What's to become of Noront's ferrochrome plant?

Wait for the bidding war to settle, says CEO

Chromite production plans, smelter plan in limbo until new ownership takes control of Noront's Ring of Fire metal assets

Chromite production plans, smelter plan in limbo until new ownership takes control of Noront's Ring of Fire metal assets

IMPERIALISM THE HIGHEST STATE OF CAPITALI$M

By: Ian Ross

By: Ian Ross

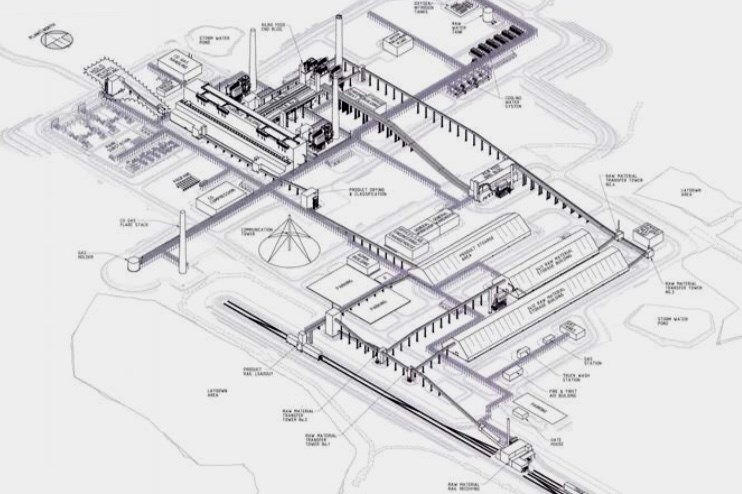

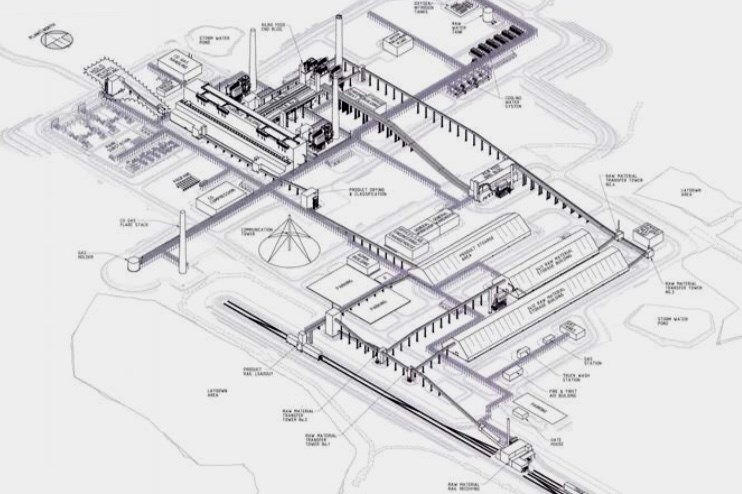

Site rendering of Noront Resources' proposed ferrochrome processing

plant in Sault Ste. Marie

Ask Alan Coutts what's to become of a proposed ferrochrome processing plant for Sault Ste. Marie and the president of Noront Resources gives a straightaway answer.

"That will ultimately be a question that will be answered by the new owners."

Noront selected Sault Ste. Marie in 2019 is its preferred location for a high-tech smelting operation, settling on a brownfield site at Algoma Steel.

But in the last few months, the Toronto mine developer and holder of the most prime mineral property in the James Bay's Ring of Fire mineral belt has become a takeover target by BHP and Wyloo Metals, the former being arguably the world's biggest mining company.

The two Australian rivals are in the early stages of a bidding war for control of Noront and its Eagle's Nest nickel-copper deposit, 500 kilometres northeast of Thunder Bay. It has an 11-year mine life with the real likelihood to extend it to 20 years.

Both companies are looking to preemptively stake their global turf and gain exposure to nickel, which is used in manufacturing lithium-ion batteries for the coming electric vehicle revolution.

Noront's 156,000-hectare land package hosts eight deposits and hundreds of documented occurrences of nickel, copper zinc, platinum, palladium, gold, titanium, vanadium, diamonds and cobalt. Many of these metals are key ingredients needed for the electric vehicle supply chain, battery storage technology, renewable energy, digital technologies, and various applications in health care, aerospace and defence.

But it was the purity and thickness of high-grade chromite, the dark grey metal discovered practically outcropping at surface in 2007, that first drew widespread attention to the region.

Noront's mining batting order has always been to lead off with Eagle's Nest, starting production in mid-2026, before digging into Blackbird, the first of four chromite deposits, and commission that project by 2028. The Sault plant would be built by then and ready to take the chromite feed.

Those timelines remain in limbo with a bidding war underway for Noront.

Noront's logistics plan involves trucking nickel concentrate down a planned 300-kilometre-long road to Nakina in northwestern Ontario and sent by rail to Sudbury for processing.

The chromite would follow the same path to a ferrochrome plant in the Sault.

About 1,000 to 1,500 construction and supply-related jobs would be created in the city, with 500 permanent plant jobs to follow for a facility that would expand as more chromite deposits come into production based on market demand.

The semi-finished ferrochrome material would be barged down the Great Lakes and Mississippi River to stainless steel manufacturers in the U.S.

Coutts mentioned their concept has been well-received by potential American customers. Most of the chrome material used by the U.S. stainless steel industry is imported from South Africa and Kazakhstan.

"We think it's a very good path forward," said Coutts.

"Ultimately, if someone buys the company they can review that and make their own decisions."

Wyloo chief executive Luca Giacovazzi told Northern Ontario Business in early June that chromite was viewed by the company as more of a "longer term opportunity."

"The focus is on nickel."

Though respectful of the work Noront had put in, Giacovazzi couldn't commit to a Sault-based processing plant. Wyloo would need to do its own technical studies to determine the best site, he said.

Wyloo is a subsidiary company of Tattarang, one of Australia's largest private investment groups. Tattarang is headed by billionaire mining magnate Andrew Forrest, who turned Fortescue Metals into the world's fourth largest iron ore producers in Australia's Pilbara region.

BHP Group is the world's largest iron ore miner with operations in Chile, Peru and western Australia. In 2021, the Melbourne-headquartered cleared US$11.3 billion in profit. The company recently established a copper and nickel exploration office in Toronto to be close to Ontario's battery metals scene.

For whichever mining company acquires Noront, don't expect the chromite to be placed on the backburner.

"Wyloo and BHP are excellent world-class companies on bulk materials like iron ore," said Coutts. "Chromite's like that.

"These guys have a ton of experience developing assets like the chrome and the associated infrastructure, and I don't think they'd have any trouble getting their heads around the opportunity.

"It might not be what attracts them in the first place, but I certainly think they'd pay a lot of attention to the (chromite) assets if they became the owners."

In elected to pursue a ferrochrome plant, Noront really stepped beyond the traditional resource development role of a junior mining company by wanting to make the rare leap to becoming a major mining player.

Coutts, a former Falconbridge executive and trained geologist, spoke confidently in past interviews that it was Noront's ambition to become a mine builder. The Ring of Fire, he said, would be their version of the mineral-rich Sudbury basin, with more than 100 years of ore production.

Noront brought Coutts aboard in 2013. He had been involved in exploration, development and operation of mines in Canada and Australia.

His chief development officer, Steve Flewelling, was hired in 2015. He had worked for Falconbridge's successor company, Xstrata Nickel/Glencore, on mining and smelting projects around the world.

Coutts said the processing space is an area they are very comfortable operating in.

"We like the fact that it was a Canadian company developing the assets," said Coutts, who was at the helm when Cliffs Natural Resources exited the Ring of Fire in 2015.

It provided an opportunity for Noront to acquire their claims and consolidate more ground after other exploration companies followed suit, allowing them to become the leading mine developer in the region, albeit with limited financial resources.

Though labelled a junior miner, Coutts said their approach was that it made the most sense, economically, not only to build the mines and produce the ore, but in the case of chromite, it was within their scope to produce an intermediate product to get a value-added lift.

"Certainly, Steve had a ton of experience with the smelting process both in Sudbury and, internationally in New Caledonia."

Coutts said they felt quite comfortable working with Hatch Engineering on the furnace design and the commissioning of a ferrochrome plant down the road.

Whether Coutts and Flewelling stick around under new ownership to see the fruits of their labour come into production remains to be seen.

In a recent interview, Wyloo's Giacovazzi was non-committal in retaining Noront's current senior management, if their bid was accepted by Noront shareholders, saying only the Ring of Fire operating team would be a mixture of new and old faces.

"That's how things work," replied Coutts. "Perhaps there's still a role for us going forward.

"But we would still recommend that path and the approach that we've taken."

Ask Alan Coutts what's to become of a proposed ferrochrome processing plant for Sault Ste. Marie and the president of Noront Resources gives a straightaway answer.

"That will ultimately be a question that will be answered by the new owners."

Noront selected Sault Ste. Marie in 2019 is its preferred location for a high-tech smelting operation, settling on a brownfield site at Algoma Steel.

But in the last few months, the Toronto mine developer and holder of the most prime mineral property in the James Bay's Ring of Fire mineral belt has become a takeover target by BHP and Wyloo Metals, the former being arguably the world's biggest mining company.

The two Australian rivals are in the early stages of a bidding war for control of Noront and its Eagle's Nest nickel-copper deposit, 500 kilometres northeast of Thunder Bay. It has an 11-year mine life with the real likelihood to extend it to 20 years.

Both companies are looking to preemptively stake their global turf and gain exposure to nickel, which is used in manufacturing lithium-ion batteries for the coming electric vehicle revolution.

Noront's 156,000-hectare land package hosts eight deposits and hundreds of documented occurrences of nickel, copper zinc, platinum, palladium, gold, titanium, vanadium, diamonds and cobalt. Many of these metals are key ingredients needed for the electric vehicle supply chain, battery storage technology, renewable energy, digital technologies, and various applications in health care, aerospace and defence.

But it was the purity and thickness of high-grade chromite, the dark grey metal discovered practically outcropping at surface in 2007, that first drew widespread attention to the region.

Noront's mining batting order has always been to lead off with Eagle's Nest, starting production in mid-2026, before digging into Blackbird, the first of four chromite deposits, and commission that project by 2028. The Sault plant would be built by then and ready to take the chromite feed.

Those timelines remain in limbo with a bidding war underway for Noront.

Noront's logistics plan involves trucking nickel concentrate down a planned 300-kilometre-long road to Nakina in northwestern Ontario and sent by rail to Sudbury for processing.

The chromite would follow the same path to a ferrochrome plant in the Sault.

About 1,000 to 1,500 construction and supply-related jobs would be created in the city, with 500 permanent plant jobs to follow for a facility that would expand as more chromite deposits come into production based on market demand.

The semi-finished ferrochrome material would be barged down the Great Lakes and Mississippi River to stainless steel manufacturers in the U.S.

Coutts mentioned their concept has been well-received by potential American customers. Most of the chrome material used by the U.S. stainless steel industry is imported from South Africa and Kazakhstan.

"We think it's a very good path forward," said Coutts.

"Ultimately, if someone buys the company they can review that and make their own decisions."

Wyloo chief executive Luca Giacovazzi told Northern Ontario Business in early June that chromite was viewed by the company as more of a "longer term opportunity."

"The focus is on nickel."

Though respectful of the work Noront had put in, Giacovazzi couldn't commit to a Sault-based processing plant. Wyloo would need to do its own technical studies to determine the best site, he said.

Wyloo is a subsidiary company of Tattarang, one of Australia's largest private investment groups. Tattarang is headed by billionaire mining magnate Andrew Forrest, who turned Fortescue Metals into the world's fourth largest iron ore producers in Australia's Pilbara region.

BHP Group is the world's largest iron ore miner with operations in Chile, Peru and western Australia. In 2021, the Melbourne-headquartered cleared US$11.3 billion in profit. The company recently established a copper and nickel exploration office in Toronto to be close to Ontario's battery metals scene.

For whichever mining company acquires Noront, don't expect the chromite to be placed on the backburner.

"Wyloo and BHP are excellent world-class companies on bulk materials like iron ore," said Coutts. "Chromite's like that.

"These guys have a ton of experience developing assets like the chrome and the associated infrastructure, and I don't think they'd have any trouble getting their heads around the opportunity.

"It might not be what attracts them in the first place, but I certainly think they'd pay a lot of attention to the (chromite) assets if they became the owners."

In elected to pursue a ferrochrome plant, Noront really stepped beyond the traditional resource development role of a junior mining company by wanting to make the rare leap to becoming a major mining player.

Coutts, a former Falconbridge executive and trained geologist, spoke confidently in past interviews that it was Noront's ambition to become a mine builder. The Ring of Fire, he said, would be their version of the mineral-rich Sudbury basin, with more than 100 years of ore production.

Noront brought Coutts aboard in 2013. He had been involved in exploration, development and operation of mines in Canada and Australia.

His chief development officer, Steve Flewelling, was hired in 2015. He had worked for Falconbridge's successor company, Xstrata Nickel/Glencore, on mining and smelting projects around the world.

Coutts said the processing space is an area they are very comfortable operating in.

"We like the fact that it was a Canadian company developing the assets," said Coutts, who was at the helm when Cliffs Natural Resources exited the Ring of Fire in 2015.

It provided an opportunity for Noront to acquire their claims and consolidate more ground after other exploration companies followed suit, allowing them to become the leading mine developer in the region, albeit with limited financial resources.

Though labelled a junior miner, Coutts said their approach was that it made the most sense, economically, not only to build the mines and produce the ore, but in the case of chromite, it was within their scope to produce an intermediate product to get a value-added lift.

"Certainly, Steve had a ton of experience with the smelting process both in Sudbury and, internationally in New Caledonia."

Coutts said they felt quite comfortable working with Hatch Engineering on the furnace design and the commissioning of a ferrochrome plant down the road.

Whether Coutts and Flewelling stick around under new ownership to see the fruits of their labour come into production remains to be seen.

In a recent interview, Wyloo's Giacovazzi was non-committal in retaining Noront's current senior management, if their bid was accepted by Noront shareholders, saying only the Ring of Fire operating team would be a mixture of new and old faces.

"That's how things work," replied Coutts. "Perhaps there's still a role for us going forward.

"But we would still recommend that path and the approach that we've taken."

It is almost one hundred years since the publication of V. I. Lenin’s Imperialism: The Highest Stage of Capitalism and Nikolai Bukharin’s Imperialism and World Economy,2 written in the midst of the carnage of World War I. Imperialism was written in the first half of 1916 and published in mid-1917; Imperialism and World Economy was not published until several months later, but it was substantially written in 1915 and very likely influenced Lenin’s own thinking, since he read the book in manuscript and wrote an introduction for it in December 1915 supporting its main analysis.

isreview.org/issue/100/lenin-and-bukharin-imperialism/index.html

No comments:

Post a Comment