Valentina Ruiz Leotaud | March 19, 2023 |

Cat 795 AC mining truck on trolley at Boliden Aitik mine.

(Reference image by Caterpillar).

A recent report by Deloitte Canada makes a case for decarbonizing commercial vehicles as a measure that is eventually less expensive than maintaining internal combustion vehicles and that has a greater impact on emissions reductions than doing so on passenger vehicles.

According to the firm, a commercial vehicle can emit up to 21 times more CO2 than a light-duty passenger vehicle.

“Electric vehicles are expected to play a significant role in enabling companies to decarbonize their commercial fleets and reduce emissions at a competitive cost,” the report reads. “According to the International Energy Agency’s projections, EVs will comprise nearly 100% of commercial vehicle sales by 2050 in a net-zero scenario—compared to just 0.1% in 2020.”

In the view of the experts at Deloitte, it is important for organizations looking to reduce their emissions to move quickly when it comes to electrification. They believe that operators that are already working to electrify their fleets are better positioned to capture an important competitive advantage—and more market share—as their business customers increasingly shift to more carbon-efficient commercial transport providers to reduce their Scope 3 emissions.

Switching to EVs is also seen as a way to shelter companies from fluctuating gas and diesel prices, particularly considering the impacts of geopolitical events such as the war in Ukraine.

Also, electricity is cheaper than diesel per gigajoule of energy across most of Canada, except in Ontario, New Brunswick, Nova Scotia, and Prince Edward Island.

The higher energy efficiency of EVs means they should be much cheaper to operate, even in jurisdictions with high electricity prices like Ontario or low fuel prices like Alberta.

Carbon tax

Savings connected to electrification are also related to the fact that Canada’s carbon tax is expected to continue to increase this decade, from $50 per tonne of CO2e in 2022 to $170 per tonne by 2030 (from 13 to 46 cents per litre). This means fuel prices are expected to rise more quickly than electricity prices over the same period.

“Organizations that are working to transform their fleet’s power source today will minimize the disruptive impacts of these regulatory changes on their businesses in the years to come,” the dossier notes.

The authors of the report do recognize that the transformation attached to electrification involves investing significant capital into vehicles and charging infrastructure. However, they do recommend that operators take advantage of the $3 billion in EV grants and incentives currently offered by Canada’s federal and provincial governments, particularly taking into account that these grants and incentives are both time-bound, expiring by 2027, and capped.

“Those who wait may find that the funds have been exhausted, requiring them to bear the full cost of their electrification efforts,” the dossier reads. “Taking early action also helps ensure that partnerships with EV manufacturers can be established to secure the vehicles and infrastructure required at a time when EV demand is outpacing supply. In addition, first movers can ally early with local utility companies to attain additional power supply that may be needed for on-site charging infrastructure.”

Maintenance

In addition to considerations around charging infrastructure, rethinking and redesigning fleet operations, routing, and networks to account for things such as charging times and how extreme temperatures affect the performance and durability of EV batteries, Deloitte suggests thinking about the costs of operating electric vehicles.

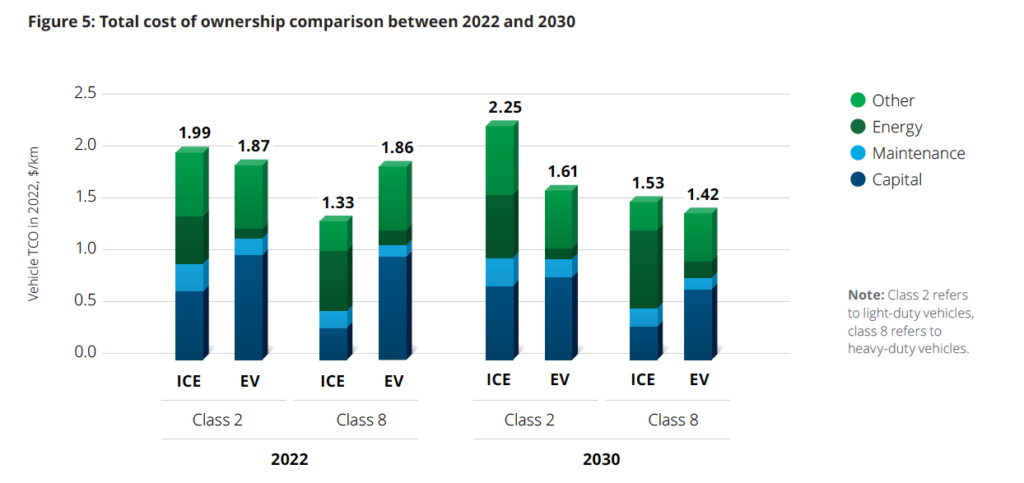

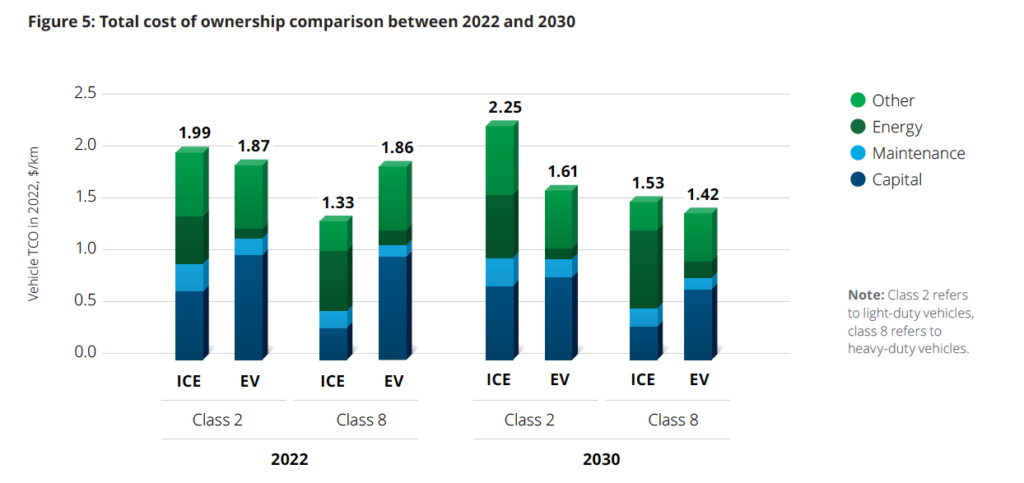

“EVs that require larger batteries to move large payloads or travel longer distances on a single charge cost significantly more than ICE vehicles; currently, a battery-electric class 8 truck can be up to four times more expensive than its diesel equivalent,” the dossier states. However, “as battery-electric technology costs are expected to decline, most class 8 commercial EVs are likely to reach TCO price parity by 2030.”

The report notes that heavy-duty industries looking into electrification should also keep in mind that maintenance costs for EV trucks are 30% to 40% lower than those for traditional trucks.

A recent report by Deloitte Canada makes a case for decarbonizing commercial vehicles as a measure that is eventually less expensive than maintaining internal combustion vehicles and that has a greater impact on emissions reductions than doing so on passenger vehicles.

According to the firm, a commercial vehicle can emit up to 21 times more CO2 than a light-duty passenger vehicle.

“Electric vehicles are expected to play a significant role in enabling companies to decarbonize their commercial fleets and reduce emissions at a competitive cost,” the report reads. “According to the International Energy Agency’s projections, EVs will comprise nearly 100% of commercial vehicle sales by 2050 in a net-zero scenario—compared to just 0.1% in 2020.”

In the view of the experts at Deloitte, it is important for organizations looking to reduce their emissions to move quickly when it comes to electrification. They believe that operators that are already working to electrify their fleets are better positioned to capture an important competitive advantage—and more market share—as their business customers increasingly shift to more carbon-efficient commercial transport providers to reduce their Scope 3 emissions.

Switching to EVs is also seen as a way to shelter companies from fluctuating gas and diesel prices, particularly considering the impacts of geopolitical events such as the war in Ukraine.

Also, electricity is cheaper than diesel per gigajoule of energy across most of Canada, except in Ontario, New Brunswick, Nova Scotia, and Prince Edward Island.

The higher energy efficiency of EVs means they should be much cheaper to operate, even in jurisdictions with high electricity prices like Ontario or low fuel prices like Alberta.

Carbon tax

Savings connected to electrification are also related to the fact that Canada’s carbon tax is expected to continue to increase this decade, from $50 per tonne of CO2e in 2022 to $170 per tonne by 2030 (from 13 to 46 cents per litre). This means fuel prices are expected to rise more quickly than electricity prices over the same period.

“Organizations that are working to transform their fleet’s power source today will minimize the disruptive impacts of these regulatory changes on their businesses in the years to come,” the dossier notes.

The authors of the report do recognize that the transformation attached to electrification involves investing significant capital into vehicles and charging infrastructure. However, they do recommend that operators take advantage of the $3 billion in EV grants and incentives currently offered by Canada’s federal and provincial governments, particularly taking into account that these grants and incentives are both time-bound, expiring by 2027, and capped.

“Those who wait may find that the funds have been exhausted, requiring them to bear the full cost of their electrification efforts,” the dossier reads. “Taking early action also helps ensure that partnerships with EV manufacturers can be established to secure the vehicles and infrastructure required at a time when EV demand is outpacing supply. In addition, first movers can ally early with local utility companies to attain additional power supply that may be needed for on-site charging infrastructure.”

Maintenance

In addition to considerations around charging infrastructure, rethinking and redesigning fleet operations, routing, and networks to account for things such as charging times and how extreme temperatures affect the performance and durability of EV batteries, Deloitte suggests thinking about the costs of operating electric vehicles.

“EVs that require larger batteries to move large payloads or travel longer distances on a single charge cost significantly more than ICE vehicles; currently, a battery-electric class 8 truck can be up to four times more expensive than its diesel equivalent,” the dossier states. However, “as battery-electric technology costs are expected to decline, most class 8 commercial EVs are likely to reach TCO price parity by 2030.”

The report notes that heavy-duty industries looking into electrification should also keep in mind that maintenance costs for EV trucks are 30% to 40% lower than those for traditional trucks.

(Graph by Deloitte).

“EV maintenance costs are lower than those of internal combustion engine (ICE) vehicles, helped by the fact that an EV drivetrain contains around 20 moving parts—compared to more than 2,000 moving parts in a typical ICE drivetrain,” the document points out. “The total cost of ownership (TCO) for some EVs is already lower than ICE vehicles.”

Finally, the market analyst believes that technological improvements should contribute to lower capital costs and the TCO over time, particularly taking into account that battery prices have steadily declined as manufacturing processes have improved and new battery chemistries identified.

“According to BloombergNEF, average battery pack prices could drop to $100/kWh by 2024, which would put the TCO of many EV models on par with their ICE equivalents,” the report states. “In addition, improving battery energy density means that new EVs will require less battery power to travel the same distance as older EVs—which translates to fewer battery cells and lower vehicle prices.”

“EV maintenance costs are lower than those of internal combustion engine (ICE) vehicles, helped by the fact that an EV drivetrain contains around 20 moving parts—compared to more than 2,000 moving parts in a typical ICE drivetrain,” the document points out. “The total cost of ownership (TCO) for some EVs is already lower than ICE vehicles.”

Finally, the market analyst believes that technological improvements should contribute to lower capital costs and the TCO over time, particularly taking into account that battery prices have steadily declined as manufacturing processes have improved and new battery chemistries identified.

“According to BloombergNEF, average battery pack prices could drop to $100/kWh by 2024, which would put the TCO of many EV models on par with their ICE equivalents,” the report states. “In addition, improving battery energy density means that new EVs will require less battery power to travel the same distance as older EVs—which translates to fewer battery cells and lower vehicle prices.”

No comments:

Post a Comment