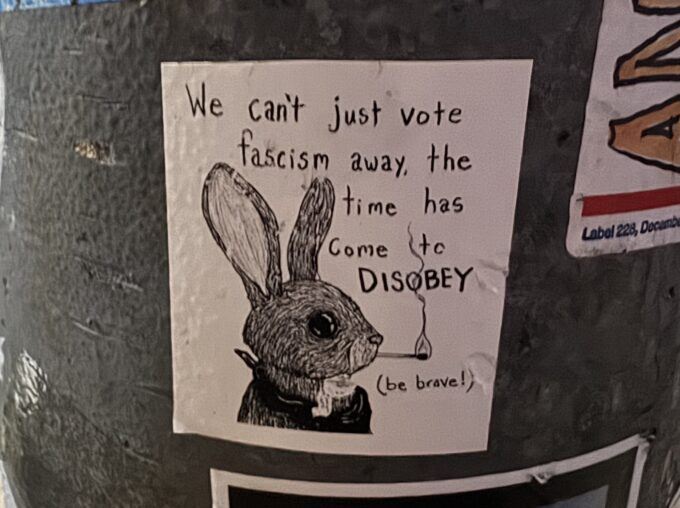

Photograph by Nathaniel St. Clair

The crisis of the existing order is not going away. Instead, it is fueling an opposition movement that could challenge the legitimacy of the ruling class. It is a perfect time for us to consider how the empire maintains “hegemony,” that is, its command over both the social order and the world of ideas.

Crisis, Reality, and Hegemony

Despite over half a century of austerity, perpetual warfare, climate crisis, vile corruption, broken promises, creeping fascism, and even genocide itself, people continue to support the ruling parties and the class they represent. Even the many millions who do so unwillingly go only halfway, adopting stances of neutrality, withdrawal, and waiting.

Why?

To find the answer, we must look to “culture:” the realm of feelings, values, beliefs, ideas, and perceptions.

The ideas of the ruling class are in every epoch the ruling ideas…the class which is the ruling material force of society, is at the same time its ruling intellectual force…Thus, their ideas are the ruling ideas of the epoch.[1]

The main idea behind cultural hegemony is that the most popular and powerful ideas and narratives are those of the ruling class. On the battlefield of the mind, ruling ideas exert a kind of “full-spectrum dominance” to eliminate rivals, but their victory is never final. The ultimate struggle is not over fine points or policy but over the nature of political “reality,” since perceived reality determines what seems practical or possible. The hegemon creates its own reality, and its leadership is measured by the fact that even self-described socialists cite this reality as proof that fundamental challenges are not viable. It’s never the “right time.”

The first step in creating a world that belongs to the people is the recognition that reality is always and forever provisional, fluid, and historical. Gramsci:

Reality does not exist on its own, in and for itself, but only in a historical relationship with the people who modify it. [2]

Life is nothing if not bursting with contradictions, and surviving this crazy world demands that we all develop what the great Black thinker, W.E.B. Du Bois, called “double consciousness.” This “twoness” is the cultural basis for challenging ruling class hegemony.[3]

Everyone is a Philosopher

Gramsci understood hegemonic thought as a “spontaneous philosophy proper to everybody.” We are all philosophers, whether we know it or not.

He argued that the ruling class’s ideas shape everyone’s thinking so profoundly that it appears as “common sense.” It is an everyday philosophy that — despite being the vehicle for ruling-class supremacy — is uncritically absorbed by the very people it lords over. It is learned from the sum total of human interactions: collective, institutional, and individual. And it is embedded in language itself.

Deep and damn near invisible.

Hegemony is not as simple as overt propaganda, although it is a part of it. If hegemonic common sense is the algorithm, propaganda is the keystrokes that tap into it and reinforce it. For example, the propagandist knows they need not loudly proclaim that the Americans are the chosen people; they must simply talk incessantly about the evil of rivals or immigrants, knowing full well that the audience will fill in the “common sense” of American Exceptionalism.

Given the enormous impact of media, propaganda, and nonstop hot takes and memes, it’s easy to miss the importance of the broader cultural arena. Media studies help us to track the daily lies and distortions, while the concept of cultural hegemony shows us the historical context and ultimate meanings of political language.

The First Commandment

The empire cannot rely solely on force. Yes, the state rules with violence, but its legitimacy is won in the battle for hearts and minds. And its most pure, essential teaching is that its superiority — its right to rule — is normal, natural, eternal, or simply reality. When political activists talk too much about “realism” or “viability,” they claim to be making tactical statements — that just coincidentally conform to the first commandment of corporate hegemony.

Hegemony works implicitly to achieve what the Judeo-Christian First Commandment makes explicit:

“I am the Lord your god, who brought you out of Egypt, out of the house of bondage. You shall have no other gods before Me.”

The ruling class is a jealous god, too, but one that prefers to pull its levers behind a curtain. Unlike religious law etched in stone with divine fire, hegemonic culture is whispered. But, like the First Commandment, ruling-class hegemony appeals to the highest values of freedom to win our acceptance. Both God and the rulers in the “Land of the Free” claim to have delivered us “out of the house of bondage.”

No ruling class can win the support of the people indefinitely without a credible claim of deliverance, of freedom, of universal values. By this measure alone, the hegemon lives on borrowed time. As Gramsci warned us: “The old world is dying, and the new cannot be born; in this interregnum a great variety of morbid symptoms appear.”[4] Some of the most loved and hated political figures of our day (and their followers) are truly “morbid” in that they still try to revive and redeem the decrepit and decayed political order.

Take it Personally, Really

Hegemony reaches right into our personal lives. For example, parasocial relationships with celebrity politicians and influencers are carefully cultivated by social media. These illusions of intimacy try to satisfy our inner cravings for pleasure, hope, and joy, even if our “imaginary friend” is a fascist, dirty cop, sexual criminal, fraud, or genocider. As second-wave feminists, and generations of gender and sexual rebels have taught us, what we experience as private and personal is always deeply political. They knew it well because patriarchy is the original hegemonic system cloaked as a natural reality.

How does a system so fundamentally at odds with either freedom or pleasure still manage its mastery using “common sense?” The slogans of the “purity test,” or “voting is a chess move, not a valentine,” are revealing.

These talking points are thinly disguised demands that we forfeit our morals, desires, and interests. When loyal Democrats mock “purity” and treat minimum standards of life, or democracy, or basic human dignity as valentines, ponies, or shiny objects, they are subtly endorsing hegemonic culture by denying the link between personal and political.

All they have to offer is classic “realpolitik.” Realpolitik, often called realism or pragmatism in everyday language, is the belief that cunning power maneuvers and national interests should guide politics with little room for ideals or values. U.S. politicians are the ultimate realists. But the use of “purity” to undermine opposition is itself the purified essence of hegemonic thinking: amoral realism that allows the existing power structure to determine the outer limits of our political possibilities.

If we take this view, the Democrats and, by extension, the system itself, become “the only game in town.” The “purity test” and “chess move” pose as level-headed, hard-nosed realism but are, in fact, the purest distillation of the prime directive of hegemonic culture: There is No Alternative. Mocking “purity” is a preemptive strike on our imaginations and visions for a better world. Realism is surrender.

The hegemon, on the other hand, imposes no such limits on itself.

Caution! Hegemony at Work!

Consider the strange career of the 14th Amendment. While it recognized due process and human rights for formerly enslaved people, the corporations had other ideas. In a series of Supreme Court decisions beginning in the 1890s, corporations asserted their claim to the status of persons and sought due process protections against government abuse under the Constitution.

Yet, their supremacy simultaneously demanded political control to minimize competition, ensure profits, and safeguard their future. Such control was achieved through a merger between the corporation and the state. In Buckley v. Valeo 1976 and First Nat’ l Bank of Boston v. Bellotti 1978, the ruling class won unlimited rights to purchase parties and politicians. By 2010, this class of “people” had their hoarded wealth sanctified as free speech in Citizens United. So purely human had the corporations become that in 2014, Hobby Lobby recognized their religious conscience.

Meanwhile, what little remained of the 14th (and the 1st, 4th, and 5th) was attacked again as due process was crushed under the weight of the police state. And they did not have to start from scratch: the Bill of Rights never applied to Black and Brown people without mass struggle and always stopped at the workplace door, leaving the bosses free to maximize profits and impose austerity.

In the end, the corporations won due-process protections of people from the very government they had taken ownership of, while simultaneously crushing the rights of real people — a stunning achievement.

While corporations gained recognition of their humanity, real people are told to sacrifice the very values, ideals, and passions that make us truly human. This is how the liberal rhetoric of purity and realism, of chess matches and valentines, keeps the working class in check and the hegemon on top.

This is not simple hypocrisy, but rather the hegemon making a legal and political “reality” of its choosing. But no matter how well-played or slick its champions are, the ruling class cannot erase the fractured world it has forced us to endure.

Double Consciousness

Dubois and Gramsci help us envision a counter-hegemonic move.

In Souls of Black Folks, Dubois realized that the structure of Black thought was “double consciousness.”

It is a peculiar sensation, this double-consciousness, this sense of always looking at one’s self through the eyes of others…One ever feels his two-ness,—an American, a Negro; two souls, two thoughts, two unreconciled strivings; two warring ideals in one dark body, whose dogged strength alone keeps it from being torn asunder.

Double consciousness, or what Gramsci described as “two theoretic consciousness (or one, contradictory consciousness),” is the saving grace of cultural hegemony.[5] This double consciousness is also a “philosophy proper to everybody” that appears just as spontaneously as those of the ruling class. Double consciousness means that raw materials for an opposition movement already exist in the minds of the millions. Wave after wave of resistance led by Black people both inspired and proved Dubois’s theory.

To claim this contested terrain and raise a counter-hegemonic banner, we will need independent, creative, massive political action. Dubois’s “dogged strength” and Gramsci’s “optimism of the will”are both calls to action.[6]

Double consciousness is the antidote to the poison of purity. While purity insists that we cancel our ideals and actions, double consciousness fully embraces “two unreconciled strivings, two warring ideals.” Into that breech the opposition must rush. That doesn’t make us pure — it makes us both fully human and revolutionaries — something no one is supposed to be according to hegemonic common sense.

Hegemony and History

If the ruling class aims to abolish historical change, then historical consciousness is the stuff of counter-hegemony.

The current phase of US cultural hegemony took shape at the end of the First Cold War and the Soviet Union’s collapse. The triumphant celebrations that followed were captured in Francis Fukuyama’s internationally influential book, The End of History and the Last Man. For Fukuyama, there was no more history to be made: Western liberalism and free markets were the final human achievements. The existing order is reality, he assured us, so just Trust and accept it.[7]

If history is over, then opposition forces with their revolutionary aspirations should be silenced and made to disappear — repressed, scapegoated, or smeared as aberrations or disorders.

Instead, an opposition positioned outside of the system is indispensable to the cultural challenge of our time: millions are still swayed by the idea that the existing system is an expression of “human nature” (the conservative) or “reality” (the liberal). In both cases, the existing order, as a historical and political construct, almost vanishes. But in truth, this belief system is a product of human thought. We can drag it into awareness where it can be studied and criticised, and someday dismantled.

The lower classes, historically on the defensive, can only achieve self-awareness…via their consciousness of the identity and class limits of their enemy; but it is precisely this process which has not yet come to the surface, at least not nationally. [8]

We study history to reveal the constructed, and transient, nature of the existing order. But historical analysis will remain unfinished unless we simultaneously make new history through actions and alliances that build alternatives in our minds and in our lives.

We might see the existing order as settler/colonialism, capitalism, patriarchy, racism, imperialism, fascism, anthropocentrism, extractivism, or a fusion of all these. We might see all these as interrelated, connected, mutually reinforcing — just like the movements that aim to replace them. The old synthesis of oppression demands a new synthesis of opposition.

Where is it? Look first to the people in motion: Occupy, Standing Rock, and BLM 2020 are recent examples. Between ICE Resistance and the Peace Movement, we have the making of a true united front against empire and fascism. Next, look at those forces outside the ruling parties that are politically and intellectually free from them. Show me an example of a challenge to ruling-class hegemony that occurred without a principled, clear-cut, unequivocal, and visionary opposition movement.

In the end, one of history’s greatest lessons is simply that political systems belong to the inescapable cycle of birth, life, and death that defines all known social orders and living things.

Take heart. We must find the “optimism of the will” and “dogged strength” because action and movement are the best way to forge a new common sense, a new opposition, and to finally meet our own historical moment.

Humankind thus inevitably sets itself only such tasks as it is able to solve…that the problem itself arises only when the material conditions for its solution are already present or at least in the course of formation.[9]

Ready or not, here we come!

Notes.

1/ Marx and Engels in The German Ideology. Since I am using classic sources to explore the core ideas and main themes of hegemony, I have taken the liberty to update some of the language, replacing “Mankind” with “Humankind” and so forth.

2/ Italian Communist Antonio Gramsci is the primary theorist of hegemony, and Prison Notebooks (PN) is the key text, but be forewarned, it’s a real bear. What Capital is to economics, Prison Notebooks is to culture. It’s dense, historical, detailed, and polemical. It was a long, slow read for me; the guidance of other writers was indispensable. I would start with Prince Kapone for the contemporary context. Jackson Lears sees Gramsci as blazing a trail to new thinking about history. I found the work of Laurie Adkin, Valeriano Ramos, Jr., Mathew Wilson, Sheetal Sharma, and Gianmaria Colpani to be very helpful. The quote is from PN 346.

3/ W.E.B. DuBois, Souls of Black Folks.

4/ PN 276

5/ PN 333

6/ PN 345

7/ Fukuyama’s sequel is literally titled Trust.

8/ PN 273

9/ Marx and Engels, Preface to a Contribution to the Critique of Political Economy