Mexico's President Asks U.S. to Coordinate on Drug Boat Strikes

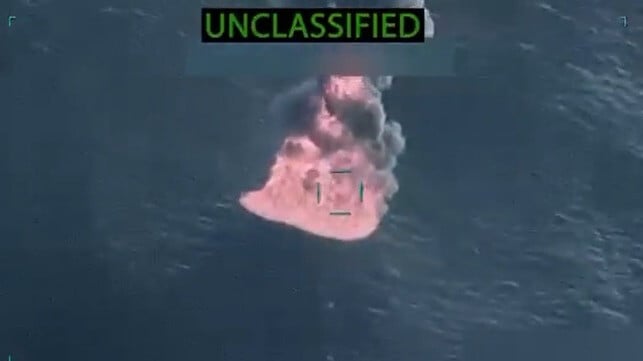

Mexico's president has spoken out against the new American policy of destroying suspected drug boats with airstrikes, calling for more cooperation between the two nations on addressing the perennial problem of narco-trafficking.

"We do not agree with these interventions and we have a model, a protocol that has yielded many results," Sheinbaum said Wednesday.

She told Telemundo that she instructed Foreign Minister Juan Ramón de la Fuente to summon the U.S. ambassador to Mexico, Ronald Johnson, and try to improve the coordination protocol for drug interdictions. Her proposal was to run joint Mexican-American naval missions to conduct intercepts at sea, resulting in arrests rather than fatalities. The objective, she said, was to ensure against any harm to Mexican nationals or breaches of Mexico's own sovereignty.

"We never want any violation of our sovereignty, nor do we want these types of operations in the economic zone, precisely because action is being taken," Sheinbaum said. "And secondly, because there could be a Mexican, whether a criminal or not, a suspected criminal, on one of these vessels."

Mexico has a longstanding relationship with the U.S. Coast Guard-led Joint Interagency Task Force - South (JIATFS), which handled interdictions in U.S. Southern Command for decades - but these responsibilities are now handled by II Marine Expeditionary Force out of Camp LeJeune, using lethal methods. The program has killed 61 people to date, including Colombian, Trinidadian and Venezuelan nationals; three people have been rescued alive.

The initiative has drawn strong objections from Venezuela and Colombia. Questions about its constitutionality have been raised by legal scholars, the Trump administration's political opponents, and elements of the Pentagon's own legal corps, centering around whether the president can use lethal force against unidentified suspects in international waters (without prior Congressional authorization).

The Trump administration has provided targeting information to the U.S. Senate for oversight purposes, selecting a limited group of Republican senators to receive briefing materials, according to ABC.

U.S.-Venezuela Tensions Intensify Regional Energy Risks

- Tensions between the U.S. and Venezuela are escalating, leading to increased energy and security risks in the Caribbean, with President Trump ruling out immediate military strikes but maintaining a naval presence.

- Venezuela's oil exports have reached their highest levels since early 2020, becoming crucial for Chinese and Indian refiners amidst sanctions on Russia and tight heavy-crude supplies, making any disruption from U.S. actions a potential squeeze on global markets.

- The crisis is intertwined with Guyana's growing oil production and ongoing maritime boundary disputes with Venezuela, further complicated by Venezuela's demand for clarification on a new gas exploration agreement between ExxonMobil and Trinidad and Tobago.

U.S.-Venezuela tensions are again rippling through energy and security markets, prompting President Donald Trump to rule out immediate military strikes while maintaining a buildup of American naval assets in the Caribbean.

His comments followed reports of U.S. patrols and maritime interdictions targeting narcotics routes linked to Caracas, a campaign that has drawn condemnation from Venezuelan President Nicolás Maduro and prompted renewed appeals to the U.N. Security Council.

Newsweek reported that Washington’s military posture remains unchanged despite the president’s denial of active strike plans.

The escalation comes as Venezuela’s oil industry shows signs of revival. The country’s crude exports topped 1.09 million barrels per day in September, the highest level since early 2020, according to Reuters. Those shipments have become increasingly important for Chinese and Indian refiners amid sanctions on Russia and tight heavy-crude supply elsewhere. Any disruption caused by new U.S. enforcement actions could once again squeeze global heavy-sour markets.

Gulf Coast refiners that previously depended on Venezuelan barrels have already turned to heavier grades from the Middle East and from Latin America, including ramping purchases from Guyana’s offshore Stabroek field, as detailed by Reuters. That shift has intertwined the Venezuelan crisis with Guyana’s emergence as one of the Western Hemisphere’s fastest-growing oil producers.

At the same time, Caracas continues to dispute maritime boundaries with Georgetown in waters adjacent to Exxon Mobil’s Stabroek block offshore Guyana. This flashpoint could take on greater significance if military pressure from Washington intensifies.

Analysts warn that any deterioration in Venezuelan stability or maritime security could slow regional project timelines and raise insurance costs across northern South America, undermining one of the few non-OPEC growth corridors now underpinning future global supply.

Venezuela has also demanded clarification from ExxonMobil and Trinidad and Tobago over a new gas-exploration agreement signed this week, arguing that parts of the area under review overlap with maritime zones claimed by Caracas. Venezuela’s foreign ministry formally requested documentation from Port of Spain outlining the project boundaries and legal framework.

By Charles Kennedy for Oilprice.com

No comments:

Post a Comment