(Image courtesy of Kazatomprom.)

Kazatomprom, the world’s biggest uranium producer, said on Thursday it was operating normally with no impact on output or exports despite unrest in Kazakhstan.

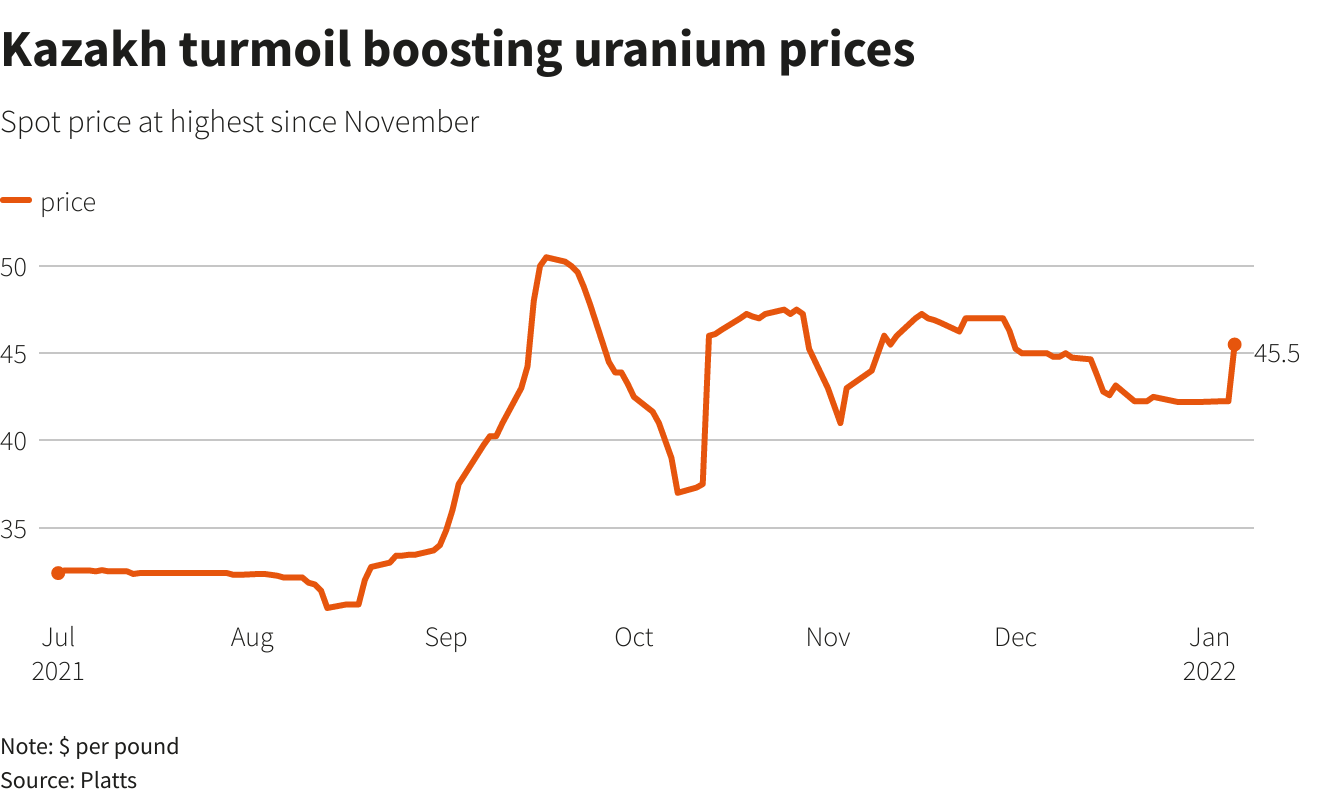

Uranium prices have risen after unrest in Kazakhstan which was spurred initially by protests against fuel price hikes. Spot prices hit $45.5 per pound on Wednesday, the highest since November 30, according to a Platts assessment.

But the central Asian country’s political turmoil does not seem to have so far affected key industries.

“Uranium mining is going according to plan there have been no stoppages. The company is fulfilling its export contracts,” a Kazatomprom spokesperson said.

Earlier, a spokesperson for the Caspian Pipeline Consortium, the group that transports the country’s main crude oil export blend, said it was operating normally. Production at Chevron’s Tengizchevroil venture also has continued.

Kazatomprom’s attributable production represented approximately 23% of global primary uranium output in 2020, according to the company’s website.

Kazatomprom’s London-listed shares clawed back some losses after the announcement, and by 1300 GMT they were down almost 3.6%. They earlier hit the lowest since end-September, adding to Wednesday’s 8% drop.

But shares in other uranium producers, such as Canada’s Cameco, are up nearly 12% so far this year. A uranium exchange traded fund (ETF) from Global X was up 2% on Thursday at the highest since end-November.

(By Mariya Gordeyeva, Olzhas Auyezov, Polina Devitt, Anisha Sircar and Sujata Rao; Editing by Alexander Smith and Kirsten Donovan)

Cameco’s Commentary on the Ongoing Situation in Kazakhstan

An incomplete and inaccurate representation of our comments has recently appeared in certain media outlets. Here is our full emailed response to a series of questions posed to us by Reuters:

The situation in Kazakhstan is dynamic and evolving. The national protests and the security clampdown on transport, financial and communication systems may add to pre-existing operating risks such as the COVID-19 pandemic’s impact on employees and contractors, as well as global supply chain disruptions to critical goods and services required for uranium production. We will have a better understanding of the operating risks once we have had a chance to communicate with our JV partner Kazatomprom.

As 40% of world’s uranium supply, any disruption in Kazakhstan could of course be a significant catalyst in the uranium market. If nothing else, it’s a reminder for utilities that an over-reliance on any one source of supply is risky. It also reinforces the shift in risk from suppliers to utilities that has occurred in this market.

These considerations underline the benefit of Cameco’s strategy to maintain a diversified portfolio of supply sources in multiple uranium-producing jurisdictions. Cameco currently has five North American uranium operations at which production has been suspended due to the weak market conditions that emerged following the Fukushima incident, but which remain in a safe state of care and maintenance. These include the McArthur River mine and Key Lake mill (the world’s largest high-grade uranium mine and mill) and the Rabbit Lake mine/mill in northern Saskatchewan; along with the Smith Ranch-Highland and Crow Butte mines in Wyoming and Nebraska respectively.

Together, these operations represent about 24 million pounds of annual productive capacity of uranium concentrate that could be brought back online should the commodity price improve to the point where the market once again calls for increased production and we have a line of sight to the appropriate homes under long-term contracts to deliver those pounds into. At present, we can’t comment with any certainty on the length of time it might take to resume production at any of these facilities.

No comments:

Post a Comment