After heist, Lebanese activists promise more bank raids

By KAREEM CHEHAYEB

FILE - A Lebanese policeman stands guard next to a bank window that was broken by depositors to exit the bank after attacking it trying to get blocked money, in Beirut, Lebanon, Wednesday, Sept. 14, 2022. A Lebanese activist group said they will continue to organize bank raids to help people retrieve their trapped savings. Activists from the Depositors' Outcry group made these remarks at a press conference on Thursday, after activists helped Sali Hafez retrieve $13,000 in her savings to help fund her sister's cancer treatment on Wednesday. (AP Photo/Hussein Malla, File)

BEIRUT (AP) — A Lebanese activist group on Thursday vowed to organize more bank heists to help people retrieve their locked savings as the country’s years-long economic crisis continues to worsen.

Activists from Depositors’ Outcry group accompanied Sali Hafez into a Beirut bank branch on Wednesday, and she was able to retrieve some $13,000 in her savings to fund her sister’s cancer treatment.

Hafez carried a toy gun when she walked into BLOM Bank on Wednesday, while the activists who accompanied her poured about gasoline, threatening to set the bank on fire if she did not get her money out.

The group told The Associated Press that they had also coordinated with a man who tried to take some of his money from a bank in the mountainous town of Aley. Local media said he carried an unloaded shotgun.

Lebanon’s cash-strapped banks have imposed strict limits on withdrawals of foreign currency since 2019, tying up the savings of millions of people. About three-quarters of the population has slipped into poverty as the tiny Middle East country’s economy continues to spiral.

Alaa Khorchid, the head of Depositors’ Outcry, said there is now no other choice for Lebanese bank depositors but to “take matters into their own hands.” He spoke at a press conference in Beirut.

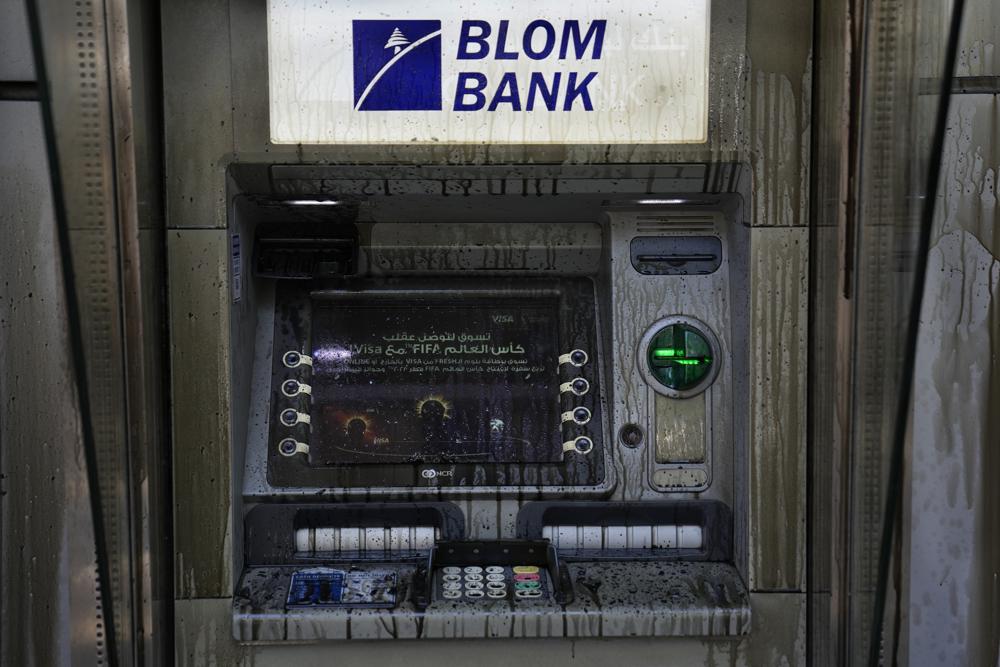

An ATM is covered with diesel fuel after it was vandalized by angry depositors who attacked a bank, in Beirut, Lebanon, Wednesday, Sept. 14, 2022.

Lebanese policemen enter a bank from a window that was broken by depositors to exit the bank after trying to get their money, in Beirut, Lebanon, Wednesday, Sept. 14, 2022.

“And we’re organizing more than this, and you have no choice. People’s rights are sacred,” he added, addressing banks in general.

“The real beginning of the revolution started yesterday, when Sali Hafez entered the bank, and there is no turning back,” Ibrahim Abdullah, a member of the Depositors’ Outcry group said at the press conference. “This revolution is against all the banks.”

Several groups advocating and protesting for Lebanese depositors have emerged since 2019, with some — like the one named the Depositors’ Union — opting to file lawsuits against banks to help depositors retrieve their money.

Wednesday’s heist occurred weeks after a food delivery driver broke into another bank branch in Beirut and held 10 people hostage for seven hours, demanding tens of thousands of dollars in his trapped savings. Many Lebanese hailed him as a hero.

The standoff and public sympathy for those taking matters into their own hands to get their savings has exposed the depths of people’s despair in Lebanon’s economic crisis, which has pulled over three-quarters of the country’s population into poverty, unable to cope with skyrocketing food, electricity, and gasoline prices.

Meanwhile, Lebanese officials struggle to implement structural reforms for an economic recovery plan approved by the International Monetary Fund to unlock billions of dollars in loans and aid to make the country viable again.

Depositors hold up two Lebanese banks to grab their own money

BEIRUT, Sept 14 (Reuters) - Two seemingly armed and desperate Lebanese depositors held up banks on Wednesday to force access to their own money, which has been blocked during a national financial meltdown.

One woman with a gun and some associates briefly held hostages at a branch of BLOM Bank (BLOM.BY) in the capital Beirut, before leaving with more than $13,000 in cash from her account, a source from a depositors' advocacy group said.

Shortly afterwards, in the mountain city of Aley, an armed man entered a Bankmed branch and retrieved some of his trapped savings, before handing himself into authorities, the Depositors Outcry and a security source said.

Lebanon's banks have locked most depositors out of their savings since an economic crisis took hold three years ago, leaving much of the population unable to pay for basics.

In a phenomenon illustrating the plight, Wednesday's holdups came after a man last month held up another Beirut bank to withdraw funds to treat his sick father. read more

BLOM Bank said a customer and accomplices arrived with a gun, threatened to set people on fire, and forced the branch manager and treasurer to bring money from a safe.

BEIRUT, Sept 14 (Reuters) - Two seemingly armed and desperate Lebanese depositors held up banks on Wednesday to force access to their own money, which has been blocked during a national financial meltdown.

One woman with a gun and some associates briefly held hostages at a branch of BLOM Bank (BLOM.BY) in the capital Beirut, before leaving with more than $13,000 in cash from her account, a source from a depositors' advocacy group said.

Shortly afterwards, in the mountain city of Aley, an armed man entered a Bankmed branch and retrieved some of his trapped savings, before handing himself into authorities, the Depositors Outcry and a security source said.

Lebanon's banks have locked most depositors out of their savings since an economic crisis took hold three years ago, leaving much of the population unable to pay for basics.

In a phenomenon illustrating the plight, Wednesday's holdups came after a man last month held up another Beirut bank to withdraw funds to treat his sick father. read more

BLOM Bank said a customer and accomplices arrived with a gun, threatened to set people on fire, and forced the branch manager and treasurer to bring money from a safe.

'NOTHING MORE TO LOSE'

Before going into hiding, the woman, Sali Hafiz, told local news channel Al Jadeed TV the gun was a toy and that she needed the money for her sister's cancer treatment.

"I have nothing more to lose, I got to the end of the road," she said, saying a visit to the bank manager two days previously had not provided an adequate solution.

"I got to a point where I was going to sell my kidney so that my sister could receive treatment."

BLOM confirmed the customer had been in to seek her money for her sister's treatment, saying she was offered total cooperation and requested to provide documentation.

"All we have is this money in the bank. My daughter was forced to take this money - it's her right, it's in her account - to treat her sister," her mother Hiam Hafiz told local TV.

Authorities did not immediately comment on the incidents.

Bankmed did not comment on its branch holdup.

Following last month's holdup, which also involved hostages, the accused perpetrator was arrested but then released without charge after the bank dropped its lawsuit.

One senior Lebanese banker, speaking on condition of anonymity, told Reuters it was a worrying precedent,

"I think this is an invitation for other people to do the same. As long as people get away with it, they will continue. What a failed state," the banker said.

Banks say they make exceptions for humanitarian cases including hospital care, but depositors say that rarely happens.

Reporting by Timour Azhari, Laila Bassam and Issam Abdallah; Writing by Maya Gebeily Editing by Frank Jack Daniel, Alexandra Hudson and Andrew Cawthorne.

Factbox-Just how bad is Lebanon's

economic crisis?

Sep 14, 2022

An ATM machine is covered with a liquid substance outside a Blom Bank branch in Beirut, Lebanon September 14, 2022. REUTERS/Emilie Madi

An ATM machine is covered with a liquid substance outside a Blom Bank branch in Beirut, Lebanon September 14, 2022. REUTERS/Emilie Madi

BEIRUT (Reuters) - Savers held up two banks in Lebanon on Wednesday to demand access to their own deposits frozen in the country's paralysed financial system, underlining desperation among citizens unable to access savings since an economic crisis began in 2019.

There were similar incidents in Beirut in August and in eastern Lebanon in January.

The result of years of state corruption, waste and unsustainable financial policies, the World Bank says the crisis is one of the worst globally since the mid-19th century.

Just how bad is the situation?

* Gross domestic product plunged to an estimated $20.5 billion in 2021 from about $55 billion in 2018, the kind of contraction usually associated with wars, the World Bank says.

* The Lebanese pound has lost some 95% of its value, driving up prices and demolishing purchasing power in the import-dependent country. A soldier's monthly wage, once the equivalent of $900, is now worth less than $50. Poverty rates have sky-rocketed in the population of about 6.5 million, with around 80% of people classed as poor, the U.N. agency ESCWA says.

* Big lenders to the state, which defaulted on its hard currency debt in 2020, Lebanon's banks have frozen ordinary depositors out of dollar accounts and severely limited all withdrawals. Withdrawals in local currency apply exchange rates that erase up to 95% of their value

* A World Bank report said in August "a significant portion" of savings had been "misused and misspent over the past 30 years". A visiting U.S. official said last year the Lebanese people deserved to know where their money had gone.

* The financial system has suffered eyewatering losses. The government estimates overall losses at around $70 billion. The deputy prime minister said in March the figure was expected to grow to $73 billion while the crisis is not addressed, yet the government has yet to enact any recovery plan.

* With Lebanon reliant on imported fuel, power is in short supply. Households are lucky to get more than a few hours a day. Fuel prices have soared as authorities gradually lifted subsidies, entirely ending them in September. A ride in a shared taxi, a popular form of transport, cost 2,000 pounds pre-crisis but now costs 50,000.

* Lebanese have emigrated in the most significant exodus since the civil war. Believing their savings are lost, many have no plans to return. A 2021 Gallup poll found a record 63% of people surveyed wanted to leave permanently, up from 26% before the crisis.

* Among those leaving are doctors. The World Health Organization has said most hospitals are operating at 50% capacity. It says around 40% of doctors, mostly specialists, and 30% of nurses have permanently emigrated or are working part-time abroad.

* Officials and the media talk of Lebanon becoming a "failed state". Public services have ground to a halt. President Michel Aoun warned last year that the state was "falling apart"

Before going into hiding, the woman, Sali Hafiz, told local news channel Al Jadeed TV the gun was a toy and that she needed the money for her sister's cancer treatment.

"I have nothing more to lose, I got to the end of the road," she said, saying a visit to the bank manager two days previously had not provided an adequate solution.

"I got to a point where I was going to sell my kidney so that my sister could receive treatment."

BLOM confirmed the customer had been in to seek her money for her sister's treatment, saying she was offered total cooperation and requested to provide documentation.

"All we have is this money in the bank. My daughter was forced to take this money - it's her right, it's in her account - to treat her sister," her mother Hiam Hafiz told local TV.

Authorities did not immediately comment on the incidents.

Bankmed did not comment on its branch holdup.

Following last month's holdup, which also involved hostages, the accused perpetrator was arrested but then released without charge after the bank dropped its lawsuit.

One senior Lebanese banker, speaking on condition of anonymity, told Reuters it was a worrying precedent,

"I think this is an invitation for other people to do the same. As long as people get away with it, they will continue. What a failed state," the banker said.

Banks say they make exceptions for humanitarian cases including hospital care, but depositors say that rarely happens.

Sep 14, 2022

BEIRUT (Reuters) - Savers held up two banks in Lebanon on Wednesday to demand access to their own deposits frozen in the country's paralysed financial system, underlining desperation among citizens unable to access savings since an economic crisis began in 2019.

There were similar incidents in Beirut in August and in eastern Lebanon in January.

The result of years of state corruption, waste and unsustainable financial policies, the World Bank says the crisis is one of the worst globally since the mid-19th century.

Just how bad is the situation?

* Gross domestic product plunged to an estimated $20.5 billion in 2021 from about $55 billion in 2018, the kind of contraction usually associated with wars, the World Bank says.

* The Lebanese pound has lost some 95% of its value, driving up prices and demolishing purchasing power in the import-dependent country. A soldier's monthly wage, once the equivalent of $900, is now worth less than $50. Poverty rates have sky-rocketed in the population of about 6.5 million, with around 80% of people classed as poor, the U.N. agency ESCWA says.

* Big lenders to the state, which defaulted on its hard currency debt in 2020, Lebanon's banks have frozen ordinary depositors out of dollar accounts and severely limited all withdrawals. Withdrawals in local currency apply exchange rates that erase up to 95% of their value

* A World Bank report said in August "a significant portion" of savings had been "misused and misspent over the past 30 years". A visiting U.S. official said last year the Lebanese people deserved to know where their money had gone.

* The financial system has suffered eyewatering losses. The government estimates overall losses at around $70 billion. The deputy prime minister said in March the figure was expected to grow to $73 billion while the crisis is not addressed, yet the government has yet to enact any recovery plan.

* With Lebanon reliant on imported fuel, power is in short supply. Households are lucky to get more than a few hours a day. Fuel prices have soared as authorities gradually lifted subsidies, entirely ending them in September. A ride in a shared taxi, a popular form of transport, cost 2,000 pounds pre-crisis but now costs 50,000.

* Lebanese have emigrated in the most significant exodus since the civil war. Believing their savings are lost, many have no plans to return. A 2021 Gallup poll found a record 63% of people surveyed wanted to leave permanently, up from 26% before the crisis.

* Among those leaving are doctors. The World Health Organization has said most hospitals are operating at 50% capacity. It says around 40% of doctors, mostly specialists, and 30% of nurses have permanently emigrated or are working part-time abroad.

* Officials and the media talk of Lebanon becoming a "failed state". Public services have ground to a halt. President Michel Aoun warned last year that the state was "falling apart"

Armed woman breaks into Beirut bank demanding her savings

No comments:

Post a Comment