UK Nuclear Projects Set to Add $1.3 Billion a Year to Power Bills

Subsidies and Contracts for Difference (CfD) that the UK government has promised to the two projects for new nuclear power stations are expected to add $1.32 billion (£1 billion) annually to the UK power bills from around 2030, The Telegraph reports, citing documents by the Treasury and the Office for Budget Responsibility (OBR).

The Hinkley Point C nuclear power station, developed by EDF, is expected to begin generating electricity in 2030-31, after years of delays and cost overruns.

That year, CfD is expected to generate $6.1 billion (£4.6 billion) in receipts, including £1.0 billion to fund subsidy payments to the Hinkley Point C nuclear power plant for its first year of expected generation, OBR said in its economic and fiscal outlook released after the UK’s latest budget announcement.

The UK government earlier this year also took the final investment decision to build the $51-billion Sizewell C nuclear power plant on the Suffolk Coast in eastern England, which was the first British-owned nuclear power station to be announced in over three decades.

Sizewell C will be the first nuclear power station in the UK financed using a regulated asset base (RAB) model that levies an additional charge on consumer energy bills, which contributes to the financing costs of the plant, OBR noted. This levy is also expected to increase energy bills as early as January.

UK households will pay slightly higher energy bills in the first quarter of 2026 after energy market regulator Ofgem last week raised the Energy Price Cap by 0.2%, against expectations of a 1% drop.

The slight increase in the price cap is driven by government policy costs and operating costs. This includes funding the government’s Sizewell C nuclear project, which will bring more clean power, Ofgem noted.

Opponents of new conventional nuclear plants in Britain argue that consumers will be burdened with a “nuclear tax” for the expensive projects in their energy bills.

“The Government has a misguided belief that nuclear will be a cheap, ‘green’ solution to our energy needs, but the evidence shows the opposite – that costs of delivery and of dealing with nuclear waste – will continue to rise,” Alison Downes, of Stop Sizewell C, told The Telegraph.

“We remain opposed to the imposition of a nuclear tax on households, given the acknowledged uncertainty about the projected costs of constructing Sizewell C.”

By Tsvetana Paraskova for Oilprice.com

Restart of two Taiwanese plants feasible, ministry says

_16403_79272.jpg)

Taiwan Power Company (Taipower) conducted the current status assessment of the Chinshan, Kuosheng and Maanshan nuclear power plants in accordance with the newly revised Nuclear Regulation Act and its regulations, conducting an inventory and analysis of seven major aspects, including unit equipment, manpower allocation, dry fuel storage, service life extension of similar units, geological seismic resistance, current status of safety inspections and preparations, and power supply efficiency.

The assessment determined that the two-unit Chinshan plant - Taiwan's oldest plant - is not feasible for reoperation. The two 604 MWe boiling water reactors (BWRs) were shut down in December 2018 and July 2019, respectively, following the expiration of their operating licences after 40 years of operation.

"Most of the important power generation equipment has been dismantled, and many instrumentation components need to be replaced and upgraded," the Ministry of Economic Affairs (MOEA) said. "Furthermore, these units are of the same type as those involved in the March 2011 Fukushima nuclear disaster in Japan, and similar units in Japan have also been decommissioned. Therefore, the Chinshan plant is not feasible for restarting."

However, the assessment concluded that it was feasible to restart both the Kuosheng and Maanshan plants. The Kuosheng plant comprises two 985 MWe BWRs that shut down in July 2021 and March 2023, respectively, while Maanshan's two 936 MWe pressurised water reactors were taken offline in July 2024 and in May this year, respectively.

The ministry said "independent safety inspections and reoperation plans will be initiated simultaneously". These inspections will include aging and seismic resistance assessments. The reoperation plans for both plants are expected to be submitted to the Nuclear Safety Council in March next year. It noted the independent safety inspection for the Maanshan plant requires peer review and assistance from the original plant supplier, and is expected to take about 1.5-2 years. The process will be longer than for the Kuosheng plant because the used fuel in the reactors of the plant still needs to be removed.

"The safety and support systems at the Kuosheng plant are still undergoing regular overhauls and maintenance as during operation," MOEA noted. "However, the power generation system has been shut down for over two years, requiring a long-term overhaul and implementation of a recovery control plan. Its functionality needs to be reconfirmed, but it is initially assessed that it is still capable of restarting.

"The equipment at the Maanshan plant has not yet been dismantled and is undergoing regular overhauls and maintenance according to the standards during operation. The reactor has been emptied, and there is still space in the fuel pool. It is also initially assessed that it is capable of restarting."

MOEA said Taipower has initiated its own safety inspection to assess the lifespan of various facilities and equipment at the nuclear power plants and to determine necessary modernisation. The Maanshan plant is expected to complete this within 1.5 to 2 years. However, the Kuosheng plant's inspection process will be longer than that of Maanshan due to the nearly 10-year delay in its dry storage facilities. Used nuclear fuel in the reactors can only be removed after the on-site dry storage facilities are operational, and the reactor core must be emptied before reactor-related safety inspections can be conducted.

The ministry stated that the restart procedure for nuclear power plants must adhere to "two musts", and regarding nuclear energy issues, "three principles" must be met. "Taipower will be required to conduct related work with the utmost rigour to ensure nuclear safety meets international standards," it said. "Subsequent reviews by international professional technical institutions and peers will be required, and the process will proceed according to the Nuclear Safety Council's review results. Further social consensus is also necessary."

Taiwan's nuclear energy policy

Taiwan's Democratic Progressive Party (DPP) was elected to government in January 2016 with a policy of creating a "nuclear-free" Taiwan by 2025. Under this policy, Taiwan's six operable power reactors would be decommissioned as their 40-year operating licences expire. Shortly after taking office, the DPP government passed an amendment to the Electricity Act, passing its phase-out policy into law. The government aims for an energy mix of 20% from renewable sources, 50% from liquefied natural gas and 30% from coal.

However, in a referendum held in November 2018, voters chose to abolish that amendment. The Ministry of Economic Affairs said the amendment was officially removed from the Electricity Industry Act on 2 December.

Nevertheless, then Minister of Economic Affairs Shen Jong-chin said in January 2019 "there would be no extension or restarts of nuclear power plants in Taiwan due to subjective and objective conditions, as well as strong public objection".

But in May this year, Taiwan's Legislative Yuan passed an amendment to the Nuclear Reactor Facilities Regulation Act that allows nuclear power plant operators to apply for a 20-year licence renewal beyond the existing 40-year limit, potentially extending a plant's operating lifespan to 60 years.

India moving towards opening nuclear sector to private players, says PM

_44651.jpg)

Speaking at the inauguration of private Indian space company Skyroot's new campus in Hyderabad - which also saw the unveiling of Skyroot's first orbital rocket, Vikram-I - the prime minister said opening India's space sector to private innovation has seen it transform into an "open, cooperative, and innovation-driven ecosystem". India now wants to repeat that in nuclear sector.

"Just as we opened space innovation to the private sector, we are now taking steps in another very important sector. We are moving toward opening the nuclear sector as well. We are laying the foundation for a strong role for the private sector in this field too. This will create opportunities in small modular reactors, advanced reactors, and nuclear innovation. This reform will give new strength to our energy security and technological leadership," he said.

According to World Nuclear Association information, India currently has 24 operable nuclear reactors totalling 7,943 MW of capacity, with six reactors - 4,768 MW - under construction. (The Indian government often classes two units at Gorakhpur where site works have begun as being under construction, although the first concrete for the reactor buildings has not yet been poured.) A further 10 units - some 7 GW of capacity - are in pre-project stages. But India's Atomic Energy Act of 1962 prohibits private control of nuclear power generation: only government-owned enterprises Nuclear Power Corporation of India Ltd (NPCIL) and BHAVINI are legally allowed to own and operate nuclear power plants in India, and private sector companies and foreign investors are not allowed to invest directly in nuclear power.

However, the government is targeting 100 GW of nuclear power by 2047 under its Viksit Bharat development strategy, and has begun the process to amend the Atomic Energy Act as well as the Civil Liability for Nuclear Damage Act of 2010, to enable broader participation by private and state sectors. Earlier this year, Minister of State Jitendra Singh confirmed that the committees had been set up by the Department of Atomic Energy to discuss and propose the amendments to the two acts.

The Atomic Energy Bill, 2025, has been listed for introduction to the Winter Session of the Indian parliament, which begins on 1 December.

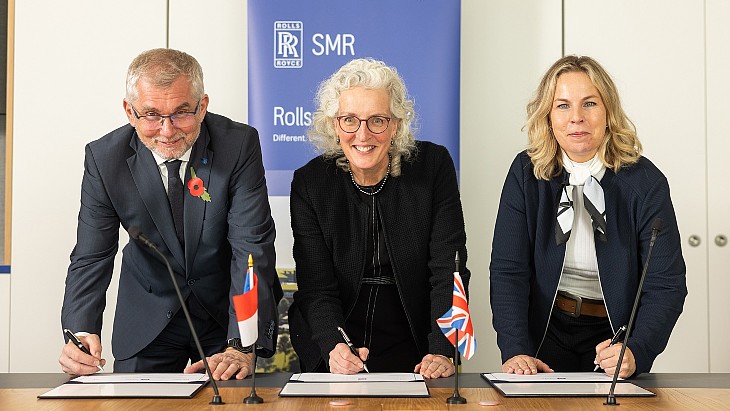

Rolls-Royce SMR and ÚJV Řež deepen collaboration

The MoU will see the companies "explore opportunities across a range of technical and regulatory areas, including nuclear safety analysis, design and engineering services, evaluation and testing, technical support to operations, licensing and regulatory requirements specific to the Czech Republic".

Rolls-Royce SMR's technology has been selected by the Czech Republic to provide up to 3 GW of capacity in the country with nuclear power plant operator ČEZ, which has also taken a 20% stake in Rolls-Royce SMR.

As well as signing the MoU, Rolls-Royce SMR hosted a technical conference for suppliers in Prague, with ČEZ saying Czech companies "have a unique opportunity to be at its birth and participate in the construction of small modular reactors both in the Czech Republic and in other world markets".

ÚJV Řež, which is 80% owned by ČEZ, has an existing contract with Rolls-Royce SMR for the analysis, testing and evaluation of critical components and Director General Martin Ruščák said: "Deepening our relationship with Rolls-Royce SMR is a valuable opportunity to leverage decades of nuclear expertise at ÚJV Řež."

"By combining our experience with Rolls-Royce SMR’s pioneering technology, we can help position the Czech industry at the forefront of the global SMR market and significantly contribute to our secure energy future," he added.

Rolls-Royce SMR Technical Director David Dodd, said: "ÚJV Řež is a globally recognised provider of technical and scientific services with over 60 years of experience supporting the European nuclear industry. Strengthening this partnership not only solidifies our own engineering capabilities, but also ensures that we are working with the best in the world in developing the Rolls-Royce SMR deployment."

The Rolls-Royce SMR is a 470 MWe design based on a small pressurised water reactor. It will provide consistent baseload generation for at least 60 years. Ninety percent of the SMR - measuring about 16 metres by 4 metres - will be built in factory conditions, limiting activity on-site primarily to assembly of pre-fabricated, pre-tested, modules which significantly reduces project risk and has the potential to drastically shorten build schedules.

It has been selected by both the Czech Republic and by the UK government for their respective proposed SMR programmes.

No comments:

Post a Comment