U.S. natural gas prices slump after fire at Texas LNG terminal

,

Bloomberg News

Jun 8, 2022

U.S. natural gas prices tumbled after a fire broke out at a Texas export terminal, threatening to leave supplies of the fuel stranded in shale basins despite surging overseas demand.

The fire is under control at Freeport LNG’s terminal in Quintana, Texas, about 65 miles (105 kilometers) south of Houston, company spokeswoman Heather Browne said Wednesday. The incident happened at about 11:40 a.m. local time and an investigation is ongoing, she said, adding that there were no injuries or risks to the surrounding community.

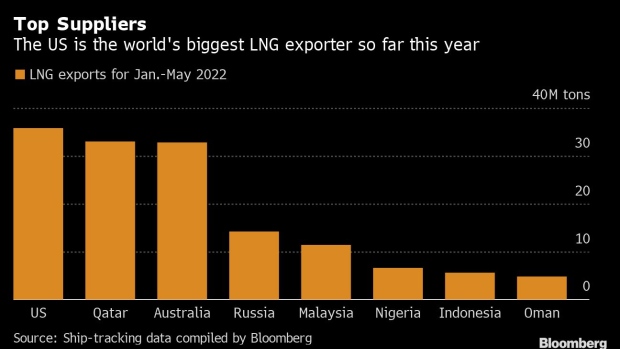

Freeport is one of seven US liquefied natural gas export terminals, which receive gas via pipeline and liquefy it before loading the super-chilled LNG onto tankers. The terminals have helped the US emerge in the past few years to vie with Qatar and Australia for position as the No. 1 exporter of LNG. As Europe clamors for cargoes after Russia’s invasion of Ukraine, the blaze could have a significant impact on global supplies of the fuel.

US natural gas futures for July delivery slid as much as 9.3 per cent to US$8.427 per million British thermal units in New York after reports of the fire first emerged, halting a rally that sent prices to fresh 13-year highs earlier. The contract settled down 6.4 per cent at US$8.699. Prices have more than doubled this year, as US gas stockpiles remain well below normal levels.

The fire is “going to curtail exports and alleviate some of the strain on US supplies,” said John Kilduff, a partner at hedge fund Again Capital in New York. US consumers “should benefit from lower prices, but Europe and Asia will probably pay higher prices.”

Freeport receives about 2 billion cubic feet of gas per day, or roughly 16 per cent of total US LNG export capacity. The tanker Elisa Larus is currently at the terminal, though it’s under way using its engine, according to vessel tracking data compiled by Bloomberg. That suggests the tanker may be moving away from Freeport.

Natural Gas Prices Tank Again As Freeport LNG Remains Shut For Almost A Month

- Natural gas prices fell another 7.5% percent on Thursday morning.

- Freeport LNG outage to lead to drop in exports to Europe and Asia.

- The cause of the explosion on Wednesday remains unclear.

Amid robust demand for U.S. LNG, one of the biggest liquefaction facilities on the Gulf Coast, Freeport LNG, will be out of commission for at least three weeks following an explosion yesterday.

An explosion rocked the Freeport LNG liquefaction plant yesterday morning, with its cause as of yet unclear. An investigation is ongoing, but according to the operator of the facility, Freeport LNG, the facility will remain shut down for weeks. It accounts for a fifth of total U.S. liquefaction capacity.

The Freeport facility has three liquefaction trains, and a fourth is being constructed. Its current gas processing capacity is 2.1 billion cu ft daily. With the outage, the situation with U.S. LNG exports will become problematic, as evidenced by the gas market’s reaction to the news of the explosion.

Initially, prices fell as traders worried that the outage would reduce American LNG’s market share, per a Financial Times report from earlier today. Bloomberg noted that the fire means a lot of gas will remain stranded at the fields amid surging demand for gas overseas.

Yet prices on international LNG markets might react differently because the Freeport LNG outage effectively means there will be less natural gas for export, especially to energy-thirty Europe and Asia.

In Europe, gas prices have been on the decline for the past few days as an early start of summer reduced immediate demand. An ample supply of LNG has also contributed to the price trend. With the outage, this trend might at some point reverse.

Asian demand, however, is on a strong rise as buyers seek to build inventory for the winter season, Bloomberg reported this week, which is lending further upward support to prices.

“LNG prices remain well above where they normally are, even adjusting for higher crude oil prices,” Sanford C. Bernstein analysts said in a note, as quoted by Bloomberg. “We expect this to be a lull before what looks like a tough winter ahead for consumers.”

Oilprice.com

European Gas Soars as Fire in US Compounds Russia Supply Concern

, Bloomberg News

(Bloomberg) -- Europe’s natural gas prices surged after a fire at a large export terminal in the US promised to wipe out deliveries to a market that’s on high alert over tight Russian supplies.

Benchmark futures traded in Amsterdam snapped a six-day falling streak, while UK prices jumped more than 34%. The Freeport liquefied natural gas facility in Texas, which makes up about a fifth of all US exports of the fuel, will remain closed for at least three weeks. The US sent nearly 75% of all its LNG to Europe in the first four months of this year.

The closure comes as pipeline supplies from Europe’s top providers are also capped. Key facilities in Norway are undergoing annual maintenance this week, while Russia’s supplies are below capacity after several European buyers were cut off for refusing to meet Moscow’s demands to be ultimately paid in rubles for its pipeline fuel.

“An export halt during the high demand winter months would have triggered a much bigger reaction, but the event highlights Europe’s precarious situation and it would likely signal an end for now to the calm trading seen in recent weeks,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Europe has been particularly reliant on US LNG to help offset risk of disruption to Russian pipeline imports, and ample supplies of the fuel in the past weeks had calmed the market after wild swings earlier this year.

“The rising importance of US gas exports to a gas-hungry Europe has been clearly highlighted by price movements on either side of the pond these past few hours,” Saxo Bank’s Hansen said.

The extent of the damage to the Freeport facility is not yet clear, but the fire could potentially knock out abut 16% of total US LNG export capacity “for an unknown period if the fire damage proves difficult to repair,” analysts at Evercore ISI said in a note.

Dutch front-month gas, the European benchmark, traded 12% higher at 89.13 euros per megawatt-hour by 8:53 a.m. in Amsterdam. The contract dropped 16% over the previous six sessions.

UK next-month futures jumped to 174.14 pence a therm. Send-outs from Britain’s LNG terminals, a key European destination for US cargoes, fell about 30% Thursday to the lowest since mid-March.

Even with tepid consumption in most of Europe amid mild weather that means that energy companies may have to turn to gas inventories just as storage levels have improved recently, getting closer to historic averages.

LNG buyers will probably start hunting for replacement shipments from the spot market, but there is a dwindling amount of supplies available, according to traders in Asia. The move is likely to boost already intense competition between Asia and Europe for the fuel.

Gas flows from Norway rebounded after a one-day halt of the giant Troll field for annual tests on Wednesday, but are still below normal as seasonal works at a number of facilities continue. Shipments of Russian gas via the Nord Stream pipeline to Germany will continue to edge down on Thursday, grid data show.

©2022 Bloomberg L.P.

No comments:

Post a Comment