Joseph Zeballos-Roig

INSIDER

Thu, June 9, 2022

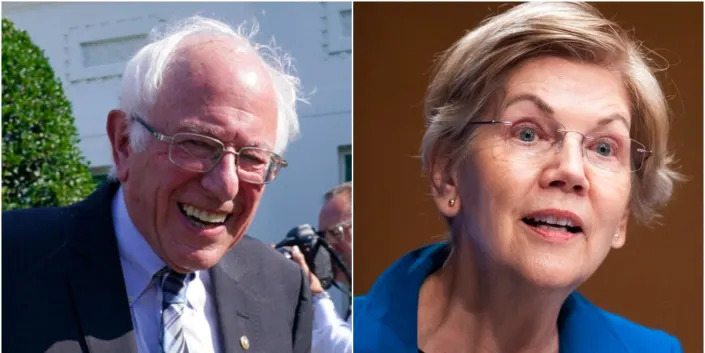

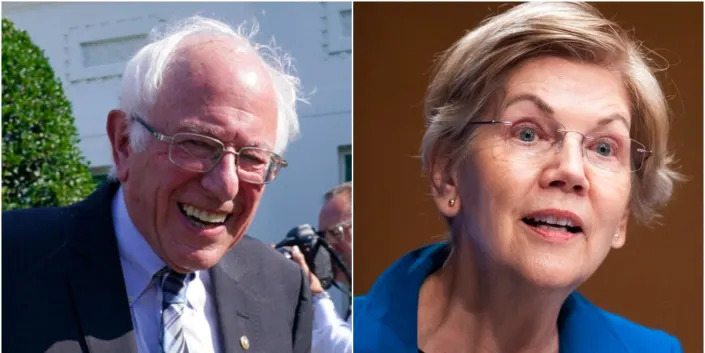

Sen. Bernie Sanders of Vermont and Sen. Elizabeth Warren of Massachusetts.

Thu, June 9, 2022

Sen. Bernie Sanders of Vermont and Sen. Elizabeth Warren of Massachusetts.

Susan Walsh/AP Photo; Tom Williams/Pool via AP

Sens. Sanders and Warren rolled out a plan to boost Social Security checks.

But Republicans slammed the proposal's tax hikes to finance the larger benefits for retirees.

The GOP generally favors other steps to preserve Social Security, like raising the retirement age.

There's a Social Security benefits cliff looming, with retirees seeing their checks garnished as soon as 2035.

According to the latest federal Social Security report, the program has just enough funding to send out monthly checks to older Americans and those with disabilities for 13 years. Beyond that, a 20% reduction in benefits is needed for the program to be sustainable.

"In the coming decades it will be vital for Congress to take steps to put Social Security and Medicare on solid financial footing for the long term," Treasury Secretary Janet Yellen said in a statement on the Social Security report.

Sen. Bernie Sanders — alongside Sen. Elizabeth Warren and a bevy of other Democrats — are putting forward a plan to change that.

Their proposal: a bill that would increase the benefit by $2,400 a year and fully fund the program through 2096.

To pay for it, the Democrats are proposing a raise to the earnings cap for paying into Social Security. Right now, Americans are taxed only on their first $147,000 in income to pay for Social Security; earnings beyond that are not touched.

Sanders' Social Security Expansion Act "would lift this cap and subject all income above $250,000 to the Social Security payroll tax," according to a fact sheet released by the senator.

Raising the income threshold isn't a new concept, and it's one that Sen. Joe Manchin, a key centrist, has already expressed support for. Earlier this year, the Democrat from West Virginia said the payroll-tax cap should be taken up to $400,000 to put Social Security on a more sustainable fiscal path.

While Sanders' plan is one solution to patching the ailing — and popular — program, Republicans indicated that it wouldn't draw their votes. They tend to resist tax increases to fund more generous safety net benefits, favoring other fixes.

Sen. Lindsey Graham of South Carolina, the ranking member of the Senate Budget Committee, suggested in a Thursday congressional hearing that the program's retirement age would probably need to be raised, a step that Sen. Mitt Romney expressed support for earlier this year. Romney previously proposed the TRUST Act, a bipartisan bill directed at helping fix Social Security and other ailing programs. Critics said that legislation might end up cutting some benefits.

"Sen. Sanders makes a wonderful plea, which many, many people agree with — the need for helping our seniors and providing better benefits for them and so forth," Romney, a Republican from Utah, said during a Senate Budget Committee hearing. "But recognize this bill has no chance whatsoever of receiving a single Republican vote in either house."

Sens. Sanders and Warren rolled out a plan to boost Social Security checks.

But Republicans slammed the proposal's tax hikes to finance the larger benefits for retirees.

The GOP generally favors other steps to preserve Social Security, like raising the retirement age.

There's a Social Security benefits cliff looming, with retirees seeing their checks garnished as soon as 2035.

According to the latest federal Social Security report, the program has just enough funding to send out monthly checks to older Americans and those with disabilities for 13 years. Beyond that, a 20% reduction in benefits is needed for the program to be sustainable.

"In the coming decades it will be vital for Congress to take steps to put Social Security and Medicare on solid financial footing for the long term," Treasury Secretary Janet Yellen said in a statement on the Social Security report.

Sen. Bernie Sanders — alongside Sen. Elizabeth Warren and a bevy of other Democrats — are putting forward a plan to change that.

Their proposal: a bill that would increase the benefit by $2,400 a year and fully fund the program through 2096.

To pay for it, the Democrats are proposing a raise to the earnings cap for paying into Social Security. Right now, Americans are taxed only on their first $147,000 in income to pay for Social Security; earnings beyond that are not touched.

Sanders' Social Security Expansion Act "would lift this cap and subject all income above $250,000 to the Social Security payroll tax," according to a fact sheet released by the senator.

Raising the income threshold isn't a new concept, and it's one that Sen. Joe Manchin, a key centrist, has already expressed support for. Earlier this year, the Democrat from West Virginia said the payroll-tax cap should be taken up to $400,000 to put Social Security on a more sustainable fiscal path.

While Sanders' plan is one solution to patching the ailing — and popular — program, Republicans indicated that it wouldn't draw their votes. They tend to resist tax increases to fund more generous safety net benefits, favoring other fixes.

Sen. Lindsey Graham of South Carolina, the ranking member of the Senate Budget Committee, suggested in a Thursday congressional hearing that the program's retirement age would probably need to be raised, a step that Sen. Mitt Romney expressed support for earlier this year. Romney previously proposed the TRUST Act, a bipartisan bill directed at helping fix Social Security and other ailing programs. Critics said that legislation might end up cutting some benefits.

"Sen. Sanders makes a wonderful plea, which many, many people agree with — the need for helping our seniors and providing better benefits for them and so forth," Romney, a Republican from Utah, said during a Senate Budget Committee hearing. "But recognize this bill has no chance whatsoever of receiving a single Republican vote in either house."

No comments:

Post a Comment