Steel Import Appetite Slows in the U.S.

- US steel prices have continued to decline, reaching their lowest levels since February, despite ongoing maintenance outages and significant cuts in steel production.

- Steel imports to the US have fallen by nearly 32% in the first eight months of 2025 compared to last year, which mills are hoping will help tighten the market.

- Europe and the US have restarted discussions regarding a tariff rate quota agreement for steel and steel products, potentially impacting future import competitiveness.

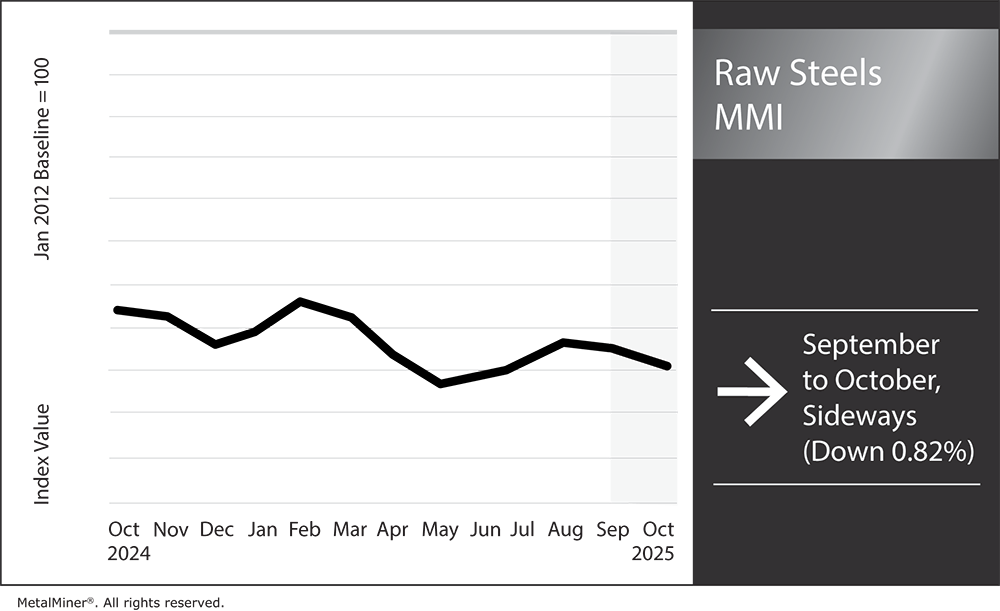

The Raw Steels Monthly Metals Index (MMI) remained sideways, with a modest 0.82% rise from September to October.

U.S. Steel Prices Remain in Search of a Bottom

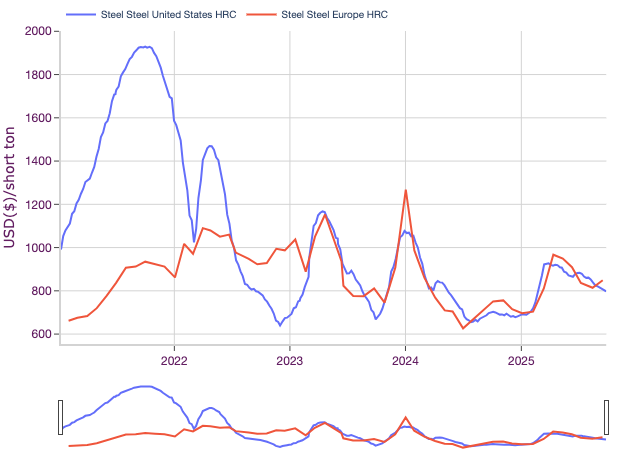

U.S. steel prices continued to soften throughout September as they entered Q4 in search of a new low. Based on their October 3 close, HRC prices have now unraveled $80/st from their late March peak, leaving them sitting at their lowest level since February.

While they remained somewhat slow, the second and third quarters showed largely steady bearish momentum across the flat rolled steel category. Once tariffs took effect, buyers backed away from the market immediately. Meanwhile, strategic purchasing efforts left the market well-stocked as mills ramped up their production.

Maintenance Outages on Deck

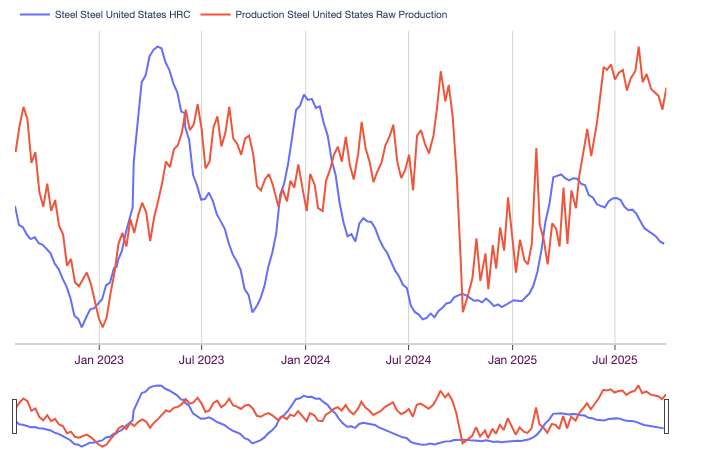

Fall maintenance outages commenced in September. Mills often use these outages to help tighten weak markets, as occurred last year. Steel prices witnessed significant declines during the first half of 2024, which triggered an over 1,500,000-ton cut before production slowly ticked upward. Prices ultimately found a bottom in anticipation of outages despite a slowdown in shipments during the final quarter.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

This time around, estimates suggest cuts will total less than half of what was taken offline during the fall of 2024. Most of the cutbacks will take place in October, with the final one completing in December. Thus far, data from the American Iron and Steel Institute shows only a modest downtrend in raw steel production levels, far short of the sharp drop that occurred last year.

Steel Import Appetite Remains Low

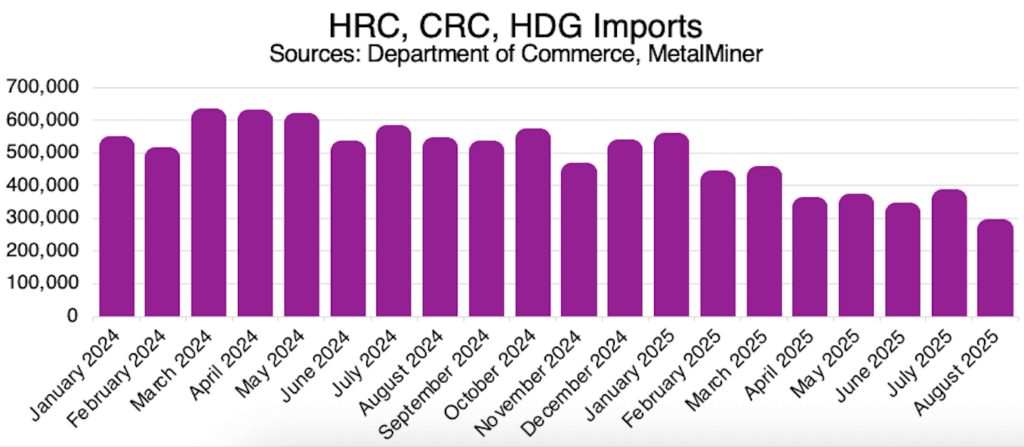

While the volume of the planned steel cuts currently stands far short of what occurred last year, mills are likely banking on the absence of imports to help tighten the market.

Data from the Department of Commerce shows that HRC, CRC and HDG imports to the U.S have fallen nearly 32% during the first eight months of 2025 compared to the same period of last year. This reflects a year-over-year drop of over 1.3 million tons. Preliminary import data also showed that August volumes fell to their lowest level since the Department of Commerce began reporting in 2019.

While demand conditions are decidedly soft, mills are wise to assume that the volume of output cuts necessary to regain control over the steel price trend is less significant than it would be under pre-tariff circumstances.

Low Demand Could Put Mills in a Tough Spot

All things considered, it is worth asking if this year’s maintenance outages will be enough to halt prices. For now, the bias remains to the downside. While mill lead times have held steady over the past month, demand conditions remain soft, with no rebound from the manufacturing sector. The ISM’s Manufacturing PMI remained in contraction during September, and U.S. construction spending continued to ease.

As the market heads into the end-of-year slow season, weakness from major steel-consuming sectors means that any attempt by mills to foment a strong uptrend in steel prices will likely prove difficult. However, the currently low import environment will give mills a chance to flatten out the current downtrend.

Europe Restarts Tariff Talks with U.S.

While the current outlook for offshore supply looks grim following the imposition of 50% tariffs on steel and steel products, hope is not entirely lost for buyers. The EU continues to push for a tariff rate quota agreement with the U.S. In fact, trade officials met in late September in an effort to revive the conversation.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

This was preceded by a meeting between German Finance Minister Lars Klingbeil and the U.S.’s Scott Bessent in early August. Ahead of the conference, Klingbeil stated, “There is talk of a quota system for steel, and it would be good if there were one…I will test out what steps the American government is prepared to take and what the solution might look like.” As with the UK, the original bilateral framework trade agreement between the EU and the U.S. left an open door for potential tariff rate deductions and/or exemptions.

Q1 Restocking Estimates Lackluster in Current Conditions

Thus far, no details have been released about the latest meeting and what, if any, progress was made. European steel prices are currently not competitive within the U.S. market. In order to become attractive to U.S. buyers, they would need to decline significantly.

Combined with soft demand, which shows no evidence of a near-term rebound, the possibility of trade shifts will likely add to buyer reluctance, even as U.S. supply conditions tighten. As a result, Q1 restocking efforts among buyers and suppliers may prove disappointing, offering yet another headwind to the steel price trend.

By Nichole Bastin

No comments:

Post a Comment