New York (AFP) - Sam Bankman-Fried, founder of the collapsed cryptocurrency exchange FTX, parried with a federal prosecutor on Thursday in high-stakes legal jousting at his criminal fraud trial that seemed to frustrate the judge.

Bankman-Fried was scheduled to take the witness stand after three weeks of devastating testimony for the 31-year-old crypto wunderkind, accused of stealing billions of dollars from clients.

But federal Judge Lewis Kaplan took the unusual step of sending the jury home Thursday and listening to Bankman-Fried, his defense lawyers and a prosecutor go over technical aspects of his upcoming testimony.

The move pushed Bankman-Fried's appearance before the jury back until at least Friday.

Bankman-Fried, once one of the most respected figures in crypto, has been charged with seven counts of fraud, embezzlement and criminal conspiracy.

If convicted, he could face a de facto life sentence of more than 100 years in prison.

Thursday's hearing initially seemed confined to points of detail, but assistant US Attorney Danielle Sassoon soon found Bankman-Fried, known widely as SBF, offering evasive answers, drawing a pointed remark from the judge.

She asked Bankman-Fried about business practices, specifically whether any internal document laid out how Alameda Research, his personally owned trading company, could use funds placed in FTX, which he could not fully answer.

Initially calm, Bankman-Fried grew visibly surprised and delivered evasive answers.

"The defendant has an interesting way of answering questions," Judge Kaplan said.

At another moment, Bankman-Fried would not make it clear whether he knew that Alameda owed money to FTX, or that the investment company enjoyed preferential treatment over other clients.

Throughout the hearing, Bankman-Fried's lawyer, Mark Cohen, suggested that the questions went beyond the scope of a technical hearing, but the judge did not intervene.

"Our position is that the use of funds was not improper and that our client didn't believe it was improper," Cohen said.

For his part, Bankman-Fried repeatedly challenged Sassoon's formulation that Alameda used FTX customer funds to invest.

At the time of FTX's bankruptcy in November 2022, some $8.7 billion was unaccounted for. Most of the funds have since been recovered by liquidators and should be paid out to customers in early 2024.

Bankman-Fried has blamed former colleagues for FTX's sudden collapse.

But key witnesses in recent weeks, all former FTX or Alameda employees, refuted his account.

Supported by internal documents compiled by the prosecution, they said he was behind the breaches and did not lose sight of the financial situation of FTX and Alameda.

Ex-girlfriend offers damning evidence

Among those taking the stand was Caroline Ellison, Bankman-Fried's former business partner and girlfriend.

She offered damning evidence against him and delivered details on his management, saying he was involved in all major decisions.

Ellison, a Stanford University mathematics graduate, was appointed by Bankman-Fried in 2021 to head Alameda, whose activities were largely financed by money from customers of FTX without their knowledge.

She has pleaded guilty to fraud charges and agreed to cooperate with the prosecution, as have two other close associates of Bankman-Fried.

Bankman-Fried's decision to testify in his own defense is unusual in a country where criminal defendants generally decline to do so because they have to face cross-examination and run the risk of incriminating themselves.

Hollywood producer Harvey Weinstein, comedian Bill Cosby, singer R. Kelly and drug trafficker Joaquin "El Chapo" Guzman were among high-profile defendants who declined to testify at their recent trials.

© Agence France-Press

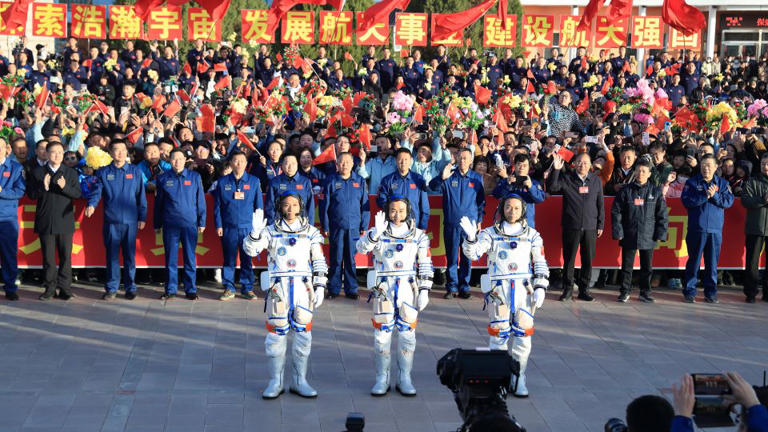

Sam Bankman-Fried, the founder of bankrupt cryptocurrency exchange FTX, arrives at court as lawyers push to persuade the judge overseeing his fraud case not to jail him ahead of trial, at a courthouse in New York, U.S., August 11, 2023.

By Luc Cohen and Jody Godoy

NEW YORK (Reuters) -Federal prosecutors rested their case against FTX founder Sam Bankman-Fried on Thursday after presenting 12 days of testimony in which former colleagues at the now-bankrupt cryptocurrency exchange said he directed them to divert customer funds to his hedge fund and lie to investors and lenders.

That paves the way for the defense to begin presenting its case in the fraud trial. Defense lawyer Mark Cohen said in a court hearing on Wednesday that Bankman-Fried would testify, a risky move that would give prosecutors the chance to cross-examine the 31-year-old former billionaire about testimony from former close colleagues that he directed them to commit crimes.

The final prosecution witness, FBI agent Marc Troiano, testified about Bankman-Fried's use of the encrpyted messaging application Signal when the trial resumed on Thursday morning in federal court in Manhattan after a week-long break.

Troiano said Signal groups that Bankman-Fried was in with colleagues often were set to delete messages automatically, as jurors saw screenshots from a phone belonging to Caroline Ellison, the former chief executive of Bankman-Fried's Alameda Research hedge fund and his on-and-off girlfriend.

Ellison testified earlier in the trial that Bankman-Fried directed employees to "be careful with what we put in writing, and not put into writing something that could get us into legal trouble."

Cohen said on Wednesday the defense plans to call three brief witnesses before Bankman-Fried takes the stand.

Bankman-Fried has pleaded not guilty to two counts of fraud and five counts of conspiracy. If convicted, Bankman-Fried could face decades in prison. Prosecutors have said Bankman-Fried used the misappropriated funds to prop up his crypto-focused hedge fund, Alameda Research, make speculative venture investments, and donate more than $100 million to U.S. political campaigns.

Legal experts have said Bankman-Fried has little to lose by bucking conventional wisdom and testifying, given weeks of testimony against him by insiders painting an unflattering portrait of his character.

He has already taken an unusual approach for a criminal defendant. Instead of laying low after he was charged, he published blog posts on his view of what went wrong and met with several journalists.

Bankman-Fried has maintained that while he made mistakes running FTX, he never intended to steal funds. His lawyers have said three of his former colleagues, who have pleaded guilty and agreed to cooperate with prosecutors, tailored their testimony to implicate Bankman-Fried in the hopes of receiving lenient sentences.

Cohen in a Wednesday evening court filing told U.S. District Judge Lewis Kaplan he wanted to ask Bankman-Fried about FTX lawyers' involvement in structuring loans from Alameda to FTX executives, which prosecutors have said was a key way the defendant and others took funds from unwitting customers.

But Cohen said Bankman-Fried's "knowledge that lawyers were involved in structuring and documenting the loans would be probative of his good-faith belief that there was nothing inappropriate."

Prosecutors may ask Bankman-Fried about why he did not disclose Alameda's privileges to FTX customers or equity investors, and why he posted on social media in the midst of a wave of customer withdrawals last November that FTX was "fine" when he knew it was short billions of dollars in funds.

In the letter, Cohen said Bankman-Fried reserves the right to decide not to testify.

Cohen said on an earlier conference call the defense could finish presenting its case by Friday, paving the way for closing arguments and jury deliberations next week.

(Reporting by Luc Cohen in New York; Editing by Will Dunham, Noeleen Walder and Jonathan Oatis)