CU

SolGold rejects Jiangxi takeover bid amid copper deals frenzy

Cascabel copper-gold project in northern Ecuador. (Image courtesy of SolGold.)

Cascabel copper-gold project in northern Ecuador. (Image courtesy of SolGold.)Ecuador-focused miner SolGold (LON: SOLG) revealed on Friday it had rejected a preliminary and conditional takeover offer from China’s Jiangxi Copper Co, the second received in less than a week.

Shares in the gold and copper mining firm jumped 14%, closing at 29.55 pence each on Friday in London.

Jiangxi Copper, already SolGold’s largest shareholder with a 12% stake, proposed 26 pence per share. The miner’s board had unanimously rejected a separate non-binding proposal from the Chinese group on November 23.

“The SolGold board remains confident in SolGold’s standalone prospects,” the company said in a statement. It advised shareholders to take no action while it considers next steps.

SolGold has long been viewed as a potential target for major Western miners such as BHP (ASX: BHP) and Newmont (NYSE: NEM), which hold stakes of 10.4% and 10.3% respectively. Interest from these majors cooled after disputes over funding the Cascabel copper-gold project, in northern Ecuador, and revisions to its scope.

Under the UK Takeover Code, Jiangxi has until 17:00 GMT on December 26 to declare whether it will make a firm offer, SolGold said.

The renewed approach comes as copper assets draw heightened attention amid forecasts of a looming supply crunch tied to global electrification, a backdrop that has fuelled a wave of attempted deals including BHP’s failed bid for Anglo American (LON: AAL) last week.

Ecuador-focused miner SolGold (LON: SOLG) revealed on Friday it had rejected a preliminary and conditional takeover offer from China’s Jiangxi Copper Co, the second received in less than a week.

Shares in the gold and copper mining firm jumped 14%, closing at 29.55 pence each on Friday in London.

Jiangxi Copper, already SolGold’s largest shareholder with a 12% stake, proposed 26 pence per share. The miner’s board had unanimously rejected a separate non-binding proposal from the Chinese group on November 23.

“The SolGold board remains confident in SolGold’s standalone prospects,” the company said in a statement. It advised shareholders to take no action while it considers next steps.

SolGold has long been viewed as a potential target for major Western miners such as BHP (ASX: BHP) and Newmont (NYSE: NEM), which hold stakes of 10.4% and 10.3% respectively. Interest from these majors cooled after disputes over funding the Cascabel copper-gold project, in northern Ecuador, and revisions to its scope.

Under the UK Takeover Code, Jiangxi has until 17:00 GMT on December 26 to declare whether it will make a firm offer, SolGold said.

The renewed approach comes as copper assets draw heightened attention amid forecasts of a looming supply crunch tied to global electrification, a backdrop that has fuelled a wave of attempted deals including BHP’s failed bid for Anglo American (LON: AAL) last week.

China’s top copper smelters to cut output to combat negative processing fees

China’s top copper smelters will cut production by over 10% in 2026, to counter overcapacity in the industry that has led to increasingly distorted copper concentrate processing fees, according to a Chinese market information provider.

Treatment and refining charges (TC/RCs), which are traditionally paid by miners to smelters, have been negative in 2025 due to tight copper supply and expanding Chinese smelting capacity, leaving smelters effectively having to pay miners.

The China Smelters Purchase Team (CSPT), a group of the top copper smelters, said its members agreed to cut production to improve market conditions, according to Shanghai Metals Market on Friday.

The move follows comments by Chen Xuesen, vice president of China’s Nonferrous Metal Industry association, who said on Wednesday that the state-backed association “firmly opposes any free and negative processing” of copper concentrate.

Chen also said China had halted about 2 million metric tons of planned new copper smelting capacity.

The decision by the smelters and Chen’s speech adds to uncertainties amid negotiations between Chinese smelters and copper mining giant Antofagasta over next year’s supply contracts, which set a benchmark for TC/RCs.

The CSPT refrained from setting copper TC/RC guidance for the fourth quarter in late October, for the third time in a row.

The CSPT also said it will set up an oversight mechanism to monitor members’ spot tendering and procurement to stamp out “malignant competition”, while setting up a blacklist system to vet suppliers and assay providers, jointly resisting any parties considered to be “maliciously disrupting” the market.

The benchmark three-month copper was up 0.64% to $11,009.50 a ton as of 10:19 GMT.

(By Dylan Duan, Lewis Jackson and Beijing Newsroom; Editing by Joe Bavier, Elaine Hardcastle)

Codelco’s record China copper offer sparks threats to walk away

Chilean copper heavyweight Codelco’s record-high offers to Chinese copper buyers are leading some to declare they will opt out of next year’s term contracts as questions grow about the relevance of the benchmark for Chinese buyers.

The Codelco premium, which is paid on top of London Metal Exchange copper prices, is often used as a reference for global copper supply contracts, as Codelco is the world’s largest copper producer and China the largest consumer.

Codelco has only made offers to Chinese buyers at a $350 a ton premium over London Metal Exchange prices, according to three sources familiar with the matter, an increase over the $89 a ton agreed during last year’s negotiations.

The offers are on a take-it-or-leave-it basis and decisions are expected to start being made next week, one of the sources said.

At least three of Codelco’s Chinese customers have already said they are prepared to walk away from term contracts this year and opt for spot deals instead, according to sources with knowledge of the matter.

A fourth customer, who has yet to receive an offer, said when asked about the premium: “Who will buy at this price?”

Codelco did not immediately respond to emailed questions about the offers.

The willingness to eschew the closely watched term deals underscores growing questions about the benchmark’s relevance for China among delegates gathered in Shanghai for the World Copper Conference Asia.

The high premium partly reflects how easily Codelco cargoes can be delivered to the US Comex exchange, where forward prices for next year are hundreds of dollars above the LME, according to three traders. They said, however, that these trades are hard to do for Chinese buyers, suggesting the premium was aimed at big trading houses instead.

However, a fourth source said lower offers would only encourage Chinese buyers to sell their cargoes to the traders for export to the US.

All sources spoke on condition of anonymity given the commercial sensitivity of the matter.

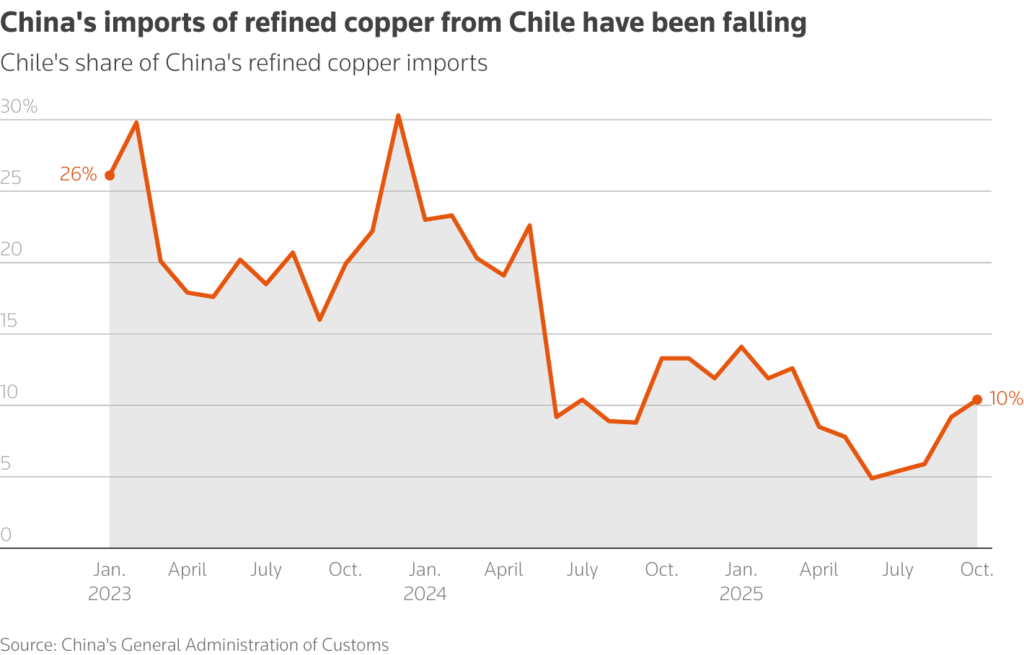

China’s imports of refined copper from Chile have fallen steadily since 2023 both in absolute terms and as a share of total imports, Chinese customs data shows.

The hike in the premium comes after fears of copper shortages next year pushed LME copper to an all-time peak of $11,200 a ton in late October. The metal traded at $10,868 a ton as of 0703 GMT.

Codelco, the world’s biggest copper miner, has already offered its European customers refined copper at a record-high premium of $325 a ton in 2026, a 39% jump year-on-year, Reuters reported last month.

(By Amy Lv, Lewis Jackson, Dylan Duan and Tom Daly; Editing by Jan Harvey and Conor Humphries)

Comex copper premium here to stay, LME executive says

Copper prices on the US Comex exchange will enjoy a premium over the London Metal Exchange that is likely to persist over the next 18 months, an LME executive said on Thursday, citing uncertainties around copper tariffs in the United States.

“There is a persistent premium on the CME contract of 2 to 3% and I do think it is fair to say this is likely now a structural difference in the markets that is likely to persist,” said Robin Martin, head of market development at LME, delivering a speech to the World Copper Conference Asia.

The divergence between CME and LME, driven by US tariffs, has drained LME inventories, and shifted copper stocks to COMEX sheds. US copper exchange inventories exceeded 400,000 short tons for the first time on Monday.

Expand access for China

The LME is working to make its service more accessible for Chinese users, Martin said. The exchange is making significant efforts to accept offshore yuan as collateral and is collaborating with major Chinese banks to streamline the service, he said.

The LME executive added the exchange is also exploring accepting Chinese government bonds as eligible collateral in its clearinghouse.

(By Dylan Duan and Lewis Jackson; Editing by Tom Hogue and Sonali Paul)

No comments:

Post a Comment