Akshay Chinchalkar

Thu, February 23, 2023

(Bloomberg) -- The rout in Adani Group shares has room to run based on charts that show key stocks in Gautam Adani’s empire may still extend declines to the 85% downside flagged by Hindenburg Research.

The combined market value of the 10 listed companies in the group has slumped by $146 billion, or about 60%, since the US-based short seller released its report almost a month ago, alleging accounting fraud and stock manipulation. Adani has denied the allegations.

Hindenburg identified seven of the stocks as having potential to drop by 85%, based “purely on a fundamental basis owing to sky-high valuations,” according to its Jan. 24 report.

Four of those seven show a strong potential to be affected by technical levels, according to a Bloomberg analysis. Charts point to further declines for flagship Adani Enterprises Ltd., tests of support for Adani Transmission Ltd. and Adani Ports & Special Economic Zone Ltd., and a let up in losses for Adani Power Ltd.

Adani Enterprises: Support Distant

Adani Enterprises has slumped about 60% from its close on Jan. 24. It has room to decline another 26% before finding initial support at the Feb. 3 intraday low of 1,017 rupees, or 33% before touching support from multiple Fibonacci levels in the area between 910 rupees to 925 rupees. Just above that zone is the value level of 945 rupees per share ascribed to the stock by Aswath Damodaran, a New York University finance professor known for his expertise on valuation.

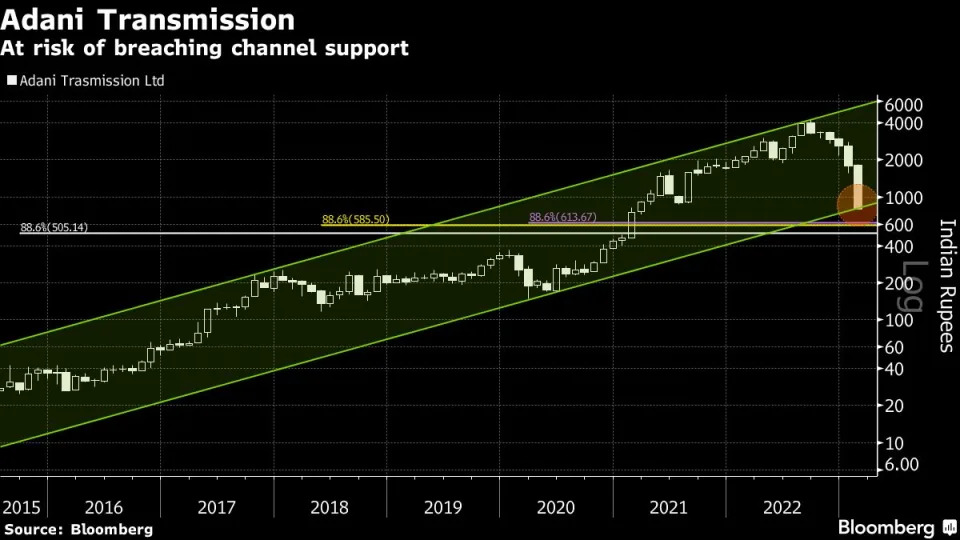

Adani Transmission: On the Brink

Adani Transmission, which has tumbled 73% since the Hindenburg report, is already testing the lower bound of support in a long-term parallel channel. Failure to arrest the decline here would open the shares to a further drop of about 20% before the next likely support around 600 rupees, where there is a cluster of Fibonacci levels. The stock has fallen by the 5% limit on every trading day since Feb. 9.

Adani Transmission, which has tumbled 73% since the Hindenburg report, is already testing the lower bound of support in a long-term parallel channel. Failure to arrest the decline here would open the shares to a further drop of about 20% before the next likely support around 600 rupees, where there is a cluster of Fibonacci levels. The stock has fallen by the 5% limit on every trading day since Feb. 9.

Adani Ports: Bounce Test

Adani Ports & Special Economic Zone has tumbled 44% from its September high, but has lost only 28% since the Hindenburg report was published Jan. 24. The share’s volatile history includes an 81% peak-to-trough plunge in 2008. Its rebound from a Feb. 3 low was assisted by a cluster of Fibonacci levels lying between 370 rupees and 410 rupees. Holding above this zone would open the way to pushing above 650 rupees, while a breach below would bring into play the pandemic crash lows of around 200 rupees.

Adani Power: Decline Stalls

Recent price action suggests some buyers are starting to see value in Adani Power after an almost 70% slump from its August highs through last week’s low. The shares are down about 43% from their Jan. 24 close. The formation of a doji candlestick pattern last week — in which opening and closing levels are closely aligned — occurred right at the lower line of a long-term rising channel. The odds of a larger rebound will increase only if the shares break above resistance at 191 rupees. Failure to do so would make the zone from 136 rupees to 141 rupees vulnerable, creating the risk of a drop to around 100 rupees.

Bloomberg Businessweek

Recent price action suggests some buyers are starting to see value in Adani Power after an almost 70% slump from its August highs through last week’s low. The shares are down about 43% from their Jan. 24 close. The formation of a doji candlestick pattern last week — in which opening and closing levels are closely aligned — occurred right at the lower line of a long-term rising channel. The odds of a larger rebound will increase only if the shares break above resistance at 191 rupees. Failure to do so would make the zone from 136 rupees to 141 rupees vulnerable, creating the risk of a drop to around 100 rupees.

Bloomberg Businessweek

No comments:

Post a Comment