\

Piotr Skolimowski, Irina Vilcu and Megan Durisin

Sat, April 1, 2023

\

(Bloomberg) -- Blocked border crossings, a minister pelted with eggs and overflowing silos — anger is mounting among farmers in eastern Europe who say a rush of grain from Ukraine threatens their businesses, and it’s steadily eroding political goodwill.

Poland and other neighboring states agreed to help get grain out of Ukraine and on to global markets after the Russian invasion blocked exports last year. Part of that supply is now piling up in eastern Europe, and it’s threatening local livelihoods.

The surplus has been created by infrastructure bottlenecks as well as farmers delaying selling last year’s produce. The hoard of grain is becoming a political issue as protests spill into the streets.

Local growers held on to their crop in anticipation of higher prices following the war. A broader global downturn has instead pushed prices down, leaving farmers in Poland, Romania, Slovakia, Hungary and Bulgaria facing lower revenue and struggling to empty their stockpiles before the new harvest starts in the summer.

Political leaders, who rushed to support Ukraine initially, are starting to complain.

“We must help Ukraine in the transport and sale of grain to countries outside the EU,” Polish Prime Minister Mateusz Morawiecki, who four months ago was offering $20 million to help Ukraine export its grain to Africa, said in a Facebook post. “But this cannot be done at the expense of Polish farmers and local markets.”

The European Commission needs to limit the amount of Ukrainian supply entering the European Union because it is destabilizing local markets, he said.

The glut is very much a local one. Ukraine’s exports to global markets are still well below pre-war levels as a deal to get grain out of Black Sea ports remains tenuous.

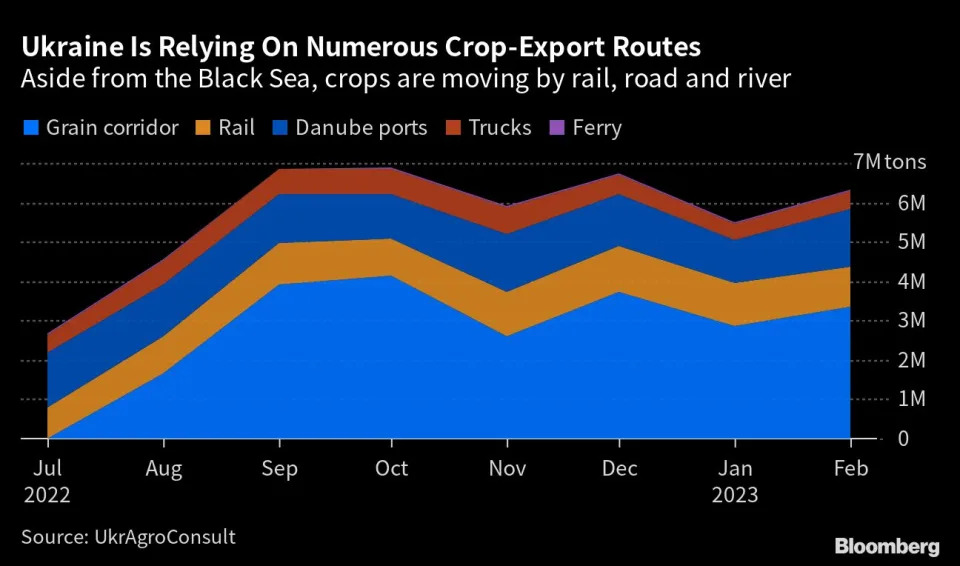

Russia’s invasion triggered concerns about a worsening hunger crisis as food prices jumped to record levels with vast amounts of Ukraine’s grain and vegetable oil stranded. Governments were forced to jump in to keep supplies flowing, with eastern Europe emerging as a transit route. While some ports have reopened, the pace of shipments is restrained. Transport by rail, road and river remains crucial.

Imports into Poland rose to 2.45 million tons in 2022 from just about 100,000 tons in previous years, which turned into a massive undertaking for the rail network. Rolling stock had to be changed because tracks were different from those in Ukraine, holding up shipments. Priority on trains was also given to coal that Poland was forced to import after banning Russian supply.

Race Against Food Inflation Starts on Rusty Soviet Rail Tracks

Poland’s Agriculture Minister Henryk Kowalczyk told producers in June not to sell their grain because prices are unlikely to fall. But benchmark Chicago wheat futures have nearly halved from the records reached just after the outbreak of the war as huge harvests in other key shippers, like Russia and Australia, quelled fears about a supply shortfall.

Grain import demand is also easing in key regions like North Africa — one of the EU’s main wheat markets — as economies there falter, said Helene Duflot, wheat analyst at Strategie Grains.

On March 17, a group of farmers dressed in yellow vests and blowing whistles, mobbed Kowalczyk at an agriculture fair in Kielce in southern Poland. He was forced to flee the venue.

Five days later, the minister was heckled and pelted with eggs during a panel discussion with EU Agriculture Commissioner Janusz Wojciechowski in the town of Jasionka, a two-hour drive from the Ukraine border. Earlier this week, Kowalczyk agreed to an plan that includes at least 10 billion zloty ($2.3 billion) in aid and a pledge to boost the capacity of ports.

Farmers however aren’t letting up, promising to resume protests unless the situation improves over the next two to three weeks.

Political Fallout

The discontent may have political consequences. Poland and Slovakia face elections later this year and farmers are an important constituency. A former Slovak premier who rejects sanctions against Russia and weapons deliveries to Ukraine is leading in the polls. Bulgaria is in a similar situation, with polls due this weekend. Poland has accepted more than a million Ukrainian refugees and has been among the biggest contributors of military and humanitarian aid to Kyiv.

Romanian farmers traveled to Brussels on Wednesday to protest in front of the European Commission building, waving banners stating “Romanian Farmers Deserve Respect!” The country, one of the EU’s largest corn and wheat producers, has facilitated more than half of Ukraine’s grain exports by land since the start of the war.

Imports rose to 570,000 tons last year from close to zero, according to Razvan Filipescu, vice-president of the Association of Farmer Producers in the Dobrogea region.

President Klaus Iohannis said the bloc’s crisis fund of €56 million ($61 million) for farmers was insufficient, while also criticizing it for failing to factor in the “huge sacrifices” made by the Balkan nation.

In a letter to European Commission President Ursula von der Leyen, Bulgaria and the four EU states surrounding Ukraine pushed for the bloc to increase financial support to farmers, consider buying the surplus grain for humanitarian aid or even restrict imports from Ukraine.

Slovakia wants the EU to work with the UN’s World Food Programme to ensure Ukrainian grain is transported out of member states, according to a person familiar with the discussion, who asked not to be named because the talks are private.

Still, Ukrainian supply could also play a part in plugging any shortfalls in Europe. Drought across the EU last summer ravaged its domestic corn harvest, necessitating extra imports to fill the gap. Shipments though are likely to ease in the months ahead as the war hits harvests.

“The whole exports from Ukraine will decrease, including to the EU, that’s clear,” said Alex Lissitsa, chief executive officer of Ukrainian agribusiness IMC.

Concerns are also emerging that the grain transit agreement itself might be broken.

“Nobody oversees the gentleman’s agreement that Europe will be a transit territory for Ukraine’s grain to Africa,” said Emil Macho, chairman of the Slovak Agriculture and Food Chamber. “It’s not working, the grain is staying right here.”

Meanwhile, anger continues to spill over. In Bulgaria, grain producers blocked border crossings with neighboring Romania for three days, demanding compensations. Almost 80% of the 2022 sunflower crop remains unsold and farmers hold more than 3 million tons of wheat from last year, said Krasimir Avramov, founder of the country’s National Association of Grain Producers.

Wieslaw Gryn, 65, is growing corn, wheat, canola and beetroot on a 320-hectare (791-acre) family farm in Rogow in eastern Poland. He says grain prices are down 40% and he still has hundred of tons to sell.

“Each year around this time I would have some surplus. But I have never had such a huge surplus as right now,” Gryn said in an interview. “My business partners are delaying payments and I need the money because I should start to grow my grain right now.”

--With assistance from Slav Okov, Daniel Hornak and Natalia Ojewska.

No comments:

Post a Comment