CU

African copper exports to China disrupted amid Tanzania unrest

African copper shipments to China are being disrupted by the temporary closure of a crucial exporting port in Tanzania following election unrest.

Copper traders and producers in the central Africa copperbelt are now seeking to reroute cargoes from the Port of Dar es Salaam, leading to congestion at other ports including Durban, in South Africa, according to several people involved in the market. The port closure also means that copper already delivered to the port is stuck there for now, some of the people said, asking not to be identified discussing private business matters.

The Port of Dar es Salaam is the heart of the copper and cobalt trade from mines in the Democratic Republic of Congo and Zambia to China, which consumes more than half of the world’s copper production. The port has attracted growing flows of metal by offering more competitive freight rates for China-bound shipments.

One senior copper trader estimated that roughly two-thirds of African copper shipments to China typically move through Dar es Salaam.

Logistics firm C Steinweg Group, which operates warehouses at the port, said on Thursday that its facilities would be closed through at least Friday.

Speaking privately, representatives from two producers and three traders said they were hoping that the disruptions would be short-lived, but some have already re-routed copper to Durban, as well as to Namibia’s Walvis Bay and Mozambique’s Beira ports.

(By Julian Luk)

Copper mining costs in Chile fall in first half-year, reversing trend

Direct production costs at Chile’s large copper mines fell in the first half of the year, the state-run Chilean Copper Commission (Cochilco) said on Thursday, marking a reversal of the upward trend of recent years.

The agency said in a report that the reduction was due to a fall in treatment and refining costs, as well as an increase in gold and silver prices during the period, by 39% and 26%, respectively. The price of copper on the London Metal Exchange also rose 15.4% during the first half of 2025.

The cash cost for the world’s largest producer of the red metal fell to $1,767 per pound, from $1,912 in the first half of 2024, it said.

The state commission measured 21 copper mining operations representing about 94% of the country’s mining production.

(By Fabián Andrés Cambero and Leila Miller; Editing by Edmund Klamann)

Eurasian Resources, Mercuria sign $100 million copper deal

Metalkol facility in Kolwezi, DRC. (Image by Eurasian Resources Group).

Metalkol facility in Kolwezi, DRC. (Image by Eurasian Resources Group).Mercuria Energy Trading SA will provide up to $100 million in prepayments to Eurasian Resources Group as part of a three-year supply agreement for copper from Democratic Republic of Congo.

The financing will help Luxembourg-registered ERG develop its copper projects in the central African nation, the company said in an emailed statement Thursday.

Mercuria is expanding aggressively into metals, with a keen focus on Central Africa’s copper-rich nations. The firm’s new metals division is up by around $300 million in trading profits so far this year, Bloomberg News reported earlier this month.

“The facility will strengthen ERG’s asset development in the Democratic Republic of the Congo — a region of growing strategic relevance to Mercuria,” Kostas Bintas, the Switzerland-based trader’s global head of metals and minerals, said in the statement.

Another Mercuria unit agreed this month to team up with Gecamines, Congo’s state miner, to trade its portion of output from copper and cobalt joint ventures. Congo is the world’s second biggest source of copper and biggest cobalt producer.

Mercuria also announced a metals trading partnership late last year with Zambia, Africa’s biggest copper producer after Congo.

“This marks an important step in deepening our collaboration with global partners as we work to realize the full potential of our core operations in the DRC,” Shukhrat Ibragimov, ERG’s chairman and chief executive, said in the statement.

ERG is 40% owned by the Kazakhstan government.

(By Michael J. Kavanagh)

Mercuria Energy Trading SA will provide up to $100 million in prepayments to Eurasian Resources Group as part of a three-year supply agreement for copper from Democratic Republic of Congo.

The financing will help Luxembourg-registered ERG develop its copper projects in the central African nation, the company said in an emailed statement Thursday.

Mercuria is expanding aggressively into metals, with a keen focus on Central Africa’s copper-rich nations. The firm’s new metals division is up by around $300 million in trading profits so far this year, Bloomberg News reported earlier this month.

“The facility will strengthen ERG’s asset development in the Democratic Republic of the Congo — a region of growing strategic relevance to Mercuria,” Kostas Bintas, the Switzerland-based trader’s global head of metals and minerals, said in the statement.

Another Mercuria unit agreed this month to team up with Gecamines, Congo’s state miner, to trade its portion of output from copper and cobalt joint ventures. Congo is the world’s second biggest source of copper and biggest cobalt producer.

Mercuria also announced a metals trading partnership late last year with Zambia, Africa’s biggest copper producer after Congo.

“This marks an important step in deepening our collaboration with global partners as we work to realize the full potential of our core operations in the DRC,” Shukhrat Ibragimov, ERG’s chairman and chief executive, said in the statement.

ERG is 40% owned by the Kazakhstan government.

(By Michael J. Kavanagh)

Indonesia to give Amman Mineral 400,000t copper concentrate export quota

Indonesia will give copper miner Amman Mineral Internasional an export quota of about 400,000 metric tons for its concentrate that will be valid for six months, local media reported on Thursday, citing an energy ministry official.

Indonesia banned exports of copper concentrate and other raw minerals from mid-2023 to boost the domestic metal processing industry, though the government let Amman continue exporting until December last year after commissioning a new smelter in West Nusa Tenggara province.

But Amman temporarily stopped operations at the facility this year due to damage on its flash converting furnace and sulfuric acid plant units, it said, requesting another export permit from the government.

The quota of about 400,000 tons quota was reported by several local media outlets, quoting remarks made on Wednesday by energy ministry official Tri Winarno.

Both Tri and an energy ministry spokesperson did not immediately respond to requests for comment. An Amman spokesperson said the firm could not provide comment.

In a Thursday stock exchange filing, Amman said the smelter was now operating partially while it was being fixed, with completion targeted in the first half of 2026.

Amman said in the filing that it had submitted a request to export concentrate, without mentioning the volume.

Amman reported in the filing that its concentrate output was at 310,143 tons between January and September 2025, a 51% drop from the same period last year.

Amman said its copper cathode output in the same period was 41,052 tons, while copper cathode sales reached 39,805 tons.

(By Stanley Widianto and Bernadette Christina; Editing by David Stanway and Martin Petty)

Anglo sees Chile copper mine returning to full output in 2027

Anglo American Plc expects its flagship copper mine in Chile to return to normal output levels in 2027 after grappling with a period of lower quality ore that’s set to constrain production next year.

Annual output at Collahuasi, in which Anglo and Glencore Plc each hold 44%, probably will get back to to about 600,000 metric tons in 2027, Anglo’s chief operating officer Ruben Fernandes said in an interview. That’s as the operation enters richer areas of the open pit and a new desalination plant comes fully on-line next year.

“Water will no longer be a problem,” Fernandes said Tuesday on the sidelines of a conference in Salvador, Brazil. “By the end of the second half, we’ll reach areas with higher-grade material, allowing Collahuasi to return to regular production.”

At full capacity, Collahuasi is one of the world’s biggest copper mines and a key asset in Anglo’s portfolio. In its latest quarterly update, Anglo warned that Collahuasi’s output will likely be lower than expected next year, compounding tightness in the copper market. The metal reached a record high on Wednesday partly because of mounting concerns over supply setbacks.

The mine is also central to Anglo’s planned merger with Teck Resources Ltd. Collahuasi’s high-grade ore would be supplied to Teck’s neighboring Quebrada Blanca mine, potentially adding 175,000 tons of copper a year and boosting profitability by an estimated $1.4 billion annually.

Fernandes said talks with the Collahuasi partners — which include Mitsui & Co.-led consortium that owns the remaining 12% — would only begin once regulatory and antitrust approvals are secured for the Anglo-Teck corporate tie-up.

“That’s when we’ll have all the green-lights to proceed with the integration,” he said.

Fernandes remains upbeat about copper’s long-term outlook, citing surging demand from the energy transition and data centers tied to artificial intelligence, even as major producers face setbacks in Indonesia, Chile and the Democratic Republic of the Congo.

“Bringing a new copper project on-line takes 15 to 20 years,” he said. “If demand grows 2.5% to 3% annually over the next two decades, it’s about 30 to 40 new mines the size of Quellaveco in Peru — each producing about 300,000 tons a year. That’s a lot of copper.”

(By Mariana Durao)

Codelco weighs fate of marginal copper assets in strategy shift

Codelco is scrutinizing operational and investment options for the coming years as some officials at the Chilean state copper behemoth push for a shift toward prioritizing profit over production.

Annual planning sessions this year include a review of options for marginal assets, such as its lowest quality mine, Gabriela Mistral, and century-old smelter Potrerillos, said people with knowledge of the matter. No decisions have been been made and the company may opt to proceed with existing plans for the assets, especially with copper prices at record highs.

While asset reviews are standard practice in the industry, the scrutiny of low-return investments reflects a shift in approach at Codelco, where the focus has been churning out as much as possible to maximize inflows to state coffers and avoiding politically sensitive closures. A collapse at its most profitable mine has further dimmed the financial outlook and undermined its chances of returning to pre-pandemic production levels.

A Codelco spokesperson declined to comment.

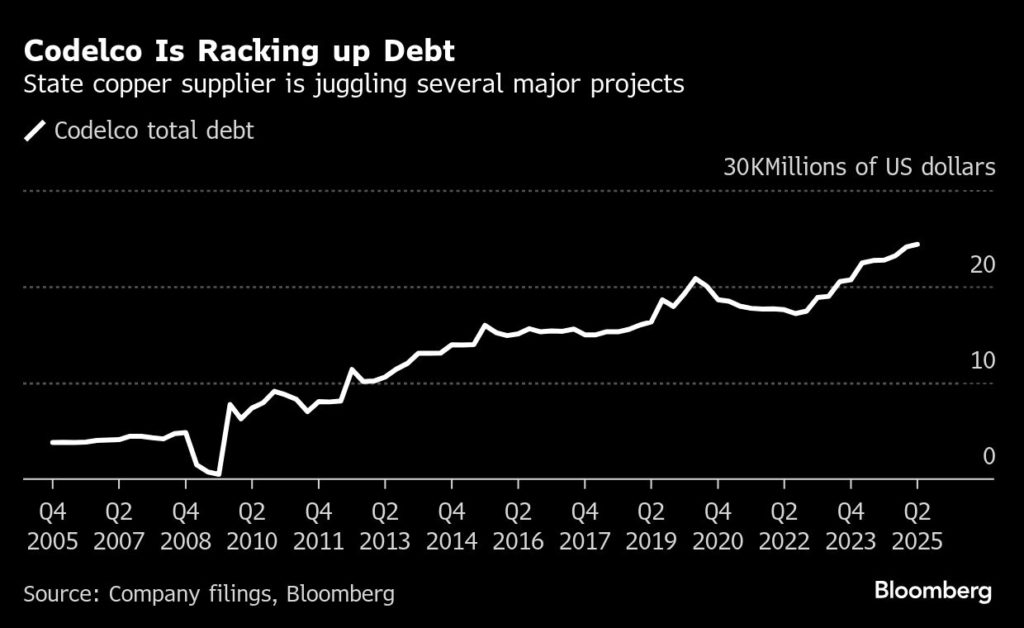

The talks come as Codelco is saddled with an enormous debt load that’s hurt prospects even as the copper market rallies. Analysts have criticized project strategies and execution at the company.

For the copper market, a shift by Codelco toward value over volume would be felt just as supply is set to tighten due to new demand from the energy transition and data-center boom.

Management is exploring ways to reduce the cost of an $800 million-plus project to extend the Gabriela Mistral mine, dubbed Gaby, said the people, asking not to be identified discussing non-public talks. Some within the company are leaning toward Gaby being mothballed once its life ends in 2028 — which would further complicate the task of returning annual production to 1.7 million tons by 2030 from about 1.4 million now. There’s also debate over the future of Potrerillos amid global smelting overcapacity.

Options for Gaby and Potrerillos are being discussed as part of business and development planning, the results of which will be presented to the board next month for further debate.

Also being debated are options for the giant El Teniente underground mine, which suffered a deadly collapse on July 31. That includes which of the remaining inactive areas should be restarted and whether gains can be squeezed out of unaffected areas to offset the impact, the people said.

Codelco has been spending unprecedented sums in recent years to overhaul aging mines and reverse a protracted output slump. Projects have come in late and over budget, pushing debt levels above $24 billion.

A potential cautionary tale for Codelco is the Salvador mine. Rather than closing its smallest operation as ore quality depleted, the company opted to sink more than $1 billion into an problematic overhaul that has yet to bear much fruit.

The Gaby open-pit project came online in 2008 and last year produced 103,000 metric tons, or about 0.5% of the world’s mined copper production. Among Codelco’s fully owned mines, Gaby has the lowest grades, resources and reserves, according to the latest annual report.

In December, the company filed a request with Chile’s environmental agency to extend Gaby’s operations until 2055, with an investment that was estimated at the time at about $800 million. Approval is pending for a project that includes a new water source and a new kind of leaching for sulfide ores. If the company decided not to proceed with the extension, it would be the first time a Codelco mine has been deactivated.

Gaby’s concession area spans a whopping 73,000 hectares (180,000 acres) in northern Chile. With a full-time staff of about 500, it was the first Codelco mine to operate with all autonomous trucks. It uses a type of processing that depends heavily on fluctuating sulfuric acid prices.

Another marginal asset coming under scrutiny is the Potrerillos smelter and refinery complex, which has been offline since mid-June due to a chimney collapse and maintenance work.

The mishap stoked debate over the pros and cons of shutting it down as a global smelting glut puts pressure on older, higher-cost plants. One possibility is to continue smelting operations there but halt refining and instead use spare capacity at another plant.

Much will depend on whether copper prices remain elevated, as well as the outcome of Chilean elections. The country’s new president will appoint three directors to the board after taking office in March, with the leading presidential candidates at opposite ends of the political spectrum.

(By James Attwood)

No comments:

Post a Comment