ECOCIDE

Containership Ablaze and Drifting in Red Sea After Crew Abandons Ship

The crew of a Chinese-owned containership reportedly abandoned the vessel this morning in the Red Sea after a fire broke out. Few details have been released, but it is believed to possibly be a container fire and not an attack from the Houthi rebels which have promised to honor the Gaza ceasefire.

The vessel is the ASL Bauhinia (24,727 dwt) built in China in 2022. It is owned by Asean Sea Lines, a Shanghai-based regional carrier. The company highlighted that the vessel entered service in October 2022 as its first 1,900 TEU vessel. It is registered in Hong Kong and classed by Japan’s ClassNK.

The ship departed the Jebel Ali commercial terminal in Dubai on January 22 and reports it was bound for Jeddah, Saudi Arabia. Asean Line which started operations in 2011 is reportedly operating the ship in partnership with another regional Chinese carrier CU Lines. The posted schedule of CU Lines shows the vessel scheduled to arrive in Saudi Arabia today and then proceed to Aqaba, Jordan.

A fire was reported aboard the vessel around midnight and the crew later reported they were abandoning ship. Associated Press reported the crew was rescued by another passing vessel.

The current position of the containership is reported approximately 140 miles off the coast of Hodeida, Yemen according to the Diaplous Group. They are reporting the vessel is ablaze and drifting.

Containership Schedule Reliability Stabilized Absorbing Red Sea Diversions

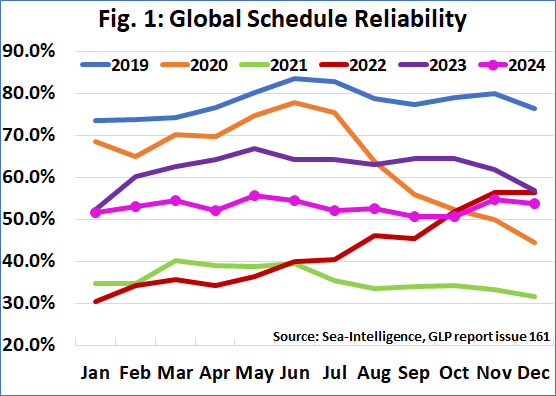

Containership schedule reliability absorbed the shocks from the diversions away from the Red Sea and leveled off despite the demands on capacity and the longer travel times. Sea-Intelligence published its end-of-year report which tracked reliability across 34 different trade routes and showed consistency for much of 2024 after losing significantly from the progress achieved in 2023.

“Throughout 2024, schedule reliability has largely remained within the 50%-55% range,” notes Alan Murphy, CEO of Sea-Intelligence. “On a year-over-year level, schedule reliability was down 3.0 percentage points lower in December 2024.”

Sea-Intelligence’s data shows a narrow range for schedule reliability in 2024 with the yearly average at 53 percent. It is slightly below the industry’s six-year average of 55 percent but significantly behind the 62 percent average for 2023. The first sharp drop came in November 2024 which collates to the beginning of the Houthis’ attacks and a second large decline in December as the carriers began diverting their ships.

Among the individual carriers, six of the top 13 achieved improvements in December 2024 versus a year earlier. Zim achieved the biggest improvement, better than 5 percent year-over-year in December while Evergreen showed the largest decline, over 12 percent. The top carriers' overage averaged just over 51 percent schedule reliability in December 2024.

Maersk continues to be among the leaders and was the only top carrier above 60 percent schedule reliability in December 2024. It comes as the carrier was working toward the implementation of its new route system as part of the Gemini Cooperation with Hapag-Lloyd. Starting on February 1, the carriers will begin a transition to a new hub approach with dedicated, right-sized shuttles working from many ports to feed containers into the main hubs on the new main loops. The route from Asia to Europe will have just three port stops as Maersk moves toward a target to exceed 90 percent schedule reliability. The company said during a briefing this week that it will take till May 2025 to complete existing loops and transition ships to the new schedules.

For the industry, December also showed a reduction in the days behind schedule. December 2024 was 0.12 days lower than a year ago and 0.24 lower than November 2024. For the year, the industry averaged 5.43 days behind schedule, which is significantly better than 2021 and 2022 during the surge after the pandemic, but still behind historical levels of five days or under.

“The average delay for late vessel arrivals decreased by 0.23 days month over month to 5.28 days, which is the lowest that the delay figure has been since July 2024,” notes Alan Murphy.

The wildcard for 2025 is the timing of a potential return to the Red Sea routes. Major carriers including Maersk, MSC, and CMA CGM, each have said it is too early to begin switching back to their normal routes. The Houthis announced they would only be respecting the Gaza ceasefire and only targeting ships related to Israel. However, previously they fired on ships such as MSC and Maersk saying that the shipping companies and their vessels were supporting Israel.

Analysts have predicted that a return to the Red Sea routes while shortening sailing distances could also result in excess capacity and a collapse in container shipping prices. Based on Sea-Intelligence’s data, the sector appears to have reached stability absorbing the disruptions to routes in 2024 while it waits to see the challenges that 2025 will bring to container shipping.

No comments:

Post a Comment