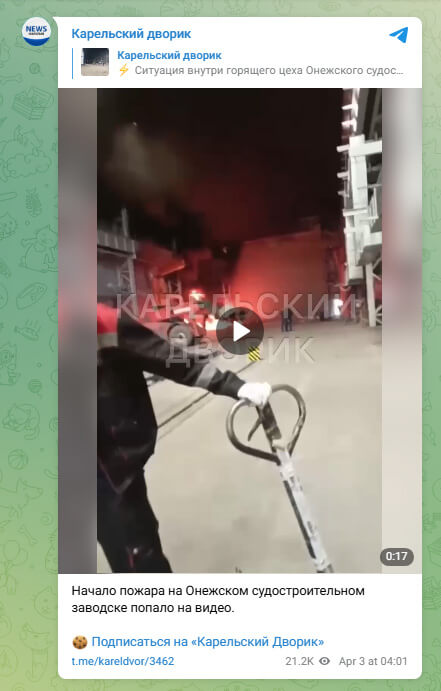

Video: Fire Damages Plant at Russia’s Onega Shipbuilding Yard

A large fire broke out this morning in the Onega Shipbuilding and Ship Repair Plant in Petrozavodsk, Russia causing damage to one of the new structures at the facility. According to the Ministry of Emergency Services, more than 60 firefighters and 20 units of equipment were dispatched. Reports indicate three individuals were injured in the fire.

The Onega Shipyard has been the focus of Russian efforts to expand its domestic shipbuilding capabilities. The facility was established in 2002 north of St. Petersburg at the convergence of Russia’s main waterways connecting the Baltic, White, Caspian, Azov, and Black Seas. Russian officials announced in 2021 that the yard would be modernized and expanded for the production of vessels including tugs, dredgers, and LNG bunkering ships. The yard employs more than 500 people.

The fire was reported at 0950 local time on April 3 with the media indicating it was likely started by two welders working near spilled fuel. They were in one of the building sheds which is 1,500 square meters (more than 16,000 square feet). Some reports are saying it was one of the new facilities being prepared for automation and digital operations.

Residents reported hearing explosions, which the Ministry is saying were gas canisters used at the shipbuilder. In one of the videos posted on Telegram, someone is heard yelling “get out” to the workers.

The Ministry said that two victims suffered burns to the upper respiratory tract and smoke inhalation and were hospitalized. A third person received medical care at the scene.

Local officials later told the media the fire had been contained by 1130 and extinguished by 1200. They said a cooling operation was underway.

Shipbuilding Orders Rebound as South Korea Looks to Benefit from U.S. Fees

South Korea’s shipbuilding industry is highlighting a rebound in orders in March after a slow start to the year. It comes as the industry looks for ways to benefit from the proposed U.S. fees on Chinese-built ships.

To combat the growing Chinese domination of shipbuilding, South Korea’s strategy has included a focus on high-value ships and larger, more technologically advanced ships. This includes all forms of gas carriers where South Korea continues to lead the orders despite China’s growth in LNG tankers. In the long term, South Korea looks toward ammonia carriers, ammonia-fueled ships, automation, and other technologies.

Reports are the strategy worked in March 2025 with the South Korean yards garnering 55 percent of the orders based on tonnage according to data from Clarkson Research Service. South Korea recorded orders for 820,000 compensated gross tons (CGT) compared to the Chinese yards booking 520,000 CGT in March. By the number of vessels, however, China continued its lead booking 31 ship orders compared to South Korea’s 17 ships.

This is a strong rebound from February when China booked 70 percent of the orders by tonnage. South Korea’s yards booked just nine percent of the tonnage ordered in February. The reports highlighted that the Korean yards historically have lagged behind the Chinese in the first quarter of the year while also noting that last year South Korea only received 16 percent of the orders for the year versus 70 percent booked in China.

China also continues to hold a strong overall lead in the sector, Clarkson’s data shows Chinese yards have an order backlog of nearly 94 million CGT which is 59 percent of the global total. South Korea’s yards while ranking second have a backlog of just over 36 million CGT or 23 percent of the total.

The South Korean industry is looking toward the U.S. to help drive future business. In February it was reported that the U.S. Trade Representative was proposing fees for Chinese-built ships calling in U.S. ports. The Trump administration has latched on to the concept as part of its plan to rebuild U.S. shipbuilding.

The Korean news outlet CHOSUNBIZ reports fears of the pending fees might already be impacting future shipbuilding plans. Citing reports from Daishin Securities it writes that ExxonMobil canceled orders for two liquefied natural gas bunkering vessels (LNGBVs) intended for China.

HD Korea Shipbuilding & Offshore Engineering, South Korea’s largest shipbuilder, reported yesterday, April 3, that it had booked an additional order for an LNG carrier valued at approximately $263 million. The group said it has now received orders for a total of 24 ships worth $4.07 billion, achieving 22.6 percent of its annual order target of $18.05 billion. By ship type, the company has received orders in 2025 for an LNG carrier, four LNG bunkering vessels, an LPG/ammonia carrier, and two ethane carriers, as well as 12 containerships, and four tankers.

The Office of the United States Trade Representative held public hearings on March 24 and March 26, regarding the proposed actions in the Section 301 investigation on China’s targeting of the maritime, logistics, and shipbuilding sectors for dominance. It also accepted written comments and for seven days afterward was also accepting rebuttal comments. No timeline was released for completing the review but it is expected the office will issue its final recommendations which Trump will incorporate into the overall plan for U.S. shipbuilding. Combined with the new tariffs, many have warned it could have a chilling effect on global trade and the shipping industry.

USACE, Eastern Shipbuilding, Royal IHC Start Construction of New Dredge

The U.S. Army Corps of Engineers joined contractors Eastern Shipbuilding Group and Royal IHC on April 4, 2025, in Panama City, FL for a steel cutting ceremony, kicking off construction of a Medium Class Hopper Dredge (MCHD) to replace the Dredge McFARLAND of the Army Corps’ Philadelphia District.

The event was attended by USACE Headquarters, North Atlantic Division, Marine Design Center, and Philadelphia District leadership as well as Royal IHC and Eastern Shipbuilding Group leadership.

“This new dredge is going to play a critical role in helping us deliver our navigation mission, which enables maritime commerce to flow on our nation’s waterways. This strengthens our economy and supports our national security,” said USACE North Atlantic Division Regional Business Director John Primavera. “USACE hasn’t built a deep draft hopper dredge in about 45 years. We’re proud to recognize this milestone and look forward to continued partnership with the shipbuilding industry and progressing on the construction of this vital ship.”

The Dredge McFARLAND is one of four oceangoing hopper dredges owned and operated by the Army Corps of Engineers and is currently conducting urgent dredging in North Carolina near the entrance of the Cape Fear River.

The new MCHD will play a critical role in enabling the Corps to continue to deliver its navigation mission and provide for safe, reliable, effective, and environmentally sustainable waterborne transportation systems for vital national security, commerce, and recreation needs. The new dredge is estimated to be placed into service in 2027 and replaces the McFARLAND.

Quotes from Eastern Shipbuilding Group and Royal IHC leaders

"The steel cutting of this highly advanced hopper dredge marks another milestone in Eastern Shipbuilding Group’s legacy of delivering world-class vessels. We are proud to partner with the U.S. Army Corps of Engineers and Royal IHC to build a state-of-the-art dredge that will enhance our nation's waterway infrastructure. Our team is committed to executing this program with the highest standards of quality, efficiency, and innovation,” said Joey D’Isernia, CEO of Eastern Shipbuilding Group, Inc.

“We are proud to see our design with the most advanced dredging technology come to life during this exciting milestone,” said Leo van Ingen, Sales Director North America at Royal IHC. “Exceeding the USACE's mission-based operational requirements and featuring one of the most advanced configurations ever developed by Royal IHC, this project marks a significant step in our collaboration with USACE and ESG. This ground-breaking hopper dredge will set new standards in efficiency, automation and sustainability.”

This highly automated, state-of-the-art vessel is undergoing construction at ESG's Allanton and Port St. Joe facilities and is scheduled for delivery in 2027.

Vessel Specifications:

Length: 320’

Beam: 72’

Hull Depth: 28’

Draft (hopper empty): 11’3”

Draft (hopper full): 25’6”

The products and services herein described in this press release are not endorsed by The Maritime Executive.

St. Johns Ship Building Receives Two New Contracts Valued at Over $17M

[By St. Johns Ship Building]

St. Johns Ship Building, a Palatka, Florida-based Jones Act facility, today announced the award of two new contracts totaling approximately $17 million in value. The projects include the construction of a state-of-the-art Crew Transfer Vessel (CTV) and two aluminum cruise vessels. This milestone underscores the shipyard's sustained momentum and reputation for delivering high-quality, purpose-built vessels that support a diverse range of maritime operations.

The new aluminum CTV is designed to meet the rigorous demands of offshore operations, ensuring safe and efficient transportation of personnel and equipment. Incorporating advanced technology and sustainable design elements, the vessel will contribute to the next generation of maritime innovation while supporting the expansion of offshore infrastructure in the United States.

In addition, St. Johns Ship Building has been contracted to construct two aluminum cruise vessels, further diversifying its production portfolio and reinforcing its capabilities in the commercial passenger vessel sector. These vessels will be built with a focus on passenger comfort, safety, and fuel efficiency.

“We are honored to secure these important contracts,” said Joe Rella, President of St. Johns Ship Building. “Our shipyard continues to build momentum, and these awards reflect both our expertise and our ability to deliver reliable, cutting-edge vessels that are critical to the success of a wide range of maritime operations. With our skilled workforce and modernized facilities, St. Johns Ship Building is well-positioned to support diverse shipbuilding needs with innovative solutions.”

Since being acquired in 2022 by Americraft Marine, St. Johns Ship Building has undergone significant investment and modernization. The facility has enhanced its production capacity to build multiple vessels concurrently, streamlining operations to deliver high-quality vessels on schedule and at scale. These improvements have strengthened its position in the U.S. shipbuilding industry, specializing in a wide variety of vessels that support commercial marine and government operations.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

No comments:

Post a Comment