Texas is actively pursuing the development of advanced nuclear reactors to meet its increasing energy demands, with significant investments and legislative support.

Companies like Natura Resources and Kairos Power are leading the way in building and testing new reactor designs, which offer improved safety and efficiency compared to traditional nuclear technology.

Texas A&M University is establishing an "Energy Proving Ground" to host multiple commercial advanced reactors, aiming to become a hub for nuclear energy innovation.

The small West Texas city of Abilene is better known for country music and rodeos than advanced nuclear physics. But that's where scientists are entering the final stretch of a race to boot up the next generation of American atomic energy.

Amid a flurry of nuclear startups around the country, Abilene-based Natura Resources is one of just two companies with permits from the U.S. Nuclear Regulatory Commission to construct a so-called "advanced" reactor. It will build its small, one megawatt molten salt reactor beneath a newly-completed laboratory at Abilene Christian University, in an underground trench 25 feet deep and 80 feet long, covered by a concrete lid and serviced by a 40-ton construction crane.

The other company, California-based Kairos Power, is building its 35 megawatt test reactor in Oak Ridge, Tennessee, the 80-year capital of American nuclear power science. Both target completion in 2027 and hope to usher in a new chapter of the energy age.

"A company and school no one has heard of has gotten to the forefront of advanced nuclear," said Rusty Towell, a nuclear physicist at Abilene Christian University and lead developer of Natura's reactor. "This is going to bless the world."

The U.S. Department of Energy has been working for years to resuscitate the American nuclear sector, advancing the development of new reactors to meet the enormous incoming electrical demands of big new industrial facilities, from data centers and Bitcoin mines to chemical plants and desalination facilities.

Leaders in Texas, the nation's largest energy producer and consumer, have declared intentions to court the growing nuclear sector and settle it in state. The project at Abilene Christian University is just one of several early advanced reactor deployments already planned here.

Dow Chemical plans to place small reactors made by X-energy at its Seadrift complex on the Gulf Coast. Last month, Natura announced plans to power oilfield infrastructure in the Permian Basin. And in February, Texas A&M University announced that four companies, including Natura and Kairos, would build small, 250 megawatt commercial-scale reactors at a massive new "proving grounds" near its campus in College Station.

"We need energy in Texas, we need a lot of it and we need it fast," said state Sen. Charles Perry, chairman of the Senate Committee on Water, Agriculture and Rural Affairs. "The companies that are coming here are going to need a different type of energy long term."

During this year's biennial legislative session, state lawmakers are hoping to make billions of dollars of public financing available for new nuclear projects, and to pass other bills in support of the sector.

"If we do what we're asked to do from industry groups out here, if we do what we think we should do and we know we should do, we could actually put a stake in the ground that Texas is the proving ground for these energies," Perry said, speaking this month in the state capitol at a nuclear power forum hosted by PowerHouse Texas, a nonprofit that promotes energy innovation.

But, he added, "Texas is going to have to decide: At what level of risk is it prudent for taxpayer dollars to be risked?"

The first new reactors might be commercially ready within five years, he said; most are 10 to 20 years away.

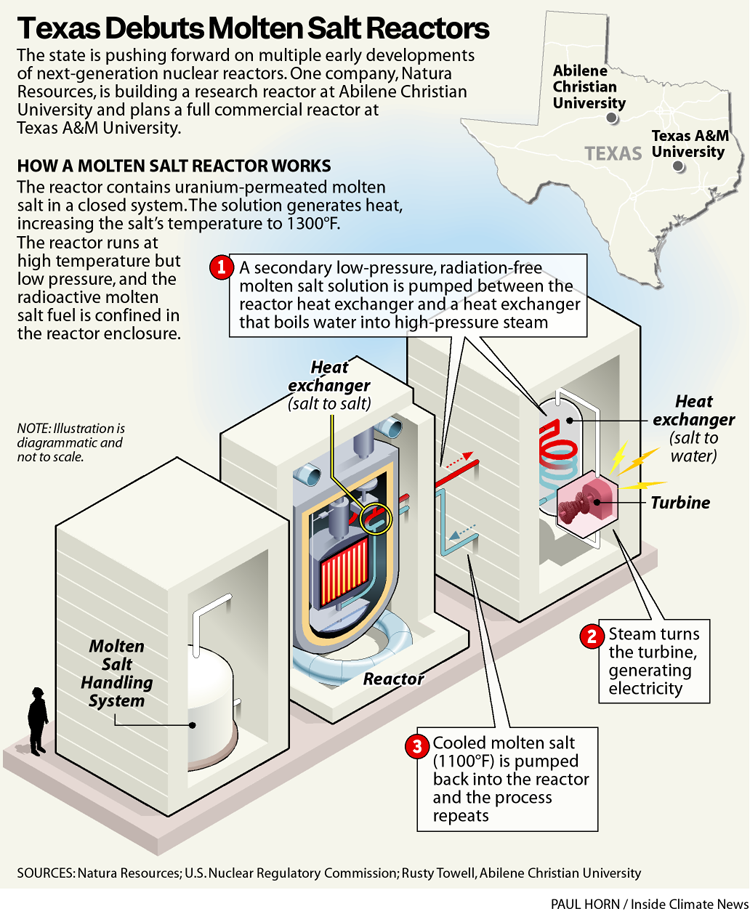

Dozens of proposed new reactor designs promise improved efficiency and safety over traditional models with less hazardous waste. While existing nuclear reactors use cooling systems filled with water, so-called "advanced" reactor designs use alternatives like molten salt or metal. It enables them, in theory, to operate at a higher temperature and lower pressure, increasing the energy output while decreasing the risks of leaks or explosions.

"Texas is going to have to decide: At what level of risk is it prudent for taxpayer dollars to be risked?" — State Sen. Charles Perry

Before it can be built, each design is extensively reviewed by the Nuclear Regulatory Commission in a yearslong process to ensure they meet safety requirements.

"We understand how much work we're facing and getting that done means finding every appropriate efficiency in our reviews," said Scott Burnell, public affairs officer for the NRC.

The commission is also reviewing a permit application by Washington-based TerraPower, founded by Bill Gates in 2006, to build a full commercial nuclear power plant in Wyoming. It expects to receive a construction permit application for the X-energy reactor at Dow in Texas this year, Burnell said.

After construction, the companies will require a separate permit to operate their projects. None have sought an operating license for an advanced nuclear reactor, but Natura plans to file its application this year.

For Towell, an Abilene native and the son of two ACU faculty members, this moment was a decade in the making. In 2015 he founded the NEXT Lab at ACU for advanced nuclear testing, got a $3 million donation from a wealthy West Texas oilman in 2017, entered into partnership with the Energy Department in 2019 and formed the company Natura in 2020. Construction finished in 2023 on NEXT's shimmering new facility. And in 2024, the NRC issued a permit to build the first advanced reactor at an American university.

What are Advanced Nuclear Reactors?

Towell, a former instructor at the U.S. Naval Nuclear Power School, said these new projects represent the first major advancement in American nuclear power technology in 70 years. While layers and layers of safety systems have been added, the basic reactor design has remained unchanged.

It uses a cooling system of circulating water to avoid overheating, melting down and releasing its radioactive contents into the atmosphere. The system operates at extremely high pressure to keep the water in liquid state far above its boiling point. If circulation stops due to power loss or malfunction, a buildup of pressure can cause an explosion, as it did at the Fukushima Daiichi nuclear plant in Japan in 2011.

In contrast, new "advanced" reactor designs use alternatives to water for cooling, like liquid metal or special gases.

Natura's design, like many others, uses molten salt. It's not table salt but fluoride salt, a corrosive, crystalline substance that melts around 750 degrees Fahrenheit and remains liquid until 2,600 degrees under regular pressure.

As a result, the reactor can operate at extremely high temperatures without high pressure. If the system ruptures, it won't jettison a plume of steam, but instead leak a molten sludge that hardens in place.

"It doesn't poof into the air and drift around the world," Towell said. "It drips down to a catchpan and freezes to a solid."

Rather than solid fuel rods, Natura's design also uses a liquid uranium fuel that is dissolved into the molten coolant. According to Towell, a former research fellow at Los Alamos National Laboratory, that decreases the amount of radioactive waste produced by the reactor and makes it easier to recycle.

The Kairos reactor design uses molten salt coolant with hundreds of thousands of uranium fuel "pebbles," while the X-energy design uses fuel pebbles with a gas coolant.

Critically, many new reactor designs are also small and modular. Instead of massive, custom construction projects, they are meant to be built in factories with assembly line efficiency and then shipped out on truck trailers and installed on site. That will allow large industrial facilities or data centers to operate their own power sources independent from public electrical grids.

Natura president Doug Robison, a retired oil company executive who worked 13 years as an ExxonMobil landman, said small reactors could run oilfield infrastructure in the Permian Basin, from pumpjacks to compressor stations.

"By powering the oil and gas industry, which uses a tremendous amount of power for their operations, we're helping alleviate the grid pressure," he said.

He also wants to power new treatment plants for the enormous quantities of wastewater produced each day in the Permian Basin. In January, Natura announced a partnership with the state-funded Texas Produced Water Consortium at Texas Tech University aimed at using small reactors to purify oilfield wastewater, most of which is currently pumped underground for disposal.

"It Always Gets Back to the Funding"

The new reactor projects fit into plans by state leaders to establish Texas as a global leader of advanced nuclear reactor technology. In 2023, Gov. Greg Abbott directed the state's Public Utility Commission to study the question and produce a report.

"Texas is well-positioned to lead the country in the development of ANRs," said the 78-page report, issued late last year. "Texas can lead by cutting red tape and establishing incentives to accelerate advanced nuclear deployment, overcome regulator hurdles and attract investment."

The report made several recommendations, and state lawmakers this year have already filed bills to enact several of them, including the creation of a Texas Advanced Nuclear Authority and a nuclear permitting officer. Most significantly, the report also recommended two new public funds to support nuclear energy deployment, including one modeled after the Texas Energy Fund, which was created in 2023 and made $5 billion in financing available for new gas power plants.

"When I talk to folks, it always gets back to the funding," said Thomas Gleeson, chairman of the Public Utility Commission, during the PowerHouse forum. "All of those issues are somewhat ancillary to: How are we going to fund this?"

Gleeson said developers will expect the state to put up at least $100 million per project through public-private partnerships in order to help reduce financial risk.

"Given the load growth in this state that we're projecting, if you want clean air and you want a reliable grid, you have to be in favor of nuclear," he said.

Critics of the plan oppose the use of public money on private projects and worry about safety.

"We don't use tax dollars to fund a bunch of experimental and pie-in-the-sky designs that should be the responsibility of private industry," said John Umphress, a retired Austin Energy program specialist who is evaluating the nuclear efforts on contract for the consumer advocacy group Public Citizen. "Nobody has really penciled out the cost because there's still a lot of proof of concept that's going to have to be pursued before these things get built."

Umphress raised concerns over materials in development to withstand the astronomical temperatures and extremely corrosive qualities of molten salt coolants.

He also noted that the U.S. still lacks a permanent repository for nuclear waste following decades of unsuccessful efforts. Most waste today is stored on site in specialized interim facilities at nuclear power plants, which wouldn't be possible if small reactors were deployed to individual industrial projects.

"That's the big issue that we still haven't solved, but it's not stopping some of these developers from pushing forward with their designs," he said. "They're hoping the federal government will take ownership of the waste and be responsible for its storage and disposal."

During the PowerHouse forum, officials expressed hope that the private sector would develop a solution after new reactor projects create demand for waste disposal.

The Energy Proving Ground

Those reactor projects are still many years away. So far, the NRC has only authorized advanced reactor construction for university research. Next it will issue permits for larger commercial reactors before they can be deployed.

Perhaps the largest early deployment of commercial advanced reactors is set to take place at Texas A&M University. In February, the school announced that four companies had committed to install their commercial reactor designs at a new 2,400-acre "Energy Proving Ground" near its College Station campus.

The site is an old Army air base, currently home to vehicle crash test facilities and an advanced warfare development complex.

The university will build infrastructure there and help streamline permitting for the reactor projects, said Joe Elabd, vice chancellor for research at the Texas A&M System. The university is requesting $200 million in state appropriations to help develop the site, he said.

"We're providing a little bit more of a plug-and-play site for these companies, as opposed to them going to a true greenfield and having to do everything for themselves," he said.

Reactors on the site will be connected to Texas' electrical GRID, Elabd said.

A&M began seeking proposals from companies to build at the site last August, and a panel of university experts selected the four finalists, which include Natura and Kairos.

A Kairos spokesperson, Christopher Ortiz, said the company is building a manufacturing facility in Albuquerque, New Mexico, which will produce the reactors deployed to Texas A&M. He said the company is currently working to identify sites for future commercial reactors, evaluating factors like workforce availability, existing infrastructure and community support.

"The Texas A&M site presents a unique opportunity to site multiple commercial power plants in one location, which makes it particularly attractive," he said.

The site will also include Terrestrial Energy, a Canadian company. And it will include Aalo Atomics, a two-year-old investor-funded startup that is currently building a 40,000-square-foot reactor factory in Austin, which it plans to unveil in April.

More than modular reactors, Aalo plans to produce entire modular power plants, called Aalo Pods, including several reactors, a turbine and a generator, which are designed to be installed at data centers.

"It's made in the factory, shipped to the site and assembled like Legos," said Aalo CEO Matt Loszak.

He estimated five to 10 years for deployment at the A&M site but said that depended on continued financial support from investors. Aalo is developing its reactor design at the Department of Energy's Idaho National Laboratory, a 70-year-old national nuclear research center.

But Loszak, a former software engineer from Canada, decided to locate his factory in Texas, he said, to be close to massive incoming energy demands and to take advantage of the state's business-friendly approach to regulation.

"Politicians here are really pro-nuclear, they want to see nuclear get built, and that's not the case in other places across the country," he said. "From a regulatory and permitting perspective, it's a great place to build stuff."

Authored by Dylan Baddour of Inside Climate News via Zerohedge.com