Arabica Coffee Prices Hit All-time High in December, Small Farmers Still Unable to Cash in

Heavy rainfall and crop damage have resulted in losses for small farmers who largely grow Robusta coffee.

Nikhil Cariappa

06 Jan 2022

Ripening coffee berries

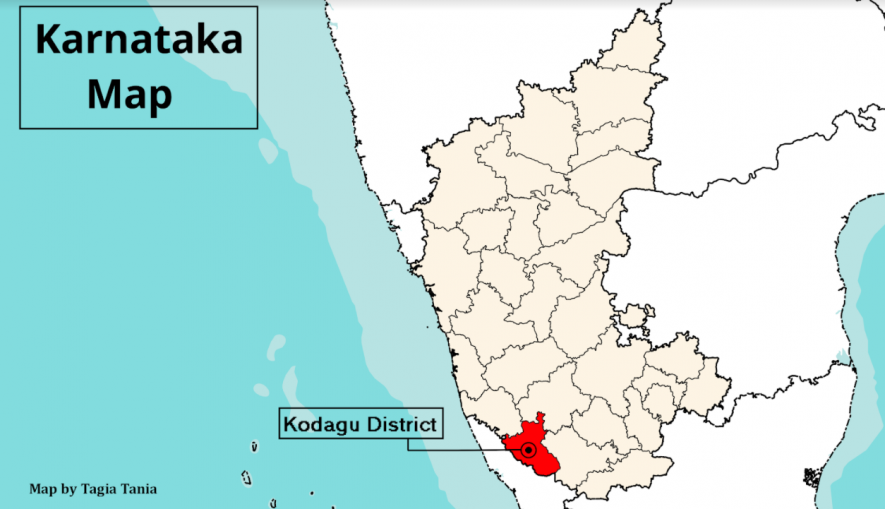

The district of Kodagu (Coorg) is rich in forests and wildlife. Due to conservation efforts, industries were not permitted to be set up here. Agriculture, especially coffee planting, has been the backbone of the Kodagu economy. The states of Karnataka, Kerala and Tamil Nadu account for 83% of the coffee production in India. Karnataka alone accounts for 70% of the production. However, this cash crop has provided diminishing returns to farmers over the last three years. In December 2021, Arabica coffee prices hit an all-time high. However, the benefits have not been passed on to small farmers in Kodagu because they largely grow Robusta. They have also been forced to endure losses caused by heavy rainfall, crop damage by wild animals, and increasing input and labour costs.

THE ECONOMICS OF COFFEE CULTIVATION

In India, two varieties of coffee are cultivated - Arabica and Robusta. Arabica fetches a higher price in the market as it is considered to have a better flavour. The harvest season for Arabica lasts from November to January, and for Robusta, from January to March. In India, Robusta accounts for 70% of the total production. Small farmers prefer to grow Robusta because the yield is higher and the maintenance cost is comparatively lower. High and unseasonal rainfall caused the coffee berries to drop off the branches this year. Once the unripe berries of Robusta coffee have prematurely dropped, it is no longer of any value to the planter.

After the harvest, the berries are dried in the sun, bagged and sold to the traders. Each bag of coffee contains 50 kgs of produce. The price/bag varies daily based on the commodity markets in New York (for Arabica) and London (for Robusta). Coffee farmers are dependent on foreign markets because almost 80% of the coffee produced in India is exported.

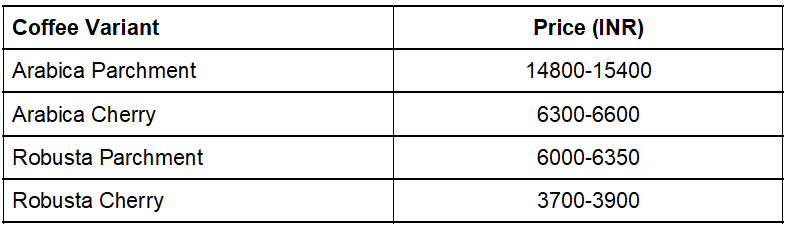

On December 27, 2021, the prices/bag of raw coffee were -

These prices refer to the value of one bag of raw coffee that distributers/trading companies pay to coffee farmers. According to several farmers, under ideal conditions, one acre of coffee plantation could yield 20-30 bags of Robusta cherry or 10-15 bags of Arabica cherry. Cherry coffee is obtained through dry processing. Parchment coffee is obtained through wet processing.

Cherry coffee is obtained once the ripe coffee berries are harvested and dried in the sun. To obtain parchment coffee, the ripe berries must be pulped, washed and dried. Small farmers with insufficient access to water resources opt for cherry. Processing the berries into parchment is expensive, time-consuming, labour intensive, requires lots of water and a facility for disposing of effluents (by-products).

Global Market

A cursory look at the commodity market charts for Arabica Coffee indicates that coffee prices hit a 34-year high in 2011. Before that, it peaked in 1997, 1986 and 1977. Various speculations were made about the reasons for the price rise, including policy changes and natural disasters. Since this is a global market, farmers in India compete with their counterparts in Brazil, Colombia, Vietnam, Indonesia, Honduras, and Ethiopia. If there are supply shortages in any other part of the world, it benefits Indian farmers. Similarly, when coffee prices crashed in 2001, the effects were felt by farmers all over the world, prompting some introspection about the beneficiaries of the present model.

INPUT COSTS

Fertilisers, diesel and labour make up the bulk of the input costs. NewsClick spoke to KK Vishwanath, a planter from Katakeri, about the input costs/acre of the planted area. He said, “For Robusta coffee, the labour requirement is 50 labour days/acre/year. The labour cost may add up to Rs 35000 and other inputs come up to Rs 15000. The farmer spends a minimum of Rs 50000/acre/year."

In the past, the farmers relied on the local tribal communities to make up the labour force on the plantations. But they have been migrating out of the district to find work in other sectors. According to Vishwanath, farmers now rely on migrant labour from West Bengal and Assam. In the past, there have been cycles of migrant labour from Bihar, Jharkhand, Kerala and even Tamils from Sri Lanka.

STAGNANT COFFEE PRICES

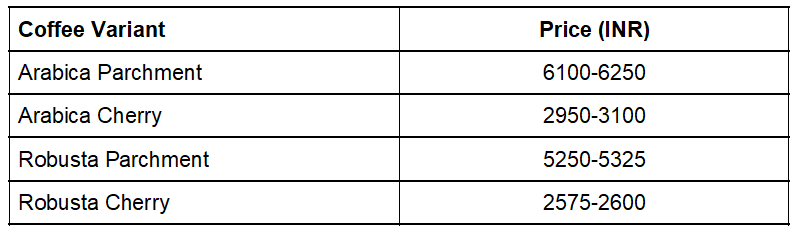

The farmers say that the prices of Robusta coffee have not increased at par with the rise in the cost of inputs. To make a comparison with the previous table, on December 9, 2013, the prices/bag of raw coffee were as follows-

In 2013, the diesel price in Karnataka was a little more than Rs 50/ltr. In 2021, the price had breached Rs 100/ltr. The cost of labour has doubled as well. In 2013, the minimum wage/day was Rs 142 in Karnataka. Today, it is Rs 357. While most costs have doubled, the coffee prices have seen a meagre rise. The price of coffee fluctuates every year, but costs always increase.

Land Holding

According to a source in the Indian Coffee Board, the largest commercial holding in Kodagu belongs to Tata Coffee Limited, which owns more than 10,000 acres of the planted area. Tata Coffee, a listed company, had announced annual revenue of Rs 2289 crore for the FY 2020-2021. This figure represents earnings from estates all over India, including those in Karnataka and Tamil Nadu. The second-largest holding in Kodagu belongs to the Bombay Burma Trading Corporation (BBTC), owned by the Wadia Group. According to the company website, the corporation owns 927 hectares (2290 acres) of planted area in Kodagu. BBTC is also a publicly traded corporation.

According to the Indian coffee board, as of 2019-2020, Kodagu had 43765 holdings or coffee estates. A majority of them were under 10 hectares (24 acres) in size. Only 519, or 1.1% of the total estates in Kodagu, were larger than 10 hectares in area. The bulk of the estates are family run and often passed down through inheritance.

Crop Damage

Planters in Kodagu have appealed to the district administration to find a solution for losses caused by monkeys and wild boars. BB Madayya, a planter from Chettalli village, lamented the problems caused by small animals. “When the arabica coffee is ripe and ready for harvest, swarms of monkeys enter the plantations and break the branches of coffee plants to suck out the sweet pulp inside the berries. This is a loss for the planter in the present year and the future because we lose the coffee seeds, and the branch will also take time to grow back”, he said.

A typical coffee plant takes 5-7 years to grow and provide any economic yield to the planter. Once destroyed, it results in long term economic consequences. The Codava Planters Association have floated a signature campaign to garner support online and pressure the Forest Department to take action. They hope that like in Bihar, monkeys and wild boars are temporarily classified as vermin so that their numbers can be reduced.

As per the organisation, “wild boars destroy the paddy fields. They also destroy the coffee, cardamom and pepper vine roots by digging the ground searching for food during monsoon season. In addition, they also dig up roots, tubers & young saplings and, in the process, loosen the soil resulting in soil erosion. Wild boars contaminate water sources with the faecal matter with very high bacterial content”.

Brazil is the world’s largest producer of coffee, while Vietnam has recently emerged as the largest producer of Robusta Coffee globally. According to Vishwanath, farmers there practise the field-grown technique of farming in open spaces. Expansion of coffee production in these countries was done through deforestation. Their counterparts in India practise shade-grown coffee cultivation, which is sustainable but offers lower returns. In Karnataka, all the coffee cultivation is done in three districts - Kodagu, Chikmagalur and Hassan. All three districts have forest cover, and the farming has not come at the expense of trees and biodiversity. Every trade-off comes with a cost.

Heavy rainfall and crop damage have resulted in losses for small farmers who largely grow Robusta coffee.

Nikhil Cariappa

06 Jan 2022

Ripening coffee berries

The district of Kodagu (Coorg) is rich in forests and wildlife. Due to conservation efforts, industries were not permitted to be set up here. Agriculture, especially coffee planting, has been the backbone of the Kodagu economy. The states of Karnataka, Kerala and Tamil Nadu account for 83% of the coffee production in India. Karnataka alone accounts for 70% of the production. However, this cash crop has provided diminishing returns to farmers over the last three years. In December 2021, Arabica coffee prices hit an all-time high. However, the benefits have not been passed on to small farmers in Kodagu because they largely grow Robusta. They have also been forced to endure losses caused by heavy rainfall, crop damage by wild animals, and increasing input and labour costs.

THE ECONOMICS OF COFFEE CULTIVATION

In India, two varieties of coffee are cultivated - Arabica and Robusta. Arabica fetches a higher price in the market as it is considered to have a better flavour. The harvest season for Arabica lasts from November to January, and for Robusta, from January to March. In India, Robusta accounts for 70% of the total production. Small farmers prefer to grow Robusta because the yield is higher and the maintenance cost is comparatively lower. High and unseasonal rainfall caused the coffee berries to drop off the branches this year. Once the unripe berries of Robusta coffee have prematurely dropped, it is no longer of any value to the planter.

After the harvest, the berries are dried in the sun, bagged and sold to the traders. Each bag of coffee contains 50 kgs of produce. The price/bag varies daily based on the commodity markets in New York (for Arabica) and London (for Robusta). Coffee farmers are dependent on foreign markets because almost 80% of the coffee produced in India is exported.

On December 27, 2021, the prices/bag of raw coffee were -

These prices refer to the value of one bag of raw coffee that distributers/trading companies pay to coffee farmers. According to several farmers, under ideal conditions, one acre of coffee plantation could yield 20-30 bags of Robusta cherry or 10-15 bags of Arabica cherry. Cherry coffee is obtained through dry processing. Parchment coffee is obtained through wet processing.

Cherry coffee is obtained once the ripe coffee berries are harvested and dried in the sun. To obtain parchment coffee, the ripe berries must be pulped, washed and dried. Small farmers with insufficient access to water resources opt for cherry. Processing the berries into parchment is expensive, time-consuming, labour intensive, requires lots of water and a facility for disposing of effluents (by-products).

Global Market

A cursory look at the commodity market charts for Arabica Coffee indicates that coffee prices hit a 34-year high in 2011. Before that, it peaked in 1997, 1986 and 1977. Various speculations were made about the reasons for the price rise, including policy changes and natural disasters. Since this is a global market, farmers in India compete with their counterparts in Brazil, Colombia, Vietnam, Indonesia, Honduras, and Ethiopia. If there are supply shortages in any other part of the world, it benefits Indian farmers. Similarly, when coffee prices crashed in 2001, the effects were felt by farmers all over the world, prompting some introspection about the beneficiaries of the present model.

INPUT COSTS

Fertilisers, diesel and labour make up the bulk of the input costs. NewsClick spoke to KK Vishwanath, a planter from Katakeri, about the input costs/acre of the planted area. He said, “For Robusta coffee, the labour requirement is 50 labour days/acre/year. The labour cost may add up to Rs 35000 and other inputs come up to Rs 15000. The farmer spends a minimum of Rs 50000/acre/year."

In the past, the farmers relied on the local tribal communities to make up the labour force on the plantations. But they have been migrating out of the district to find work in other sectors. According to Vishwanath, farmers now rely on migrant labour from West Bengal and Assam. In the past, there have been cycles of migrant labour from Bihar, Jharkhand, Kerala and even Tamils from Sri Lanka.

STAGNANT COFFEE PRICES

The farmers say that the prices of Robusta coffee have not increased at par with the rise in the cost of inputs. To make a comparison with the previous table, on December 9, 2013, the prices/bag of raw coffee were as follows-

In 2013, the diesel price in Karnataka was a little more than Rs 50/ltr. In 2021, the price had breached Rs 100/ltr. The cost of labour has doubled as well. In 2013, the minimum wage/day was Rs 142 in Karnataka. Today, it is Rs 357. While most costs have doubled, the coffee prices have seen a meagre rise. The price of coffee fluctuates every year, but costs always increase.

Land Holding

According to a source in the Indian Coffee Board, the largest commercial holding in Kodagu belongs to Tata Coffee Limited, which owns more than 10,000 acres of the planted area. Tata Coffee, a listed company, had announced annual revenue of Rs 2289 crore for the FY 2020-2021. This figure represents earnings from estates all over India, including those in Karnataka and Tamil Nadu. The second-largest holding in Kodagu belongs to the Bombay Burma Trading Corporation (BBTC), owned by the Wadia Group. According to the company website, the corporation owns 927 hectares (2290 acres) of planted area in Kodagu. BBTC is also a publicly traded corporation.

According to the Indian coffee board, as of 2019-2020, Kodagu had 43765 holdings or coffee estates. A majority of them were under 10 hectares (24 acres) in size. Only 519, or 1.1% of the total estates in Kodagu, were larger than 10 hectares in area. The bulk of the estates are family run and often passed down through inheritance.

Crop Damage

Planters in Kodagu have appealed to the district administration to find a solution for losses caused by monkeys and wild boars. BB Madayya, a planter from Chettalli village, lamented the problems caused by small animals. “When the arabica coffee is ripe and ready for harvest, swarms of monkeys enter the plantations and break the branches of coffee plants to suck out the sweet pulp inside the berries. This is a loss for the planter in the present year and the future because we lose the coffee seeds, and the branch will also take time to grow back”, he said.

A typical coffee plant takes 5-7 years to grow and provide any economic yield to the planter. Once destroyed, it results in long term economic consequences. The Codava Planters Association have floated a signature campaign to garner support online and pressure the Forest Department to take action. They hope that like in Bihar, monkeys and wild boars are temporarily classified as vermin so that their numbers can be reduced.

As per the organisation, “wild boars destroy the paddy fields. They also destroy the coffee, cardamom and pepper vine roots by digging the ground searching for food during monsoon season. In addition, they also dig up roots, tubers & young saplings and, in the process, loosen the soil resulting in soil erosion. Wild boars contaminate water sources with the faecal matter with very high bacterial content”.

Brazil is the world’s largest producer of coffee, while Vietnam has recently emerged as the largest producer of Robusta Coffee globally. According to Vishwanath, farmers there practise the field-grown technique of farming in open spaces. Expansion of coffee production in these countries was done through deforestation. Their counterparts in India practise shade-grown coffee cultivation, which is sustainable but offers lower returns. In Karnataka, all the coffee cultivation is done in three districts - Kodagu, Chikmagalur and Hassan. All three districts have forest cover, and the farming has not come at the expense of trees and biodiversity. Every trade-off comes with a cost.

No comments:

Post a Comment