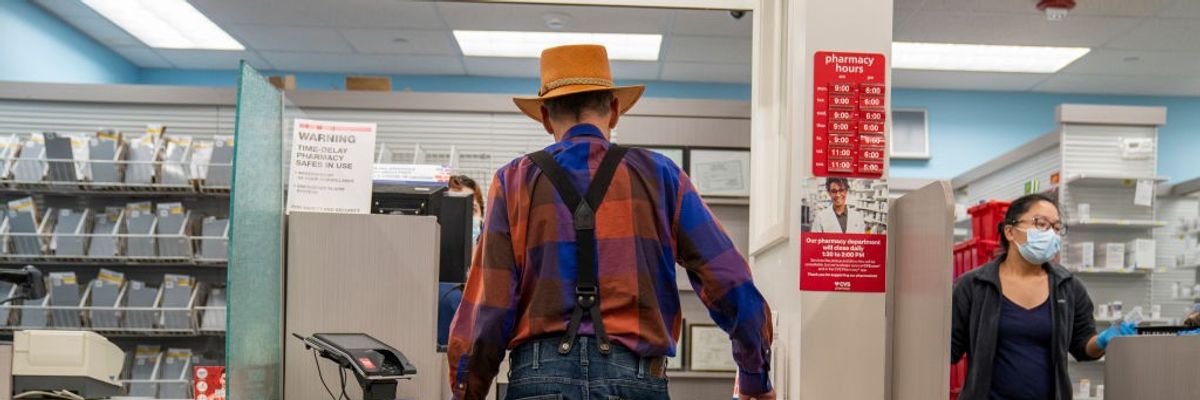

An elderly man waits for his prescription to be filled on October 3, 2023 at a CVS pharmacy in New York City.

(Photo: Robert Nickelsberg/Getty Images)

Eloise Goldsmith

Dec 11, 2024

COMMON DREAMS

When the Inflation Reduction Act became law in 2022, it included a historic provision that gave the Centers for Medicare and Medicaid Services (CMS) the ability to negotiate maximum fair prices for select drugs. This means that CMS now has an important tool to resist high prices imposed by pharmaceutical companies and lower the cost that Medicare recipients pay for their drugs. So far, Medicare has negotiated the maximum fair prices for 10 drugs, which will go into effect January 1, 2026.

But according to a report released Wednesday by the watchdog group Public Citizen, the manufacturers behind these drugs are able to rely on another method to protect their profits: patent abuses and evergreening tactics.

The report defines "evergreening tactics" as the practice of "patenting trivial and/or obvious modifications of existing medications to lengthen exclusivity on branded medicines."

The makers of the drugs Eliquis, Imbruvica, Jardiance, Farxiga, and Entresto, for example, obtained patents on what constitute trivial or minor changes to earlier patent claims, "such as crystalline forms of drug compounds which would be discovered and managed during routine testing that is part of the drug approval process," according to Public Citizen. These new patents allow the manufacturers to extend their monopoly on these drugs.

"Big Pharma patent abuse is cheating Medicare enrollees of more affordable drugs and costing taxpayers billions," said Public Citizen Access to Medicines program researcher Jishian Ravinthiran in a statement.

"Patent abuses enable Big Pharma companies to unfairly extend their monopolies and keep prices artificially high. As CMS negotiates the prices Medicare will pay for top-selling drugs, it should take into account the billions we've already lost due to these patenting tactics," he added.

The report makes this same point, arguing that the agency's initial offers on pharmaceuticals should take into account how long-monopoly drugs have been able to obtain longtime exclusivities on medicines by manipulating patents.

This is paramount, Public Citizen argues, given the scope of lost savings. The group estimates that Medicare will lose somewhere between $4.9 and $5.4 billion in savings that should have accrued to taxpayers if four out of the 10 drugs did not take advantage of patenting tactics, and therefore would have faced greater competition prior to negotiation.

"These lost savings are nearly as much as what Medicare is expected to save if negotiated prices go into effect on all of the selected drugs in the first year of the program ($6 billion)," according to the report.

As an example, the drug etanercept, which is marketed as Enbrel, is on the list of 10 drugs that will be subject to a negotiated cap come January 2026. Etanercept's maker Amgen did not contribute to the original research and development of etanercept, per Public Citizen, it just acquired the original maker of the drug, Immunex, in 2002.

Immunex's patent of etanercept was set to expire in 2019, but "by using abusive patent practices" Amgen was able to extend the patent protections through 2029, according to Public Citizen. Amgen was able to evade competition of two potential "biosimilar" competitors, Erelzi and Eticovo, which received FDA approval in the 2010s.

Referencing analysis done in a separate report, Public Citizen estimated "that biosimilars could have entered the market after August 2019 were it not for Amgen's unwarranted patent exclusivities, and we calculated Medicare would have spent $1,891,500,836 less on a net basis had enrollees been able to use lower-cost alternatives by the time negotiated prices go into effect on January 1, 2026."

Huge Administrative Waste Makes Clear For-Profit Insurance Is 'Actually Very Bad': Analysis

"It is totally fair for people to identify private insurers as the key bad actor in our current system," writes Matt Bruenig of the People's Policy Project. "The quicker we nationalize health insurance, the better."

"It is totally fair for people to identify private insurers as the key bad actor in our current system," writes Matt Bruenig of the People's Policy Project. "The quicker we nationalize health insurance, the better."

Healthcare advocates risk arrest protesting care denials at UnitedHealthcare headquarters on July 15, 2024 in Minnetonka, Minnesota.

(Photo: David Berding/Getty Images for People's Action Institute)

Jake Johnson

Dec 10, 2024

COMMON DREAMS

Last week's murder of UnitedHealthcare CEO Brian Thompson brought to the surface a seething hatred of the nation's for-profit insurance system—anger rooted in the industry's profiteering, high costs, and mass care denials.

But that response has led some pundits to defend private insurance companies and claim that, in fact, healthcare providers such as hospitals and doctors are the real drivers of outlandish U.S. healthcare costs.

In an analysis published Tuesday, Matt Bruenig of the People's Policy Project argued that defenders of private insurers are relying on "factual misunderstandings and very questionable analysis" and that it is reasonable to conclude that the for-profit insurance system is "actually very bad."

"From a design perspective, the main problem with our private health insurance system is that it is extremely wasteful," Bruenig wrote, estimating based on existing research that excess administrative expenses amount to $528 billion per year—or 1.8% of U.S. gross domestic product.

"All healthcare systems require administration, which costs money, but a private multi-payer system requires massively more than other approaches, especially the single-payer system favored by the American left," Bruenig observed, emphasizing that excess administrative expenses of both the insurance companies and healthcare providers stem from "the multi-payer private health insurance system that we have."

He continued:

To get your head around why this is, think for a second about what happens to every $100 you give to a private insurance company. According to the most exhaustive study on this question in the U.S.—the CBO single-payer study from 2020—the first thing that happens is that $16 of those dollars are taken by the insurance company. From there, the insurer gives the remaining $84 to a hospital to reimburse them for services. That hospital then takesanother $15.96 (19% of its revenue) for administration, meaning that only $68.04 of the original $100 actually goes to providing care.

In a single-payer system, the path of that $100 looks a lot different. Rather than take $16 for insurance administration, the public insurer would only take $1.60. And rather than take $15.96 of the remaining money for hospital administration, the hospital would only take $11.80 (12% of its revenue), meaning that $86.60 of the original $100 actually goes to providing care.

High provider payments, which some analysts have suggested are the key culprit in exorbitant healthcare costs, are also attributable to the nation's for-profit insurance system, Bruenig argued.

"Medicaid and Medicare are able to negotiate much lower rates than private insurance, just as the public health insurer under a single-payer system would be able to. It is only within the private insurance segment of the system that providers have been able to jack up rates to such an extreme extent," he wrote. "Given all of this, I think it is totally fair for people to identify private insurers as the key bad actor in our current system. They are directly responsible for over half a trillion dollars of administrative waste and (at the very least) indirectly responsible for the provider rents that are bleeding Americans dry."

"The quicker we nationalize health insurance," he concluded, "the better."

Bruenig's analysis comports with research showing that a single-payer system such as the Medicare for All program proposed by Sen. Bernie Sanders (I-Vt.), Rep. Pramila Jayapal (D-Wash.), and other progressives in Congress could produce massive savings by eliminating bureaucratic costs associated with the private insurance system.

One study published in the Annals of Internal Medicine in January 2020 estimated that Medicare for All could save the U.S. more than $600 billion per year in healthcare-related administrative costs.

"The average American is paying more than $2,000 a year for useless bureaucracy," said Dr. David Himmelstein, lead author of the study, said at the time. "That money could be spent for care if we had a Medicare for All program."

Deep-seated anger at the systemic and harmful flaws of the for-profit U.S. insurance system could help explain why the percentage of the public that believes it's the federal government's responsibility to ensure all Americans have healthcare coverage is at its highest level in more than a decade, according to Gallup polling released Monday.

"There's a day of reckoning that is happening right now," former insurance industry executive Wendell Potter, president of the Center for Health and Democracy, said in an MSNBCappearance on Monday. "Whether we're talking about employers, patients, doctors—just about everybody despises health insurance companies in ways that I've never seen before."

No comments:

Post a Comment