Flood and cyclone-prone areas in eastern Australia may be ‘uninsurable’ by 2030, report suggests

Report mapped 10 electorates considered most at risk of becoming uninsurable due to flood, fire and other extreme weather risk

Report mapped 10 electorates considered most at risk of becoming uninsurable due to flood, fire and other extreme weather risk

State Emergency Service members look over flood waters in Richmond, New South Wales, in March 2022. A report suggests 20% of properties in the area could could soon be uninsurable due to flood plain risk.

Photograph: Xinhua/REX/Shutterstock

Royce Kurmelovs

Royce Kurmelovs

Mon 2 May 2022

Extreme weather due to the climate crisis is expected to increasingly make some Australian homes “uninsurable”, with a new report suggesting up to one in 25 households will struggle to be covered by 2030.

The analysis by the Climate Council, using data from consultants Climate Valuation, mapped the 10 electorates across the country considered most at risk of becoming uninsurable due to flood, fire and other extreme weather risk.

The most at-risk areas were mostly found to be in flood and cyclone-prone areas of Queensland and in parts of Victoria built over flood plains near major rivers.

“Uninsurable” is defined in the report as an area where the required type of insurance product was expected to be not available, or only available at such high cost that no one could afford it.

Nicki Hutley, an economist and member of the Climate Council who wrote the report, said insurance costs were already rising sharply and people were struggling to get insurance in parts of the country. She said people were seeing changes, citing the black summer bushfires and the recent devastating floods in northern New South Wales.

Hutley said the report highlighted the level of “under-insurance” across the country, a term that refers to situations in which a property was covered for lesser risks but not for the greatest threat in the area where they lived. ASIC has previously estimated the rate of under-insurance in the country may be up to 80%.

The report includes a tool that shows how the risk of different catastrophes, and uninsurability, grows under different scenarios over timeframes out to 2100. People can enter their address to see how their property is expected to be affected.

Advertisement

It suggested up to 27% of properties in the electorate of Nicholls, in northern Victoria, and 20% of properties in Richmond, in New South Wales, could soon be uninsurable due to flood plain risk.

Dr Karl Mallon, chief executive of Climate Valuation, said the company aimed to make risks visible to homeowners, insurance companies and authorities.

“The underlying technology is indeed intended to give people an understanding whether a property has insurance challenges in the way an insurance industry does not,” he said.

The Climate Council report used generalised assumptions about the type of building at each address: that each is a single storey, detached house built using recent design specifications and materials.

The replacement costs were conservatively assumed to be $314,000 a home, based on Australian Bureau of Statistics data of the average cost. It categorises a property as uninsurable if the expected annual cost of damage is more than 1% of the rebuild cost.

Not everyone working in the field is convinced a totally accurate house-by-house analysis is possible.

CSIRO has become ‘extravagant consulting company’, one of its former top climate scientists says

Sharanjit Paddam, an expert in climate and environmental risk at Finity Consulting, said the report was “really important” at a broad level, particularly if it started to “make people think about whether climate change is going to affect their property, and their insurance costs”.

But he said he would be reluctant to say some areas would be totally uninsurable as there was always uncertainty about models that have to make “really difficult assumptions for which we don’t necessarily have all the information available”.

“The results won’t necessarily be correct at an individual home level but it will give a good guide to where the areas of risk are,” Paddam said.

“However, I don’t think the eight years is an exaggeration because the risk is here today, and we know this is the case because the government has intervened in cyclone costs to make it more affordable today.

He said there were also costs involved in doing nothing. “Not doing anything about climate change is the most expensive option and I think this report makes that very clear,” he said.

Extreme weather due to the climate crisis is expected to increasingly make some Australian homes “uninsurable”, with a new report suggesting up to one in 25 households will struggle to be covered by 2030.

The analysis by the Climate Council, using data from consultants Climate Valuation, mapped the 10 electorates across the country considered most at risk of becoming uninsurable due to flood, fire and other extreme weather risk.

The most at-risk areas were mostly found to be in flood and cyclone-prone areas of Queensland and in parts of Victoria built over flood plains near major rivers.

“Uninsurable” is defined in the report as an area where the required type of insurance product was expected to be not available, or only available at such high cost that no one could afford it.

Nicki Hutley, an economist and member of the Climate Council who wrote the report, said insurance costs were already rising sharply and people were struggling to get insurance in parts of the country. She said people were seeing changes, citing the black summer bushfires and the recent devastating floods in northern New South Wales.

Hutley said the report highlighted the level of “under-insurance” across the country, a term that refers to situations in which a property was covered for lesser risks but not for the greatest threat in the area where they lived. ASIC has previously estimated the rate of under-insurance in the country may be up to 80%.

The report includes a tool that shows how the risk of different catastrophes, and uninsurability, grows under different scenarios over timeframes out to 2100. People can enter their address to see how their property is expected to be affected.

Advertisement

It suggested up to 27% of properties in the electorate of Nicholls, in northern Victoria, and 20% of properties in Richmond, in New South Wales, could soon be uninsurable due to flood plain risk.

Dr Karl Mallon, chief executive of Climate Valuation, said the company aimed to make risks visible to homeowners, insurance companies and authorities.

“The underlying technology is indeed intended to give people an understanding whether a property has insurance challenges in the way an insurance industry does not,” he said.

The Climate Council report used generalised assumptions about the type of building at each address: that each is a single storey, detached house built using recent design specifications and materials.

The replacement costs were conservatively assumed to be $314,000 a home, based on Australian Bureau of Statistics data of the average cost. It categorises a property as uninsurable if the expected annual cost of damage is more than 1% of the rebuild cost.

Not everyone working in the field is convinced a totally accurate house-by-house analysis is possible.

CSIRO has become ‘extravagant consulting company’, one of its former top climate scientists says

Sharanjit Paddam, an expert in climate and environmental risk at Finity Consulting, said the report was “really important” at a broad level, particularly if it started to “make people think about whether climate change is going to affect their property, and their insurance costs”.

But he said he would be reluctant to say some areas would be totally uninsurable as there was always uncertainty about models that have to make “really difficult assumptions for which we don’t necessarily have all the information available”.

“The results won’t necessarily be correct at an individual home level but it will give a good guide to where the areas of risk are,” Paddam said.

“However, I don’t think the eight years is an exaggeration because the risk is here today, and we know this is the case because the government has intervened in cyclone costs to make it more affordable today.

He said there were also costs involved in doing nothing. “Not doing anything about climate change is the most expensive option and I think this report makes that very clear,” he said.

The floods affecting Australia’s eastern seaboard are a “1 in 1,000-year event”, according to New South Wales Premier Dominic Perrottet. But that’s not what science, or the insurance industry, suggests.

THE CONVERSATION

Throughout Australia in areas prone to fires, cyclones and floods, home owners and businesses are facing escalating insurance costs as the frequency and severity of extreme weather events increase with the warming climate.

Premiums have risen sharply over the past decade as insurers count the cost of insurance claims and factor in future risks. The latest report from the Intergovernmental Panel on Climate Change, published this week, predicts global warming of 1.5℃ will lead to a fourfold increase in natural disasters.

Rising insurance premiums are creating a crisis of underinsurance in Australia.

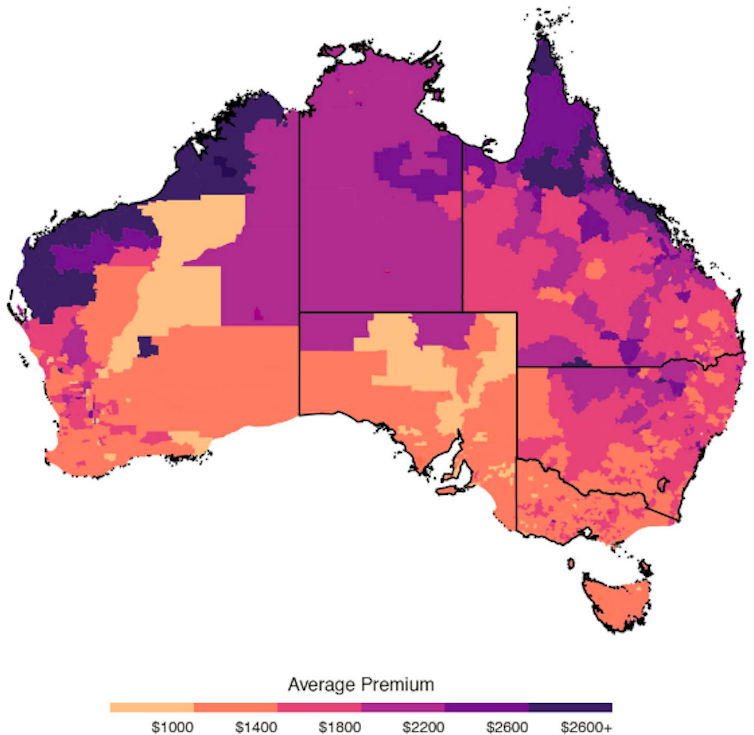

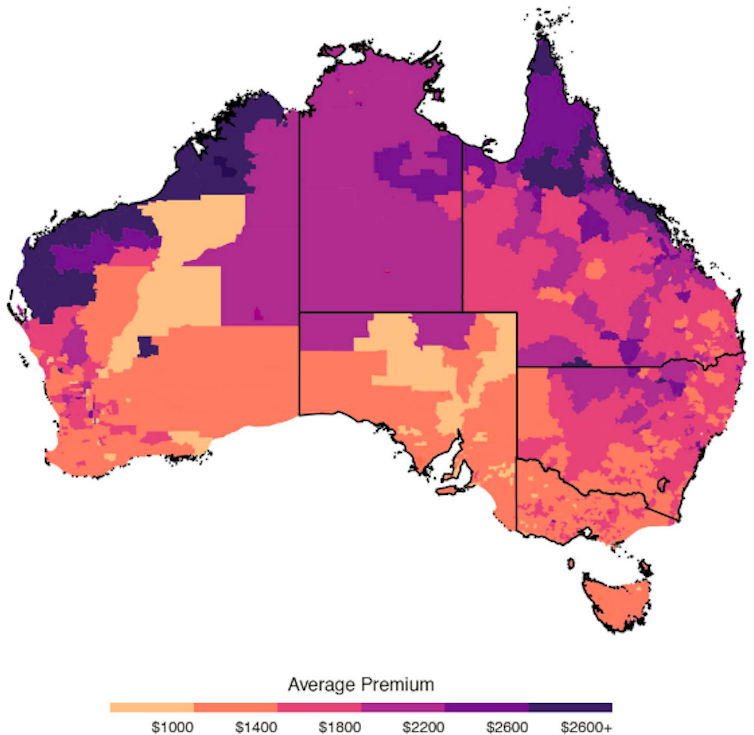

In 2017 the federal government tasked the Australian Competition and Consumer Commission to investigate insurance affordability in northern Australia, where destructive storms and floods are most common. The commission delivered its final report in 2020. It found the average cost of home and contents insurance in northern Australia was almost double the rest of Australia – $2,500 compared with $1,400. The rate of non-insurance was almost double – 20% compared with 11%.

Average premiums for combined home and contents insurance, 2018–19

ACCC analysis of data obtained from insurers., CC BY

While the areas now experiencing their worst flooding in recorded history aren’t part of the riskiest areas identified by the insurance inquiry, the dynamics are the same.

Those not insured or underinsured will be financially devastated. Insurance premiums will rise. As a result, more people will underinsure or drop their insurance completely, compounding the social disaster that will come with the next natural disaster.

So, what do about it?

Tackling insurance affordability

There are two main ways to reduce insurance premiums.

One is to reduce global warming. Obviously this is not something Australia can achieve on its own, but it can be part of the solution.

The other is to reduce the damage caused by extreme events, by constructing more disaster-resistant buildings, or not rebuilding in high-risk areas.

The federal government, however, has put most of its eggs in a different basket, with a plan to subsidise to insurance premiums in northern Australia.

A sign of floods present and past in Chinderah, northern NSW, on March 1 2022. Jason O'Brien/AAP

This won’t do much for those affected by the current floods. It won’t even do much to solve the insurance crisis in northern Australia.

The reinsurance pool, a blunt tool

In the 2021 budget the federal government committed A$10 billion to a cyclone and flood damage reinsurance pool, “to ensure Australians in cyclone-prone areas have access to affordable insurance”. The legislation to establish this pool is now before parliament.

The ostensible rationale is that the government can drive down insurance costs for consumers by stepping in and acting as wholesaler in the reinsurance market, in which insurers insure themselves against the risk of crippling insurance payouts.

The idea is that discounted reinsurance will lead insurers to lower their premiums.

Read more: A national insurance crisis looms. The Morrison government's $10 billion 'pool' plan won't fix it

There is no guarantee, however, that insurers will pass on their cheaper costs to customers. This means the benefits of the pool are unclear.

So are its costs. Effectively, the government is shifting risk from insurers to itself, subsidising insurance premiums for those in some parts the country from the public purse.

The ACCC inquiry gave considerable attention to the idea of a reinsurance pool. While acknowledging there could be some benefits, it concluded the risks outweigh the rewards:

We do not consider that a reinsurance pool is necessary to address availability issues in northern Australia.

Targeting and mitigating

Above and beyond the aforementioned problems, there are two telling failures of the reinsurance pool plan.

First, subsidising insurance companies doesn’t target help to those who need it most: low-income households.

There is a growing body of research showing that natural disasters, and the ways governments respond to them, is contributing to greater inequality.

As the South Australian Council of Social Service makes clear in a report published this week, improving insurance access for people on low incomes at risk from natural disaster requires targeted support, such as promoting non-profit “mutual” insurance schemes.

Read more: Natural disasters increase inequality. Recovery funding may make things worse

Second, only mitigation can bring the overall cost of natural disasters down. Ways to do this include public works (building levees, upgrading stormwater systems, conducting planned burns) and improving buildings (reinforcing garage doors, shuttering windows, managing vegetation around homes, and so on).

The ACCC’s insurance report identifies a range of ways mitigation strategies can be tied into insurance pricing. Yet none of these has been incorporated into the Morrison government’s response to the insurance crisis.

There is little support for the reinsurance pool outside of the federal government. Neither the ACCC, the insurance industry nor community sector advocacy organisations support reinsurance as a meaningful solution.

A reinsurance pool for the whole of Australia?

For the areas of NSW and Queensland now flooded, as well as the rest of the country outside the ambit of the reinsurance pool, the relentless rise in insurance costs will continue, tipping ever more homes out of the insurance safety net.

We must find better solutions to the insurance crisis than what is being offered to northern Australia. A reinsurance pool cannot be a national solution because it isn’t the solution for northern Australia.

There are no cheap and easy solutions, but the terrain is clearly mapped out across an array of inquiries and reports into insurance and climate vulnerability. More than a blanket subsidy for the insurance industry, the time has come for climate vulnerability to be taken seriously by the federal government.

Premiums have risen sharply over the past decade as insurers count the cost of insurance claims and factor in future risks. The latest report from the Intergovernmental Panel on Climate Change, published this week, predicts global warming of 1.5℃ will lead to a fourfold increase in natural disasters.

Rising insurance premiums are creating a crisis of underinsurance in Australia.

In 2017 the federal government tasked the Australian Competition and Consumer Commission to investigate insurance affordability in northern Australia, where destructive storms and floods are most common. The commission delivered its final report in 2020. It found the average cost of home and contents insurance in northern Australia was almost double the rest of Australia – $2,500 compared with $1,400. The rate of non-insurance was almost double – 20% compared with 11%.

Average premiums for combined home and contents insurance, 2018–19

ACCC analysis of data obtained from insurers., CC BY

While the areas now experiencing their worst flooding in recorded history aren’t part of the riskiest areas identified by the insurance inquiry, the dynamics are the same.

Those not insured or underinsured will be financially devastated. Insurance premiums will rise. As a result, more people will underinsure or drop their insurance completely, compounding the social disaster that will come with the next natural disaster.

So, what do about it?

Tackling insurance affordability

There are two main ways to reduce insurance premiums.

One is to reduce global warming. Obviously this is not something Australia can achieve on its own, but it can be part of the solution.

The other is to reduce the damage caused by extreme events, by constructing more disaster-resistant buildings, or not rebuilding in high-risk areas.

The federal government, however, has put most of its eggs in a different basket, with a plan to subsidise to insurance premiums in northern Australia.

A sign of floods present and past in Chinderah, northern NSW, on March 1 2022. Jason O'Brien/AAP

This won’t do much for those affected by the current floods. It won’t even do much to solve the insurance crisis in northern Australia.

The reinsurance pool, a blunt tool

In the 2021 budget the federal government committed A$10 billion to a cyclone and flood damage reinsurance pool, “to ensure Australians in cyclone-prone areas have access to affordable insurance”. The legislation to establish this pool is now before parliament.

The ostensible rationale is that the government can drive down insurance costs for consumers by stepping in and acting as wholesaler in the reinsurance market, in which insurers insure themselves against the risk of crippling insurance payouts.

The idea is that discounted reinsurance will lead insurers to lower their premiums.

Read more: A national insurance crisis looms. The Morrison government's $10 billion 'pool' plan won't fix it

There is no guarantee, however, that insurers will pass on their cheaper costs to customers. This means the benefits of the pool are unclear.

So are its costs. Effectively, the government is shifting risk from insurers to itself, subsidising insurance premiums for those in some parts the country from the public purse.

The ACCC inquiry gave considerable attention to the idea of a reinsurance pool. While acknowledging there could be some benefits, it concluded the risks outweigh the rewards:

We do not consider that a reinsurance pool is necessary to address availability issues in northern Australia.

Targeting and mitigating

Above and beyond the aforementioned problems, there are two telling failures of the reinsurance pool plan.

First, subsidising insurance companies doesn’t target help to those who need it most: low-income households.

There is a growing body of research showing that natural disasters, and the ways governments respond to them, is contributing to greater inequality.

As the South Australian Council of Social Service makes clear in a report published this week, improving insurance access for people on low incomes at risk from natural disaster requires targeted support, such as promoting non-profit “mutual” insurance schemes.

Read more: Natural disasters increase inequality. Recovery funding may make things worse

Second, only mitigation can bring the overall cost of natural disasters down. Ways to do this include public works (building levees, upgrading stormwater systems, conducting planned burns) and improving buildings (reinforcing garage doors, shuttering windows, managing vegetation around homes, and so on).

The ACCC’s insurance report identifies a range of ways mitigation strategies can be tied into insurance pricing. Yet none of these has been incorporated into the Morrison government’s response to the insurance crisis.

There is little support for the reinsurance pool outside of the federal government. Neither the ACCC, the insurance industry nor community sector advocacy organisations support reinsurance as a meaningful solution.

A reinsurance pool for the whole of Australia?

For the areas of NSW and Queensland now flooded, as well as the rest of the country outside the ambit of the reinsurance pool, the relentless rise in insurance costs will continue, tipping ever more homes out of the insurance safety net.

We must find better solutions to the insurance crisis than what is being offered to northern Australia. A reinsurance pool cannot be a national solution because it isn’t the solution for northern Australia.

There are no cheap and easy solutions, but the terrain is clearly mapped out across an array of inquiries and reports into insurance and climate vulnerability. More than a blanket subsidy for the insurance industry, the time has come for climate vulnerability to be taken seriously by the federal government.

Published: March 2, 2022

Author

Author

Antonia Settle

Academic (McKenzie Postdoctoral Research Fellow), The University of Melbourne

Academic (McKenzie Postdoctoral Research Fellow), The University of Melbourne

No comments:

Post a Comment