Boeing Offers $119,000 a Year to End Strike. Why the Stock Is Rising.

Boeing Workers Want the Pension Plan Restarted. It Won’t Happen.© Chona Kasinger/Bloomberg

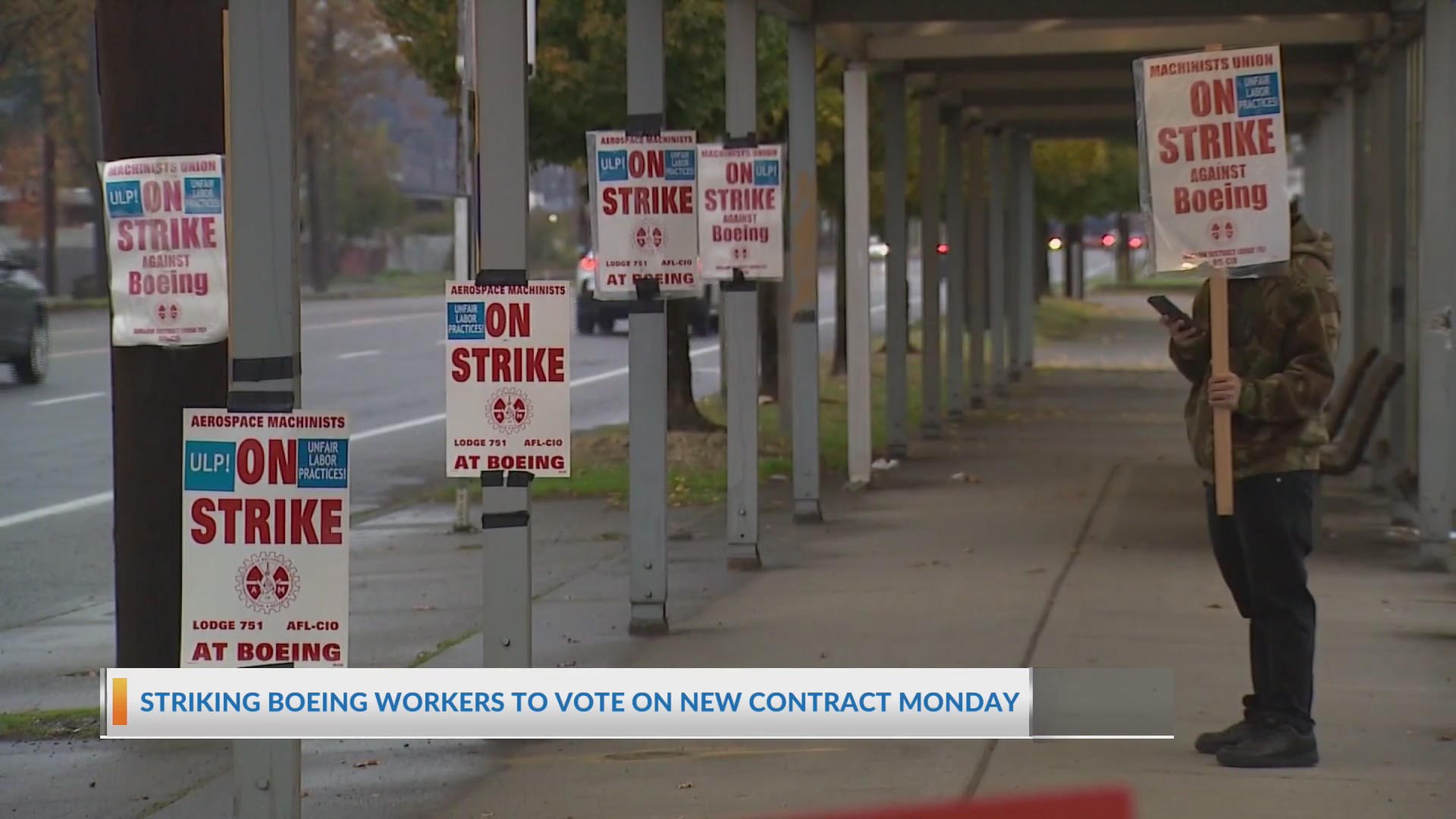

Boeing has a new tentative offer for its striking workers in the Pacific Northwest. The union has slated a vote for Nov. 4, just before the presidential election. Maybe the third time is a charm?

Shares rose 3.5% on Friday, closing at $154.59 while the S&P 500 and Dow Jones Industrial Average were up 0.4% and 0.7%, respectively.

The new deal includes wage increases north of 40% compounded over four years and a $12,000 ratification bonus. Union members have rejected two deals—one raising wages by about 25%, and another raising wages by about 35%.

The most recent deal was voted down by 64% of workers. That offer wasn’t endorsed by Union leadership. The third offer is endorsed.

“In every negotiation and strike, there is a point where we have extracted everything that we can in bargaining and by withholding our labor,” reads part of an IAM 751 tweet. “We are at that point now and risk a regressive or lesser offer in the future.”

The IAM, or International Association of Machinists and Aerospace Workers, local 751 represents the striking workers.

The new deal means the average machinist will be making about $119,000 annually at the end of the contract, up about $44,000 from the prior average of some $76,000.years, as well as a larger signing bonus.

Reuters

ReutersStriking Boeing workers to vote Monday on new pay deal

More videos

FirstpostBoeing’s Billion-Dollar Move to Avoid Junk Status |

4:22

Benzinga (Video)Boeing Strike Could End as Union Endorses New Contract Offer. Workers To Vote On 38% Pay Raise.

0:34

The defined benefit pension, which was frozen about a decade ago, isn’t being restarted. Instead, Boeing will match 100% of up to 8% of an employee’s 401(k) contribution. The company will also contribute 4% of an employee’s base pay. That is 20% of base pay going into a 401(k) if an employee contributes 8%. That’s similar to the recently rejected offer.

Wall Street struck a cautious tone on Friday when reviewing the deal. “These votes can be unpredictable, but there is at least some momentum with the last vote on Oct. 23 coming at a 64% reject rate versus 95% reject for the first contract offer,” wrote Jefferies analyst Sheila Kahyaoglu in a Friday report. “This deal also came together quickly with union endorsement and comments about risking a potentially regressive or lesser offer in the future.”

She estimates wage increases alone add about $1.1 billion to Boeing’s costs by the end of the contract. Don’t forget that Boeing recently announced some 17,000 layoffs, which would likely more than offset the increase.

Kahyaoglu rates Boeing stock Buy. Her price target is $200 a share.

“We encourage all of our employees to learn more about the improved offer and vote on Monday, Nov. 4,” said a Boeing company spokesperson in an emailed statement.

Boeing hopes workers vote yes.

Wall Street estimates Boeing is burning through $1.5 billion a month while the strike continues. The strike entered its 50th day on Friday.

Through Friday trading, Boeing stock was down about 41% year to date. Shares were down about 5% since the strike began on Sept. 13.

Write to Al Root at allen.root@dowjones.com

Boeing stock pops on tentative agreement

with union to end strike as overall cost

nears $10 billion

Weary Boeing (BA) investors are getting a lift on Friday after the planemaker and its main worker union, the International Association of Machinists (IAM), struck a tentative deal.

Under the proposal, Boeing upped its pay hike to 38% over the course of the four-year contract, up from the last offer’s 30% raise; merged the prior $7,000 ratification bonus with a $5,000 lump sum payment for a total $12K into 401(k) plans or as a cash payout; increased its 401(K) match; and lowered health care premiums, among other things.

Boeing stock is up nearly 4% in midday trade as traders and investors bet the new offer will seal the deal.

“It is time for our Members to lock in these gains and confidently declare victory,” the IAM said to its 30,000 union members. “We believe asking members to stay on strike longer wouldn't be right as we have achieved so much success.”

Boeing’s only statement with regards to the sweetened offer: “We encourage all of our employees to learn more about the improved offer and vote on Monday, Nov. 4.”

Interestingly, Boeing committed to building its next airplane in the Seattle/Puget Sound region, where IAM is located, suggesting union members will assemble it. Boeing has a non-union plant in South Carolina, where some 787 Dreamliners are built.

For Boeing, the resolution of this labor strike is tantamount. Last week, the company reported negative operating cash flow of $1.34 billion and a staggering third quarter net loss of $6.17 billion, bringing total losses in 2024 to nearly $8 billion.

Will they vote "yes?" Boeing workers from the International Association of Machinists and Aerospace Workers District 751 attend a rally at their union hall during an ongoing strike in Seattle, Washington, U.S. Oct. 15, 2024. (REUTERS/David Ryder/File Photo)

Boeing said negative operating cash flow reflected lower commercial plane deliveries as well as the impact of the work stoppage. Prior to the labor strike, Boeing was under heavy scrutiny to improve its safety culture following the Alaska Airlines door blowout in January, which was limiting the number of 737 MAX aircraft it could produce.

Boeing’s dwindling cash position threatened the company’s investment credit rating, which led to the company announcing earlier this week that it would launch a $19 billion share sale to boost its cash reserves.

The financial impact of the ongoing labor strike, entering its sixth week, has been costly for Boeing, the industry, and its union workers. The Anderson Economic Group estimates union members lost $808.3 million in wages, with Boeing suppliers losing over $2.3 billion.

With Anderson estimating losses for Boeing at nearly $5.6 billion, the research firm projects overall direct losses for all parties involved, and the Seattle Metro area, at $9.66 billion.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

No comments:

Post a Comment