Plan Approved to Turn SS United States into World’s Largest Artificial Reef

The famed ocean liner s.s. United States is one step closer to becoming the world’s largest artificial reef as the purchase of the vessel was approved by the Okaloosa County Board of County Commissioners in Florida today. They have agreed to pay $1 million to acquire the vessel and expect to close on the acquisition in the coming days or weeks.

The sale of the ship ends a 55-year effort to determine her fate after she was retired from passenger service in 1969. A non-profit, the SS United States Conservancy has owned her since 2011 exploring opportunities to repurpose the ship. They decided after being ordered to vacate their current pier in Philadelphia that reefing the ship was preferable to scrapping.

“The Conservancy explored a number of other options prior to coming to the artificial reef decision,” Alex Fogg, Natural Resources Chief for Okaloosa Country told the board in his presentation. He had previously said the country was looking at the ship for two years as part of its plan to enhance tourism and attract the dive community to the area around Destin – Fort Walton Beach, in Florida’s panhandle region.

“They (SS United States Conservancy) looked at making this potentially a pier-side entertainment center, apartments, restaurants, and a bunch of different options. The costs were very, very expensive and they weren’t able to find an investor that would follow through with that option,” said Fogg.

The acquisition remains contingent on resolving a court-ordered mediation in Philadelphia between the current owners and Penn Warehousing, which operates the pier. In the briefing for the country board, it says a tentative agreement calls for the country to assume the rent payments at $3,400 per day as of September 12 and a $50,000 initial upfront payment. They will also pay a portion of the expected repairs to the pier and agreed to a $100,000 penalty if the ship is not removed by December 12.

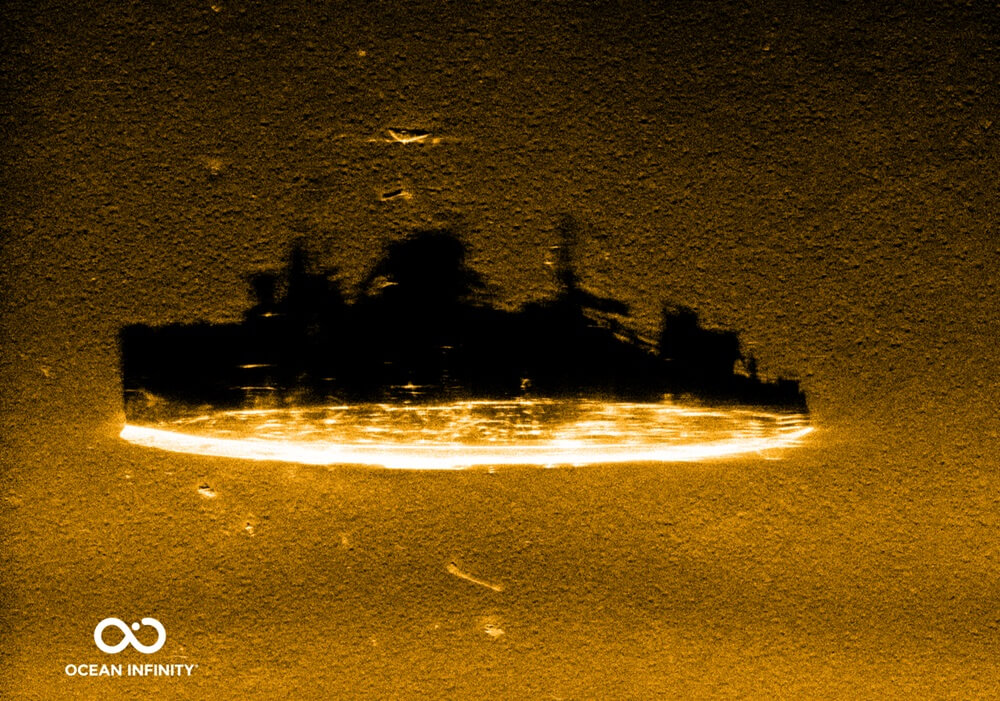

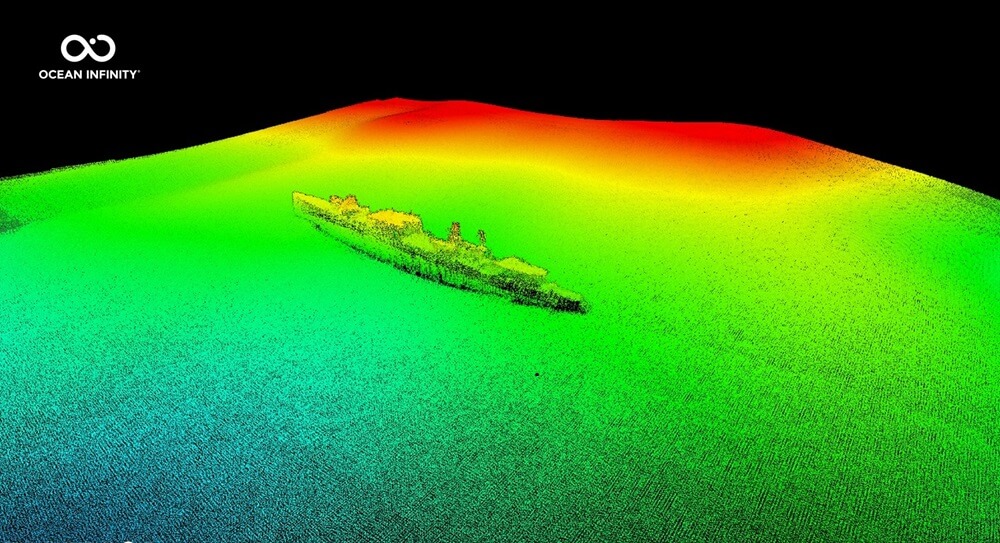

Today’s vote authorized the purchase contract to proceed along with a conservative budget of $10 million. Once taking title, the plan calls for the s.s. United States to be towed to Norfolk, Virginia for remediation. This includes removing fuel from her tanks, cleaning the tanks, scraping paint and loose material, removing PCBs, flooring, windows, portholes, and other contaminants.

The vessel will lose her distinctive profile as the two massive funnels will be removed, with at least one stored for possible display at a future museum. Also, the mast will be removed. The county expects it will spend approximately $5 million with the remainder coming from private partners. It will take an estimated 180 to 230 days to prepare the ship.

The county justifies the project citing a potential $3 million annual economic benefit from the reefing project. While the final position has not been determined, the plan is to have the ship at a depth so that the upper deck would be accessible to novice and beginning divers and the lower area to technical divers.

Long-term supporters of the ship consider it a tragic end to one of the most iconic symbols of American technology and the heyday of Atlantic travel. The county refers to the ship as the “pinnacle of American post-war maritime engineering.” Last-minute appeals to save the ship were unsuccessful.

The Conservancy says the loss of the dock in Philadelphia forced its hand. Without a development partner, unable to secure a new berth, and facing significant costs they were forced to seek a buyer. They, however, highlight that Okaloosa County agreed to provide $1 million to help establish a museum about the ship which will tell the story. In addition to the funnels, they have agreed to remove from the ship a propeller, the builder’s plate, and other significant elements for possible use in the museum.

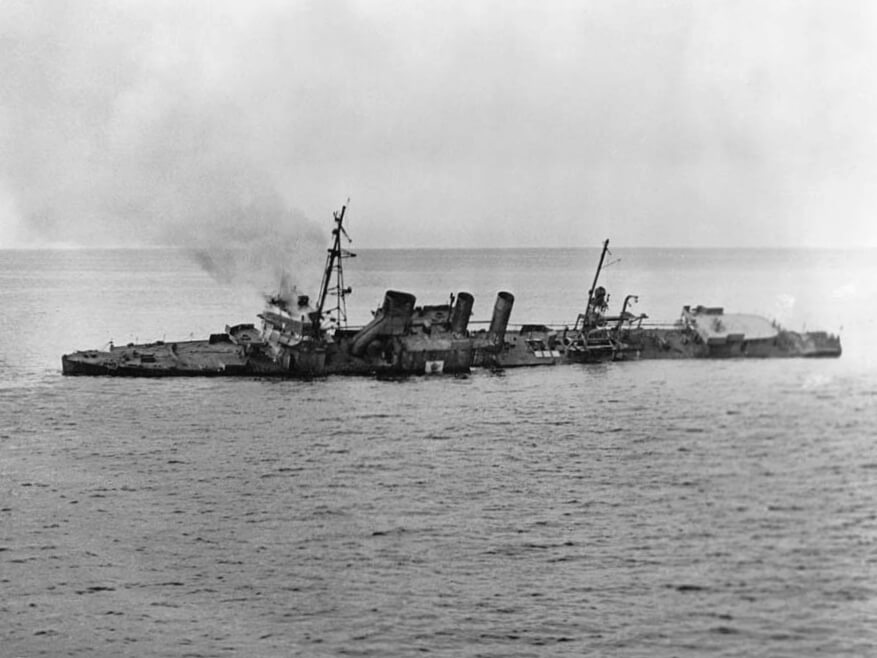

Completed in 1952, the s.s. United States was the fastest ocean liner traveling during her trials at a reported speed of over 38 knots, while many believe she achieved 40 knots or more during trials. During her service career, she never ran at full speed, including during her record-breaking maiden voyage. Her construction was heavily subsidized by the U.S. Government with the promise she could be quickly converted to carry 14,000 troops 10,000 miles without refueling. Designed by America’s foremost naval architect, William Francis Gibbs, she used technology similar to U.S. warships giving her power and speed as well as the highest level of safety features. Gibbs, fearful of fire at sea, also insisted the vessel be outfitted with no wood aboard in the passenger areas.

The s.s. United States was in commercial service for just 17 years mostly making Atlantic crossings and in the 1960s added a few cruises to her annual program. With competition growing from jets and the loss of a U.S. contract to transport military families and diplomats, the ship was losing money and retired in 1969. Acquired and later sold by the U.S. government, a series of owners looked for ways to reactivate the ship or convert her into a shoreside attraction. She becomes the first ocean liner to be purposefully sunk to become a reef. Deployment is projected for 2025 or 2026.