By Tsvetana Paraskova - Apr 16, 2025

President Trump’s tariff-driven price slump threatens America’s hard?won petroleum export surplus.

Ongoing tariff uncertainty and volatile oil prices make budgeting and drilling decisions difficult.

With a cash?flow breakeven around $62.50–$65/barrel, U.S. producers fear lower prices will stall new well drilling and long?term growth.

The Trump Administration insists that U.S. shale will survive lower oil prices and could work well and innovate further at current price levels of WTI crude prices of about $60 per barrel, and even lower.

The industry is not convinced.

While public statements from the oil lobby and oil producers welcome President Donald Trump’s rollback of regulations and eased permitting processes, executives are privately fuming about the administration’s perceived target to bring oil prices down to $50 a barrel.

Separately, the trade and tariff chaos in markets – triggered by President Trump’s tariffs, tariff pauses, and tariff exemptions – is depressing oil prices as analysts now believe a recession followed by lower energy demand is more likely to happen than not.

U.S. Petroleum Trade Surplus Undermined

With oil prices down by more than 15% from last year’s levels, American oil exports could fetch lower prices for export. This will dent the absolute value of the U.S. petroleum trade surplus, which America began to show with the surge in oil production in the shale revolution era.

Before the shale boom in the 2010s, the U.S. was running a deficit in petroleum trade as it was importing more crude and petroleum products than it exported.

The shale revolution flipped the trade position to a surplus for America, and the U.S. has been a net petroleum exporter every year since 2020.

Related: Trump’s Trade War With China Enters a More Aggressive Phase

President Trump’s tariff policies – which tanked oil prices and raised the odds of a recession – are undermining America’s petroleum trade surplus. That’s not a desirable outcome for an administration fixated on fixing trade deficits. Petroleum and energy trade, in fact, is one of the few sectors in which the U.S. has a large trade surplus in the dozens of billions of U.S. dollars annually.

Even if the EU, Japan, and South Korea pledge to buy and indeed buy more U.S. LNG and oil, part of the gains could be offset by weak prices and lower demand for energy in case all the tariff uncertainty brings about a global downturn or recession.

Weaker global demand for oil and gas would not support increases in U.S. oil production and doesn’t bode well for the future LNG export projects which need firm commitments to take the plans to final investment decisions.

“You claim that the energy industry is the darling of your economic plan, and you just made life very difficult,” Robert Yawger, director of the futures division at investment bank Mizuho Americas, told The Wall Street Journal.

U.S. Shale Growth At Risk

Then there is the issue of how the U.S. could sustain production to remain the energy export superpower it has been over the past few years.

U.S. Energy Secretary Chris Wright, the former boss at fracking firm Liberty Energy, remains bullish on U.S. oil production—and believes that the industry will not only survive but thrive even with oil at $60 or below.

Yet, the industry begs to differ—at least that’s what executives wrote anonymously in March in comments to the quarterly Dallas Fed Energy Survey for the first quarter.

“There cannot be "U.S. energy dominance" and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters),” an executive at an exploration and production firm said.

“The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel,” the executive noted.

Another executive put it even more bluntly, “The administration’s chaos is a disaster for the commodity markets. "Drill, baby, drill" is nothing short of a myth and populist rallying cry. Tariff policy is impossible for us to predict and doesn't have a clear goal. We want more stability.”

Stability is the furthest from where the oil market has been in the past two weeks. Stability may be OPEC’s buzzword for ‘relatively high oil prices,’ but it is also crucial for the capital investment and drilling decisions in the U.S. shale patch.

Without any certainty about the cost of drilling wells – including the price of steel – producers face difficulty budgeting and maintaining shareholder payouts at current levels.

Drilling and ‘all-in’ corporate costs, including overhead, dividend, and servicing debt, amounts to a cash flow WTI breakeven of $62.50 per barrel for new activity in 2025, according to estimates by Rystad Energy.

Executives at U.S. firms think they need $65 per barrel, on average, to profitably drill a new well this year, per the Dallas Fed Energy Survey.

WTI Crude prices have already dropped below this level and were below $62 a barrel early on Tuesday.

Prices could drop further if global oil demand growth slows with weakening economies amid the trade and tariff chaos.

Even OPEC, the most bullish on oil demand of any forecaster, has just cut its 2025 and 2026 demand growth estimate.

In the monthly report on Monday, OPEC said it sees global oil demand growth at 1.3 million barrels per day (bpd) in each of 2025 and 2026, down by 150,000 bpd for each of the two years.

OPEC’s very bullish forecast (and it should be such if the OPEC+ alliance wants to continue justifying easing of the production cuts) is two to three times higher than most other growth estimates by major Wall Street banks.

After years of supporting oil prices with the production cuts, OPEC will also seek to regain market share at the expense of U.S. shale.

In this context, the U.S. Administration’s tariffs and the uncertainty they bring for American producers undermine the American energy dominance agenda.

By Tsvetana Paraskova for Oilprice.com

U.S. Onshore Oil Production Faces Economic Policy Challenges

Recent economic policy changes, particularly tariffs, have created market uncertainty for US oil and gas operators, potentially causing production to fall below record highs.

Oil producers are concerned about policy unpredictability and its impact on capital investment programs, especially as they aim to balance growth with shareholder returns.

While steel tariffs have some effect on cost structures, the larger risk to the industry comes from potential demand destruction due to an economic recession spurred by tariff strategies.

US oil and gas operators have encountered an avalanche of economic policy changes from the Trump administration over the last week, creating market uncertainty in an already maturing industry. Rystad Energy expects onshore Lower-48 production will fall short of the record high output of 11.37 million barrels per day (bpd) of oil, achieved in November 2023, until at least June of this year. However, this outlook faces serious downside pressure should the recent price downturn hold, forcing operators to cut back on rig activity.

Consistent returns are top of mind for US producers looking to squeeze as many dollars as possible out of their barrels. For these tight oil players, decreased reinvestment rates result from fewer growth-oriented private players on the market along with their continued focus on disciplined spending and modest growth. Existing capital frameworks will be put to the test over the coming quarters, should President Trump’s tariff strategy lead to an economic recession and, by extension, oil demand destruction.

US oil operators face both significant subsurface and above ground risks as they plan their capital investment programs. While most oil plays are seeing deteriorating normalized productivity, US producers must also compete on a global market to meet an uncertain but likely decelerating demand outlook.

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

Read the full Rystad Energy Shale Trends whitepaper here.

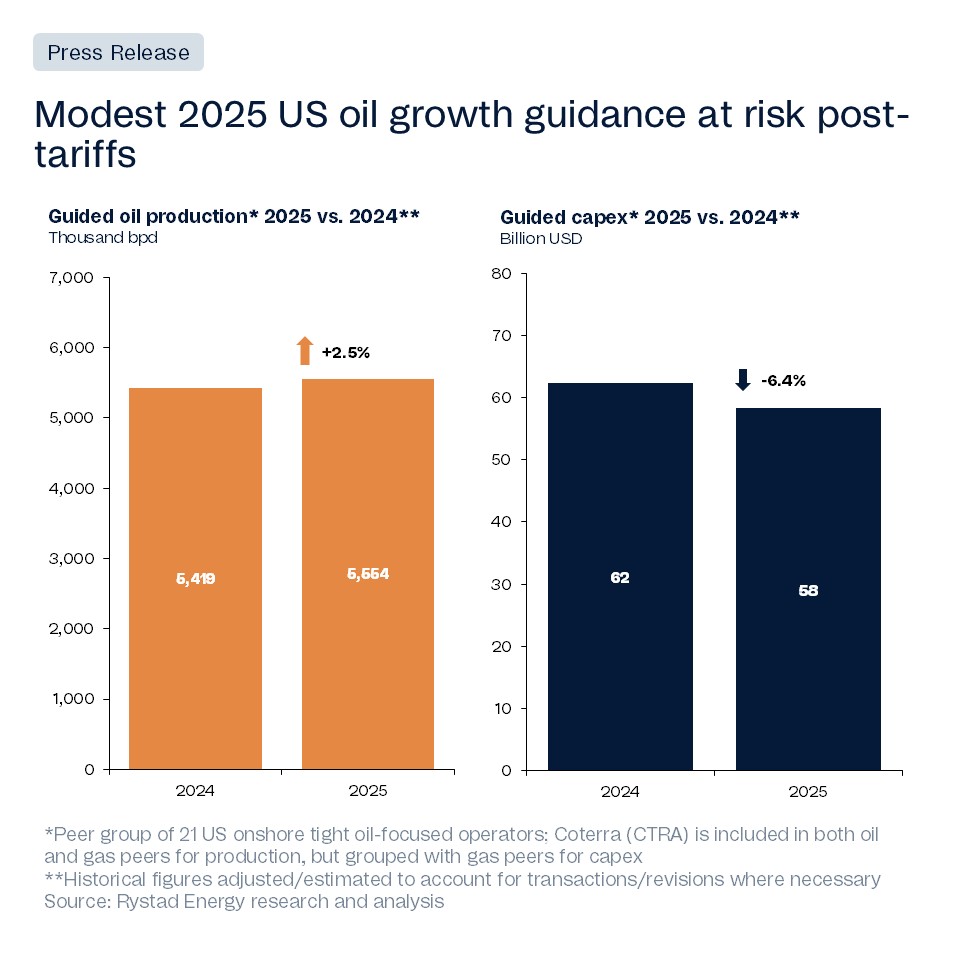

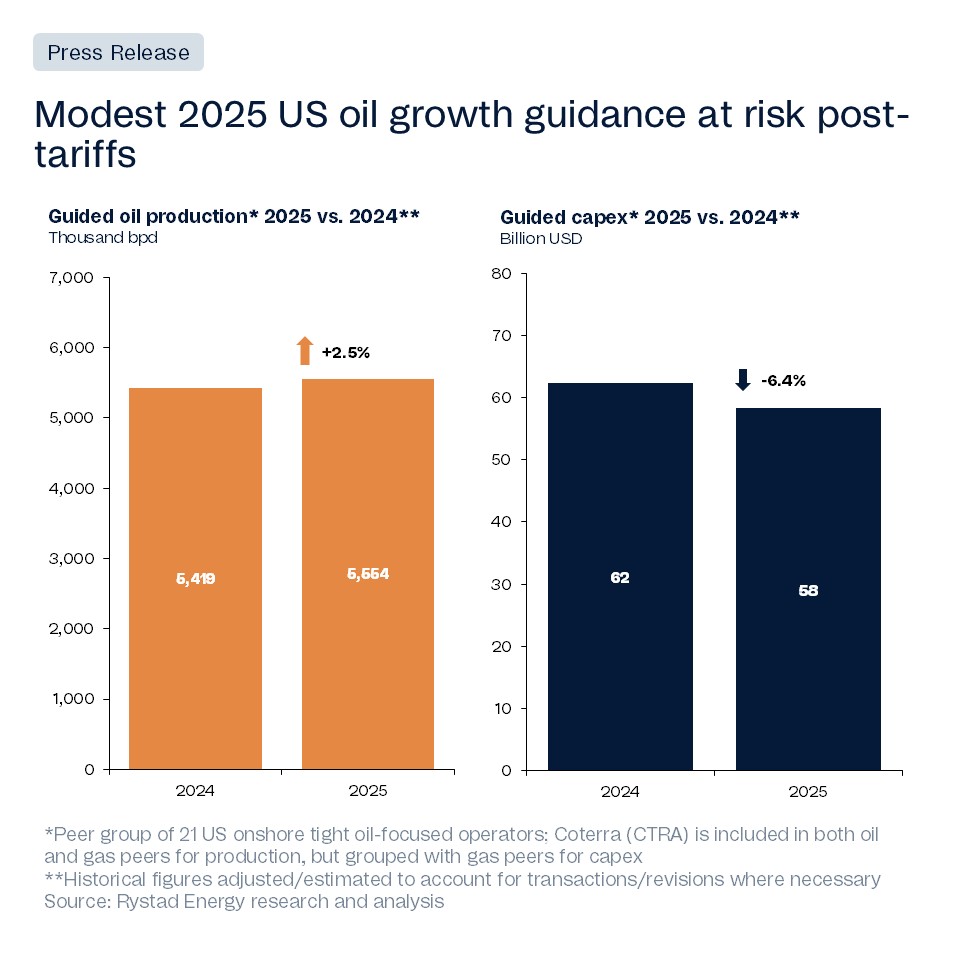

Even prior to the drop in prices following the president’s tariff rollout, exploration and production (E&P) management teams worried about policy unpredictability. Publicly traded firms guided plans to increase volumes by roughly 2.5% in 2025 while reducing spending by more than 6%. Much of this growth, which is now at risk due to the collapse in prices, is driven by some of the largest diversified public players and supermajors, capable of diverting cash flows from global operations to fund more growth-oriented programs in US tight oil, while still maintaining capital discipline at a corporate level. Although half-cycle breakeven prices of most wells being drilled today are in the $50 per barrel range, we estimate that public, tight oil E&Ps need more than another $9 per barrel to cover shareholder returns.

Rystad Energy has long maintained that presidents have very few supply-oriented policy measures at their disposal to increase US oil output. Doing this while also bringing down prices at the same time is even more unrealistic, as producers see WTI in the $70 per barrel range as supportive of only modest growth

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

E&P executives also stressed the negative impact from steel tariffs on their cost structure and the extent to which higher input costs make it even harder to grow volumes in a soft oil market. However, relative to the price drop caused by the onset of tariffs, Rystad Energy sees the tariffs themselves as only having a minimal net impact on well costs.

Currently, we expect about 300,000 bpd of exit-to-exit growth in 2025, all in the Permian—a concentration that presents another risk. Permian natural gas prices remain weak, and our projections show that dry gas production in the basin has little or no growth potential in 2025.

By Rystad Energy

By Rystad Energy - Apr 16, 2025

Recent economic policy changes, particularly tariffs, have created market uncertainty for US oil and gas operators, potentially causing production to fall below record highs.

Oil producers are concerned about policy unpredictability and its impact on capital investment programs, especially as they aim to balance growth with shareholder returns.

While steel tariffs have some effect on cost structures, the larger risk to the industry comes from potential demand destruction due to an economic recession spurred by tariff strategies.

US oil and gas operators have encountered an avalanche of economic policy changes from the Trump administration over the last week, creating market uncertainty in an already maturing industry. Rystad Energy expects onshore Lower-48 production will fall short of the record high output of 11.37 million barrels per day (bpd) of oil, achieved in November 2023, until at least June of this year. However, this outlook faces serious downside pressure should the recent price downturn hold, forcing operators to cut back on rig activity.

Consistent returns are top of mind for US producers looking to squeeze as many dollars as possible out of their barrels. For these tight oil players, decreased reinvestment rates result from fewer growth-oriented private players on the market along with their continued focus on disciplined spending and modest growth. Existing capital frameworks will be put to the test over the coming quarters, should President Trump’s tariff strategy lead to an economic recession and, by extension, oil demand destruction.

US oil operators face both significant subsurface and above ground risks as they plan their capital investment programs. While most oil plays are seeing deteriorating normalized productivity, US producers must also compete on a global market to meet an uncertain but likely decelerating demand outlook.

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

Read the full Rystad Energy Shale Trends whitepaper here.

Even prior to the drop in prices following the president’s tariff rollout, exploration and production (E&P) management teams worried about policy unpredictability. Publicly traded firms guided plans to increase volumes by roughly 2.5% in 2025 while reducing spending by more than 6%. Much of this growth, which is now at risk due to the collapse in prices, is driven by some of the largest diversified public players and supermajors, capable of diverting cash flows from global operations to fund more growth-oriented programs in US tight oil, while still maintaining capital discipline at a corporate level. Although half-cycle breakeven prices of most wells being drilled today are in the $50 per barrel range, we estimate that public, tight oil E&Ps need more than another $9 per barrel to cover shareholder returns.

Rystad Energy has long maintained that presidents have very few supply-oriented policy measures at their disposal to increase US oil output. Doing this while also bringing down prices at the same time is even more unrealistic, as producers see WTI in the $70 per barrel range as supportive of only modest growth

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

E&P executives also stressed the negative impact from steel tariffs on their cost structure and the extent to which higher input costs make it even harder to grow volumes in a soft oil market. However, relative to the price drop caused by the onset of tariffs, Rystad Energy sees the tariffs themselves as only having a minimal net impact on well costs.

Currently, we expect about 300,000 bpd of exit-to-exit growth in 2025, all in the Permian—a concentration that presents another risk. Permian natural gas prices remain weak, and our projections show that dry gas production in the basin has little or no growth potential in 2025.

By Rystad Energy

No comments:

Post a Comment