LEISURE CAPITALI$M

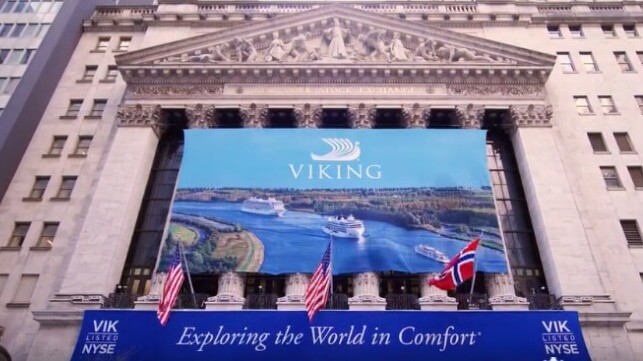

Viking Takes Wall Street by Storm with Best IPO of 2024

Viking, the luxury operator of ocean, river, and exploration cruises, roared onto Wall Street going public today, May 1, with what is being called the best deal of 2024. The company, which is a niche brand for aging baby boomers with lots of time and money to travel, became the third highest-valued cruise company with a market valuation of $10.4 billion in a heavily oversubscribed offering. By dollar amounts, it appears to be the second-largest initial offering of the year and comes after two years of largely no new deals.

The company filed for its offering in February in what analysts said was a well-time move to capture the strength of the stock market and the surging growth in the cruise business. The size of the deal was increased and priced today at $24 per share, at the high end of the projected $21 to $25 per share range.

The total offering raised about $1.5 billion after the number of shares was increased by two investment groups, TPG and Canada Pension Plan Investment Board, which had been long-term investors in Viking. They sold approximately 53 million shares and committed an additional nine million for the overallotment while Viking sold 11 million new shares raising $264 million for the company, while the investors realized nearly $1.3 billion.

Viking was started in 1997 by shipping industry executive Torstein Hagen (profiled in The Maritime Executive in 2018) who had previously run another luxury cruise line named Royal Viking Line. Hagen was intrigued by European river cruising and acquired four vessels to start this firm and three years later acquired a firm called KD River Cruises. The company entered ocean cruising in 2015 and exploration cruising in 2022. Today, Viking operates 92 ships, including 80 on rivers ranging from Europe to Egypt, Asia, and the Mississippi in the United States. They currently have two expedition cruise ships as well as 12 ocean cruise ships and more on order from Fincantieri.

Torstein Hagen started Viking in 1997 with just four river cruise ships and today the company became valued at $10.4 billion (Viking)

The cruise line became well known through its sponsorship of the TV series Masterpiece Theater on the U.S.’s Public Broadcasting System. Hagen is fond of calling his company a “thinking man’s cruise.” The product is for adult travelers, excluding children from the ships as well as not having casinos. Hagen and his daughter Karine retain control of the company with 87 percent of the voting power.

Last year, Viking had revenues of $4.7 billion but reported a net loss of $1.8 billion (EBITDA profit of $1.09 billion in 2023). The prior year the company had revenues of $3.2 billion and a profit of $399 million. In addition to the growth, investors are attracted by some of the highest revenues per passenger in the industry and a view that luxury travel will be the fastest-growing segment of the industry.

The market valuation of Viking leaped the company past Norwegian Cruise Line Holdings which has a market valuation of $8.1 billion. Norwegian reported strong earnings today but missed estimates and also reported cost increases while failing to excite investors with its outlook. Norwegian’s stock was down 14 percent. Viking with a market value of $10.4 billion is behind Carnival Corporation, the world’s largest cruise company, and both lag far behind Royal Caribbean Group which at nearly $36 billion market valuation is the first cruise company to regain its pre-pandemic valuation.

Viking’s stock was up more than $2 per share in trading today on the New York Stock Exchange.

After Nearly Two-Year Delay, Virgin Voyages Will Launch Fourth Cruise Ship

Virgin Voyages which was launched to disrupt the cruise industry with a new approach to the business is finally set to introduce its fourth cruise ship completing one of the most challenging startups. The cruise line which was announced with great promise and fanfare ran into headwinds as its introduction coincided with the onset of the COVID-19 pandemic.

Virgin Voyages this week announced the September 2025 introduction of its fourth cruise ship, Brilliant Lady (110,000 gross tons), which is 21 months after the originally announced first voyage for the cruise ship. The company faced timing challenges with the introduction of each of its ships as the first ship Scarlet Lady was on her positioning trip to the United States in March 2020 when the cruise industry shut down due to the pandemic. She would not start sailing till 2021 with similar delays for the startup of Valiant Lady and Resilient Lady.

The cruise line has been forced to also reshuffle its deployment plans several times including in September 2023 when they announced the cancelation of all the planned cruises for Brilliant Lady, which had been scheduled to enter service in December. At the time the company blamed “unexpected construction, supply chain, and staffing challenges,” while it also reported it was completing a new round of financing.

The delay of Brilliant Lady caused them to also cancel winter 2024 Caribbean cruises for the Valiant Lady and summer 2024 Greek Island cruises for Resilient Lady. Most recently in an unrelated development, they said they will not be running a second season in Australia after reporting the Resilient Lady would reroute around Africa due to the current security problems in the Red Sea.

When the cruise line delayed Brilliant Lady, they said it was likely to take up to two years to ramp up for her launch. She was floated out from the building dock on November 25, 2022, and Fincantieri counts her as delivered in 2023. She, however, did her final dry docking in Palermo, Italy in February 2024 and Virgin sent her to the anchorage off Cyprus where she is laid up.

Virgin says a few subtle changes are planned for the fourth cruise ship reported an “adapted frame, meaning Brilliant Lady is designed to sail through the Panama Canal.” Seatrade reports this included removing deck and lifeboat overhangs which are excluded for clearances at the Panama Canal. Virgin Voyages also reports she will introduce new dining and entertainment options.

The cruise line started with a business model that called for inclusive pricing, dining and entertainment options, and a “no kids” policy marketing the cruises as “adults only.” Most of the cruises have been seven days or less in length with destinations in the Caribbean, Europe, the Mediterranean, and this most recent season Australia. The cruise line attests to having “some of the highest repeater rates in the industry.”

The introduction of Brilliant Lady now scheduled for September 2025 is set to adapt the model. She will be offering cruises between 5 and 14 nights and heading to new destinations. The company reports homeports were requested by its travelers. The ship enters service sailing from New York to Bermuda and Canada followed by winter cruises from Miami to the Caribbean. In March 2026, she sails westward marking the brand's first Panama Canal transit, cruises from Los Angeles, and an introductory season between May and September 2026 from Seattle to Alaska.

No comments:

Post a Comment