Loan caution may give Canadian banks first profit drop since '20

, Bloomberg News Aug 22, 2022

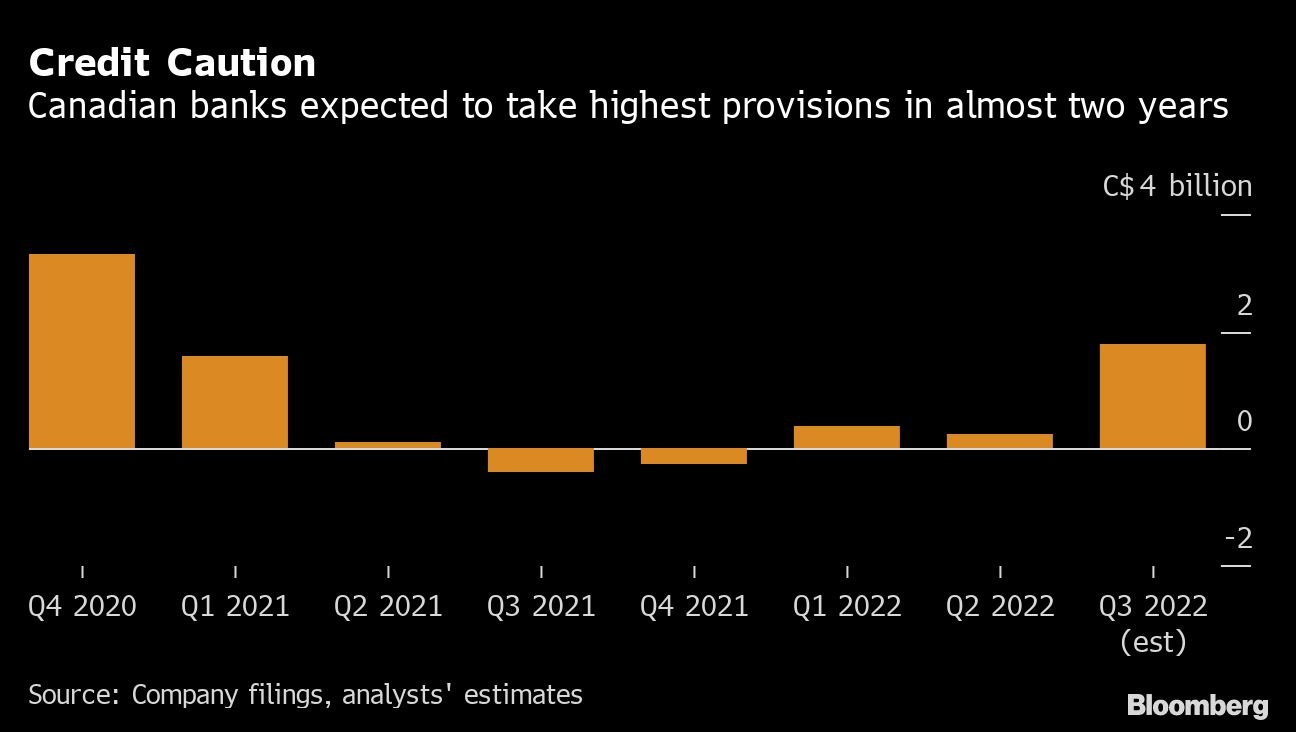

Canada’s six largest banks are expected to report their first decline in earnings in two years as rising economic pessimism spurs them to stockpile more capital to protect against potential loan losses.

Net income for the country’s six largest lenders is expected to fall 4.5 per cent to a combined $14.4 billion (US$11.1 billion) for their fiscal third quarter, according to the average of analysts’ estimates compiled by Bloomberg. It would be the first drop from a year earlier since the same quarter in 2020. Earnings reports start Tuesday, kicked off by Bank of Nova Scotia.

Canada’s banks are facing what Credit Suisse Group AG analyst Joo Ho Kim calls a “dual timeline,” with loan growth strong and rising interest rates making debt more profitable in the near term, but the longer-term outlook clouded by the risk that central banks’ rapid rate increases may lead to a recession that slows growth and causes defaults.

“The outlook forward -- and the uncertainty associated with that -- is what the banks are worried about at this time,” Joo Ho said in an interview. “That impacts the banks in terms of how they manage their balance sheets in terms of allowances and capital.”

Reporting Date:

- Aug. 23, Bank of Nova Scotia

- Aug. 24, Royal Bank of Canada, National Bank of Canada

- Aug. 25, Canadian Imperial Bank of Commerce, Toronto-Dominion Bank

- Aug. 30, Bank of Montreal

That tension between present strength and future concerns is evident in the divergence between analysts’ projections for the banks’ profit including provisions for credit losses, and for earnings excluding those set-asides. While Joo Ho expects a 2 per cent decline in the Big Six banks’ core earnings per share for the third quarter, he’s forecasting a 6 per cent gain in pretax, pre-provision profit.

The banks’ set-asides for credit losses in the quarter ended July 31 are expected to swell to $1.71 billion, according to the estimates. That’s more than six times the amount in the previous quarter and a swing from $409 million in releases a year earlier.

Still, the banks’ third-quarter results are expected to show net interest margins receiving a “nice lift” from higher rates while continued strong loan growth may put net interest income at or near a peak, Paul Holden, an analyst at Canadian Imperial Bank of Commerce, said in a note to clients.

Net interest income -- the difference between what banks earn from loans and what they pay out in deposits -- is expected to be up 3.7 per cent from the second quarter, according to analysts’ estimates.

“Loan growth remains strong for now, however we expect a deceleration of growth in the coming quarters as demand for credit tempers with higher borrowing costs and a slowing economy,” Holden wrote.

The eight-company S&P/TSX Commercial Banks Index has fallen 6.4 per cent this year, while the broader S&P/TSX Composite Index is down 5.2 per cent .

While lending remains robust, the banks’ capital-markets units likely took a hit last quarter as plunging stock prices froze the market for initial public offerings and other share sales. Still, the quarter’s turbulent markets may have spurred gains in trading revenue to counter declining investment-banking fees.

“Investment-banking activities have ground to a halt,” Gabriel Dechaine, an analyst at National Bank of Canada, told clients. “However, as US bank results showed us, we could still see strong trading-revenue growth.”

The trajectory of expenses will be another focus in this week’s reports. With Canada’s labor market historically tight, lenders including CIBC, Royal Bank of Canada and Bank of Nova Scotia have been boosting pay for workers. With salaries and benefits accounting for more than half of most banks’ non-interest expenses, those cost pressures could start to eat into the companies’ bottom lines.

Non-interest expenses are expected to be up 0.4 per cent from the second quarter and 3.7 per cent from a year earlier, analysts estimate.

“While the ongoing economic recovery and increased business activity will continue to driver higher discretionary spend, the banks also highlighted that inflationary pressures are also anticipated to spur higher salaries and benefits,” John Aiken, an analyst at Barclays Plc, wrote in the note to clients. “After holding expenses largely in check over the past couple of quarters, we anticipate expenses will edge higher through the second half of the year.”