Bloomberg News | December 5, 2023 |

Credit: Minera Poderosa SA

Mining executives in Peru are imploring authorities to crack down on escalating violence by informal miners, which this weekend cost the lives of nine staff members of a large, legal gold mine.

“Formal mining is under attack,” Angela Grossheim, the head of industry group SNMPE and a former minister, told reporters Tuesday. “Illegal mining today is the country’s main illicit activity, even bigger than drug trafficking.

Over the weekend, workers in a shaft at a mine run by Cia. Minera Poderosa SA were ambushed by explosives, bringing the number of deaths in clashes with informal miners at Poderosa to 16 in the past two years. Peru is a major gold and copper supplier, with the two metals attracting more informal mines made more lucrative by high prices and new techniques.

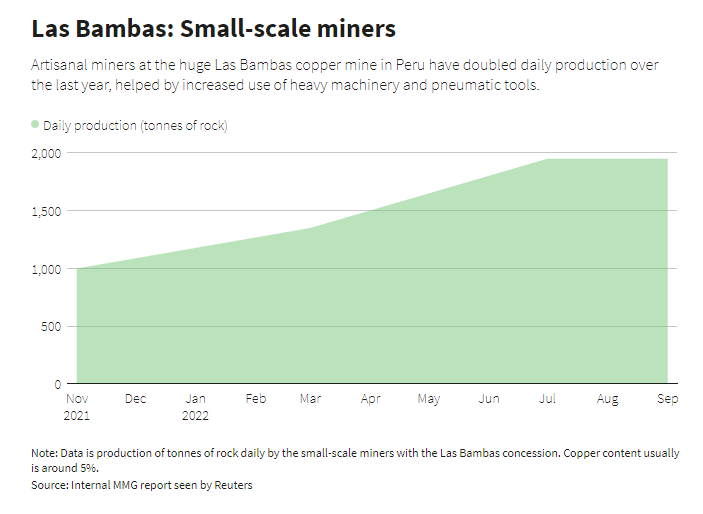

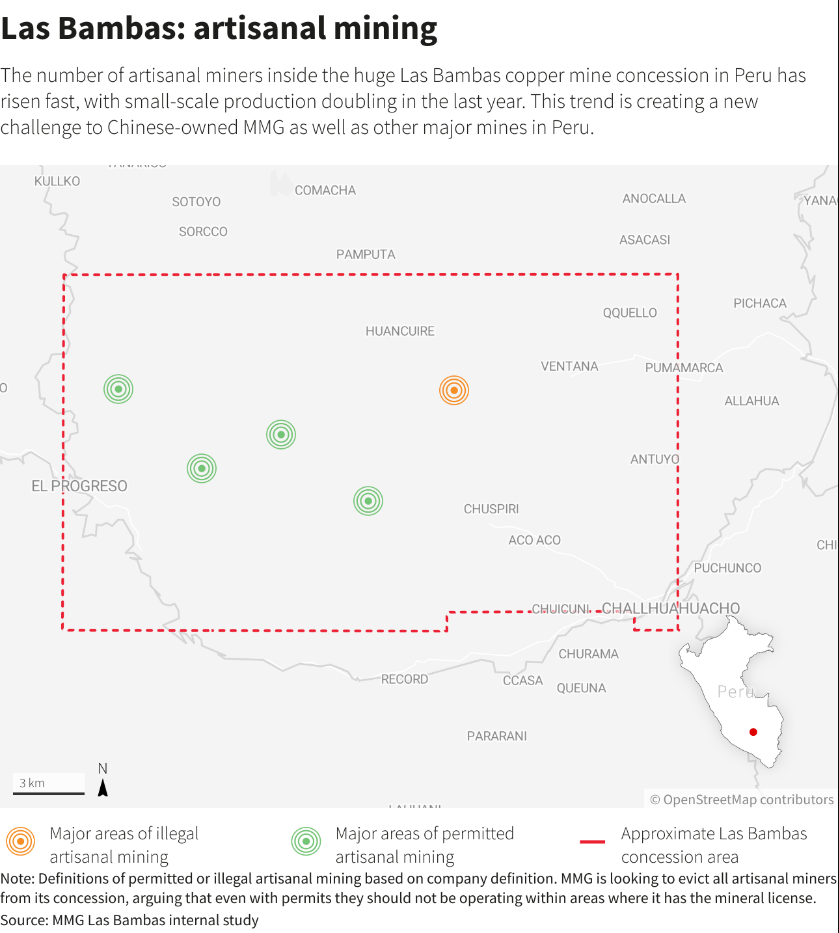

Conflicts have extended to some of Peru’s sprawling copper deposits, including Southern Copper Corp.’s Los Chancas project and MMG Ltd.’s Las Bambas mine. Both have struggled to develop new pits in areas that have drawn informal miners. The Los Chancas mining camp was burned down last year.

The industry is laying part of the blame on temporary permits known in Peru as Reinfo, a registry that allows informal miners to operate with some legal protections while they formalize operations. But the registry has been open for a decade and many workers have remained in the system without formalizing.

“It’s time to put a stop to this mantle of impunity,” said Poderosa corporate affairs manager Pablo de la Flor. He added that Poderosa has been in conflict with informal miners who are part of the Reinfo registry.

Poderosa is calling on authorities to send in the army at a site where hundreds of additional police officers have been deployed. The Lima-based firm has hired an additional 1,200 security guards just in the past few months.

(By Marcelo Rochabrun)

Mining executives in Peru are imploring authorities to crack down on escalating violence by informal miners, which this weekend cost the lives of nine staff members of a large, legal gold mine.

“Formal mining is under attack,” Angela Grossheim, the head of industry group SNMPE and a former minister, told reporters Tuesday. “Illegal mining today is the country’s main illicit activity, even bigger than drug trafficking.

Over the weekend, workers in a shaft at a mine run by Cia. Minera Poderosa SA were ambushed by explosives, bringing the number of deaths in clashes with informal miners at Poderosa to 16 in the past two years. Peru is a major gold and copper supplier, with the two metals attracting more informal mines made more lucrative by high prices and new techniques.

Conflicts have extended to some of Peru’s sprawling copper deposits, including Southern Copper Corp.’s Los Chancas project and MMG Ltd.’s Las Bambas mine. Both have struggled to develop new pits in areas that have drawn informal miners. The Los Chancas mining camp was burned down last year.

The industry is laying part of the blame on temporary permits known in Peru as Reinfo, a registry that allows informal miners to operate with some legal protections while they formalize operations. But the registry has been open for a decade and many workers have remained in the system without formalizing.

“It’s time to put a stop to this mantle of impunity,” said Poderosa corporate affairs manager Pablo de la Flor. He added that Poderosa has been in conflict with informal miners who are part of the Reinfo registry.

Poderosa is calling on authorities to send in the army at a site where hundreds of additional police officers have been deployed. The Lima-based firm has hired an additional 1,200 security guards just in the past few months.

(By Marcelo Rochabrun)