PRELUDE TO BREAD RIOTS

Surging Wheat Prices to Spur Canada Farmers to Sow More Acres

, Bloomberg News

(Bloomberg) -- The historic surge in wheat prices is expected to spur Canadian farmers to sow more acres.

Acres of spring wheat in Canada, one of the world’s top exporters, could rise 2% to 3% in 2022 as soaring prices encourage growers to shift acres from oats, pulses and durum, said Neil Townsend, chief market analyst at FarmLink in Winnipeg, Manitoba.

Russia’s invasion of Ukraine is hindering shipments from one of the world’s vital breadbaskets, leaving grain importers scouring for supplies elsewhere.

“The spring wheat market is on a tear,” said Stephen Vandervalk, vice president of Alberta for the Western Canadian Wheat Growers. “There’s no doubt that this price increase that’s happening now will affect seeding.”

There’s Not Enough Extra Canadian Wheat to Fill Global Shortfall

The potential boost in wheat acreage comes amid lingering concerns about dry conditions in Canada. Drought zapped as much of 40% of Western Canada’s grain output last year and swaths of Alberta and Saskatchewan remain under extreme drought conditions, according to the Canadian Drought Monitor.

Stockpiles are insufficient to support additional wheat exports from Canada until growers harvest a new crop. While parts of major growing areas remain dry, spring wheat is able to handle drought better than other crops, Vandervalk said.

©2022 Bloomberg L.P.

‘Ludicrous’ Wheat Fuels Investor Frenzy and

Farmer Angst

, Bloomberg

(Bloomberg) -- Wheat’s biggest weekly surge ever is prompting investors to rush toward the amber grain while nervous U.S. farmers worry about missing out.

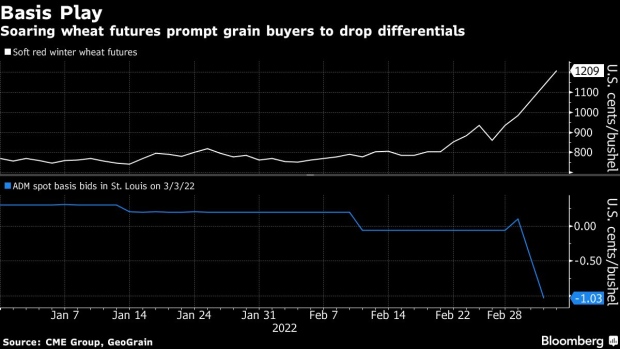

Wheat prices are diverging in some local markets, with the differential between cash prices and benchmark futures on the Chicago exchange plummeting as wheat buyers balk at the highest prices since 2008. That’s potentially sidelining farmers who are already contending with the worst farm cost inflation in years.

“This crazed cash market scenario we are seeing because of the war is hurting farmers’ ability right now to market their old and even new crop wheat,” said Mary Kennedy, an analyst at agriculture publisher DTN Progressive Farmer. Some growers say their bids have been pulled from grain elevators, she said.

Money managers reduced short positions by 11,017 contracts of futures and options in the week ended March 1, marking the least bearish position in almost three months, according to Commodity Futures Trading Commission data.

In a sign of how hot the wheat market is getting, the Teucrium Wheat Fund has gone from about $91 million in net assets early last week to $207 million Thursday, according to Teucrium.

Retail investors are piling in as benchmark wheat futures in Chicago have risen 50% in two weeks, with the market soaring higher after Russia invaded Ukraine.

“Wheat futures are in ludicrous mode, there is no other way to say it,” said Matt Campbell, a risk management consultant at StoneX. “Futures and cash are diverging sharply. This is a very scary marketplace right now.”

(Adds latest fund data in fourth paragraph; ETF flow in fifth.)

©2022 Bloomberg L.P.

No comments:

Post a Comment