Rio Tinto kicked off number 2 perch, Agnico tops $100 billion for the first time

Global mining started 2026 the way it ended 2025 – with a huge rally.

Gold now looks to have $5,000 in sight, silver’s wild swings are getting wilder, and copper is hitting all time highs with regularity.

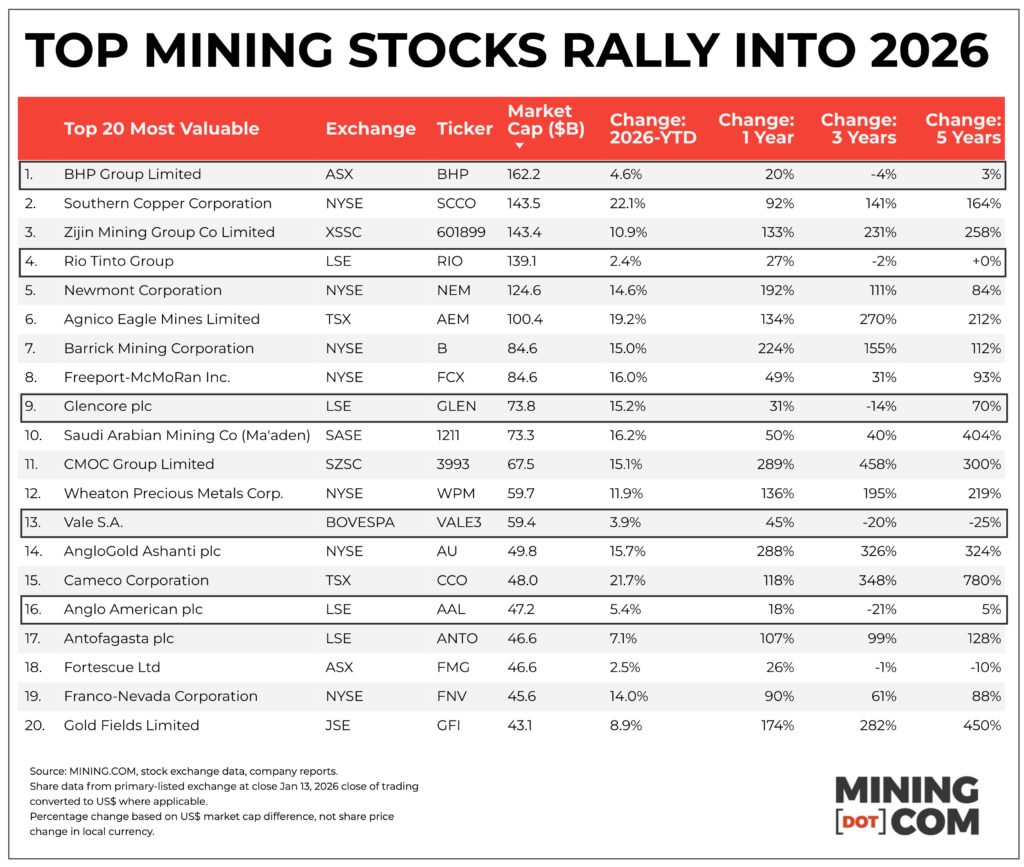

Mining stocks have duly responded, and after a blowout 2026, the Top 50 biggest mining stocks’ collective value now sits comfortably above the $2 trillion level reached at the end of last year.

You have to scour the corners of the mining world to find something that’s down and titanium and silicon are not exactly pillars of the industry.

While the metal and mineral price rally is broadbased and most mining stocks in the upper echelons already sport double digit percentage gains YTD, a few underperformers stand out. Stocks of the losers (or small gainers) appear to be driven by factors beyond buoyant metal prices.

Global mining is beefing up – and that’s before the mergers and acquisition currently being discussed.

Since inception, the MINING.COM TOP 50 was headed by two firms – BHP and Rio Tinto – the only miners with consistent market capitalizations above $100 billion (with a wobble here and there).

Now there are six firms with the distinction. The latest is Agnico Eagle, (TSX:AEM) which on Tuesday entered the ranks of the triple digit billion dollar miner. If only just.

The Toronto-based company joins Chinese champion Zijin Mining (SHA: 601899), Southern Copper (NYSE: SCCO), the mining arm of Grupo Mexico, and Denver’s Newmont Corporation (NYSE: NEM) which rode gold and copper prices all the way to the top towards the end of last year.

While the ascent of these counters is not surprising given gold’s glorious run and copper’s inexorable climb, the recent underperformance of BHP (ASX:BHP) and Rio Tinto (LSE:RIO), appears to have more to do with doubts over M&A.

While there is little separating them, it is striking that Rio Tinto is now in position number four, below Southern Copper and Zijin. Rio Tinto is up 2.2% on the LSE so far this year at $140.8 billion. Zijin has added 11% in Shanghai in USD terms while Southern Copper has surged by 22% in New York just eight trading days in.

In fact Rio Tinto and BHP (up 4.6% for $162 billion) are some of the only counters that have not seen double digit gains in 2026. Rio Tinto has received the sharp end of investor skepticism over a combination with Glencore.

Glencore in turn has gained 15.2% in value in London to $73.9 billion. The talks between Baar and Melbourne date back more than a year and investors have had ample time to digest its prospects.

The downsides of a deal for Rio Tinto, apart from what to do with coal, do not seem insurmountable while the upsides when it comes to copper are obvious. A merged entity would become the clear copper king with attributable production of roughly 1.6 million tonnes a year by 2028 – and when Glencore’s projects come on stream in the early 2030s it could hit 2m tonnes-plus (versus BHP and Codelco’s 1.3m tonnes).

Rio Tinto just this week appointed three investment banks to give advice so at least who needs who more may soon become apparent.

BHP’s lacklustre performance also appears to have an M&A angle, this time because the company has been relegated to the sidelines after more than one failed attempt over the years (including with Rio Tinto) while others partner up.

Today a RioCore would be worth not that much more than $200 billion (a number the likes of GOOG gains or gives up in an afternoon) and it’s easy to forget that BHP flirted with this level all the way back in April 2022 when it briefly displaced oil major Shell as the most valuable stock on the FTSE.

Trading in two other merger candidates has also been uninspiring. Anglo American (LSE:AAL) stock rose by 5.4% by Tuesday for a $46.7 billion valuation while Teck Resources (TSX:TECK.B) is 5.2% for the better at $24.3 billion in Toronto (well outside the top 20).

BHP’s odd last-minute intervention aside, AngloTeck is coming closer to reality with the EU poised to also clear the deal within weeks. At current prices a combined entity would only just make it into the top 10. That Anglogold Ashanti (NYSE:AU) is now worth more than its erstwhile parent must sting in the offices of 17 Charterhouse (slated for evacuation).

Apart from an operational level agreement with Glencore to explore in Canada’s Sudbury basin, absent from the conversation has been Vale (BOVESPA:VALE3).

Long the number three most valuable and for a day or two in 2022 also worth more $100 billion, the Brazilian miner continues to drift down the ranking. An IPO for the Rio de Janeiro-based company’s base metals unit would be in 2027 by the earliest.

Mining’s traditional big 5 diversified giants – BHP, Rio Tinto, Glencore, Vale and Anglo American – that trace their roots back many decades if not more than a century, not that long ago occupied the top five spots as a matter of course and constituted nearly a third of the overall value of the Top 50.

It is not just their recent performance that stands out, when looking at a three-year (or even five-year) chart it is hard not to conclude that the old guard has not kept up with the new world of mining.

Among spectacular gains for copper, gold and other commodity specialists with three/four or sometimes eight-fold gains in value since 2022, the geographically spread out, diversified mining model remains in the red.

And mergers and acquisitions and spinoffs and bolt-ons, it seems, do not provide solutions for this perennial disappointment.