Giant Wind Turbine Installation Vessel Delivered to Cadeler

Cadeler, which already attests to being the world’s largest operator in offshore wind installation, operations, and maintenance services, took delivery today, August 16, on the first of its new larger installation vessels. It comes just three months after the company claimed a first for lifting a giant offshore wind turbine into position and is the next step after the acquisition of Eneti which positioned the company including an orderbook of now seven vessels.

The first of the vessels from the orderbook, Wind Peak, was delivered from the COSCO Shipping Heavy Industry shipyard in Qidong, China. The company has a second sistership, Wind Pace, scheduled for delivery in the second quarter of 2025 as its two P-Class jack-up installation vessels. Cadeler highlights that the vessels are designed for the growing needs and demands of future wind farms in terms of size, scope, and complexity and will be the largest in its fleet.

"Our customers are constantly pushing the boundaries in terms of size and complexity of the wind turbines being installed offshore,” said Mikkel Gleerup, CEO of Cadeler. “Wind Peak is a representation of this, and we owe our ability to set new standards in the industry to the hardworking Cadeler team, our excellent shipyard, and trusted strategic partners.”

First time giant 14.7 MW wind turbine and blades were lifted into position by a Cadeler vessel

The ships are engineered to operate at some of the most challenging offshore installation sites worldwide and have the capability to install the largest wind turbines currently being deployed across the globe. The ships will each have 5,600 square meters of deck space with a payload capacity of over 17,600 tons. The main crane is capable of lifting more than 2,500 tons at 53 meters. The size and capacity mean the vessels have the ability to transport and install seven complete 15 MW turbine sets or five sets of 20+ MW turbines per load. Each vessel can accommodate up to 130 crew members and installation technicians.

Liang Yanfeng, Chairman of COSCO SHIPPING Heavy Industry called the vessels among the most advanced offshore wind turbine installation vessels globally. In addition to the load capacity, he said they are also pioneers in the use of hybrid oil-electric power technology.

Designs for the vessels were developed in partnership with COSCO, GustoMSC NOV, Kongsberg, Huisman, and MAN Energy.

The vessel expands on Cadeler’s current capacity. This spring one of the company’s current vessels installed the first 14.7 MW Siemens Gamesa offshore wind turbine, complete with the 108-meter (354 foot) blades, at OW Ocean Winds' Moray West Wind Farm in Scotland.

In addition to the two P-class vessels, Cadeler has two M-class and now three A-class all on order from COSCO Heavy Industries. The company recently placed the order for the third A-Class vessel and when they are all delivered by 2027, Cadeler will have a fleet of 11 installation vessels. They will all be operating under the Danish flag.

BOEM Approves Environmental Analysis for Oregon Offshore Wind Leasing

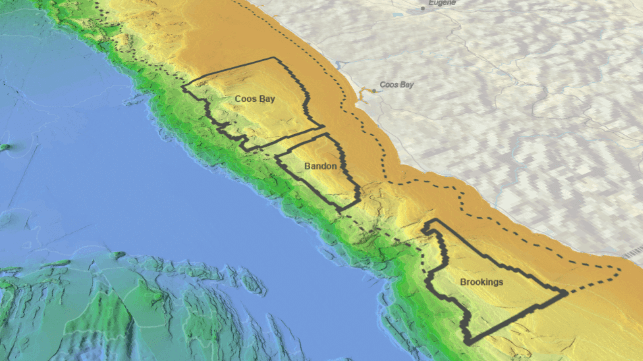

The U.S. Bureau of Ocean Energy Management (BOEM) has finalized its environmental review process for the auction of wind lease areas off the coast of Southern Oregon, finding that the development activity will have no significant impact to people or to the environment.

"Working with Tribes, government partners, ocean users, and the public, we gathered a wealth of data, diverse perspectives, and valuable insights that shaped our environmental analysis," said BOEM director Elizabeth Klein. "We remain committed to continuing this close coordination to ensure potential offshore wind energy leasing and any future development in Oregon is done in a way that avoids, reduces, or mitigates potential impacts to ocean users and the marine environment."

Local tribes and fishermen oppose wind development off the Oregon coast, and BOEM's review process is locally controversial. This month, commissioners in both affected Oregon counties decided to put referenda on the November ballot to ask residents whether they should formally oppose offshore wind. While federal regulators will make the final decision on leasing and permitting, and the wind lease auctions will likely take place before the ballot, the referenda will provide a measurement of local sentiment.

"We had a town hall on this subject and it was it was attended by a broad base of people — both conservatives and liberals," Coos County commissioner Rod Taylor told local station KGW. "I don't recall hearing one person at that town hall who was in favor of this wind energy project."

BOEM's wind lease areas cover about 195,000 acres - about 11 percent smaller than originally proposed - and have about 2.4 GW of generation potential. The areas were selected with local fishing interests in mind, but trawl and longline fishermen are concerned that the long mooring chains of floating offshore wind farms would effectively close off large sections of ocean to fishing activity.

"We’re moving to a place now where we are considering coming out and just saying no to offshore wind rather than being willing to work through a process, because that process is stalled," said Heather Mann, executive director of the Midwater Trawlers Cooperative, speaking to Jefferson Public Radio. "BOEM is moving forward regardless."

The environmental analysis that BOEM approved Tuesday is a preliminary review. The full environmental impact assessment for a U.S. offshore wind development comes during the project permitting phase, after the developer has invested in a lease area and formulated a construction and operations plan. Any specific project off the West Coast would still have to undergo further environmental review before construction; to date, BOEM has approved a final environmental impact statement for nine projects and rejected none.

BOEM's regulatory decisions may not necessarily be the controlling factor for the timing of commercial development. The U.S. East Coast offshore wind industry has encountered setbacks due to high interest rates and supply chain delays, which have raised costs. Development on the U.S. West Coast will be even more costly, because the region's deep water will require more expensive floating offshore wind platforms and moorings.

Dominion and Equinor Win Central Atlantic Wind Leases Paying Total of $93M

The U.S. Department of the Interior is reporting strong interest in its latest offshore wind auction completed yesterday for sites off the Central Atlantic states. A total of six companies participated in the auction for the two sites offered with the winning bids of $92.65 million from Dominion Energy and Equinor.

The Bureau of Ocean Energy Management conducted the auction which was scheduled in June for sites located offshore from Delaware, Maryland, and Virginia. They highlighted that it was the first offshore sale in the region in a decade. Combined the two sites have the potential for an additional 2.2 million homes or the capacity for approximately 6.3 GW according to the Department of the Interior.

Equinor Wind provisionally won a lease for 101,443 acres located approximately 26 nautical miles from Delaware Bay. The company’s winning bid was just over $75 million. Equinor highlights the potential for around 2 GW of power from the lease area.

The second parcel consists of 176,505 acres and is located approximately 35 nautical miles from the entrance of Chesapeake Bay. The winner is Virginia Electric and Power Company (Dominion Energy) but it drew just $17.65 million. BOEM estimates the area could provide between 2.1 and 4 GW of power. The lease area is adjacent and to the east of where the company's 2.6-gigawatt Coastal Virginia Offshore Wind project. Dominion also agreed in July to acquire from Avangrid the 40,000-acre Kitty Hawk Wind North offshore wind lease area, to be renamed CVOW South. It could provide an additional 800 MW.

“Today’s lease sale represents a major milestone in meeting the demand for clean renewable energy along the East Coast,” said Bureau of Ocean Energy Management (BOEM) Director Elizabeth Klein. The bureau is reporting that the sale resulted in over $23 million in bidding credits, including over $11 in investments for workforce training and domestic supply chain, and an additional $11 million for fisheries compensatory mitigation. The terms of the bidding include stipulations for buying U.S. materials and seeking project labor agreements.

They are also highlighting that the federal government has already approved nine commercial-scale offshore wind projects and held five offshore wind lease auctions under the Biden-Harris administration. BOEM also released a schedule for future auctions through 2028 and reports it will continue to work with the Central Atlantic Intergovernmental Renewable Energy Task Force to explore and identify potential additional areas for future wind leasing. Trump, however, has vowed to stop offshore wind energy development if re-elected president.

Today’s auction announcement starts a long-term process for planning and review for the sites. Equinor said in its statement that it would be post-2035 before the site could become operational as part of its long-term commitments.

Work is underway on Equinor’s Empire Wind 1 project for New York, while Dominion Energy highlighted this week that it has completed the installation of 54 monopiles for its Coastal Virginia Offshore Wind project while targeting between 70 and 100 before work pauses at the end of October.

The industry has come under renewed scrutiny in the weeks since one of the blades fractured at the Vineyard Wind 1 project off the coast of Massachusetts. Work is proceeding on the recovery at the site and the Bureau of Safety and Environmental Enforcement (BSEE) yesterday revised its Suspension Order to enable Vineyard Wind to resume activities including the installation of towers and nacelles, but further blade installation or power production remains suspended at this time while the investigation and inspection of the blades continues.

No comments:

Post a Comment