Chevron Completes Hess Acquisition, Including Offshore Guyana Stake

Despite objections from ExxonMobil, Chevron has completed its planned acquisition of privately-held rival Hess, including a 30 percent stake in Exxon's lucrative Stabroek Block developments off Guyana.

Exxon attempted to block the Hess acquisition by filing an arbitration case through the International Chamber of Commerce. Hess's contract for the ownership of the Stabroek Block lease included a clause providing right of first refusal to Exxon in the event of a sale of Hess' stake; Exxon insisted that this clause applied in the event of the sale of Hess itself. Chevron disagreed, and acrgued

On Friday morning, Exxon lost its arbitral case, and Chevron completed the process of closing on the acquisition of Hess within four hours of the arbitration panel's announcement. Chevron CEO Mike Wirth celebrated the win, thanking the arbitral panel for recognizing the "longstanding practice and understanding that asset-level rights of first refusal do not apply in parent company merger and acquisition transactions."

Exxon has accepted the reality that - despite its objections - Chevron is its new business partner in the Stabroek Block project. "We disagree with the ICC panel’s interpretation but respect the arbitration and dispute resolution process," Exxon said in a statement. "We welcome Chevron to the venture and look forward to continued industry-leading performance and value creation in Guyana."

The Stabroek Block is one of the world's most promising offshore finds, and is a powerhouse behind Exxon's profit margins. The IEA predicts that it will singlehandedly produce one percent of the world's oil in future years. Even with the high cost of offshore operations, the first four Stabroek FPSOs will produce oil at a breakeven cost of less than $35 per barrel, according to independent estimates - meaning that even in an era of low oil prices, the projects will still be profitable.

Chevron Completes Hess Megadeal After Winning Guyana Arbitration

Chevron Corporation said on Friday it had completed the $53-billion acquisition of Hess Corporation after winning an arbitration case against Exxon over the Guyana assets of Hess.

In 2023, Chevron proposed a $53-billion deal to buy Hess Corp and thus take Hess’s assets in the Bakken in North Dakota and the 30% stake in Guyana’s Stabroek offshore oil field—a top-performing asset with the potential to yield even more barrels and billions of U.S. dollars for the project’s partners.

Exxon is the operator of the Stabroek block with a 45% stake. Hess held 30%, and China’s state firm CNOOC has the remaining 25% stake.

Proceeds for the consortium, which is already pumping more than 660,000 barrels per day (bpd) from several projects in the block, are rising with growing production, even at relatively lower oil prices, because the Guyana block is estimated to have a breakeven oil price of about $30 per barrel.

Chevron’s bid to buy Hess’s stake in the Guyana projects was challenged by Exxon and CNOOC, who claim they have a right of first refusal for Hess’s stake under the terms of a joint operating agreement (JOA) for the Stabroek block. Hess and Chevron claimed the JOA doesn’t apply to a case of a proposed full corporate merger.

The dispute went to arbitration, which ruled in favor of Chevron, the company said today, announcing the completion of the Hess acquisition, “following the satisfaction of all necessary closing conditions, including a favorable arbitration outcome regarding Hess’ offshore Guyana asset.”

Chevron now owns a 30% position in the Guyana Stabroek Block, which has more than 11 billion barrels of oil equivalent discovered recoverable resource.

In addition, the Federal Trade Commission (FTC) on Friday lifted its earlier restriction, clearing the way for John Hess to join Chevron’s Board of Directors, subject to Board approval.

“The combination enhances and extends our growth profile well into the next decade, which we believe will drive greater long-term value to shareholders,” said Mike Wirth, Chevron chairman and CEO.

By Michael Kern for Oilprice.com

Do Upstream Mergers Really Deliver Value for Shareholders?

- The article questions whether large M&A transactions in the E&P sector consistently translate into tangible shareholder value, despite initial promises of immediate accretion and synergies.

- The ExxonMobil acquisition of Pioneer Natural Resources is examined as a case study, highlighting the industrial logic behind the deal but also pointing out the lack of immediate financial benefits for ExxonMobil shareholders, such as increased stock price or EPS accretion.

- The author suggests that while M&A may offer long-term benefits in terms of scale and sustainability for companies, the short-term impact on shareholder returns often appears negligible or even negative, describing it as a "shell game" for investors.

I've been noodling around with an idea for a while now. The thing on my mind is when do investors actually gain from the big gobs of money E&P companies spend on M&A? A lot of promises are made in the early days. But as time wears on, I rarely see any effort made to reconcile results with these promises. So bear with me as I go through this little exercise.

Now I am not saying that M&A isn't necessary as strong companies buy out smaller, weaker companies to get their premium assets. That part of the transaction is easily understood, and I will review that thought in the ExxonMobil/Pioneer Natural Resources case as we go through this exercise. My point here is investors are still waiting for these results to show up in their mail box. In fairness, not a lot time has elapsed, but I think trends are instructive. Let's dive in.

Upstream M&A: Shell game?

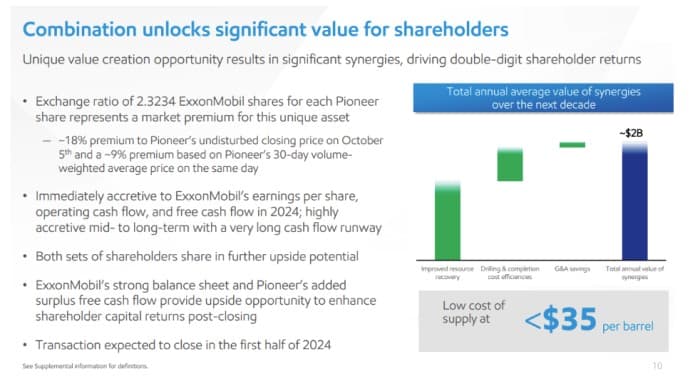

The upstream industry has been on a buying binge the last several years with hundreds of billions worth of transactions on the books. One of the most notable thus far has been ExxonMobil’s (NYSE:XOM) acquisition of Pioneer Natural Resources, for approximately $253 per share or a substantial $64.5 billion, including debt, in an all-stock transaction. As noted in the deal slide from the announcement, this was an 18% premium to recent pricing for Pioneer. In exchange for XOM diluting current holders of its stock by about 255 mm shares or ~6%, the company made some firm promises in regard to the future upside for the combined company. Among other things XOM holders were told the transaction would be “immediately accretive to EPS.” Hold that thought.

Some time has gone by since the deal closed in May of 2024 and it seemed appropriate to peek under the hood to see how the company was delivering on these commitments. It’s also worth reviewing just what drove Exxon’s interest in paying a premium to Pioneer to obtain their Midland acreage.

The Industrial Logic of ExxonMobil and Pioneer

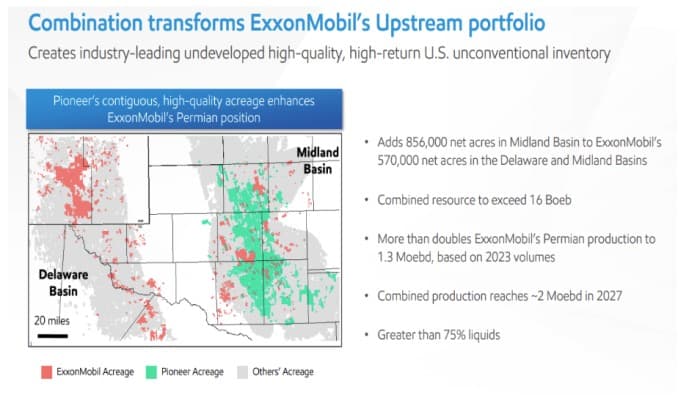

Industrial logic is the term applied to these mega deals. It’s one of the terms, along with synergy and accretive, that are bandied about on announcement day. As you can see below, Pioneer’s Midland basin acreage was like a missing puzzle piece to Exxon’s prior footprint in the play. Exxon is a technology company with a track record of pushing the envelope to drive down costs and increase production, but to fully deploy their technical expertise, they needed more room.

When you snap the two pieces together, you get a blocky, connected plot of land that runs for 50-75 miles east and west, and the better part of a couple of hundred miles north and south. 1.4 million acres is a sizeable chunk of dirt. That’s significant and opens the door to huge numbers of 4-5 mile laterals, with centralized logistics, sand, water, the stuff of fracking, and helping lock-in low cost of supply. The easy stuff put in place, XOM engineers are free to work their magic wringing maximum barrels out of each foot of completed interval. That’s all great for the company, but does this add to the value of the company in a way that benefits shareholders? Something real, and tangible that they can spend. Today. Like the stock price going up. Or special dividends. It seems like it should, and that’s where we will look next for any sign the company is about to embark on an enhanced shareholder rewards package.

Capitalization is one metric by which we might judge the impact of a transaction. Suppose company A, worth X, buys company Z, worth Y. In that case, logic suggests that company AZ should match the value of the two merger partners, or X + Y. Referring back to our ExxonMobil example, on May 2nd, the day before the merger closed the share price of XOM was $116.21 per share. With 3,998,000,000 shares outstanding that works out to a capitalization of $462 bn. At the agreed price of $253 per share for Pioneer their capitalization was $59.5 bn. The two together should have created an entity worth $521 bn, a point from which the merger driven success of the company should have been a value accretion launching pad. By the end of 2024 XOM stock was trading at $107.27. With 4,424 bn shares outstanding the company’s capitalization stood at $474 bn. In about six months, some $47 bn in capitalization had vanished into thin air.

Investors were promised the transaction would be immediately accretive to earnings per share. In June, 2024 reporting for the second quarter showed EPS to be $2.14 per share. For the fourth quarter EPS was $1.67 per share. So no immediate accretion. Perhaps patience will pay off. For the first quarter of 2025 EPS was $1.76 per share and the forecast for Q-2 is $1.55 share. One step forward and another back. What matters is that, thus far the combined company has not equaled its standalone performance. This is a sobering thought in light of the dilution visited upon shareholders, and the expense the company is going to repurchase shares.

Related: Goldman: The Boom Years of U.S. Oil Output Growth Are Over

I may be piling on a bit here as the time elapsed since the merger is minimal. ROCE or Return on Capital Employed, shows little sign of being moved significantly higher in the merger. For a Twelve-Trailing Month-TTM period, Exxon’s ROCE was 0.10882, a slight improvement from Full Year-2024’s 0.1082. Moving in the right direction, but after spending $64.5 bn in stock dilution, one might hope for a teensy bit more. Like I said, perhaps not enough time has gone by to attach much weight to the change in ROCE.

Summing up

So, where does that leave us as we eagerly anticipate another mega merger? I refer, of course, to the one that now hangs in the balance for Chevron (NYSE:CVX) and Hess (NYSE:HES), with an arbitrator set to rule on XOM’s claim of primacy in the pre-emptive right to buy HESS’ share in the Stabroek field, offshore Guyana. If we buy into CVX today it will cost us $150 per share. If the arbitrator rules in their favor and the assets of Hess are merged into CVX, will the price of CVX then become X+Y-dilution? Or the CVX price plus the Hess price of $171 per share, less the amount of stock CVX will print~$351 mm shares to meet the deal price of $60 bn? Will the combined company have a capitalization of $327 bn? If history is any guide this outcome is unlikely.

It is certainly food for thought as another serial acquirer comes to mind. I refer here to Occidental Petroleum, (NYSE: OXY), which after the Anadarko deal of 2019 for $57 bn, and then the CrownRock deal of 2024 for $12 bn- a combined cash and stock outlay of $69 bn for a company with a present day capitalization of $42 bn. Warren Buffett with a 26.92% stake in OXY, for which he’s paid an average of $51.92 per share, is down 21% on his investment. I wonder what his response would be today if the OXY plane landed in Omaha with a deal in management’s pocket. I have a pretty good idea actually.

I will reiterate-the Industrial logic of upstream M&A is abundantly clear. As an industry matures size and scale matter, and perhaps (likely) this is where value shows up for shareholders who remain long for an extended period. The company can continue to develop oil and gas deposits long after the standalone company would have drilled itself out of existence. But over the short run, it looks like a shell game to me.

By David Messler for Oilprice.com

No comments:

Post a Comment