What Do IMO's New Climate Targets Mean for Shipping?

[By Don Maier]

The world’s largest shipping companies are starting to update their fleets for a greener future. Maersk received the world’s first dual-fuel methanol container ship in July 2023, and dozens more container ships that can run on alternative fuels are currently on order.

The industry – responsible for about 3% of global greenhouse gas emissions, more than Canada and Ireland combined – has reasons to act and to have some confidence in its multimillion-dollar investments.

On July 7, the 175 member countries of the International Maritime Organization, a United Nations agency that regulates global shipping, agreed to a new climate strategy that includes reaching net-zero greenhouse gas emissions “by or around, i.e., close to, 2050.”

The strategy’s language is vague, obscure and almost noncommittal. But it points the industry toward a cleaner future. New European Union rules will also soon go into effect that will significantly raise costs for ships burning highly polluting sulfur fuel oil.

I spent several years working in the shipping industry and follow it as a researcher and analyst. Here’s what I see changing.

Setting their own direction

The new IMO strategy does not explicitly set a new fuel standard, but it seems to indicate that less reliance on cheap, environmentally harmful, heavy-sulfur fuel oil is the best direction, and possibly less use of low-sulfur fuel oil.

What the strategy does is set goals to reduce international shippings’ greenhouse gas emissions by at least 20% by 2030, compared with 2008 levels; by at least 70% by 2040; and to reach net-zero emissions around 2050. The IMO also commits to implement a greenhouse gas emissions-pricing mechanism – a carbon levy or tax – by 2027, and to develop a goal-based marine fuel standard. At this time, that’s the only direction the IMO has provided regarding the emissions-pricing mechanism.

While the new strategy may not have been as clear or restrictive as many people hoped, the IMO may be providing the maritime industry an opportunity to set the direction itself.

A number of large ship owners and operators have already built and placed orders for container ships with some sort of alternative fuel use, primarily methanol or liquefied natural gas, and there is some interest in hydrogen. LNG is still a fossil fuel, though it’s less polluting than traditional sulfur fuel oil. Methanol, however, can be made from either natural gas or renewable sources.

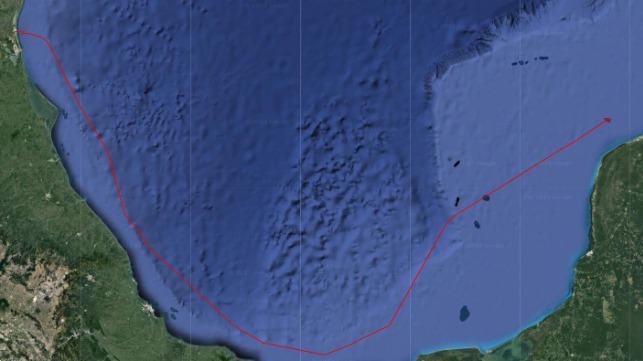

Maersk’s new dual-fuel vessel – to be powered in part by green methanol – is small and plans to operate in the Baltic Sea, but Maersk may be using this vessel as a prototype for larger alternative-fuel containerships expected to be delivered next year. Evergreen, also among the world’s larger shipping companies, has ordered 24 dual-fueled methanol ships.

Purchases like Maersk’s and Evergreen’s are an indication that the maritime industry will be moving in the direction of greener fuels. They also indicate that the industry is willing to follow the IMO’s focus on well-to-wake emissions, meaning not just emissions from ship operations but also from fuel production.

Building a supply chain

The other significant challenge faced by the maritime industry is having a sufficient supply chain available to support dual-fueled vessels, which can operate on alternative fuels.

There are currently a limited number of ports worldwide with the necessary infrastructure to provide alternative fuels. But, here again, simple economics suggests that if there is enough demand, supply should follow.

With Maersk, Evergreen and others preparing to operate more dual-fuel containerships, the industry is demonstrating demand so the green-methanol supply chain can develop, and hopefully soon. Japan recently launched its first dual-fueled LNG bunkering ship – essentially a floating gas station – to develop the supply of LNG fuel.

Not mandatory, but many countries will try

The new IMO strategy has some big caveats: The goals are nonbinding, and the strategy explicitly encourages compliance when “national circumstances allow.” In other words, no nation-state will be under any legal obligation to comply.

The statement seems to have been included as a means to appear focused on achieving goals while placating some countries that may not be able or willing to meet the goals by 2030 or beyond.

It’s also unclear whether the “national circumstance” pertains to a physical nation-state, to flag registry – meaning where the ship is registered – or both. Many ships are registered in countries with weaker regulations. Adding such language appears to say that the IMO is serious about emissions and understands that some countries may have significant challenges to meet the standards. It also gets around opposition to a carbon levy, or tax on emissions, which some delegates – China for example – adamantly opposed.

Many countries, such as the U.S., United Kingdom, Australia and those in the European Union, will work to meet the strategy, I believe. The EU is already launching its own carbon levy on shipping beginning in 2024.

Who pays for the higher costs?

One factor that the IMO, most analysts and environmentalists rarely discuss is the additional cost of using an alternative fuel.

By some estimates, green methanol costs three times as much as low-sulfur fuel oil. And low-sulfur fuel oil is more expensive than high-sulfur fuel oil. The maritime research company Drewry estimated that switching to methanol on a well-to-wake basis would increase fuel costs by 350%, or equal to approximately an additional $1,000 for each 40-foot-long shipping container aboard.

Shipping lines will soon also face higher costs from the European Union if they don’t clean up their emissions. Starting in 2024, the EU Emissions Trading System will cover all cargo and passenger ship voyages in EU waters and ports involving over 5,000 gross tons, regardless of where the ship is registered. The costs to those with high emissions are expected to significantly increase the operating costs for the global shipping fleet.

Hecla Emissions Management, a consulting arm set up by Wilhelmsen Ship Management and Affinity Shipping, analyzed the three-year phase-in period for just the EU change and expects it to cost the shipping industry nearly $19 billion.

Whether we like it or not, these additional costs will be born by the cargo owners, who will pass the costs along to their customers – and, ultimately, the consumer, meaning you and me.

Don Maier is an associate professor of practice in supply chain management at University of Tennessee. His professional career included roles in the logistics and supply chain management teams at FedEx, Office Depot, Penske Logistics, Monsanto and Merisant (a division of Monsanto). He has also served as dean for the Maine Maritime and Cal Maritime Academies.

This article appears courtesy of The Conversation and may be found in its original form here.

To Get to Zero by 2050, Regulatory Details May Matter More Than Targets

Action at the International Maritime Organization (IMO) to regulate emissions from fuel production, and to consider all types of greenhouse gases (GHGs) — not just CO2 — is moving slowly and not receiving much attention. But these regulatory details are probably more important than the headline-grabbing move to target net-zero GHG emissions by 2050. Here’s why.

A growing proportion of global GHG emissions — at 3% and climbing — come from the global shipping industry. The majority of those pollutants come from large ocean-going container ships, tankers and bulk carriers that move finished goods, raw materials, minerals, and food all over the globe. Measures to curb this rise in emissions are already being enacted but the details of how they come into effect are vitally important. In this article we investigate these details and why they matter.

Methanol and methane are currently winning the alternative fuels race – what are the consequences?

The lion’s share of new ships on order are now fueled by alternative fuels rather than traditional oil-based heavy fuel oil according to data obtained by DNV Alternative Fuels Insights. Methane (in the form of liquefied natural gas [LNG]) and methanol are the most popular choices. While this may sound like good news, zero-emission versions of these fuels are still a long way off – as Clear Seas explored in an earlier article.

Methanol and methane seem like attractive alternative fuels at first glance because they contain less carbon – the source of CO2 emissions – than conventional oil-based fuels and are relatively inexpensive. But this picture changes when all GHGs (not just CO2) are considered over the total lifecycle of fuel production and consumption.

When methanol is produced from fossil natural gas – the most common production method – vast quantities of CO2 are emitted. When these upstream CO2 emissions from the methanol manufacturing are added to the exhaust emissions from the ship’s engine, methanol turns out to be worse for the environment than conventional oil-based fuel – by approximately 20%.1 If regulations come into force that take into account the lifecycle emissions from production as well as consumption, ship operators who use methanol-powered ships will need to look for options outside of the widely available fossil-based methanol if they want to achieve GHG reductions — and these are currently limited.

A methanol production facility (Methanex)

Methane, in addition to being a clean-burning fuel, is itself a powerful GHG, and so when it leaks out during production or as unburnt fuel in the engine exhaust gas of ships, it counteracts the benefit of the reduction in carbon content of the fuel described above. Researchers at the University of British Columbia supported by Clear Seas found that although measures to control methane emissions are available both in the fuel production and delivery supply chain as well as on ships, there is currently little incentive to implement them.2

Methane emissions are not given high enough priority by ship owners and operators

The most common fuel choice for new cargo ships being ordered today is methane – in the form of LNG. Most ship operators are hoping to reduce emissions through a transition to bio-LNG and ultimately to zero-emissions by using e-methane3 in the same ships. However, decisions are being made now about which natural gas engines to install on the LNG-fueled ships being ordered and these ships will be in operation for decades. As the Clear Seas supported research has discovered, there is currently little incentive for them to install the more expensive high-pressure dual-fuel engines that cut methane emissions. Action now while ships are still on the drawing board is needed or else the technology will be locked-in at the shipyard with limited opportunity to retrofit.

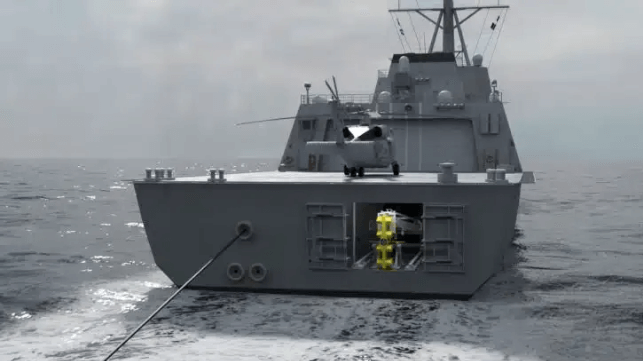

A methane-fuelled container ship (CMA CGM)

These methane-fueled ships need to be refueled, so ship fuel suppliers are also investing in liquefaction plants and refueling equipment needed to deliver methane fuel in the form of LNG. LNG plants with low-emission, electric-drive compressors and refueling barges with re-liquefaction equipment to capture leaking methane are available, but they are more expensive.4 Suppliers need to have at least the prospect of being able to charge a premium for their products or of claiming low-carbon fuel standard carbon tax credits to justify the increased investment. The alternative is leaky high-emitting infrastructure – again, in place for decades.

Emissions from the production of methanol need to be factored into international shipping emissions regulations

Ship owners may be choosing methanol-fueled ships on the assumption they will be rewarded under the currently incomplete energy efficiency index emissions reduction measures that recently came into force. At the moment, these measures only take into account CO2 from the combustion of the fuel on the ship. Once more comprehensive regulations arrive that take account of upstream emissions from the production of methanol, shippers may have no choice but to return to burning carbon-intensive oil-based fuels.5

Fixing the problem with fossil methanol is costly. One option is to mix it with enough sustainably sourced bio-methanol to reduce the reliance on high-emissions fossil methanol. Another alternative is to capture and sequester some of the CO2 emitted during production. But these projects will take time to scale up and will require investment justified only if greener methanol can command a price premium in the market – a premium that will only be there if upstream emissions from methanol production are properly accounted for in regulations.

What is being done to properly regulate GHG emissions from ships?

In July 2023, the IMO adopted a revised GHG reduction strategy. IMO member states have discussed several proposals for the levels of ambition for 2030, 2040, and 2050 targets to phase out lifecycle GHG emissions, and the measures that will move the industry towards these targets. The majority of member states support the need for the international shipping sector to reach zero lifecycle GHG emissions by 2050, be aligned with the 1.5°C warming limit, and avoid any out-of-sector offsets while doing so. Measures to support the shipping industry in meeting these targets that have received support include a technical element such as a GHG fuel standard that starts low and increases over time and considers lifecycle GHG emissions along with an economic element such as GHG pricing.

However, targets and measures towards mitigating the climate impacts of shipping can only be successful if they are supported by appropriate metrics that capture the full range of GHGs and the full lifecycle of alternative fuels. The energy efficiency existing ship index (EEXI) and carbon intensity indicator (CII) indexes are energy efficiency measures that are currently only based on a CO2 intensity (CO2 emissions per transport work) metric to further contribute to the intensity targets of the initial IMO GHG Strategy. Although there have been discussions at the IMO on amending the indexes to a lifecycle metric taking into account all GHGs, not just CO2, no formal proposals on this issue were made in recent IMO sessions.

Amendment of the existing indexes to include lifecycle GHGs, especially CO2, methane (CH4) and nitrous oxide (N2O), is critical for the international shipping sector to meet its climate targets, align with the 1.5°C temperature limit goal, incentivize the “right” alternative fuel(s) and technology, and avoid the risks of stranded assets. Although these topics are actively being negotiated at the IMO, there is not yet a consensus.

This article appears here courtesy of Clear Seas. It was written in collaboration with the UBC research team working on decarbonizing marine shipping.

Authors:

Imranul Laskar is a PhD Researcher in Resource, Environment and Sustainability at UBC.

Amanda Giang is an Assistant Professor in the Institute for Resources, Environment and Sustainability at UBC.

Paul Blomerus is Executive Director and marine fuels decarbonization expert at Clear Seas.

References:

1 Ongoing Clear Seas research on Marine Fuels for Reducing Greenhouse Gas Emissions from Shipping

2 Laskar, I.I., Giang, A., 2023. Policy approaches to mitigate in-use methane emissions from natural gas use as a marine fuel. Environmental Research: Infrastructure and Sustainability 3, 025005.

3 e-methane is methane synthesized from hydrogen produced through electrolysis of water using renewable electricity.

4 Temporary infrastructure like truck-to-ship refueling or portable containerized solutions are sometimes promoted to prevent so-called fossil fuel lock-in of LNG. This is counterproductive. Short-term methane emissions resulting from venting of methane before, during and after refueling operations is a major hazard of the operation of this lower-cost mobile equipment. LNG refueling from properly equipped jetties and bunker vessels has a better likelihood of reducing or eliminating methane emissions.

5 Methanol-fueled ships are dual-fuel capable so can still use conventional heavy fuel oil or diesel fuel as an alternative to methanol when it is not available.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.