By Sara Ashley O'Brien, CNN Business

August 16, 2020

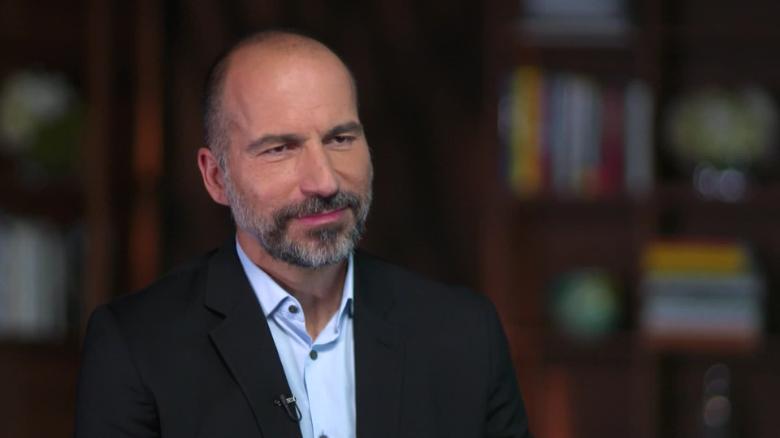

Exclusive: Amanpour interviews Uber's CEO

(CNN Business)

When faced with tough legislation over the years, Lyft and especially Uber relied on a tried and tested playbook: threaten to suspend service in the area. The threat, which the companies would sometimes follow through on, appeared designed to rile up customers and drivers, and put more pressure on lawmakers.

Now Uber (UBER) and Lyft (LYFT) are once again betting on a version of this playbook as they confront a heated legal battle in their home state over a new law impacting how much of the on-demand economy classifies its workers.

The two companies have said they may suspend their operations in California as soon as this week while simultaneously pushing for a referendum in November to exempt them from the law, known as AB-5. But industry watchers say the shutdown may not have the same impact on residents now as it once did in earlier fights because of their steep drop in ridership from the pandemic.

"If a tree falls in the forest and no one's there to hear it, then did it really happen?" said Bradley Tusk, a venture capitalist, political strategist and former regulatory adviser to Uber. "If voters couldn't get an Uber or a Lyft when they wanted it, that's one thing. But ridership is down so drastically, if this does prompt a political outcry, it'll come from the drivers, not the riders."

Court orders Uber, Lyft to reclassify drivers as employees in California

The threats from Uber and Lyft to halt their businesses came after a California court ordered them last Monday to reclassify their drivers in the state as employees in 10 days. This reclassification would represent a radical shift for the two businesses. They built up massive fleets of drivers by treating them as independent contractors. That way they were not entitled to benefits like minimum wage, overtime pay, workers' compensation, unemployment insurance and paid sick leave.

Uber CEO Dara Khosrowshahi said last week that it would be "really, really unfortunate," but the company would "essentially shut down Uber until November when the voters decide" if it cannot delay the order until the referendum vote. Not long after, Lyft cofounder John Zimmer said on the company's quarterly earnings call that it would also be "forced to suspend rideshare operations in California."

"Lyft cannot comply with the injunction at a flip of the switch," Zimmer added.

At a time when Uber and Lyft arguably have the least leverage with riders, the stakes are the highest for the companies to mobilize support for a more favorable solution. Both companies are grappling with sharp revenue declines from the pandemic and have histories of steep losses. Now they risk losing access to a state whose economy is larger than most countries -- or else overhauling their business models.

Moreover, if they lose the battle in their home state, it may only add momentum for other states to rethink legislation for the gig economy.

Under AB-5, which went into effect January 1, companies must prove workers are free from company control and perform work outside the usual course of the company's business in order to classify workers as independent contractors rather than employees. Last week's injunction is part of an ongoing lawsuit brought in May by California Attorney General Xavier Becerra and a coalition of city attorneys.

In their ideal world, Uber and Lyft would delay the enforcement until California residents vote on the referendum, known as Prop 22, that the companies have each backed with tens of millions of dollars. If passed, it would exempt Uber, Lyft, Instacart, DoorDash and Uber-owned Postmates from the law while providing drivers with some additional benefits. (The other companies are not part of the ongoing lawsuit so are not facing the same deadline.)

But their initial attempt at an appeal proved unsuccessful. On Thursday, a California judge denied them. Uber said it plans to again appeal the order; Lyft filed an appeal Friday with a California appellate court.

In the absence of a legal victory, shutting down is one way for Uber and Lyft to attempt to wield the power of their apps in order to sway public opinion. And there is certainly precedent for it. The companies have threatened to leave, or have left, a number of cities, including Chicago, Houston and Austin. In 2015, in New York City, the company put a tab on its app to show New York riders what it would be like to need to wait 25 minutes for a car if the city's mayor's proposed regulations went through.

Uber's delivery service is now bigger than its rides business

But multiple industry watchers noted that Uber and Lyft may be in a weaker position this time. Uber's ride-hailing revenue for the second quarter of this year declined 67% from the same period a year earlier. Lyft's business similarly shrank during the second quarter ending in June, with its revenue falling 61% and ridership falling by nearly the same amount.

A sharp drop in ridership from the public health crisis may only be one part of their problem in this fight. Bruce Schaller, a transportation consultant and a former New York City transportation official, said the public is "far more sympathetic to worker rights issues now with respect to these companies than they were five or six years ago," citing the recession and pandemic, which have drawn increased attention to the plight of essential workers.

California is hardly the only legal challenge Uber and Lyft are facing. Massachusetts has a similar law to AB-5 and the attorney general there recently sued the companies over worker misclassification. Decisions in Pennsylvania and New York around unemployment insurance also go against the companies' stance on employment. Last year, the New Jersey Labor Commissioner determined Uber owed $649 million in unpaid unemployment insurance contributions as a result of driver misclassification.

Terri Gerstein of the Harvard Labor and Worklife Program and Economic Policy Institute questioned if the companies may also eventually withdraw from other markets where their business model is similarly in limbo: "What's the long term plan?"

California ruling against Uber, Lyft threatens to upend gig economy

BY CHRIS MILLS RODRIGO - 08/16/20

© Getty Images

The business models for Uber, Lyft and dozens of other gig worker companies that have sprouted up over the last decade are up in the air after a California judge ruled that rideshare drivers must be classified as employees rather than contractors.

Uber and Lyft have until Thursday to appeal the decision. The end result will likely have repercussions well beyond California.

Failure to overturn the ruling would mean the two companies, which already fail to turn a profit, will be unable to operate under their current business structures in a state known for setting nationwide precedents.

San Francisco Superior Court judge Ethan Schulman ruled Monday that Uber and Lyft must classify their drivers as full employees under Assembly Bill (AB) 5, a landmark law that establishes a test for determining whether workers can be classified as independent contractors.

Schulman sided with California Attorney General Xavier Becerra (D), who brought the lawsuit after the two ridesharing giants resisted the law after it took effect in January, arguing their core business is technology rather than ride-hailing.

Both companies reacted aggressively to Monday’s court decision, threatening to shut down operations in California if they are forced to provide workers with basic protections like a minimum wage and the right to organize. Those threats have put drivers in a precarious position.

“As deplorable as that is, it's not surprising, because now that the pandemic has pushed the vast majority of drivers into financial ruin, Uber and Lyft are ready to completely abandon them,” Erica Mighetto, a driver in the San Francisco area and member of Rideshare Drivers United, told The Hill.

After the ruling, both companies filed motions to extend a 10-day stay that Schulman placed on his decision to give Uber and Lyft time to file appeals. He denied their motions, meaning Thursday is still their deadline for appealing.

Legal experts say that while the companies are almost certain to appeal, they’re unlikely to make any new arguments when they do so.

“Based on what I heard in the oral argument, I think they’re really going to go hard on this idea that this is going to cause irreparable harm both to the companies and to drivers,” said Veena Dubal, associate professor at the University of California’s Hastings College of the Law in San Francisco.

That argument was rejected in court by Schulman, who said the companies had plenty of time to figure out how to comply with the law.

The case will also likely hinge on rules for determining employment status. AB5 codified a test for determining whether workers can be considered independent contractors.

The first prong of the test says the worker must be free from control and direction of the hiring entity. Both Uber and Lyft have emphasized the flexibility that they provide drivers on their platforms, letting them select their own hours and rides.

However, researchers have raised questions about that independence, noting that drivers are tightly surveilled and have to follow strict policies. Additionally, nothing about being a full employee has a requirement for hours.

Uber has taken some steps to resolve that part of the codified test in California, such as letting drivers set their own surge rates and showing them whole trips before they pick up riders.

But those changes don’t “give drivers sufficient control to say that they control their own destiny, and that they control their own work,” Bryant Greening, an attorney at LegalRideshare, a law firm that specializes in rideshare cases, told The Hill.

The second prong of the state test, and the most important in this case, is that the task performed by workers must be outside of the usual course of the hiring entity’s business.

Uber and Lyft have long held that they are technology platforms, not ride hailing businesses. That argument has been increasingly harder to defend.

“It’s this simple,” Schulman wrote in his ruling, “Defendants’ drivers do not perform work that is ‘outside the usual course’ of their business. Defendants’ insistence that their businesses are ‘multi-sided platforms’ rather than transportation companies is flatly inconsistent with the statutory provisions that govern their businesses as transportation network companies, which are defined as companies that ‘engage in the transportation of persons by motor vehicle for compensation.’”

The third prong of the test requires that the worker participate in a type of task that has been established before as being independent.

If any one of the prongs is failed, the worker cannot be considered an independent contractor under state law.

Even though they’re expected to file appeals, Uber and Lyft have already begun charting next steps.

In addition to threatening to leave the state -- a tactic Uber used frequently while it expanded across the country -- the two firms have joined forces with other gig companies to pour millions of dollars into a ballot measure Prop 22, that would exempt them from state labor laws that threaten their business models.

The ballot measure would entitle gig company workers to some protections including minimum earnings, vehicle insurance and health care subsidies, but would exempt the companies from having to give them full employee status.

Uber and Lyft asked Schulman to delay his decision until after the vote on Prop 22 to let voters decide, a plea that was swiftly rejected by the court.

Prop 22 would establish the kind of third employee classification type that Uber CEO Dara Khosrowshahi has long sought. Khosrowshahi sent a letter to the White House earlier this year asking President Trump to consider legislative action on a worker classification that could let Uber maintain the flexibility of having independent contractors while adding some basic worker protections. He made a similar push for new laws in a New York Times op-ed on Monday.

An Uber and Lyft driver in California named John, who asked that his last name not be used for fear of reprisal, said the companies’ threats to leave the state also have the effect of pressuring drivers to support Prop 22.

Now Uber (UBER) and Lyft (LYFT) are once again betting on a version of this playbook as they confront a heated legal battle in their home state over a new law impacting how much of the on-demand economy classifies its workers.

The two companies have said they may suspend their operations in California as soon as this week while simultaneously pushing for a referendum in November to exempt them from the law, known as AB-5. But industry watchers say the shutdown may not have the same impact on residents now as it once did in earlier fights because of their steep drop in ridership from the pandemic.

"If a tree falls in the forest and no one's there to hear it, then did it really happen?" said Bradley Tusk, a venture capitalist, political strategist and former regulatory adviser to Uber. "If voters couldn't get an Uber or a Lyft when they wanted it, that's one thing. But ridership is down so drastically, if this does prompt a political outcry, it'll come from the drivers, not the riders."

Court orders Uber, Lyft to reclassify drivers as employees in California

The threats from Uber and Lyft to halt their businesses came after a California court ordered them last Monday to reclassify their drivers in the state as employees in 10 days. This reclassification would represent a radical shift for the two businesses. They built up massive fleets of drivers by treating them as independent contractors. That way they were not entitled to benefits like minimum wage, overtime pay, workers' compensation, unemployment insurance and paid sick leave.

Uber CEO Dara Khosrowshahi said last week that it would be "really, really unfortunate," but the company would "essentially shut down Uber until November when the voters decide" if it cannot delay the order until the referendum vote. Not long after, Lyft cofounder John Zimmer said on the company's quarterly earnings call that it would also be "forced to suspend rideshare operations in California."

"Lyft cannot comply with the injunction at a flip of the switch," Zimmer added.

At a time when Uber and Lyft arguably have the least leverage with riders, the stakes are the highest for the companies to mobilize support for a more favorable solution. Both companies are grappling with sharp revenue declines from the pandemic and have histories of steep losses. Now they risk losing access to a state whose economy is larger than most countries -- or else overhauling their business models.

Moreover, if they lose the battle in their home state, it may only add momentum for other states to rethink legislation for the gig economy.

Under AB-5, which went into effect January 1, companies must prove workers are free from company control and perform work outside the usual course of the company's business in order to classify workers as independent contractors rather than employees. Last week's injunction is part of an ongoing lawsuit brought in May by California Attorney General Xavier Becerra and a coalition of city attorneys.

In their ideal world, Uber and Lyft would delay the enforcement until California residents vote on the referendum, known as Prop 22, that the companies have each backed with tens of millions of dollars. If passed, it would exempt Uber, Lyft, Instacart, DoorDash and Uber-owned Postmates from the law while providing drivers with some additional benefits. (The other companies are not part of the ongoing lawsuit so are not facing the same deadline.)

But their initial attempt at an appeal proved unsuccessful. On Thursday, a California judge denied them. Uber said it plans to again appeal the order; Lyft filed an appeal Friday with a California appellate court.

In the absence of a legal victory, shutting down is one way for Uber and Lyft to attempt to wield the power of their apps in order to sway public opinion. And there is certainly precedent for it. The companies have threatened to leave, or have left, a number of cities, including Chicago, Houston and Austin. In 2015, in New York City, the company put a tab on its app to show New York riders what it would be like to need to wait 25 minutes for a car if the city's mayor's proposed regulations went through.

Uber's delivery service is now bigger than its rides business

But multiple industry watchers noted that Uber and Lyft may be in a weaker position this time. Uber's ride-hailing revenue for the second quarter of this year declined 67% from the same period a year earlier. Lyft's business similarly shrank during the second quarter ending in June, with its revenue falling 61% and ridership falling by nearly the same amount.

A sharp drop in ridership from the public health crisis may only be one part of their problem in this fight. Bruce Schaller, a transportation consultant and a former New York City transportation official, said the public is "far more sympathetic to worker rights issues now with respect to these companies than they were five or six years ago," citing the recession and pandemic, which have drawn increased attention to the plight of essential workers.

California is hardly the only legal challenge Uber and Lyft are facing. Massachusetts has a similar law to AB-5 and the attorney general there recently sued the companies over worker misclassification. Decisions in Pennsylvania and New York around unemployment insurance also go against the companies' stance on employment. Last year, the New Jersey Labor Commissioner determined Uber owed $649 million in unpaid unemployment insurance contributions as a result of driver misclassification.

Terri Gerstein of the Harvard Labor and Worklife Program and Economic Policy Institute questioned if the companies may also eventually withdraw from other markets where their business model is similarly in limbo: "What's the long term plan?"

California ruling against Uber, Lyft threatens to upend gig economy

BY CHRIS MILLS RODRIGO - 08/16/20

© Getty Images

The business models for Uber, Lyft and dozens of other gig worker companies that have sprouted up over the last decade are up in the air after a California judge ruled that rideshare drivers must be classified as employees rather than contractors.

Uber and Lyft have until Thursday to appeal the decision. The end result will likely have repercussions well beyond California.

Failure to overturn the ruling would mean the two companies, which already fail to turn a profit, will be unable to operate under their current business structures in a state known for setting nationwide precedents.

San Francisco Superior Court judge Ethan Schulman ruled Monday that Uber and Lyft must classify their drivers as full employees under Assembly Bill (AB) 5, a landmark law that establishes a test for determining whether workers can be classified as independent contractors.

Schulman sided with California Attorney General Xavier Becerra (D), who brought the lawsuit after the two ridesharing giants resisted the law after it took effect in January, arguing their core business is technology rather than ride-hailing.

Both companies reacted aggressively to Monday’s court decision, threatening to shut down operations in California if they are forced to provide workers with basic protections like a minimum wage and the right to organize. Those threats have put drivers in a precarious position.

“As deplorable as that is, it's not surprising, because now that the pandemic has pushed the vast majority of drivers into financial ruin, Uber and Lyft are ready to completely abandon them,” Erica Mighetto, a driver in the San Francisco area and member of Rideshare Drivers United, told The Hill.

After the ruling, both companies filed motions to extend a 10-day stay that Schulman placed on his decision to give Uber and Lyft time to file appeals. He denied their motions, meaning Thursday is still their deadline for appealing.

Legal experts say that while the companies are almost certain to appeal, they’re unlikely to make any new arguments when they do so.

“Based on what I heard in the oral argument, I think they’re really going to go hard on this idea that this is going to cause irreparable harm both to the companies and to drivers,” said Veena Dubal, associate professor at the University of California’s Hastings College of the Law in San Francisco.

That argument was rejected in court by Schulman, who said the companies had plenty of time to figure out how to comply with the law.

The case will also likely hinge on rules for determining employment status. AB5 codified a test for determining whether workers can be considered independent contractors.

The first prong of the test says the worker must be free from control and direction of the hiring entity. Both Uber and Lyft have emphasized the flexibility that they provide drivers on their platforms, letting them select their own hours and rides.

However, researchers have raised questions about that independence, noting that drivers are tightly surveilled and have to follow strict policies. Additionally, nothing about being a full employee has a requirement for hours.

Uber has taken some steps to resolve that part of the codified test in California, such as letting drivers set their own surge rates and showing them whole trips before they pick up riders.

But those changes don’t “give drivers sufficient control to say that they control their own destiny, and that they control their own work,” Bryant Greening, an attorney at LegalRideshare, a law firm that specializes in rideshare cases, told The Hill.

The second prong of the state test, and the most important in this case, is that the task performed by workers must be outside of the usual course of the hiring entity’s business.

Uber and Lyft have long held that they are technology platforms, not ride hailing businesses. That argument has been increasingly harder to defend.

“It’s this simple,” Schulman wrote in his ruling, “Defendants’ drivers do not perform work that is ‘outside the usual course’ of their business. Defendants’ insistence that their businesses are ‘multi-sided platforms’ rather than transportation companies is flatly inconsistent with the statutory provisions that govern their businesses as transportation network companies, which are defined as companies that ‘engage in the transportation of persons by motor vehicle for compensation.’”

The third prong of the test requires that the worker participate in a type of task that has been established before as being independent.

If any one of the prongs is failed, the worker cannot be considered an independent contractor under state law.

Even though they’re expected to file appeals, Uber and Lyft have already begun charting next steps.

In addition to threatening to leave the state -- a tactic Uber used frequently while it expanded across the country -- the two firms have joined forces with other gig companies to pour millions of dollars into a ballot measure Prop 22, that would exempt them from state labor laws that threaten their business models.

The ballot measure would entitle gig company workers to some protections including minimum earnings, vehicle insurance and health care subsidies, but would exempt the companies from having to give them full employee status.

Uber and Lyft asked Schulman to delay his decision until after the vote on Prop 22 to let voters decide, a plea that was swiftly rejected by the court.

Prop 22 would establish the kind of third employee classification type that Uber CEO Dara Khosrowshahi has long sought. Khosrowshahi sent a letter to the White House earlier this year asking President Trump to consider legislative action on a worker classification that could let Uber maintain the flexibility of having independent contractors while adding some basic worker protections. He made a similar push for new laws in a New York Times op-ed on Monday.

An Uber and Lyft driver in California named John, who asked that his last name not be used for fear of reprisal, said the companies’ threats to leave the state also have the effect of pressuring drivers to support Prop 22.

“They’re shooting a salvo over the bow, they basically want to scare drivers, they want to scare them into voting yes,” he told The Hill.

The resolution of Uber and Lyft’s battles against California labor laws could have ripple effects nationwide for other companies that rely on gig work, like grocery or food delivery, that have grown immensely during the coronavirus pandemic.

Dubal called the decision "probably the most important one that has come out globally,” because “California is such a huge market for them, and... the judge made such clear legal statements about how this is not a technology company but a transportation company and they are clearly in violation of the law.”

For Mighetto, the San Francisco area driver, forcing Uber and Lyft to choose between offering worker protections or folding is long overdue.

“We're really hopeful that we can put a stop to Prop 22, and that Uber and Lyft come to the reality that there's no place for them anywhere unless they treat their workers fairly,” she said.

The resolution of Uber and Lyft’s battles against California labor laws could have ripple effects nationwide for other companies that rely on gig work, like grocery or food delivery, that have grown immensely during the coronavirus pandemic.

Dubal called the decision "probably the most important one that has come out globally,” because “California is such a huge market for them, and... the judge made such clear legal statements about how this is not a technology company but a transportation company and they are clearly in violation of the law.”

For Mighetto, the San Francisco area driver, forcing Uber and Lyft to choose between offering worker protections or folding is long overdue.

“We're really hopeful that we can put a stop to Prop 22, and that Uber and Lyft come to the reality that there's no place for them anywhere unless they treat their workers fairly,” she said.

No comments:

Post a Comment