Tripling of nuclear capacity is achievable, says World Nuclear Association

_40405.jpg)

On Energy Day at the 2025 United Nations Climate Change Conference, COP30, in Belém, Brazil, World Nuclear Association previewed findings from its forthcoming report, World Nuclear Outlook Report 2025.

The goal of tripling global nuclear capacity by 2050 was endorsed by 31 countries at COP28 and COP29. At the moment there are about 440 nuclear power reactors with a combined capacity of almost 397 GWe operating in 31 countries with at least 70 power reactors under construction, which will add another 77 GWe. Nuclear generation reached an all-time high of 2,667 TWh in 2024.

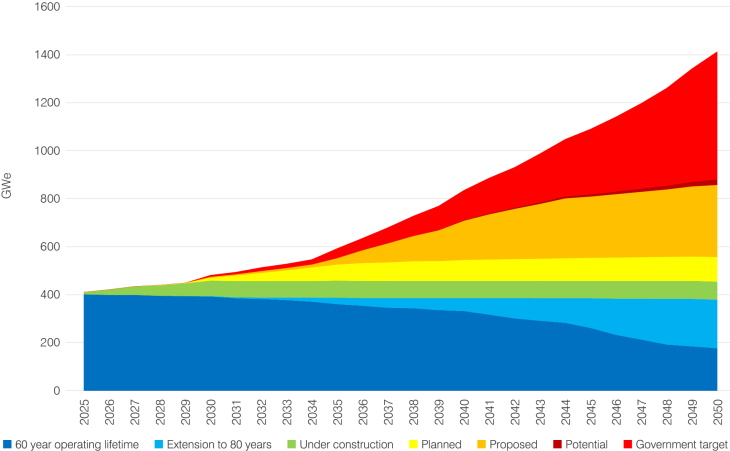

This study compiles national government targets and goals for nuclear capacity for 2050 and assesses them alongside plans for continued and extended operation of existing reactors, completion of those under construction, and realisation of planned and proposed projects.

The national government targets and goals for nuclear capacity for 2050 total 1,363 GWe. When nuclear capacity operable, under construction, planned or proposed that is not covered by government targets is also included, the total capacity for 2050 comes to 1,428 GWe, exceeding the 1,200 GWe target set in the Declaration to Triple Nuclear Energy. This assumes that the operation of existing reactors is extended up to 80 years.

Assessment of global nuclear capacity (GWe) up to 2050 (Image: World Nuclear Association)

World Nuclear Association says the global capacity projected for 2050 is "heavily dependent on the actions of a small number of countries", with China and the USA's national goals responsible for more than half of the total global nuclear capacity in 2050. When the capacities projected for France, India, and Russia are added to those of China and the USA, these five countries would reach almost 1,000 GWe of nuclear capacity by 2050.

"Meeting these targets presents considerable challenges," World Nuclear Association says. "Construction rates would need to accelerate, with new connection rates in 2050 being more than four times that required in 2030 and double the historic peak connection rates achieved in the mid-1980s.

"Achieving these goals would require action from governments and the nuclear industry. It would also require regulatory reform, and access to channelling large amounts of affordable financing to the entire nuclear value chain. Accelerated development will be required for the deployment of small modular reactors (SMRs) and advanced reactor technologies. To support deployment of the reactors, there would need to be strengthened and expanded supply chains and workforce. Significant investment and advances in the nuclear fuel cycle would also be needed, from mining to fuel fabrication, to provide the fuel required to meet the needs of the expanded global nuclear capacity."

Speaking from COP as part of the launch of World Nuclear Outlook 2025, World Nuclear Association Director General Sama Bilbao y León said: "Our analysis indicates that at least tripling nuclear capacity by 2050 is achievable with the timely action of bold global industry leaders, forward-thinking governments, and an increasingly engaged civil society. This is our chance to build a cleaner, more secure energy future for everyone everywhere, powered by affordable 24/7, low-carbon nuclear energy."

"Earlier this week IEA’s World Energy Outlook 2025, said 'a common element across its scenarios is the revival of fortunes for nuclear energy', recognising the tripling target," World Nuclear Association said. "At the same time, IEA scenarios, including its Net Zero Emission case of 1,079 GWe by 2050, fall short of the ambition in the Declaration to Triple Nuclear and World Nuclear Association’s most recent stocktake. The best available industry data, reflecting the scale of government ambition for nuclear energy, are now compiled in the World Nuclear Outlook Report 2025, and are ready to be considered in future scenarios."

The full report will be published later this year. A preview summary of the report can be found here and a presentation by Jonathan Cobb, the lead author of the report, can be viewed here.

Study evaluates potential market for SMRs in industrial sector

Commissioned by uranium enrichment services provider Urenco, the study - titled A new nuclear world: How small modular reactors can power industry - analyses the energy demands of 11 industries representing 80% of industrial energy use, going beyond data centres to examine where SMRs can make a tangible impact on industrial energy delivery, and quantifies how changes in delivery models and market drivers can expand SMR market access. The report is supported by World Nuclear Association.

"Data centres, chemicals, and coal repowering (i.e., coal-to-nuclear transition) are expected to drive near-term demand, with synthetic aviation fuels representing the largest long-term opportunity," the study says. "Without SMRs, these industrial sectors may face constrained growth or be forced to default to carbon-intensive alternatives due to the lack of clean, reliable energy. Despite this large potential market, only 7 GW would be deployed by 2050 under current deployment trends."

Four supply scenarios are presented: the Current Scenario, which reflects limited deployment based on current supply capabilities; the Programmatic Scenario, which achieves moderate growth through sustained government support and enhanced project management; the Breakout Scenario, which achieves scalable, predictable, and low-cost delivery through shipyard manufacturing; and the Transformation Scenario, with full re-engineering of nuclear technology into a mass-manufactured product, representing approximately 2,300 reactors of 300 MW capacity, where the entire project delivery process is designed for manufacture and assembly.

In addition, for each supply scenario, four demand scenarios are evaluated, reflecting different policy environments and levels of customer value recognition for nuclear energy. These scenarios assess how varying long-term gas prices (Energy Cost scenario), energy security premiums (Security scenario), and different degrees of policy support and decarbonisation commitment (Announced Pledges and Net Zero scenarios) affect the size of the accessible SMR market.

The study found that SMRs are a strong technical match for the energy needs of the industries considered, and could supply up to about 15,000 TWh or 2,200 GW of their demand.

The study also found that manufacturing innovation is key to unlocking the full potential of the SMR market. Improvements to current construction methods (the Programmatic supply scenario) could achieve 120 GW by 2050. However, evolving to full mass manufacturing (the Transformation supply scenario) could enable nearly 700 GW deployment, representing a USD0.5–1.5 trillion investment opportunity.

"This 700 GW of accessible SMR market represents nearly double the current global nuclear capacity, and would expand nuclear capacity beyond the projected goal to triple conventional deployment by 2050," the report says. "The top five SMR accessible markets, representing more than 75% of the 700 GW opportunity, are synthetic aviation fuels (203 GW), coal plant repowering (110 GW), synthetic maritime fuels (90 GW), data centres (75 GW), and chemicals (55 GW). Sectors such as food & beverage (43 GW), iron & steel (33 GW), upstream oil & gas (33 GW), and district energy (33 GW) also represent sizable opportunities, with district energy being particularly relevant in Europe."

It adds: "Serving the 700 GW potential market will require the transformation of the nuclear delivery model from bespoke construction projects to programmatic construction or manufacturing-based delivery. This transformation increases the effective demand for, and the ability to supply, nuclear projects."

According to the study, simultaneous improvement across these Six Critical Market Drivers can enable the evolution of nuclear delivery models and expand market penetration for SMRs: delivery innovation through product-based manufacturing; regulatory evolution toward product-based licensing; economic viability through policy support; site availability through pre-qualification programmes; capital access from mainstream financing; and developer ecosystem maturation with proven delivery track records.

"The gap between today's 7 GW and tomorrow's 700 GW is bridgeable," the study concludes. "The technology exists. The industrial demand is urgent. The policy momentum is building. The delivery models are emerging ... The opportunity is massive. The pathway is clear. The transformation is achievable. The time to act is now."

Urenco Group CEO Boris Schucht said: "Decarbonising industry presents a tremendous challenge that we must all embrace if we are to achieve net-zero by 2050 or sooner. We believe the new-nuclear SMR market holds one of the solutions to this problem: flexible, adaptable, safe technologies that can produce clean energy consistently and affordably. This study acknowledges that with a strong focus on enabling delivery, SMRs can be maximised to their fullest and most competitive potential, significantly enhancing the ability of the nuclear industry to make an important contribution to energy security and net-zero goals."

"We're witnessing a transformation in how nuclear energy services can be delivered to industrial customers," Kirsty Gogan, Managing Partner of Lucid Catalyst, said. "The innovations in manufacturing, licensing, and siting that this study identifies as being critical for enabling scale are already emerging in the market. With the right policy support and industry coordination across six critical areas, small modular reactors can provide a net-zero solution for energy-intensive industries requiring highly reliable, competitive, and scalable, emissions-free heat and power."

King Lee, Head of Policy and Industry Engagement at World Nuclear Association, added: "This study highlights the scale of opportunity for nuclear energy to support decarbonisation of a wide range of industrial sectors. To realise the full potential of nuclear energy would require new regulatory frameworks and production and deployment models to unlock the economy and scale of implementation far beyond current projections."

US affirms support for Korean uranium enrichment

_65927.jpg)

The briefing, issued on 13 November by the White House and the Office of the President of the Republic of Korea, follows Trump's 29 October state visit to Korea at which the two presidents "declared a new chapter in the US-ROK Alliance, the linchpin for peace, security and prosperity on the Korean Peninsula and in the Indo-Pacific region".

The factsheet reaffirms a USD350 million strategic trade and investment deal announced in July and outlines commitments on a range of trade and security issues, with South Korea saying it welcomes US support for its civil and naval nuclear power programmes.

"Consistent with the bilateral 123 Agreement and subject to US legal requirements, the United States supports the process that will lead to the ROK’s civil uranium enrichment and spent fuel reprocessing for peaceful uses," the briefing states.

"The United States has given approval for the ROK to build nuclear-powered attack submarines. The United States will work closely with the ROK to advance requirements for this shipbuilding project, including avenues to source fuel."

Formal cooperation agreements are required between countries that want to trade nuclear power goods and services, and those involving the USA are called 123 Agreements after the paragraph of the country's 1954 Atomic Energy Act which requires them.

South Korea is a prominent nuclear energy country - 26 reactors, totalling about 26 GWe of capacity, provide around one-third of its electricity, and South Korean nuclear technology is exported widely - but the terms of its 123 Agreement dating back to 1974 had constrained it from pursuing uranium enrichment or fuel reprocessing.

A 20-year extension, agreed in 2015, allowed a little more freedom and opened up the possibility of future enrichment through consultation with the USA, according to information from World Nuclear Association, and a high-level bilateral commission was set up for ongoing discussions.

Belarus to build third unit at nuclear power plant

The decision was taken at a meeting on Friday, hosted by President Alexander Lukashenko. The government has stressed the need for new capacity and studies have been carried out to decide whether that will be in the form of a new unit at the country's first nuclear power plant, in Ostrovets, or at a new site in the east of the country.

Lukashenko, according to an account of the meeting on the President's website, noted that the population of Ostrovets had nearly doubled to 15,000 people with many high quality jobs and "graduates from energy faculties dream of getting a job there".

He said that the option of building a third unit at the existing plant had the benefits of an already approved site as well as a skilled workforce and the necessary social infrastructure: "The ground conditions there have already been thoroughly studied. There is no need for any additional surveys."

Although the option of building a new nuclear plant would cost more, it had the benefits that it could "transform the eastern region from a backwater into a highly developed territory of Belarus. This means new jobs, investment, innovative projects, and new technologies", he said.

Vice Premier Viktor Karankevich said the decision to go ahead with the third unit at Ostrovets would also be matched by work to survey potential sites in Mogilev Oblast, in the east of the country, with the possibility of more new capacity in that region if energy demands supports it.

(Image: Belarus President's Office)

(Image: Belarus President's Office)

During the meeting, the performance of the existing nuclear power plant was reviewed, five years after the first unit came online.

Lukashenko said: "The construction of the nuclear power plant not only strengthened our energy security, but also determined the further development of Belarus as a high-tech state ... we have provided ourselves with a source of affordable, environmentally friendly energy for decades to come, and have achieved an economic and environmental effect."

He also stressed the electrification of the country, in heating and transport, and said that according to surveys, public support for nuclear energy in the country had risen from 60% before the Ostrovets plant was built, to more than 80% now.

The Belarus nuclear power plant has two VVER-1200 reactors and is located in Ostrovets in the Grodno region in the northwest of the country. A general contract for the construction was signed with Russia's Rosatom in 2011, with first concrete on the first unit in November 2013. Construction of unit 2 began in May 2014. The first power unit was connected to the grid in November 2020, with the second unit put into commercial operation in November 2023. More than a quarter of Belarus's electricity is now generated by nuclear.

Rosatom reported that its Director General Alexey Likhachev held talks on Thursday with Alexander Turchin, Prime Minister of Belarus at which "the two sides discussed in detail possible options for the further development of Belarus's nuclear energy sector".

No comments:

Post a Comment