By Metal Miner - Apr 17, 2025

President Trump's administration has implemented new tariffs, including a 10% blanket levy on many imports and increased tariffs on China, which significantly impacts the cost and availability of construction metals in the US.

The tariffs are creating volatility in the prices of construction materials like steel and aluminum, leading to concerns about increased costs, project delays, and potential shifts in the market favoring domestic producers.

Geopolitical tensions, particularly with China, are central to the tariff situation, as China is a major source of US imports and a large global metals producer, and its trade practices are a key driver of the new policies.

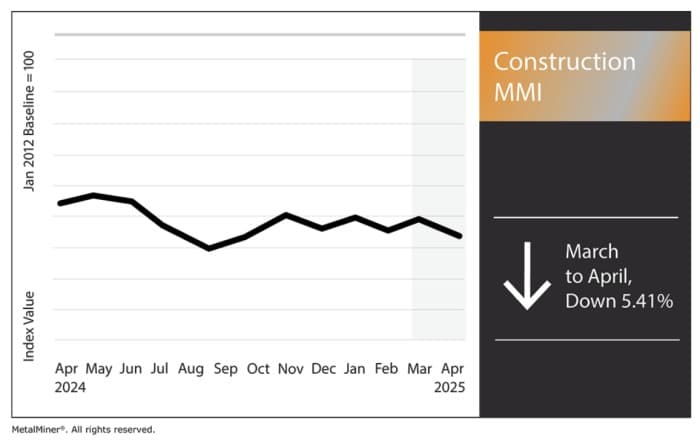

The Construction MMI (Monthly Metals Index) broke out of its over 6-month-long sideways trend to pivot down 5.41%. This new movement outside of its sideways range could indicate more volatility in the short term than the index experienced in the past 12 months.

The new Trump tariffs on China caused some volatility in the price of construction materials, including H-beam steel and steel rebar. If the U.S. and China fail to negotiate these new policies, the index will likely remain unpredictable for the short term..

The U.S. construction and manufacturing sectors are bracing for impact as President Trump’s 2025 10% blanket tariffs take shape. Trump has declared a 10% levy on all foreign goods entering the United States, a sweeping tariff policy aimed at bolstering domestic industry which was recently covered in MetalMiner’s weekly newsletter. That figure excludes Canada and Mexico, which already incurred 25% tariffs earlier this year.

However, as of April 9, the White House announced that the 10% tariffs are on hold for 90 days, except for those levied against China. This trade move could dramatically reshape the flow of construction metals like steel, aluminum and copper into the U.S. market.

Trump Tariffs: 10% Blanket Levy on Imports

Trump’s 10% blanket levy marks a sharp departure from the targeted tariffs of the past. Trump has defended the sweeping tariffs as necessary to address large trade deficits and nonreciprocal trade practices he says have hollowed out U.S. manufacturing. “They give us great power to negotiate,” the president stated, suggesting the tariffs could be a lever for further mediation.

China has been hit especially hard by the Trump tariffs. Imports from China, including construction metals like H-beam steel and steel rebar, faced a punitive 54% duty as of early April. Despite the broad reach, the duties do not treat all products equally, and the administration has carved out some notable exemptions.

According to a White House fact sheet, the Trump tariffs currently exempt certain critical goods and prior tariff regimes from the new 10% levy. For example, steel, aluminum, automobiles and automobile parts remain governed by existing Section 232 tariffs and won’t incur the additional 10% charge, a move that MetalMiner’s free comprehensive tariff guide offers revenue saving strategies on.

Along with this, Trump has separately raised the Section 232 tariff on aluminum from 10% to 25%, matching the 25% rate on foreign steel while ending country exemptions under that program.

U.S. Construction Metals Imports in the Crosshairs

For the U.S. construction industry, metals like steel and aluminum are in the crosshairs of the new trade barriers. Even though steel and primary aluminum fall under pre-existing tariffs, Trump’s latest actions expand and reinforce those duties while including new duties on other construction materials separate from metals. As of March 12, the administration eliminated all country exemptions for steel and aluminum tariffs.

The new 10% blanket tariff further complicates the picture for construction metals that previously went without duties. On July 9, imported construction materials like copper wiring, structural components, nails, fasteners and machinery will soon face a 10% cost increase if the country of origin is subject to the tariffs.

Although raw copper is exempt, many finished products or alloys used in construction will be subject to the extra fees. Indeed, early signs of the impact are already emerging in price indices. The U.S. Producer Price Index for March showed that industrial metals costs were climbing, driven by tariffs on steel and aluminum, which had been in effect for only a month.

Domestic Ripple Effects: Winners and Losers

Domestically, Trump’s tariffs are reshaping the landscape for construction metals, bringing both gains and setbacks. U.S.-based steel producers and aluminum manufacturers stand to gain the most right out of the gate as the new trade barriers tilt the playing field in their favor.

However, these gains come with some pain for downstream industries. Construction firms, real estate developers and manufacturers that consume large volumes of metal will encounter higher input costs almost immediately. Industry observers warn of project delays and cancellations if metal prices continue to climb.

Geopolitical Tensions and the “China Factor”

As both the largest source of U.S. non-North American imports and the world’s biggest metals producer, China lies firmly at the center of the tariff storm. Meanwhile, China’s real estate boom has cooled dramatically under the weight of debt crises and slowing growth. On a related note, Chinese steel exports recently surged to a 9-year high, and countries like Turkey and Indonesia have already imposed fresh tariffs or duties to block the influx of Chinese steel.

By Jennifer Kary

.jpg)

No comments:

Post a Comment