Bloomberg News | February 7, 2025 |

China’s central bank. Credit: Adobe Stock

China’s central bank expanded its gold reserves for a third month in January, even as the precious metal kept rallying to a record high.

Bullion held by the People’s Bank of China rose by 0.16 million troy ounces last month, according to data released Friday. The central bank resumed adding gold reserves in November after a six-month halt that followed an 18-month buying spree.

The move shows the PBOC’s commitment to diversify reserves even with gold at historically high levels, and it joins a slew of other central banks adding gold to their holdings amid geopolitical and economic uncertainties. The precious metal has set successive records this week, supported by haven demand.

“The PBOC will likely continue to diversify its reserves in the longer term, given the rising geopolitical uncertainty,” said David Qu, an economist at Bloomberg Economics. Politics may be the key reason behind the move as the central bank resumed buying after Donald Trump was elected, he said.

Buying gold for jewelry buying remains subdued in China due to tepid economic growth.

(By Yihui Xie)

London sees record gold outflow in January in race to ship to US

Bloomberg News | February 7, 2025

Gold bullion.

(Image by the London Bullion Market Association, Instagram.)

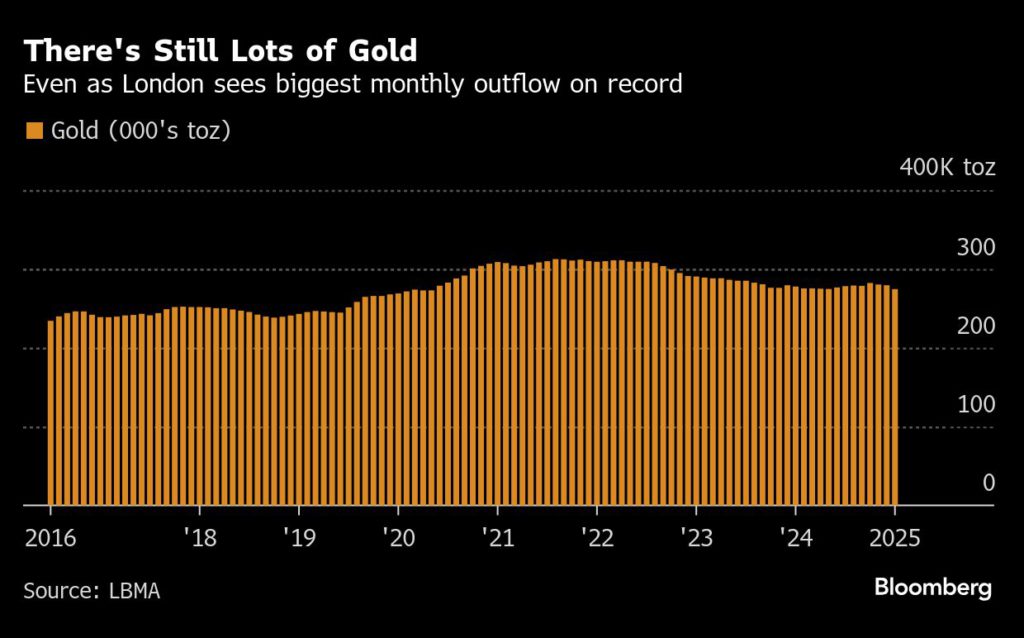

The amount of gold stored in London vaults fell by 4.9 million troy ounces in January, the largest monthly decline since records began in 2016, as traders rushed to ship the precious metal to the US to avoid tariff risks and capture premium prices.

London is the world’s largest hub for gold trading, with about $800 billion worth stored in vaults underneath the capital. Worries that President Donald Trump will impose tariffs affecting gold sent US prices soaring past those in London last month, offering a lucrative arbitrage opportunity for owners able to fly their holdings across the Atlantic.

The outflows, worth nearly $14 billion, reduced January stocks by 1.7% from December’s levels, according the data collected by the London Bullion Market Association, a trade group.

That includes holdings in commercial vaults owned by JPMorgan Chase & Co. and Brink’s Co, among others, as well as gold accounts in the Bank of England’s vault.

The amount of gold stored in London vaults fell by 4.9 million troy ounces in January, the largest monthly decline since records began in 2016, as traders rushed to ship the precious metal to the US to avoid tariff risks and capture premium prices.

London is the world’s largest hub for gold trading, with about $800 billion worth stored in vaults underneath the capital. Worries that President Donald Trump will impose tariffs affecting gold sent US prices soaring past those in London last month, offering a lucrative arbitrage opportunity for owners able to fly their holdings across the Atlantic.

The outflows, worth nearly $14 billion, reduced January stocks by 1.7% from December’s levels, according the data collected by the London Bullion Market Association, a trade group.

That includes holdings in commercial vaults owned by JPMorgan Chase & Co. and Brink’s Co, among others, as well as gold accounts in the Bank of England’s vault.

“The monthly decline in gold stocks reflects the well-documented market dynamics at present,” the LBMA said. “Given the flow of metal from London to New York, a 151 tonne decline in stocks in January is unsurprising.”

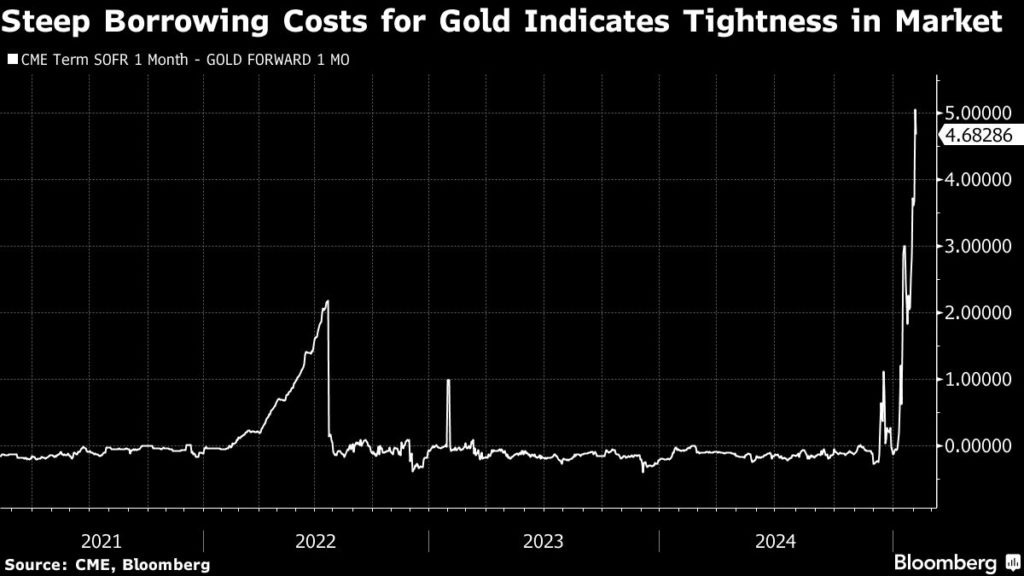

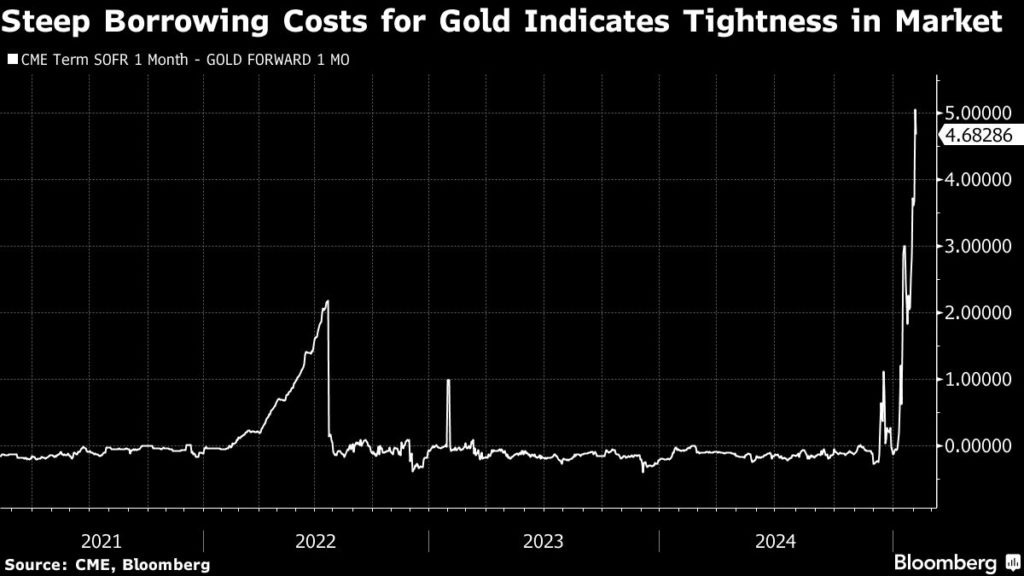

The one-month lease rate for gold, which reflects the short-term cost of borrowing it, jumped to the highest in decades in January. Long lines to withdraw the metal formed at the BOE’s vault, leading to unusually large discounts for gold stored there compared with the wider market.

Silver stocks also saw the biggest outflow on record following the emergence of a similar New York premium. That premium hasn’t closed yet, though the spread in gold narrowed significantly this week.

“Like gold, silver’s outflow is directly linked to the movement of metal from London to NY due to tariff concerns,” the LBMA said.

So far, the White House hasn’t given any indication as to whether precious metals will be targeted by any potential tariffs.

The premium between New York and London markets on Wednesday implied a roughly 20% chance that Trump will include gold in a 10% blanket tariff on all US imports, analysts with Citigroup Inc said.

(By Jack Ryan)

BOE says tariff premium is fueling clamor to withdraw gold

Bloomberg News | February 6, 2025 |

Bank of England headquarters in London. Credit: Wikipedia

The rush to ship gold from London to the US to take advantage of premium prices is fueling strong demand for slots to withdraw metal from the Bank of England’s vault, an official said.

Worries that US President Donald Trump will impose tariffs affecting gold has led to premiums in the New York market and weeks-long queues to withdraw metal from the BOE. Bars at the central bank’s vault have also been trading at a discount to the wider market this week, as withdrawal delays make the gold at the BOE less attractive than bullion held in more accessible commercial vaults.

As commercial gold holders look to take advantage of the price differential, there has been robust demand for delivery slots, BOE Deputy Governor Dave Ramsden said at a press conference on Thursday.

“All of those bodies who ship the gold, they’ve all got the delivery slots they need over the next few weeks,” Ramsden said. “If you were coming in new to us, you might have to wait a bit longer because all the existing slots are booked up. But this is a very orderly process.”

Long delays to withdraw bullion — which is trading near a record high — are all the more problematic for traders at the moment, as they seek to avoid the risk of tariffs and capture premium prices by shipping their gold to the US.

The BOE plays a crucial role in the London gold market, the world’s largest bullion-trading hub. It maintains accounts for other central banks, which favor storing their gold in London where it can easily be lent out or sold. The BOE also allows selected commercial operators to hold gold accounts, to provide liquidity to central banks.

Ramsden said gold inventories held in the bank’s vault had only declined about 2% since the end of December.

“It’s an obvious point, but gold is a physical asset, so there are real logistical constraints and security constraints. You know getting into the bank for me this morning was a bit trickier because there was a lorry in the bullion yard,” he said. “It takes time and the stuff is also quite heavy as you know.”

(By Jack Ryan)

Bloomberg News | February 6, 2025 |

Bank of England headquarters in London. Credit: Wikipedia

The rush to ship gold from London to the US to take advantage of premium prices is fueling strong demand for slots to withdraw metal from the Bank of England’s vault, an official said.

Worries that US President Donald Trump will impose tariffs affecting gold has led to premiums in the New York market and weeks-long queues to withdraw metal from the BOE. Bars at the central bank’s vault have also been trading at a discount to the wider market this week, as withdrawal delays make the gold at the BOE less attractive than bullion held in more accessible commercial vaults.

As commercial gold holders look to take advantage of the price differential, there has been robust demand for delivery slots, BOE Deputy Governor Dave Ramsden said at a press conference on Thursday.

“All of those bodies who ship the gold, they’ve all got the delivery slots they need over the next few weeks,” Ramsden said. “If you were coming in new to us, you might have to wait a bit longer because all the existing slots are booked up. But this is a very orderly process.”

Long delays to withdraw bullion — which is trading near a record high — are all the more problematic for traders at the moment, as they seek to avoid the risk of tariffs and capture premium prices by shipping their gold to the US.

The BOE plays a crucial role in the London gold market, the world’s largest bullion-trading hub. It maintains accounts for other central banks, which favor storing their gold in London where it can easily be lent out or sold. The BOE also allows selected commercial operators to hold gold accounts, to provide liquidity to central banks.

Ramsden said gold inventories held in the bank’s vault had only declined about 2% since the end of December.

“It’s an obvious point, but gold is a physical asset, so there are real logistical constraints and security constraints. You know getting into the bank for me this morning was a bit trickier because there was a lorry in the bullion yard,” he said. “It takes time and the stuff is also quite heavy as you know.”

(By Jack Ryan)

Citi sees gold soaring to $3,000 on tensions triggered by Trump

Bloomberg News | February 6, 2025 |

Image courtesy of the Trump Statue Initiative.

Citigroup Inc. expects gold prices to hit a record $3,000 an ounce within three months, with geopolitical tensions and trade wars stoked by US President Donald Trump boosting demand for safe-haven assets.

Trump jolted markets with the prospect of tariffs that could slow economic growth, reignite inflation and disrupt global commerce. Investors will continue to seek bullion’s security and central banks are likely to keep building out their reserves, analysts including Kenny Hu wrote in a report.

“The gold bull market looks set to continue under Trump 2.0,” the Citi analysts said, citing risks such as slower growth and high interest rates.

Gold hit successive records in the past few days as concerns about the tug of war between the US and China, as well as the possibility Trump will impose duties on other nations, support bullion’s role as a store of value in uncertain times.

Citi upgraded its three-month price target for gold from $2,800 an ounce, which the precious metal has already surpassed. Spot gold slipped as much as 1.2% to $2,834.26 an ounce on Thursday.

The bank also said that an appreciating US dollar will increase the incentive for central banks from emerging economies to boost gold holdings in order to support their own currencies, while investors will turn both to physical gold and exchange-traded funds.

Trade-war fears have also led dealers in London to shift metal to the US, fearing the possibility that bullion won’t be excluded from potential tariffs. Premiums as of Wednesday implied a roughly 20% chance of Trump including gold in a 10% blanket global tariff, Citi said.

“A Russia/Ukraine peace deal, and confirmation of whether gold would be exempt from broad tariffs (or not), could provide a buying opportunity over the next 2-3 months,” the Citi analysts said.

The bank raised its average price target for the year by $100 to $2,900 an ounce, while leaving its 6 to 12 month price target of $3,000 unchanged.

Silver and palladium edged lower, while platinum rose. The Bloomberg Dollar Spot Index was little changed.

Bullion rose earlier in the week after President Donald Trump said the US could take over Gaza, a comment that his aides sought to tone down, and that he wants to start working on a new nuclear deal with Iran. Washington is also expected to present a plan to end Russia’s war on Ukraine next week.

(By Jack Ryan)

Bloomberg News | February 6, 2025 |

Image courtesy of the Trump Statue Initiative.

Citigroup Inc. expects gold prices to hit a record $3,000 an ounce within three months, with geopolitical tensions and trade wars stoked by US President Donald Trump boosting demand for safe-haven assets.

Trump jolted markets with the prospect of tariffs that could slow economic growth, reignite inflation and disrupt global commerce. Investors will continue to seek bullion’s security and central banks are likely to keep building out their reserves, analysts including Kenny Hu wrote in a report.

“The gold bull market looks set to continue under Trump 2.0,” the Citi analysts said, citing risks such as slower growth and high interest rates.

Gold hit successive records in the past few days as concerns about the tug of war between the US and China, as well as the possibility Trump will impose duties on other nations, support bullion’s role as a store of value in uncertain times.

Citi upgraded its three-month price target for gold from $2,800 an ounce, which the precious metal has already surpassed. Spot gold slipped as much as 1.2% to $2,834.26 an ounce on Thursday.

The bank also said that an appreciating US dollar will increase the incentive for central banks from emerging economies to boost gold holdings in order to support their own currencies, while investors will turn both to physical gold and exchange-traded funds.

Trade-war fears have also led dealers in London to shift metal to the US, fearing the possibility that bullion won’t be excluded from potential tariffs. Premiums as of Wednesday implied a roughly 20% chance of Trump including gold in a 10% blanket global tariff, Citi said.

“A Russia/Ukraine peace deal, and confirmation of whether gold would be exempt from broad tariffs (or not), could provide a buying opportunity over the next 2-3 months,” the Citi analysts said.

The bank raised its average price target for the year by $100 to $2,900 an ounce, while leaving its 6 to 12 month price target of $3,000 unchanged.

Silver and palladium edged lower, while platinum rose. The Bloomberg Dollar Spot Index was little changed.

Bullion rose earlier in the week after President Donald Trump said the US could take over Gaza, a comment that his aides sought to tone down, and that he wants to start working on a new nuclear deal with Iran. Washington is also expected to present a plan to end Russia’s war on Ukraine next week.

(By Jack Ryan)

Russians’ hunt to shield savings pushes gold purchases to record

Bloomberg News | February 5, 2025 |

(Image from Vladimir Putin’s website)

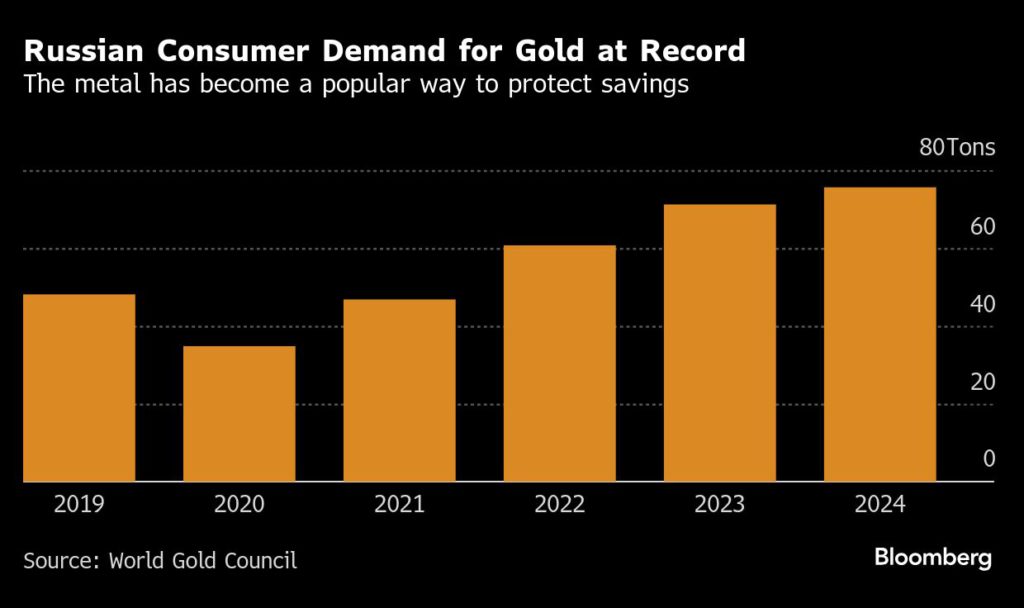

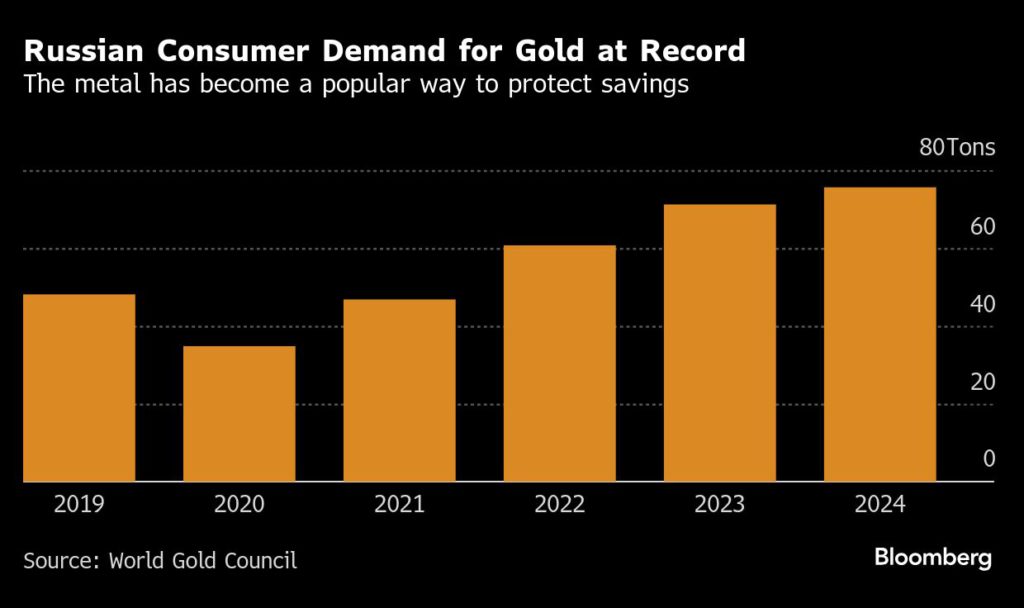

Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output.

Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins and jewelery in 2024, the fifth biggest figure among all nations, according to World Gold Council data published Wednesday. That’s an increase of 6% on the previous year and more than 60% since President Vladimir Putin ordered his troops into Ukraine almost three years ago.

Russia is the world’s second-biggest gold producer, mining over 300 tons of the precious metal a year. Since the invasion of Ukraine, Russian gold has been shunned in the West, with flows to trading hubs like London and New York drying up. Russia’s central bank, once the biggest gold buyer globally, also hasn’t resumed purchases at significant volumes.

Retail gold demand shifted upward after the Kremlin’s invasion of Ukraine as Russians started to find alternative ways of securing their savings instead of traditional investments in dollars or euros. Western sanctions last year intensified cross-border payment difficulties and led to some foreign currency shortages, while the ruble also fell to historic lows.

To spur gold sales, Russia canceled value-added tax on retail purchases of the metal right after the invasion following more than a decade of discussing such a move.

Bloomberg News | February 5, 2025 |

(Image from Vladimir Putin’s website)

Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output.

Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins and jewelery in 2024, the fifth biggest figure among all nations, according to World Gold Council data published Wednesday. That’s an increase of 6% on the previous year and more than 60% since President Vladimir Putin ordered his troops into Ukraine almost three years ago.

Russia is the world’s second-biggest gold producer, mining over 300 tons of the precious metal a year. Since the invasion of Ukraine, Russian gold has been shunned in the West, with flows to trading hubs like London and New York drying up. Russia’s central bank, once the biggest gold buyer globally, also hasn’t resumed purchases at significant volumes.

Retail gold demand shifted upward after the Kremlin’s invasion of Ukraine as Russians started to find alternative ways of securing their savings instead of traditional investments in dollars or euros. Western sanctions last year intensified cross-border payment difficulties and led to some foreign currency shortages, while the ruble also fell to historic lows.

To spur gold sales, Russia canceled value-added tax on retail purchases of the metal right after the invasion following more than a decade of discussing such a move.

Gold price hits fresh record on haven demand

Bloomberg News | February 5, 2025

Gold’s hot run continues. Stock image.

Gold pared gains from a new all-time high, as trade-war worries bolstered haven demand and there were continued signs of short-term tightness in the market.

Bullion rallied as much as 1.4% to exceed $2,882.36 an ounce before paring some gains after Bloomberg reported that US allies expect President Donald Trump’s administration to present a long-awaited plan to end Russia’s war on Ukraine at the Munich Security Conference in Germany next week.

Bullion prices still held at elevated levels, supported by concerns about the fallout of trade wars, particularly between the US and China. Markets are also waiting to see if there are any ripple effects for US monetary policy if tariffs reignite inflation.

There are indications of increased demand for gold as major dealers seek to shift metal to the US before any tariffs are imposed. One month so-called lease rates in London have jumped to about 4.7%, far above previous levels of close to zero. The rate reflects the return that holders of bullion in London’s vaults can get by loaning their metal out to other buyers on a short-term basis.

Bloomberg last week reported that the rush for gold has led to weekslong queues to withdraw bullion from the Bank of England — where many central banks around the world hold reserves — to deposit with private banks. Gold has also been flowing into depositories of New York’s Comex exchange.

That has added to tightness in the market, according to Rhona O’Connell, head of market analysis for EMEA and Asia at StoneX Group Inc.

The typical 400-ounce bars that are traded in London aren’t suited for the Comex market, where traders must deliver 100-ounce or kilobars, but they can be refined in places like Switzerland.

“Metal is still going into Comex warehouses and elsewhere in the States,” said O’Connell. Authorities could possibly even intervene by lending out gold if the situation became drastic enough, she said.

“If it gets much tighter or threatens to become disorderly I would not be surprised if the official sector injected liquidity, because one thing that central banks won’t tolerate is a disorderly gold market.”

The dollar extended losses, following a US jobs report on Tuesday that pointed to a gradual slowdown in the labor market. A weaker greenback makes commodities like gold cheaper for most buyers.

Spot gold gained 1% to $2,873.69 an ounce as of 12:40 p.m. in New York. Silver, platinum and palladium also rose.

(By Sybilla Gross and Jack Ryan)

Bloomberg News | February 5, 2025

Gold’s hot run continues. Stock image.

Gold pared gains from a new all-time high, as trade-war worries bolstered haven demand and there were continued signs of short-term tightness in the market.

Bullion rallied as much as 1.4% to exceed $2,882.36 an ounce before paring some gains after Bloomberg reported that US allies expect President Donald Trump’s administration to present a long-awaited plan to end Russia’s war on Ukraine at the Munich Security Conference in Germany next week.

Bullion prices still held at elevated levels, supported by concerns about the fallout of trade wars, particularly between the US and China. Markets are also waiting to see if there are any ripple effects for US monetary policy if tariffs reignite inflation.

There are indications of increased demand for gold as major dealers seek to shift metal to the US before any tariffs are imposed. One month so-called lease rates in London have jumped to about 4.7%, far above previous levels of close to zero. The rate reflects the return that holders of bullion in London’s vaults can get by loaning their metal out to other buyers on a short-term basis.

Bloomberg last week reported that the rush for gold has led to weekslong queues to withdraw bullion from the Bank of England — where many central banks around the world hold reserves — to deposit with private banks. Gold has also been flowing into depositories of New York’s Comex exchange.

That has added to tightness in the market, according to Rhona O’Connell, head of market analysis for EMEA and Asia at StoneX Group Inc.

The typical 400-ounce bars that are traded in London aren’t suited for the Comex market, where traders must deliver 100-ounce or kilobars, but they can be refined in places like Switzerland.

“Metal is still going into Comex warehouses and elsewhere in the States,” said O’Connell. Authorities could possibly even intervene by lending out gold if the situation became drastic enough, she said.

“If it gets much tighter or threatens to become disorderly I would not be surprised if the official sector injected liquidity, because one thing that central banks won’t tolerate is a disorderly gold market.”

The dollar extended losses, following a US jobs report on Tuesday that pointed to a gradual slowdown in the labor market. A weaker greenback makes commodities like gold cheaper for most buyers.

Spot gold gained 1% to $2,873.69 an ounce as of 12:40 p.m. in New York. Silver, platinum and palladium also rose.

(By Sybilla Gross and Jack Ryan)

No comments:

Post a Comment