WWIII

IAEA's Grossi 'deeply concerned' after Israel attack on Iran nuclear facilities

The International Atomic Energy Agency Director General Rafael Mariano Grossi has told the agency's board of governors "nuclear facilities must never be attacked, regardless of the context or circumstances, as it could harm both people and the environment".

In a statement on Friday he said: "We are currently in contact with the Iranian nuclear safety authorities to ascertain the status of relevant nuclear facilities and to assess any wider impacts on nuclear safety and security. At present, the competent Iranian authorities have confirmed that the Natanz enrichment site has been impacted and that there are no elevated radiation levels. They have also reported that at present the Esfahan and Fordow sites have not been impacted.

"This development is deeply concerning ... such attacks have serious implications for nuclear safety, security and safeguards, as well as regional and international peace and security."

He noted previous IAEA general conference resolutions on the topic of avoiding military attacks on nuclear facilities and said: "As Director General of the International Atomic Energy Agency, and consistent with the objectives of the IAEA under the IAEA Statute, I call on all parties to exercise maximum restraint to avoid further escalation. I reiterate that any military action that jeopardises the safety and security of nuclear facilities risks grave consequences for the people of Iran, the region, and beyond."

Grossi added: "Yesterday, the Board of Governors adopted an important resolution on Iran’s safeguards obligations. In addition to this, the Board resolution stressed its support for a diplomatic solution to the problems posed by the Iranian nuclear programme. The IAEA continues to monitor the situation closely, stands ready to provide technical assistance, and remains committed to its nuclear safety, security and safeguards mandate in all circumstances ... in accordance with its Statute and longstanding mandate, the IAEA provides the framework and natural platform where facts prevail over rhetoric and where engagement can replace escalation."

According to Iran's official Islamic Republic News Agency (IRNA) at least five nuclear scientists were known to be among those killed in the strikes, including Fereydoun Abbasi-Davani - who headed the Atomic Energy Organisation of Iran from 2011 to 2013 - and Mohammad Mehdi Tehranchi, president of Azad University. Israel said that its actions had been a pre-emptive move targeting what it called Iran's programme to develop nuclear weapons and to "neutralise an immediate and existential threat to our people".

Iran says that its nuclear programme is peaceful and condemned what it called the IAEA board's "anti-Iran resolution". According to an IRNA report a joint statement by the Ministry of Foreign Affairs and the Atomic Energy Organization of Iran on Thursday said that in response to the resolution, a new uranium enrichment facility had been ordered in a "secure location" and "first-generation centrifuges at the Fordow enrichment site would be replaced with sixth-generation machines".

According to World Nuclear Association's Information Paper on Iran, the country has one nuclear power reactor operating, with construction of a second Russian-designed unit at the Bushehr site taking place. According to a presentation at the IAEA general conference last September, first concrete was expected on a third unit by the end of 2024, with another unspecified unit under construction, and further power units planned.

The nuclear power plants have not been listed among the targets of the attacks, which instead included the uranium enrichment centres at Natanz.

Iran's enrichment facilities

Unenriched, or natural, uranium contains about 0.7% of the fissile uranium-235 (U-235) isotope. ("Fissile" means it's capable of undergoing the fission process by which energy is produced in a nuclear reactor). The rest is the non-fissile uranium-238 isotope. Most nuclear reactors need fuel containing between 3.5% and 5% U-235 - known as low-enriched uranium, or LEU. Advanced reactor designs that are now being developed - and many small modular reactors - and research reactors, which are often used to produce medical radioisotopes, amongst other things - will require higher enrichments still - typically up to 20%.

Enrichment increases the concentration of the fissile isotope by passing the gaseous uranium hexafluoride (UF6) through so-called cascades of gas centrifuges, in which a fast spinning rotor inside a vacuum casing makes use of the very slight difference in mass between the fissile and non-fissile isotopes to separate them.

But the same technology that is needed to enrich uranium for use in nuclear power or research reactors could also be used to enrich uranium to the much higher levels (90% U-235 and above) that could be used in nuclear weapons. This means that uranium enrichment is strategically sensitive from a non-proliferation standpoint, so there are strict international controls to ensure that civilian enrichment plants are not used in this way.

Iran is known to operate enrichment plants at Natanz, about 80km southeast of Qom, and Fordow, 20km north of Qom. Iranian authorities have confirmed to the IAEA that the Natanz enrichment site has been impacted but "at present" Fordow, and a site at Esfahan, where there is a uranium conversion facility, have not been impacted.

According to World Nuclear Association, there are two enrichment plants at Natanz: the Pilot Fuel Enrichment Plant, with two cascades designated for production of uranium enriched up to 20% U-235, ostensibly for the Teheran Research Reactor, and R&D purposes; and the Fuel Enrichment Plant, which is built underground.

In a quarterly report, published on 31 May, the IAEA verified that cascades at the Fuel Enrichment Plant were being fed with natural UF6 to produce material enriched up to 5% U-235. It verified that Iran was testing some centrifuges and feeding both natural and depleted UF6 into others in the various R&D production lines at the Pilot Fuel Enrichment Plant.

According to the IAEA's quarterly report, as of 27 May some 82 cascades were operational at the Fuel Enrichment Plant, with seven operational cascades at the Pilot Fuel Enrichment Plant. The Fuel Enrichment Plant had produced an estimated 2671.3 kg of UF6 enriched up to 5% since its previous report. The pilot plant had produced 19.2 kg of uranium enriched up to 60%, about 243 kg with up to 5% enrichment and 453 kg with enrichment up to 2% U-235.

The Fordow Fuel Enrichment Plant has 13 operating cascades, according to the IAEA, where over 166 kg of UF6 enriched up to 60% U-235 were produced since the agency's previous quarterly report, as well as 67 kg of material enriched up to 20%, 724.5 kg enriched up to 5%, and nearly 369 kg of up to 2% enrichment.

The agency said that Iran's total inventory of enriched uranium as of 27 May stood at 2221.4 kgU of material with an enrichment of up to 2%; 5508.8 kgU up to 5%, 274.5 kgU up to 20% and 408.6 kgU with up to 60% enrichment.

The UF6 feedstocks - natural and depleted UF6 - have low levels of radioactivity, but significant chemical toxicity, so have to be handled appropriately, as does the enriched uranium product. The materials themselves are stored in purpose-built cylinders to provide the necessary physical protection.

The IAEA has continued to underline that "armed attacks on nuclear facilities could result in radioactive releases with grave consequences within and beyond the boundaries of the State which has been attacked". As Grossi highlighted in his speech to the IAEA Board, as of Friday morning Vienna time, the IAEA had been told there had been no increase in radiation levels at Natanz following the attacks.

Israel Shuts Leviathan Gas Field Amid Iran Conflict, Choking Supply to Egypt

Israel’s Energy Ministry ordered Chevron to shut down the Leviathan gas field amid heightened regional threats following strikes on Iran.

Egypt, reliant on Israeli gas during peak demand, now faces a supply crunch and may turn to costly emergency LNG imports.

The disruption has raised global alarm, sending European gas prices higher and highlighting vulnerabilities in East Med energy corridors.

Israel has ordered the shutdown of its massive Leviathan gas field, cutting off a critical supply line to Egypt just as regional tensions with Iran erupt into open conflict.

Chevron, the operator of Leviathan, confirmed the halt on Friday after Israel’s Energy Ministry issued the order, citing escalating security threats. Energean Plc also suspended output from its Israeli assets. The Leviathan shutdown is already impacting gas flows to Egypt, according to Bloomberg sources close to the pipeline network.

Egypt, facing peak summer demand and a widening domestic gas shortfall, now faces the prospect of emergency LNG purchases ahead of schedule—tightening an already brittle global gas market. European gas prices spiked as much as 6.6% Friday on the news.

The Leviathan field, located in the Levant Basin, is Israel’s largest energy asset with 22.9 trillion cubic feet of recoverable gas and had been exporting record volumes to Egypt—981 million cubic feet per day in 2024, an 18% year-over-year surge. Egypt, with declining domestic production and LNG export ambitions, had increasingly leaned on Israeli imports to fill the gap.

Chevron’s Tamar field remains operational, and Energean’s Karish field continues to serve domestic Israeli demand. But if shutdowns persist, Egypt’s LNG export capacity—and its own power grid—could be strained, and Jordan’s access to gas also stands at risk.

The timing is striking. Just months ago, Leviathan’s operators announced plans to expand capacity from 12 to 21 billion cubic meters, with eyes on Europe as a key customer. Now, the field is offline as Israel braces for retaliation after launching strikes on Iranian nuclear infrastructure.

For Egypt, the implications are immediate. For global gas traders, the situation underscores the fragility of East Med supply routes in a geopolitical flashpoint.

Chevron stated its personnel and infrastructure remain safe. But the gas isn't flowing—and the regional energy balance just shifted overnight.

By Julianne Geiger for Oilprice.com

Israel’s Energy Ministry ordered Chevron to shut down the Leviathan gas field amid heightened regional threats following strikes on Iran.

Egypt, reliant on Israeli gas during peak demand, now faces a supply crunch and may turn to costly emergency LNG imports.

The disruption has raised global alarm, sending European gas prices higher and highlighting vulnerabilities in East Med energy corridors.

Israel has ordered the shutdown of its massive Leviathan gas field, cutting off a critical supply line to Egypt just as regional tensions with Iran erupt into open conflict.

Chevron, the operator of Leviathan, confirmed the halt on Friday after Israel’s Energy Ministry issued the order, citing escalating security threats. Energean Plc also suspended output from its Israeli assets. The Leviathan shutdown is already impacting gas flows to Egypt, according to Bloomberg sources close to the pipeline network.

Egypt, facing peak summer demand and a widening domestic gas shortfall, now faces the prospect of emergency LNG purchases ahead of schedule—tightening an already brittle global gas market. European gas prices spiked as much as 6.6% Friday on the news.

The Leviathan field, located in the Levant Basin, is Israel’s largest energy asset with 22.9 trillion cubic feet of recoverable gas and had been exporting record volumes to Egypt—981 million cubic feet per day in 2024, an 18% year-over-year surge. Egypt, with declining domestic production and LNG export ambitions, had increasingly leaned on Israeli imports to fill the gap.

Chevron’s Tamar field remains operational, and Energean’s Karish field continues to serve domestic Israeli demand. But if shutdowns persist, Egypt’s LNG export capacity—and its own power grid—could be strained, and Jordan’s access to gas also stands at risk.

The timing is striking. Just months ago, Leviathan’s operators announced plans to expand capacity from 12 to 21 billion cubic meters, with eyes on Europe as a key customer. Now, the field is offline as Israel braces for retaliation after launching strikes on Iranian nuclear infrastructure.

For Egypt, the implications are immediate. For global gas traders, the situation underscores the fragility of East Med supply routes in a geopolitical flashpoint.

Chevron stated its personnel and infrastructure remain safe. But the gas isn't flowing—and the regional energy balance just shifted overnight.

By Julianne Geiger for Oilprice.com

UK Firm Energean Halts Offshore Israel Production After Strikes on Iran

UK-based oil and gas producer Energean plc has suspended production from its offshore platform in Israel following the escalation of tensions in the Middle East.

Energean on Friday confirmed it received notice from the Ministry of Energy and Infrastructure on June 13, 2025, ordering the temporary suspension of production and activities of the Energean Power FPSO, following the recent geopolitical escalation in the region.

“All production activities have now been temporarily suspended and notices have been issued to Energean’s customers and other stakeholders,” Energean said in a statement.

The company maintains a close dialogue with the Israeli Ministry of Energy and Infrastructure and other relevant stakeholders “to facilitate the safe resumption of production as soon as possible.”

The suspension of activities comes after Israel launched a series of coordinated airstrikes on Iran, targeting nuclear facilities in what it describes as a decisive move to prevent the Islamic Republic from becoming a nuclear power.

Iran has vowed to retaliate, and Israel is preparing for that retaliation.

Offshore Israel, the UK’s Energean is also developing the Katlan gas field, which the company said last month is progressing on schedule, with first gas on track for the first half of 2027.

Israel’s offshore area has several large natural gas fields, which were shut during similar Israel-Iran escalations in recent years.

The Leviathan and Tamar fields, operated by U.S. supermajor Chevron, have briefly halted operations following similar events.

Last October, Chevron briefly suspended natural gas production and supply from two platforms offshore Israel as a precaution following an Iranian missile attack on Israel.

By Tsvetana Paraskova for Oilprice.com

UK-based oil and gas producer Energean plc has suspended production from its offshore platform in Israel following the escalation of tensions in the Middle East.

Energean on Friday confirmed it received notice from the Ministry of Energy and Infrastructure on June 13, 2025, ordering the temporary suspension of production and activities of the Energean Power FPSO, following the recent geopolitical escalation in the region.

“All production activities have now been temporarily suspended and notices have been issued to Energean’s customers and other stakeholders,” Energean said in a statement.

The company maintains a close dialogue with the Israeli Ministry of Energy and Infrastructure and other relevant stakeholders “to facilitate the safe resumption of production as soon as possible.”

The suspension of activities comes after Israel launched a series of coordinated airstrikes on Iran, targeting nuclear facilities in what it describes as a decisive move to prevent the Islamic Republic from becoming a nuclear power.

Iran has vowed to retaliate, and Israel is preparing for that retaliation.

Offshore Israel, the UK’s Energean is also developing the Katlan gas field, which the company said last month is progressing on schedule, with first gas on track for the first half of 2027.

Israel’s offshore area has several large natural gas fields, which were shut during similar Israel-Iran escalations in recent years.

The Leviathan and Tamar fields, operated by U.S. supermajor Chevron, have briefly halted operations following similar events.

Last October, Chevron briefly suspended natural gas production and supply from two platforms offshore Israel as a precaution following an Iranian missile attack on Israel.

By Tsvetana Paraskova for Oilprice.com

Shipping Not Immediately Impacted as World Watches Israel-Iran Conflict

The global shipping industry is holding its breath anxiously watching the emerging conflict between Israel and Iran as is the world. Analysts are scrambling to predict the potential impact on shipping while security services are issuing cautions and some nations are already issuing advice to shipping.

As would be expected, the price of oil jumped dramatically on world markets after the news that Israel had struck and killed leadership within Iran’s military and nuclear program, bombed nuclear sites, and defense installations. At midday, the global price of oil was up around seven percent on a barrel after news that Iran’s first response was limited to about 100 drones launched at Israel. The Israel Defense Force is saying the drones were intercepted and caused no damage.

“The Strait of Hormuz remains open and commercial traffic continues to flow uninterrupted,” reported the Joint Maritime Information Center while also saying “JMIC has no indications of an increased threat to the maritime environment.”

JMIC however immediately raised the “likelihood of regional conflict” to “significant.” It said the effect on the maritime environment is not predictable. It is advising increased security measures and monitoring the situation.

The UK Maritime Trade Operations had issued its first warning of “increased tension” on June 11. The UK today, June 13, according to a report from Reuters, advised merchant ships to avoid sailing through the southern Red Sea and the Gulf of Aden.

Greece’s Ministry of Shipping reports Reuters also issued a warning to commercial shipping. The Ministry is asking Greek ship owners and operators to send details of their planned transits through the Strait of Hormuz. Greece is especially sensitive due to its entanglements with Iran which has seized and held Greek-owned tankers in the past.

One company, the UK’s gas producer Energean has already reported it was temporarily suspending production on its FPSO located off the northern coast of Israel. The company said it had been ordered to suspend activities by Israel’s Ministry of Energy and Infrastructure.

Iran has not indicated its strategy other than announcing that “a bitter and painful fate awaits Israel.” It has however also said it believes the United States supported the efforts although the Trump administration has been quick to disavow any involvement in the attacks. It however announced that its oil infrastructure was functioning normally and not part of the overnight attacks.

Well-known shipping industry analysts Peter Sand, Chief Analyst at Xeneta, and Lars Jensen, CEO of Vespucci Maritime, both speculated on the potential of a “de facto closure” of the Strait of Hormuz similar to what the Houthis achieved with the Red Sea in 2024.

“Any closure of the Strait of Hormuz would see services re-routed, with increased reliance on India West Coast ports for connecting the Far East to Indian sub-continent,” commented Peter Sand on the potential impact to the container shipping segment in particular. “The inevitable disruption and port congestion, as well as the potential for higher oil prices, would cause a spike in ocean freight container shipping rates, with carriers likely also pushing for a ‘security surcharge’ on these trades in the coming days.”

Jensen highlighted three major risks with the first of course being oil prices. In addition to the impact on oil from the closing of the Strait of Hormuz, he highlights the impact on imports and exports from Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, and Iraq. A disruption at Saudi Arabia’s main ports, Jebel Ali and Khalifa, Jansen points out could spill over to regional congestion in Asia.

Iran, he notes in the past has shown it is “not adverse” to interfering with commercial shipping. It has held the MSC Aries containership for over a year as well as having a history of seizing crude oil tankers. The Houthis released the crew but still hold the vehicle carrier Galaxy Leader which they seized in November 2023.

How Will the Israel-Iran Conflict Unfold?

Israel's attack on one of Iran's outposts (Tasmin News Agency - CC BY 4.0)

Israel's attack on one of Iran's outposts (Tasmin News Agency - CC BY 4.0)Published Jun 13, 2025 3:46 PM by The Maritime Executive

Israel has declared that its attacks on Iran early on the morning of June 13 are only the beginning of what could be an initial three-week campaign. As yet the 100 drones Iran announced had been launched at Israel in a counter-attack do not appear to have arrived. Both sides have a range of options that they could pursue as the conflict pans out, although, at this early juncture, the Israeli attacks on the Iranian command and control system appear to have stymied a massive True Promise-3 response which Iran had threatened would be the result of any attack on Iran.

As reported earlier, as yet there does not appear to be any immediate disruption to shipping in the Gulf, and remarkably, Gulf airlines - whilst avoiding Iranian airspace and destinations - appear to be maintaining much of their schedules, albeit with delays due to diversions through safer airspace. Reports from ship monitoring companies carried in the Wall Street Journal suggest that a larger number than normal of vessels are in anchorages off Iran’s ports awaiting docking, but such numbers would have built up prior to the Israeli attack, possibly caused by the after-effects of the explosion at the Bandar Abbas commercial port. A pattern of activity is not yet apparent in satellite imagery of the Bandar Abbas roads, save that a lot of ships are under way.

Bandar Abbas Anchorage, June 13 (Sentinel-2)

Any Iranian attempt to close the Straits of Hormuz would be a very risky endeavor. Firstly, it would curtail Iran’s own oil exports, which are its primary source of finance. A blockade would quickly degenerate into open warfare. Whilst the IRGC Navy (Nedsa) can make a nuisance of itself in times of peace, Iranian maritime capability, both that belonging to Nedsa and the antiquated regular navy (Nedaja), would rapidly take up positions on the seabed if they tangled with US or allied navies in open conflict. Moreover, a closure of the Straits of Hormuz would severely impact GCC states - and Iran at this juncture would not wish to make enemies of these countries, who at the moment are professing outrage about the Israeli attacks.

Likewise, attacks on infrastructure in GCC countries, or on US assets based in these countries, would force GCC countries into alignment with the United States, which in reality is the inclination of their leaders, but unspoken because of popular support in these GCC countries for the Palestinian cause.

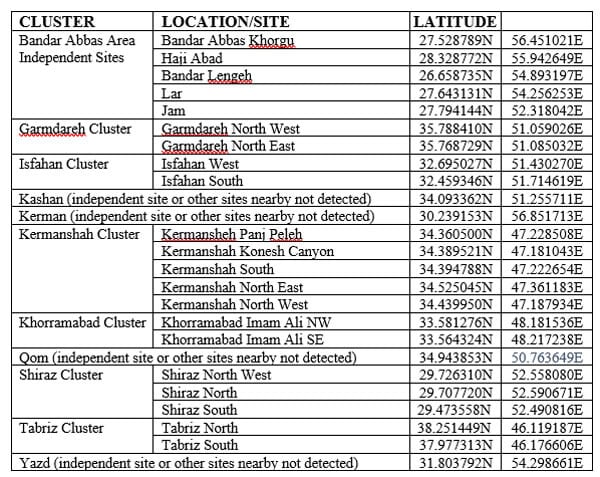

Israel will undoubtedly aim further attacks at the IRGC’s 24 identified missile sites in the western half of the country, spread from north to south. All feature underground storage bunkers, from which both drone and missile mobile launchers can be driven out, ready to go into action within minutes. The site at Kermanshah Konesh Canyon has at least 60 such tunnel bunkers and appears to have been an early Israeli target, with secondary explosions visible in the Israeli attack video released.

More than 50 underground bunkers visible in the Kermanshah Konesh Canyon missile complex (Google Earth, June 6, 2024)

Each site has multiple tunnel entrances, from which a further multiple of missiles or drones can be launched. Some sites also feature hardened silos, with automated revolver carousels enabling the rapid reloading of ballistic missiles; the site at Haji Abad for example has at least seven silos, aligned for targets along the Bahrain-Riyadh axis. There are also a number of coastal tunnel complexes, housing Nedsa missile boats.

For Israel to be safe from Iranian counter-attacks, all the sites listed below will need to be neutralized or destroyed. Those sites armed with the latest Haj Qassem medium-range solid fuel missile will be a particular priority, as these missiles have a separating warhead which appears to be independently maneuverable and equipped with a passive targeting system.

The late Maj Gen Mohammad Bagheri and Brigadier Amir Ali Hajizadeh tour a ‘missile megacity’, March 25 (Press TV)

Israel has couched its attack as a last-minute unavoidable step needed to prevent Iran from acquiring nuclear weapons. But also important to Israel will be curbing this enduring Iranian ballistic missile threat, as well as ending Iran’s strategy of regional expansionism which has plagued the region for decades. Israel’s aims in this regard are shared with the United States. Attacking the Iranian leadership will help attain this objective, as well as paralyzing Iranian counter-attack planning, weakening the hardliners who dominate the IRGC. Israel may also choose to hold back attacks on the regular armed forces, which are more closely aligned with the reformist cause headed up by President Masoud Pezeshkian. The retention of most of the Nedaja fleet dockside in Bandar Abbas Naval Harbor in recent weeks could be interpreted as a desire not to present a provocation; by not attacking the regular armed forces, Israel would leave them with the strength to take on the hardliners in a post-attack struggle for power.

Bandar Abbas Naval Base June 2 ((Sentinel-2/CJRC, subject to imagery resolution limitations)

1. Moudge Class frigate

2. Alvand Class frigate

3. Moudge Class frigate

4. Alvand Class frigate

5. Kilo Class submarine in dry dock, with probable second Kilo under cover in dry dock alongside

6. 2 x Sina or Kaman Class fast attack craft

7. Intelligence collector IRINS Zagros (H313)

8. Hengam Class landing ship IRINS Larak (L512) in floating dry dock

9. Bandar Abbas Class logistics vessel IRINS Bushehr (K442)

10 and 11. Hengam Class landing ships IRINS Tonb (L513) and Lavan (L514)

12. 2 x Hendijan Class auxiliaries

13 and 14. Total of 4 x Delvar Class auxiliaries

15. 2 x Kaman or Sina Class fast attack craft

16. Probably 2 x Hendijan Class auxiliaries

17. Ghadir and Nahang Class midget submarines

18. Kilo Class submarine missing from its normal berth

19. Probable Fateh Class medium submarine

Bandar Abbas Naval Base outer harbor: Forward base ship IRINS Makran (K441)

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

No comments:

Post a Comment