by Editor

November 18, 2021

America’s largest public pension plan that serves California state and local workers is going to make riskier investments.

On Monday, the board of the California Public Employees’ Retirement System, or CalPERS, voted to make changes to its portfolio in the face of what are expected to be lower returns in future years, even as it also decided to keep constant its expected rate of return.

Earlier coverage: With lower returns on the horizon, public pensions will turn to riskier assets, Moody’s says

Public pension systems take in contributions from governmental employers and employees, and invest their portfolios in ways that aim to maximize returns, while also protecting the existing assets. That is always a tricky balance to strike, but after a blockbuster few years, most public pension systems are bracing for what many assume can only be an era of lower returns in the future.

“The portfolio we’ve selected incorporates a diverse mix of assets to help us achieve our investment return target,” CalPERS said in a statement. “By adding 5% leverage over time, we’ll better diversify the fund to protect against the impact of a serious drawdown during economic downturns.”

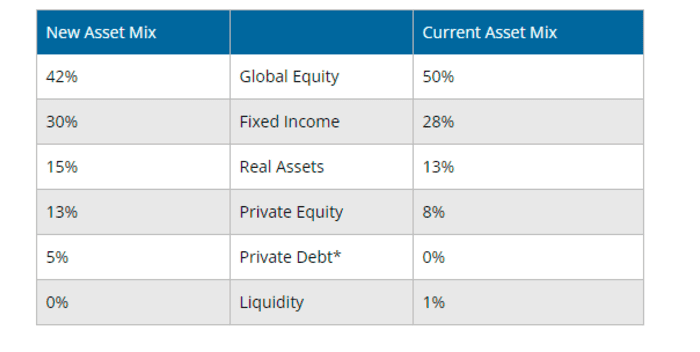

The fund has long had extensive allocations to alternative assets — on its website, it calls itself “one of the largest private-equity investors in the world” — but has never added leverage to its portfolio. An allocation to private debt is also new.

Source: California Public Employees’ Retirement System

The investment staff already has the ability to take active leverage up to 20%, the CIO said at the board meeting, as reported by Pensions & Investments Magazine.

CalPERS serves approximately 2 million members and has $495 billion in its portfolio. It assumes it will achieve a 6.8% return on its investments. In the fiscal year ending June, 2021, it actually retuned 21.3% – but in the year ending 2020, only 4.7%.

As previously reported, the “assumed rate of return” for a public pension can be controversial. Lowering the target investment return means raising the amount governments — and by extension, taxpayers — and workers need to pay in.

And paying more to the pension obligations can mean crowding out what can feel like more immediate budget needs such as education, road repair, and other municipal services.

Pension accounting assumes that all the inputs — contributions from employers and employees, and investment returns — leave the portfolio well-funded enough to pay all obligations for the next 30 years. But some observers have recently argued that the strain of coming up with that much money, which will likely never be needed all at one time, is too burdensome for state and local governments.

See: Public pensions don’t have to be fully funded to be sustainable, paper finds

No comments:

Post a Comment