AUSTRALIAN MINERS IN CANADA

Canadian nickel miner still wants BHP takeover, shunning Forrest

BNN/BLOOMBERG

Aug 20, 2021

A small Canadian nickel miner reiterated support for takeover by BHP Group after its largest shareholder, Australian mining magnate Andrew Forrest, tried snubbing the deal.

Noront Resources Ltd. said Friday in a statement that its board continues to recommend that shareholders accept BHP’s cash offer that values the company at CUS$325 million (US$254 million), a day after Forrest’s Wyloo Metals Pty Ltd. said it wouldn’t sell its shares to the world’s largest miner. Wyloo Metals, which owns about 25 per cent of Noront and holds a convertible loan that could lift its control to 37 per cent, said it would consider making a superior offer.

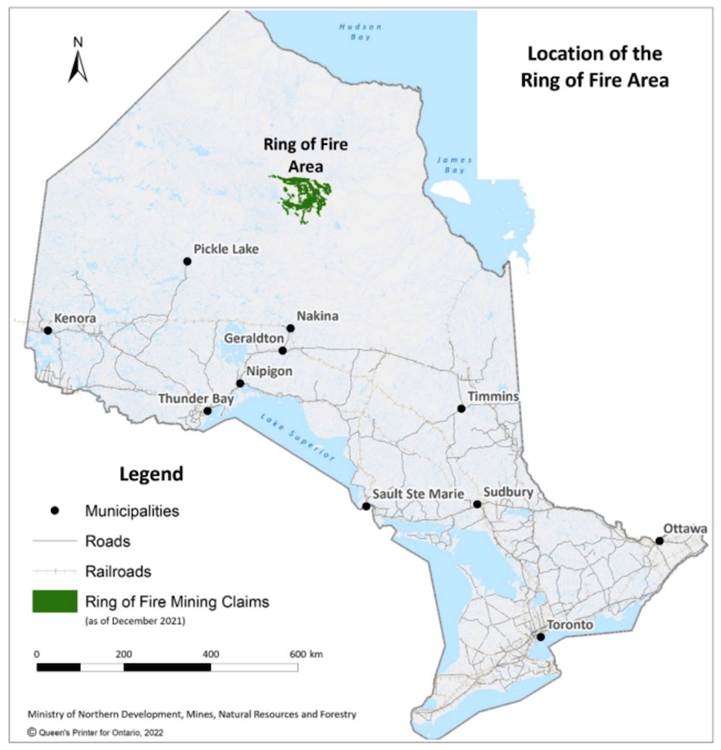

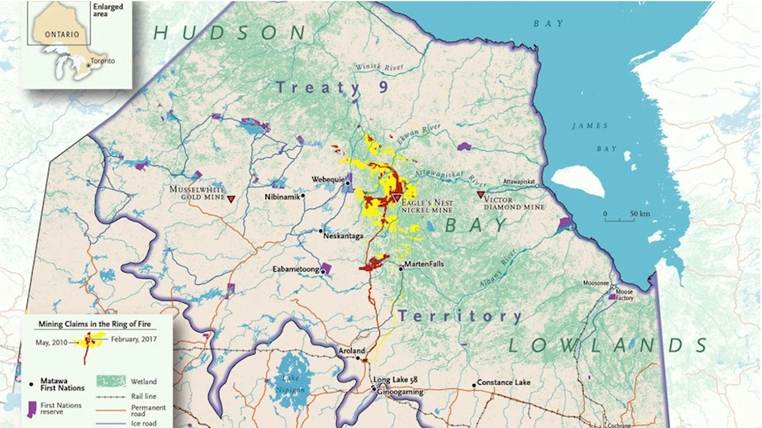

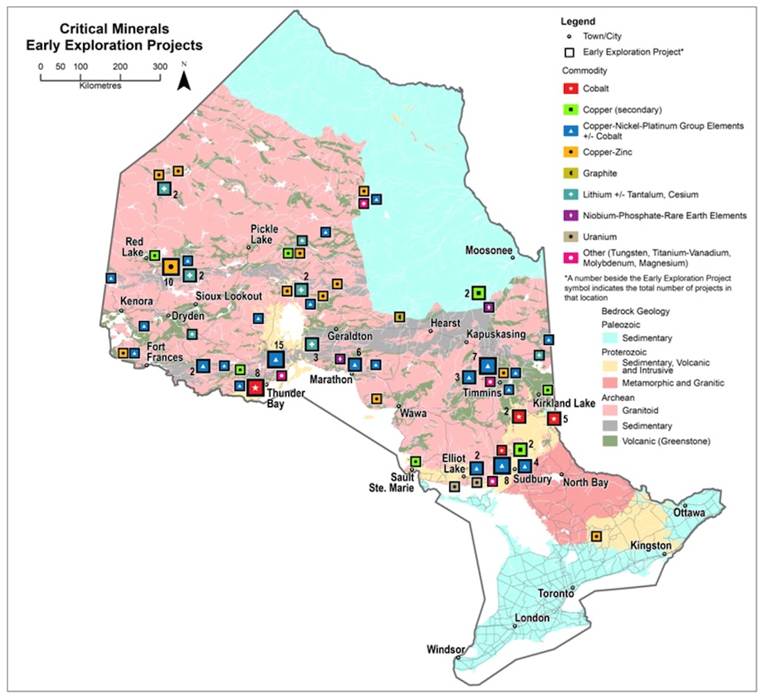

The wrangle over the Toronto-based minerals explorer highlights a race among mining heavyweights to control supplies of raw materials that are key to a clean energy future. Noront has been developing one of Canada’s largest potential mineral reserves, in a largely untapped northern Ontario region dubbed the Ring of Fire. The high-grade nickel deposit also has chromite, copper and zinc. Nickel is one of the key metals used in batteries for electric vehicles.

Noront, whose main asset is the Eagle’s Nest nickel-and-copper deposit in the Ontario region, said success of BHP’s offer doesn’t require Wyloo’s support, according to the statement. Noront shares fell 4.8 per cent to 50 Canadian cents at 10:56 a.m. trading in Toronto, below BHP’s 55-cent-a-share offer made July 27.

Noront still sides with BHP's deal to acquire Ring of Fire deposits

Ring of Fire mine developer Noront Resources remains firm on favouring a $325-million deal by international miner BHP to buy their nickel, copper, palladium assets in the Far North.

Noront, the subject of an inside takeover attempt by its largest shareholder, Wyloo Metals, fired back at the Australian mining company for several "misleading statements" made this week stemming from a new bid by BHP to acquire them.

In late July, BHP Lonsdale, made an offer to acquire Noront for $325 million, at $0.55 cents a share, beating out Wyloo's announced offer from May of $133 million, at $0.315 per share.

Noront claims Wyloo hasn't made a formal offer to acquire them, only announced an intention to do so.

Wyloo is Noront's biggest shareholder at 24 per cent and said it intends to increase that to 37 per cent shortly by converting a loan into common shares of Noront.

BHP, through a subsidiary company, owns 3.7 per cent of Noront.

In an Aug. 20 news release, Noront reiterated an earlier recommendation by its board of directors that Noront shareholders to accept the BHP offer, deeming it "fair, from a financial point of view" and to "tender their Noront shares as soon as possible."

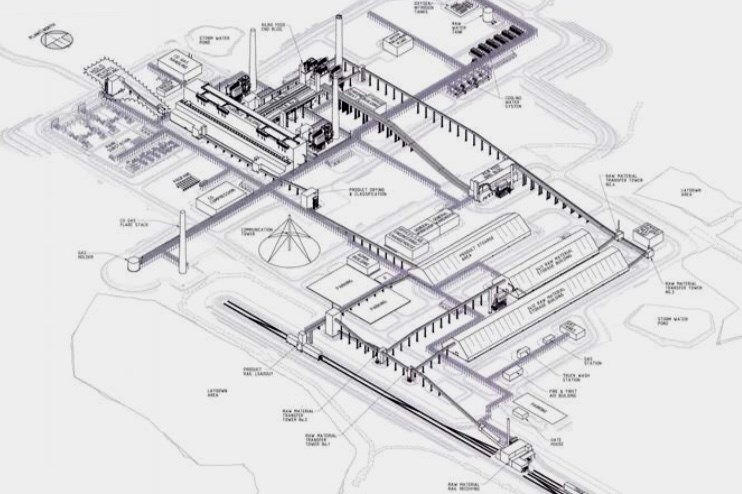

Noront's highly-prized claims in the remote James Bay region includes the high-grade Eagle’s Nest nickel, copper, platinum and palladium deposit and a string of high-grade chromite deposits in the Far North mineral belt called the Ring of Fire, 500 kilometres northeast of Thunder Bay.

This week, Wyloo made the claim that that Noront has denied them access to due diligence information in order to made a better offer to shareholders than BHP's.

Noront responded that on transactions of this nature, it's customary for interested parties to enter into a confidentiality agreement before Noront provides any due diligence information.

BHP has agreed to this, Noront said, but Wyloo "declined to do so."

Contrary to Wyloo's assertions, Noront further said Wyloo's support is "not required" for this transaction for BHP's offer "to be successful."

"The minimum tender condition for the offer is that more than 50 per cent of the shares not owned by BHP be tendered to the (BHP) offer, and this condition can be satisfied regardless of whether Wyloo tenders its Noront shares to the offer."

Wyloo Metals not a huge fan of BHP muscling its way into the Ring of Fire

An Australian slug fest appears to be shaping up in a contest to acquire Noront Resources and some of the choice, almost mining-ready, nickel and chromite deposits in the Ring of Fire.

Wyloo Metals said in an Aug. 19 news release it's not backing down from a rival bid by BHP to acquire Toronto-based junior miner Noront, insisting it has no intention of relinquishing its majority position to maintain control of Canada's next great mining camp in the James Bay region.

Perth-headquartered Wyloo finally broke its month-long silence after Melbourne-based BHP, one of the world's largest mining companies, jumped into the fray in July with a cash offer of $325 million, at $0.55 cents a share, to Noront investors, besting Wyloo's overture to Noront last May of $133 million, at $0.315 per share.

Viewing Wyloo's move as a hostile takeover, Noront's board of directors recently recommended shareholders accept the BHP offer.

In the release, Wyloo said its "disappointed" Noront's board chose not to "meaningfully engage or negotiate" prior to accepting BHP's offer.

Want to read more stories about business in the North? Subscribe to our newsletter.

Privately-held Wyloo came aboard as Noront's largest shareholder last December, picking up the 23 per cent stake vacated by Resources Capital Fund. By late May, Wyloo boldly elected to acquire all of the outstanding common shares of Noront before BHP entered the scene in late July.

BHP's offer came through BHP Lonsdale, a BHP subsidiary company and owner of 3.7 per cent of Noront shares.

Wyloo is a Perth-based subsidiary of Australian mining magnate Andrew Forrest's Tattarang. The company said it intends to increase its stake in Noront from 24 pe cent to 37 per cent by converting a US$15-million convertible loan into common shares of Noront.

In the release, Wyloo said BHP's bid is unlikely to succeed given the "minimum mandatory tender condition...is unlikely to be satisfied" without Wyloo's support as a cornerstone investor in Noront.

Wyloo further claims it's being stonewalled by Noront from being able to upgrade its offer to Noront's shareholders. The company said it's prepared to make a "superior offer" if only it were allowed to access the books.

"Despite numerous attempts to date, the Noront board has denied Wyloo Metals from obtaining access to due diligence on reasonable terms for a shareholder with a cornerstone position.

"Unfortunately, the total value of any superior offer contemplated by Wyloo Metals must accommodate the Cdn$13 million break fee payable to BHP, which was agreed to by the Noront Board to the direct detriment of Noront’s shareholders."

Wyloo said Noront's land package "hosts some of the most prospective mineral deposits in the world" with the potential for become "Canada’s next great mineral district, supporting the production of future-facing commodities for multiple generations."

"Wyloo Metals continues to firmly believe in the immense potential of the Ring of Fire and therefore does not intend to support or tender its Noront shares to BHP's offer."

Forrest declares nickel war on BHP

Brad Thompson Reporter

Updated Aug 20, 2021 –

Andrew Forrest has declared his intention to battle BHP for nickel assets and is casting a big shadow over what could emerge as a bidding war for Western Areas that has implications for BHP’s ambitions in battery metals.

Forrest-owned Wyloo Metals said it opposed BHP’s takeover bid for Noront Resources in Canada and is willing become involved in a bidding war for the promising nickel producer.

And a day after IGO Limited confirmed it was in takeover talks with Western Areas, it was revealed Forrest-owned Wyloo Metals has accumulated a 5.28 per cent stake in Western Areas

.

Andrew Forrest is set to have a say on nickel consolidation in WA. Rebecca Mansell

The stake, together with others in West Australian-based nickel players, means the iron ore billionaire will at least have a big say in any predicted consolidation in the sector.

The move makes the nickel-rich area of WA the second front on which Dr Forrest and BHP’s growing interests in the key battery metal may potentially clash. They are now in open warfare in Canada over Noront and control of projects in the mineral-rich Ring of Fire region in the James Bay Lowlands of Northern Ontario.

Breaking its silence on BHP trumping its bid for Noront with a $C325 million offer last month, Wyloo said it was willing to fight BHP for control.

“Noront’s Ring of Fire land package hosts some of the most prospective mineral deposits in the world,” Wyloo said.

“These deposits have the potential to become Canada’s next great mineral district, supporting the production of future-facing commodities for multiple generations.

“Wyloo Metals continues to firmly believe in the immense potential of the Ring of Fire and therefore does not intend to support or tender its Noront shares to BHP’s offer.“

Wyloo said it was disappointed that the Noront board did not seek to meaningfully engage or negotiate with it before accepting the BHP offer.

The Forrest entity camp said its cornerstone interest of in Noront amounted to 37.5 per cent on a partially diluted basis and BHP’s bid was unlikely to succeed without its support.

Wyloo claimed the Noront board was standing in the way of it making a superior takeover offer.

“Wyloo Metals would consider proposing a superior offer to acquire the outstanding common shares of Noront it does not already own, should it be provided with access to due diligence,” it said.

“Despite numerous attempts to date, the Noront board has denied Wyloo Metals from obtaining access to due diligence on reasonable terms for a shareholder with a cornerstone position.“

Wyloo said it was “unfortunate” that the total value of any superior offer it was contemplating would need to accommodate a $C13 million break fee payable to BHP, which “was agreed to by the Noront board to the direct detriment of Noront’s shareholders”.

Closer to his home in WA, Dr Forrest’s moves could also prompt a response from BHP given its relies on Western Areas, IGO and other smaller companies for a portion of the nickel it will need to supply Elon Musk’s Tesla and other car and battery-making customers through BHP Nickel West.

Wyloo, owned by Dr Forrest’s private investment company, Tattarang, has a 15 per cent stake in Mincor Resources, which is gearing up to produce 15,000 tonnes of nickel a year and supply BHP Nickel West.

Wyloo also owns shares in Panoramic Resources, a nickel player preparing to restart its Savannah operation in WA’s remote east Kimberley.

Run by Tattarang young gun Luca Giacovazzi, Wyloo has been accumulating shares in Western Areas since March, reaching the 5.23 per cent mark on Thursday as IGO and Western Areas confirmed takeover talks after being flushed out by an exclusive report in The Australian Financial Review’s Street Talk column.

RELATED

BHP beats Forrest in takeover battle for prized nickel project

Analysts have said IGO, looking to shore up nickel production as its Nova mine comes to the end of its life, will need to fork out more than $1 billion to secure Western Areas.

Wyloo was a step ahead of BHP in Canada, where it took a substantial share in Noront and then launched a takeover bid. BHP reacted by trumping the Wyloo offer for Noront and its highly rated Eagle’s Nest nickel project.

The Western Areas share price has jumped from $2.47 on Wednesday to $2.95 in trading on Friday.

Brad Thompson writes across business and politics from Western Australia for The Australian Financial Review. Brad is based in our Perth bureau. Connect with Brad on Twitter. Email Brad at bradthompson@afr.com