Europe Set for End to Five Decades of Russian Gas Via Ukraine

By Anna Shiryaevskaya and Priscila Azevedo Rocha

By Anna Shiryaevskaya and Priscila Azevedo Rocha

December 31, 2024

(The Institute for the Study of W)

(Bloomberg) -- Russian gas flows to Europe via Ukraine appear set to stop as time runs out for a last-minute solution before a key transit deal expires, raising the stakes for the continent’s energy security as it draws heavily on reserves.

Benchmark prices jumped to the highest in over a year on Tuesday, as preliminary data for Jan. 1 showed no bookings had been registered for transit on the route — which for five decades has been a key avenue for gas into Europe, even during the nearly three years since Russia’s full-scale invasion of Ukraine.

If confirmed, the halt will mean a handful of central European countries that have relied on the flows will be forced to source more expensive gas elsewhere, adding to pressure on supplies at a time when the region is already depleting its winter storage at the fastest level in years.

For now, no alternative is in place for the five-year-old transit agreement, despite months of political wrangling. While the shipments across Ukraine account for only about 5% of Europe’s gas needs, the region is still feeling the aftershocks of an energy crisis triggered by the Kremlin’s full-scale invasion of its neighbor.

The looming end of the transit deal has highlighted Europe’s continued reliance on Russian gas via pipelines and shipments of liquefied fuel, as well as the cracks in the bloc’s approach to weaning itself off Russian supplies.

European Commission President Ursula von der Leyen has set a political objective of phasing out Russian fossil fuels by 2027 in the wake of the invasion, and has said the end of transit will have little impact on regional energy markets. Still, countries like Hungary and particularly Slovakia have waged an increasingly bitter campaign to keep the fuel flowing.

Europe is also facing an increasingly tight global gas market. The front-month contract rounded out the year with a 51% annual gain — the biggest since 2021.

Read: High Gas Prices Spell Tough Start to 2025 for European Consumers

Initial data for Wednesday indicate no orders for gas at the Sudzha intake station on the Russia-Ukraine border. The so-called nominations, which could still change in the coming hours, represent requests by Russia’s Gazprom PJSC to move gas ordered by its customers.

Data from Slovak grid operator Eustream show zero nominations for gas transit through the Velke Kapusany point, a key interconnection on the Slovakia-Ukraine border that has historically been a major route for Russian gas supplies to Europe.

Escalating Dispute

While traders remain on alert for indications that flows could somehow continue, an escalating public dispute between Ukraine and Slovakia has dampened optimism in recent weeks.

Ukrainian President Volodymyr Zelenskiy earlier this month rejected any arrangement that would ultimately send money to Russian coffers while the war continues. Meanwhile, Slovak Prime Minister Robert Fico has threatened Ukraine with a possible electricity cutoff, raising questions about broader energy security in the region.

In a last-ditch effort over the weekend, Fico urged the EU to address the looming halt of supplies via Ukraine, saying the economic effect on the bloc would outweigh the impact on Russia. He estimated that European consumers could face as much as €50 billion ($52 billion) in extra gas prices per year and another €70 billion in higher electricity costs.

Slovakia and some other Central European states have favored discounted gas from the east, and in recent months, key companies from the region have raced to build support for an alternative to the Russia-Ukraine deal.

Slovakia has said it can handle the loss of Russian gas, but other supplies would likely be costly to bring into the landlocked nation. Russian gas also used to flow from Slovakia into Austria and the Czech Republic, though the latter two nations no longer buy the fuel directly from Gazprom.

‘Expected Situation’

“The stop of flow via Ukraine on 1 January is the expected situation and the EU is prepared for it,” a European Commission spokesperson told Bloomberg News. The commission, the EU’s executive, has been working with member states for more than a year to prepare for such a scenario, she added.

The bloc has diversified its supplies since 2022, turning increasingly to imports of liquefied natural gas, notably from the US. There are “various options” for regulating gas transit to central and eastern Europe, including through another pipeline route and LNG terminals, the German economy ministry said Tuesday.

Officials from Poland, which assumes the rotating presidency of the EU on Wednesday, said the nation is in close contact with the commission and “ready to coordinate further steps with member states, if needed as from Jan. 1.”

Read: European Gas Faces a Raft of Challenges With Transit Deal Ending

Rows between Moscow and Kyiv have previously disrupted gas shipments to European customers in early January.

In 2009, Russian gas flows via Ukraine to Europe stopped for almost two weeks, with more than 20 nations affected during freezing temperatures, until the two nations signed a gas deal ending their dispute. A shorter disruption occurred in 2006. The expiring agreement, set in 2019, was also a result of last-minute negotiations.

However, the war makes a quick resolution unlikely for now. Russian President Vladimir Putin last week indicated there was no time left to conclude an agreement before the end of the year. Separately, he said a lawsuit from Ukraine’s Naftogaz — alleging that Gazprom hasn’t fully paid for transit services — is another barrier.

Some European nations have also warned against ideas that would brand Gazprom’s fuel as non-Russian. Energy companies in the region have previously floated options such as taking ownership of the fuel when it enters Ukraine, or resorting to a complex swap involving Azerbaijan’s energy company Socar as a mediator.

Russia still supplies gas to nations such as Serbia and Hungary via another pipeline, TurkStream, which bypasses Ukraine. But that link isn’t sufficient to fully compensate for the entire loss of the Ukraine route. Another pathway, across Poland, is now closed. The Nord Stream pipeline linking Germany to Russia was damaged in explosions in 2022, and the newer Nord Stream 2 link has never been authorized by Berlin.

--With assistance from Daryna Krasnolutska and Petra Sorge.

(Updates with additional information throughout.)

©2024 Bloomberg L.P.

(Bloomberg) -- Russian gas flows to Europe via Ukraine appear set to stop as time runs out for a last-minute solution before a key transit deal expires, raising the stakes for the continent’s energy security as it draws heavily on reserves.

Benchmark prices jumped to the highest in over a year on Tuesday, as preliminary data for Jan. 1 showed no bookings had been registered for transit on the route — which for five decades has been a key avenue for gas into Europe, even during the nearly three years since Russia’s full-scale invasion of Ukraine.

If confirmed, the halt will mean a handful of central European countries that have relied on the flows will be forced to source more expensive gas elsewhere, adding to pressure on supplies at a time when the region is already depleting its winter storage at the fastest level in years.

For now, no alternative is in place for the five-year-old transit agreement, despite months of political wrangling. While the shipments across Ukraine account for only about 5% of Europe’s gas needs, the region is still feeling the aftershocks of an energy crisis triggered by the Kremlin’s full-scale invasion of its neighbor.

The looming end of the transit deal has highlighted Europe’s continued reliance on Russian gas via pipelines and shipments of liquefied fuel, as well as the cracks in the bloc’s approach to weaning itself off Russian supplies.

European Commission President Ursula von der Leyen has set a political objective of phasing out Russian fossil fuels by 2027 in the wake of the invasion, and has said the end of transit will have little impact on regional energy markets. Still, countries like Hungary and particularly Slovakia have waged an increasingly bitter campaign to keep the fuel flowing.

Europe is also facing an increasingly tight global gas market. The front-month contract rounded out the year with a 51% annual gain — the biggest since 2021.

Read: High Gas Prices Spell Tough Start to 2025 for European Consumers

Initial data for Wednesday indicate no orders for gas at the Sudzha intake station on the Russia-Ukraine border. The so-called nominations, which could still change in the coming hours, represent requests by Russia’s Gazprom PJSC to move gas ordered by its customers.

Data from Slovak grid operator Eustream show zero nominations for gas transit through the Velke Kapusany point, a key interconnection on the Slovakia-Ukraine border that has historically been a major route for Russian gas supplies to Europe.

Escalating Dispute

While traders remain on alert for indications that flows could somehow continue, an escalating public dispute between Ukraine and Slovakia has dampened optimism in recent weeks.

Ukrainian President Volodymyr Zelenskiy earlier this month rejected any arrangement that would ultimately send money to Russian coffers while the war continues. Meanwhile, Slovak Prime Minister Robert Fico has threatened Ukraine with a possible electricity cutoff, raising questions about broader energy security in the region.

In a last-ditch effort over the weekend, Fico urged the EU to address the looming halt of supplies via Ukraine, saying the economic effect on the bloc would outweigh the impact on Russia. He estimated that European consumers could face as much as €50 billion ($52 billion) in extra gas prices per year and another €70 billion in higher electricity costs.

Slovakia and some other Central European states have favored discounted gas from the east, and in recent months, key companies from the region have raced to build support for an alternative to the Russia-Ukraine deal.

Slovakia has said it can handle the loss of Russian gas, but other supplies would likely be costly to bring into the landlocked nation. Russian gas also used to flow from Slovakia into Austria and the Czech Republic, though the latter two nations no longer buy the fuel directly from Gazprom.

‘Expected Situation’

“The stop of flow via Ukraine on 1 January is the expected situation and the EU is prepared for it,” a European Commission spokesperson told Bloomberg News. The commission, the EU’s executive, has been working with member states for more than a year to prepare for such a scenario, she added.

The bloc has diversified its supplies since 2022, turning increasingly to imports of liquefied natural gas, notably from the US. There are “various options” for regulating gas transit to central and eastern Europe, including through another pipeline route and LNG terminals, the German economy ministry said Tuesday.

Officials from Poland, which assumes the rotating presidency of the EU on Wednesday, said the nation is in close contact with the commission and “ready to coordinate further steps with member states, if needed as from Jan. 1.”

Read: European Gas Faces a Raft of Challenges With Transit Deal Ending

Rows between Moscow and Kyiv have previously disrupted gas shipments to European customers in early January.

In 2009, Russian gas flows via Ukraine to Europe stopped for almost two weeks, with more than 20 nations affected during freezing temperatures, until the two nations signed a gas deal ending their dispute. A shorter disruption occurred in 2006. The expiring agreement, set in 2019, was also a result of last-minute negotiations.

However, the war makes a quick resolution unlikely for now. Russian President Vladimir Putin last week indicated there was no time left to conclude an agreement before the end of the year. Separately, he said a lawsuit from Ukraine’s Naftogaz — alleging that Gazprom hasn’t fully paid for transit services — is another barrier.

Some European nations have also warned against ideas that would brand Gazprom’s fuel as non-Russian. Energy companies in the region have previously floated options such as taking ownership of the fuel when it enters Ukraine, or resorting to a complex swap involving Azerbaijan’s energy company Socar as a mediator.

Russia still supplies gas to nations such as Serbia and Hungary via another pipeline, TurkStream, which bypasses Ukraine. But that link isn’t sufficient to fully compensate for the entire loss of the Ukraine route. Another pathway, across Poland, is now closed. The Nord Stream pipeline linking Germany to Russia was damaged in explosions in 2022, and the newer Nord Stream 2 link has never been authorized by Berlin.

--With assistance from Daryna Krasnolutska and Petra Sorge.

(Updates with additional information throughout.)

©2024 Bloomberg L.P.

By ZeroHedge - Dec 26, 2024

The US is already the largest LNG supplier to Europe, and could theoretically replace Russian LNG imports.

Replacing Russian LNG with US LNG could increase shipping costs and European prices.

Europe's decarbonization goals may limit its willingness to make long-term commitments to US LNG.

Samantha Dart, co-head of global commodities research at Goldman, published a note to clients outlining five key questions and answers about the US-EU liquefied natural gas trade. This comes just days after President-elect Donald Trump threatened the EU with a barrage of tariffs unless Brussels ramped up purchases of American LNG.

For context, last Friday, Trump wrote on Truth Social:

"I told the European Union that they must make up their tremendous deficit with the United States by the large-scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!"

Dart told clients that the US is already Europe's largest LNG supplier and a key source of supply growth. She said replacing Russian LNG with US LNG imports could raise shipping costs and European prices to incentivize re-routing cargoes.

She said such a shift would have minimal impact on US LNG export revenues, as total export capacity remains fixed, adding exporters with long-term contracts with proposed US LNG projects would benefit. However, Europe's decarbonization strategy may limit the willingness of European companies to make long-term NatGas commitments with US exporters.

Dart laid out key questions and answers about the US-EU LNG trade that help clients understand that US LNG Gulf exports can "theoretically" replace Russian NatGas flowing into the EU. How much US LNG is exported to Europe?

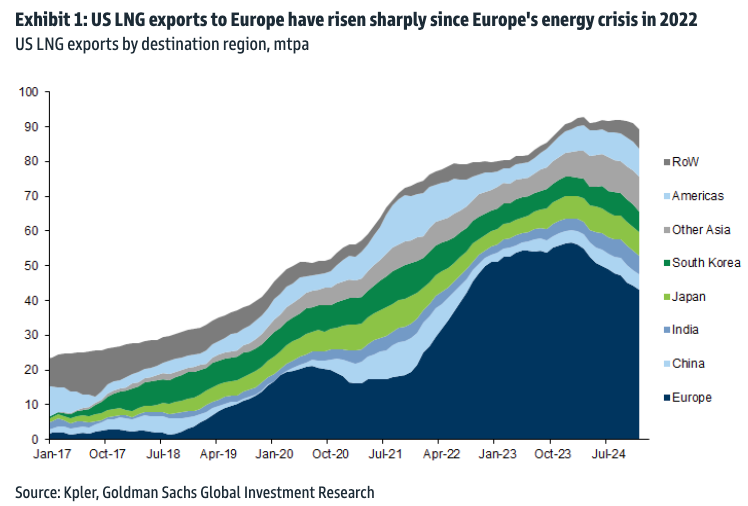

US LNG exports averaged 91 mt over the past year (Dec23-Nov24), of which 47 mt or 51% were delivered to Europe. US LNG exports to Europe have grown significantly in levels and as a share of total US LNG exports since the European energy crisis in 2022, peaking in 2023 (Exhibit 1).

Are US LNG volumes sold in the spot market or are they contracted?

The vast majority of US LNG sales are under contract. That said, US contracts typically have flexible destination ports, in that the buyer is not obligated to deliver to a particular location. This allows buyers of US LNG to re-sell or re-direct cargoes to higher-paying destinations. This was evident during the European energy crisis, when European gas prices increased sharply relative to the rest of the world. Even as total US LNG exports grew, this worked as an effective incentive for US LNG deliveries to non-European destinations to contract by 41%, while European deliveries increased by 197%[1], as seen in Exhibit 1.What portion of European LNG imports come from the US?

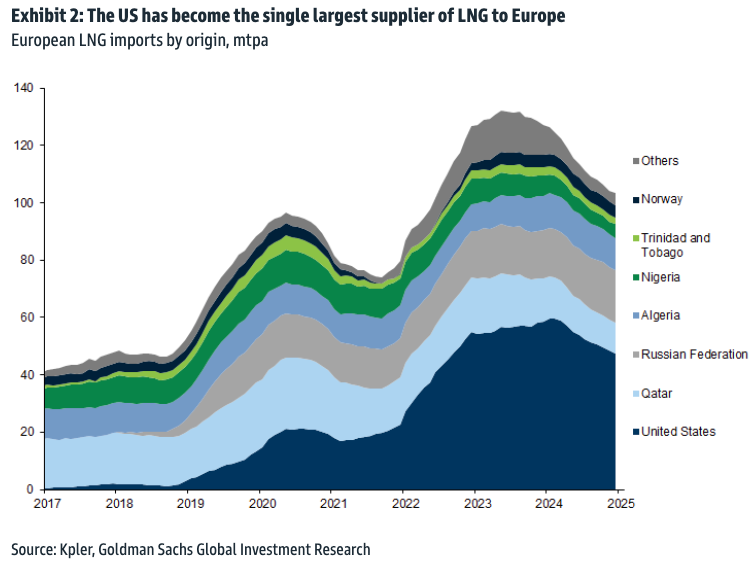

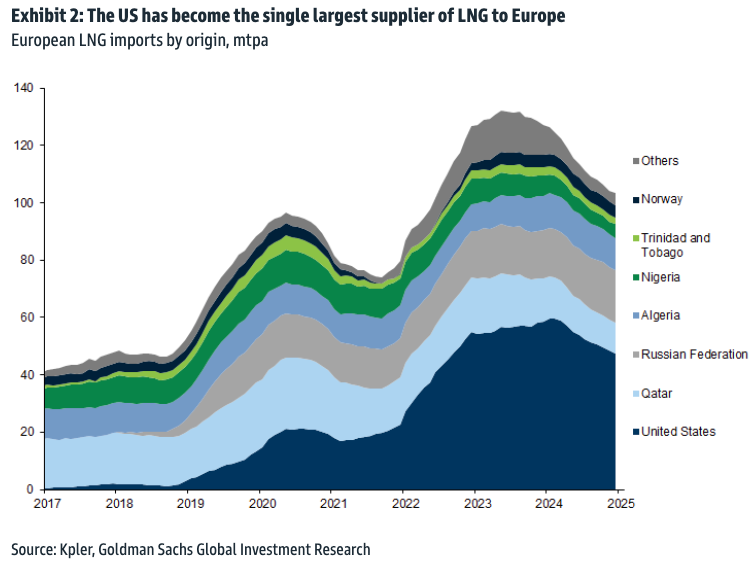

The US has become the single largest source of LNG to Europe, averaging 46% of imports into the region over the past 12 months (Exhibit 2). Most European LNG imports are sourced from Atlantic Basin suppliers to minimize shipping costs. Importantly, the US is also the primary source of likely European LNG import growth, based on long-term LNG contracts signed by European buyers since the start of the Ukraine war. US volumes contracted by European buyers in the period add to just under 16 mtpa, which is more than with any other single supplier globally (Exhibit 3).

The vast majority of US LNG sales are under contract. That said, US contracts typically have flexible destination ports, in that the buyer is not obligated to deliver to a particular location. This allows buyers of US LNG to re-sell or re-direct cargoes to higher-paying destinations. This was evident during the European energy crisis, when European gas prices increased sharply relative to the rest of the world. Even as total US LNG exports grew, this worked as an effective incentive for US LNG deliveries to non-European destinations to contract by 41%, while European deliveries increased by 197%[1], as seen in Exhibit 1.What portion of European LNG imports come from the US?

The US has become the single largest source of LNG to Europe, averaging 46% of imports into the region over the past 12 months (Exhibit 2). Most European LNG imports are sourced from Atlantic Basin suppliers to minimize shipping costs. Importantly, the US is also the primary source of likely European LNG import growth, based on long-term LNG contracts signed by European buyers since the start of the Ukraine war. US volumes contracted by European buyers in the period add to just under 16 mtpa, which is more than with any other single supplier globally (Exhibit 3).

Can US LNG replace Russian LNG imports into the EU?

Theoretically, yes. US LNG deliveries to non-EU countries are currently approximately 18 mtpa above the levels observed during the peak of the European energy crisis, suggesting there is enough flexibility in the market to replace Russia's current 17 mtpa of LNG exports to the region. However, such a reallocation of flows might offer little benefit, if any, to Europe or the US. Less optimal routes for LNG deliveries (for example, longer routes for Russian cargoes) would likely lead to higher freight costs. In addition, European import costs might go up in order to motivate the re-route of US cargoes that would have otherwise opted to deliver elsewhere.

Total US LNG exports would also not increase as a result of this reallocation, given that US LNG export capacity would not be impacted in the process.How could Europe support growing US LNG exports?

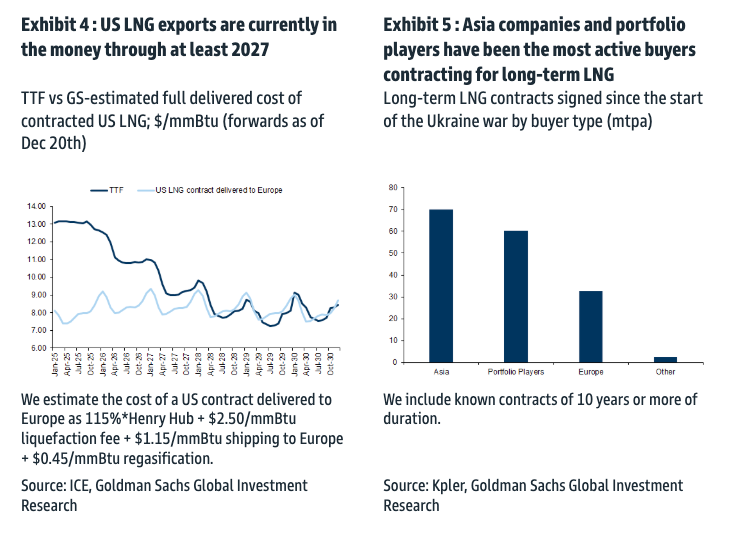

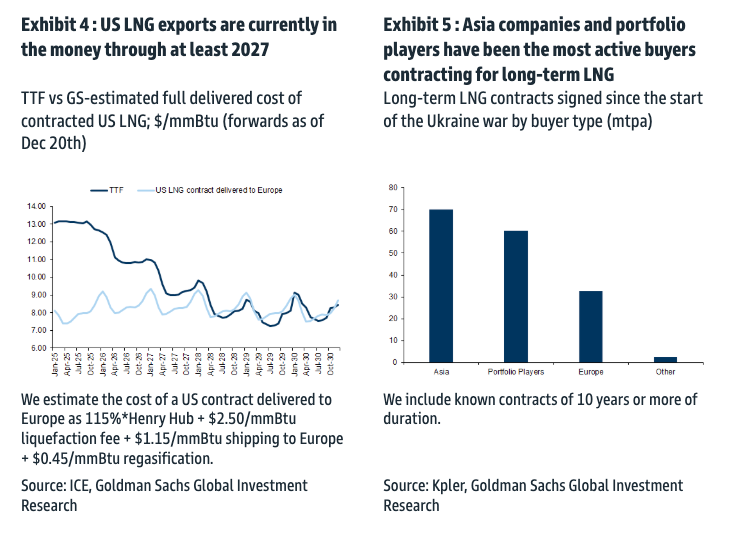

Additional long-term contracting by European buyers with proposed US LNG projects would be the most impactful measure the EU could take to support higher future US LNG exports, as this would increase the likelihood such contracted liquefaction projects reach a final investment decision (FID). As of now, the forward curve for European gas prices suggests new long-term US LNG export contracts are in the money through at least 2027 (Exhibit 4). That said, Europe's decarbonization goals might limit European companies' appetite for long-term commitments to grow natural gas use. In fact, when we look across all long-term LNG contracts signed since the start of the Ukraine war, European companies are far behind Portfolio player companies and Asia importers (Exhibit 5).

It appears that Goldman believes Trump's 'America First' policy of replacing Russian LNG to Europe with American LNG is "theoretically" possible.

By Zerohedge.com

Theoretically, yes. US LNG deliveries to non-EU countries are currently approximately 18 mtpa above the levels observed during the peak of the European energy crisis, suggesting there is enough flexibility in the market to replace Russia's current 17 mtpa of LNG exports to the region. However, such a reallocation of flows might offer little benefit, if any, to Europe or the US. Less optimal routes for LNG deliveries (for example, longer routes for Russian cargoes) would likely lead to higher freight costs. In addition, European import costs might go up in order to motivate the re-route of US cargoes that would have otherwise opted to deliver elsewhere.

Total US LNG exports would also not increase as a result of this reallocation, given that US LNG export capacity would not be impacted in the process.How could Europe support growing US LNG exports?

Additional long-term contracting by European buyers with proposed US LNG projects would be the most impactful measure the EU could take to support higher future US LNG exports, as this would increase the likelihood such contracted liquefaction projects reach a final investment decision (FID). As of now, the forward curve for European gas prices suggests new long-term US LNG export contracts are in the money through at least 2027 (Exhibit 4). That said, Europe's decarbonization goals might limit European companies' appetite for long-term commitments to grow natural gas use. In fact, when we look across all long-term LNG contracts signed since the start of the Ukraine war, European companies are far behind Portfolio player companies and Asia importers (Exhibit 5).

It appears that Goldman believes Trump's 'America First' policy of replacing Russian LNG to Europe with American LNG is "theoretically" possible.

By Zerohedge.com

No comments:

Post a Comment